Redemption of Preference Shares in Companies

Preference shares in companies offer preferential rights in dividend payments and capital repayment during liquidation. Redemption of preference shares involves returning the preference share capital to the shareholders. This process requires adherence to specific provisions under the Companies Act, such as having the necessary provisions in the company's articles for redemption. Learn about the meaning, provisions, and accounting treatment related to redeeming preference shares.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Guest Lecture at Smt. Maniben M.P. Shah Women's College of Arts & Commerce, Matunga. By CS Charul Y. Patel Asst. Professor, Department of Accountancy, SIES College of Commerce & Economics, Sion - East. 1

Redemption of Preference Shares 2

LEARNING OBJECTIVES ::::::: Understand the meaning of Preference Shares and redemption Learn various provisions of the Companies Act regarding preference shares and their redemption Familiarize redemption of fully paid-up preference shares: Understand the logic behind the methods of redemption yourself with various methods of Learn the accounting treatment for redemption 3

PREFERENCE SHARES Section 85(1) of the Companies Act defines preference shares as those shares which carry preferential rights. Its preferential rights are:- 1. Preference in payments of dividends before any dividends can be paid to common shareholders. 2. Preference in repayments of capital in the event of liquidation / winding up of company. A preference share always enjoys fixed rate of dividend. But a Preference share does not enjoy any voting rights. Every preference share is cumulative and redeemable, as now irredeemable Preference shares cannot be issued at all. 4

REDEMPTION OF PREFERENCE SHARES Redemption of preference shares means to discharge or return the amount of preference share capital to the preference share holders Under section 100 of the companies Act 1956, a company cannot refund its paid up share capital except with the permission of the court. But no court s permission is required in case of preference shares, being the companies are prohibited to issue the irredeemable preference share. 5

Articles of the company must have the provision for redemption. The terms of issue, generally stipulate the time of redemption and whether the redemption will be at par or premium. The Preference Shares will have the maximum redemption period of 20 years Prior to the amendment of the Companies Act, 1988, companies were permitted to issue both redeemable and irredeemable preference shares. Only fully paid preference shares can be redeemed. 6

If partly paid shares are to be redeemed, call must be made first & then redemption can be done. After redemption, the capital base of company must remain same as it was prior to redemption. So redemption of Preference Shares will not be taken as reducing the Authorized Share Capital of the Company. So redemption of Preference share is subject to : - provisions of this section, - provisions in the Articles of the company - and terms of redemption agreed at the time of issue of the Preference shares 7

Source of Redemption Alternatives or sources for redemption are : A) Redemption out of available Profits for Dividend (Free Reserves or Divisible Profits) B) Redemption by Fresh issue of Shares (New Equity or Preference Shares only) C) Redemption partly out of profits & by fresh issue The section rules out any other source such as issue of debentures, borrowing from banks and other financial institutions for carrying out redemption. Note that a Company has no right to sales its Assets to redeem its Preference Shares. 8

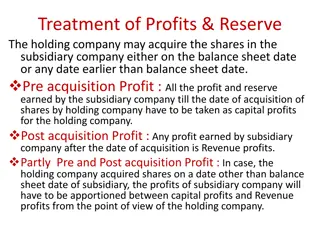

A) Redemption entirely out of Profits When redemption is entirely out of profits, a sum equal to the nominal value of the shares to be redeemed must be transferred to Capital Redemption Reserve Account (CRR A/c). CRR = FV of Preference shares to be redeemed Only Divisible Profits i.e. profits otherwise available for dividend, can be used to create CRR Redemption may be at par or at premium according to the terms of issue. 9

If redemption is at premium, such premium must be met out of the balance in Share / Securities premium Account or divisible profits of company. After redemption, Capital Redemption Reserve Account can be used only for the purpose of issue of fully paid bonus shares. This reserve must be kept intact unless otherwise sanctioned by the court. 10

Divisible Profits / Free Reserves Profits available for Dividend U/S 205 1) Profit & Loss A/C 2) General Reserve 3) Reserve Fund 4) Contingency Reserve 5) Dividend Equalization Fund / Reserve 6) Workmen s Accident or Compensation Fund (after payment of liability if any) 7) Investment Fluctuation Fund 8) Sinking Fund 11

Non - Divisible Profits Capital Reserve Old Capital Redemption Reserve Securities Premium Account Revaluation Reserve Statutory Reserves Shares forfeited A/c Profit prior to incorporation Debenture redemption reserve/fund Development rebate reserve 12

B) Redemption entirely by Fresh issue Only issue of Equity shares or Preference shares Issue of Debentures cannot be considered as fresh issue Fresh issue of shares can be at Par, Premium or Discount When redemption is entirely out of proceeds of fresh issue, Proceeds of fresh issue = FV of Pref. shares to be redeemed Fresh Proceeds of new issue of shares means: 1. Fresh issue at par amount received from issue i.e. FV 2. Fresh issue at discount Net amount received from the issue after discount i.e. Face Value - Discount 3. Fresh issue at premium amount received from issue of shares but excluding securities premium i.e only FV 13

C) Redemption partly out of Profits & partly out of proceeds of Fresh issue When fresh issue is known, CRR to be found: CRR = FV of Pref Shares to be redeemed LESS Face Value of New Shares LESS Discount Allowed on Issue of New Shares (if any) When CRR is known, fresh issue is to be found : Fresh Issue = FV of Pref Shares to be redeemed LESS CRR 14

Premium on Redemption of Preference Shares Preference shares to be redeemed Fresh Issue CRR Existing Securities Premium Premium on fresh Issue Divisible Profits FV of fresh issue LESS discount if any From divisible profits In the Balance sheet On the shares issued for redemption 15

Use of CRR and Bonus Shares After redemption CRR cannot be used for any other purpose except for the issue of fully paid up bonus shares to the equity shareholders BONUS SHARES are the shares without Cost i.e. - for which nothing is paid by shareholders. - issued to only Existing Equity Shareholders. - issued in a ratio of the shares an investor holds. The main objective of this provision is to safeguard the interest of the creditor CRR will be shown in the B/S under the head reserve and surplus, until CRR is used for the purpose of issue of bonus shares As a result of this there is no reduction in capital of the company when redemption is out of profits. 16

Steps to be followed along with the Journal Entries 1) Final call on Pref. Shares to be redeemed a) For final call due Final Call on Pref. Share A/c To Pref. Share Capital A/c dr. b) For receiving the final call Bank A/c To Final Call on Pref. Share A/c dr. 17

2) Amount due on redemption a) If redemption is at par Pref. Share Capital A/c To Preference Shareholders A/c dr. b) If redemption is at premium Pref. Share Capital A/c Premium on Red of Pref. A/c dr. To Preference Shareholders A/c dr. 18

3) Fresh Issue (Equity/Preference shares) a) At par Bank A/c To Eq./ Pref. Share Capital A/c dr. b) At premium Bank A/c To Eq./ Pref. Share Capital A/c To Securities Premium A/c dr. c) At discount Bank A/c Discount on issue of Shares A/c To Eq./ Pref. Share Capital A/c dr. dr. 19

4) Create /Transfer to CRR Divisible Profits A/c To CRR A/c dr. 5) Adjustment of Premium of Redemption Securities Premium A/c Divisible Profits A/c To Premium on Red. A/c dr. dr. 6) Payment to Preference Shareholders Preference Shareholders A/c dr. To Bank A/c 20

7) Bonus issue (a) For bonus declared CRR A/C Divisible Profits A/c To Bonus to Eq. Sh. A/c dr. dr. (b) For bonus paid Bonus to Eq. Sh. A/c To Equity Share Capital A/c dr. 21

Balance Sheet after Redemption Preference Shares which are redeemed will not appear in the B/S after red. If Fresh issue of Eq. Shares is made or if bonus shares are issued (out of CRR), Equity Share capital will increase by the same in the B/S after red. If fresh issue (new) of Preference shares is made, the same will appear in the B/S after red. Divisible Profits A/c balances will change to the extent used for creating CRR 22

Securities Premium A/c balance will change to the extent used for adjustment of Premium on Red. CRR will appear only if bonus shares are not issued Bank A/C balance will be calculated after considering fresh issue and redemption to Prf. If some Preference Shareholders could not be paid (e.g. not traceable), the balance outstanding to them will be shown on the liabilities side of the B/S under Current Liabilities 23

Summary 1) Final call on Pref. Shares to be redeemed 2) Amount due on redemption par/premium 3) Fresh Issue par / premium / discount 4) Creation of CRR 5) Adjustment of Premium of Redemption 6) Payment to Preference Shareholders 7) Bonus issue 24