Treatment of Profits and Reserves in Holding Companies

The treatment of profits and reserves in holding companies when acquiring shares in subsidiary companies is essential for understanding the apportionment of pre-acquisition and post-acquisition profits. This involves distinguishing between capital profits and revenue profits, calculating the cost of control and capital reserve, and considering minority interests. An illustration further explains how to determine the cost of control and capital reserve in a specific scenario.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

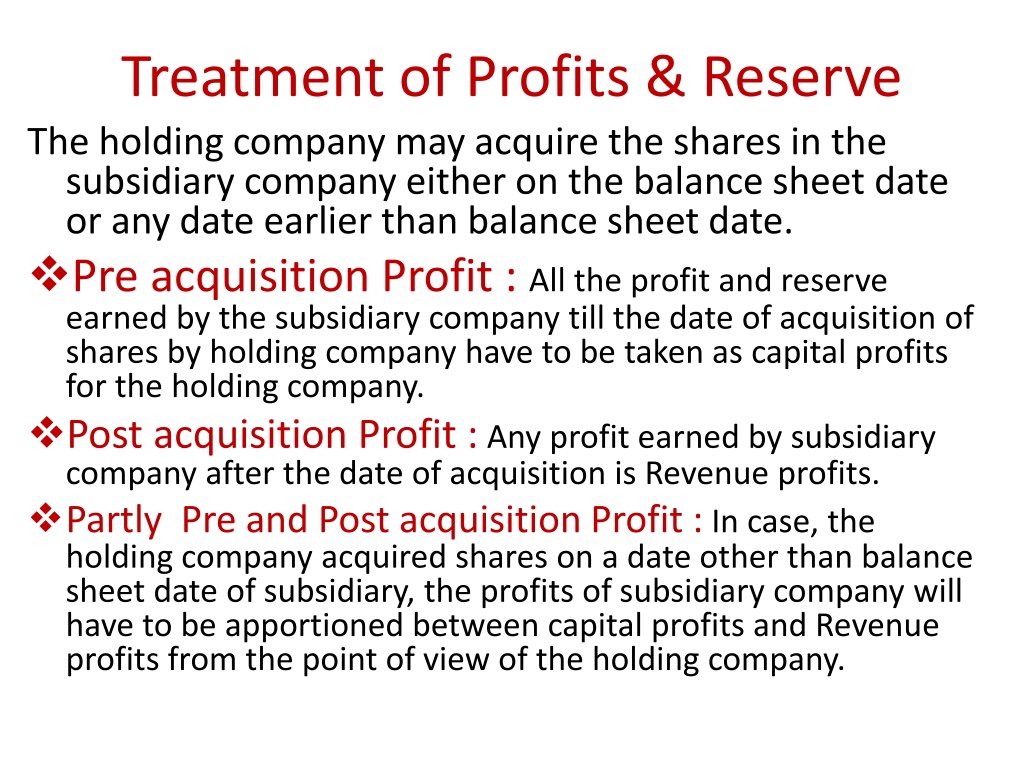

Treatment of Profits & Reserve The holding company may acquire the shares in the subsidiary company either on the balance sheet date or any date earlier than balance sheet date. Pre acquisition Profit : All the profit and reserve earned by the subsidiary company till the date of acquisition of shares by holding company have to be taken as capital profits for the holding company. Post acquisition Profit : Any profit earned by subsidiary company after the date of acquisition is Revenue profits. Partly Pre and Post acquisition Profit : In case, the holding company acquired shares on a date other than balance sheet date of subsidiary, the profits of subsidiary company will have to be apportioned between capital profits and Revenue profits from the point of view of the holding company.

Treatment of Profits & Reserve The share of the H. Co. in Pre-acquisition Profit & Reserve ( Capital Profit) will be taken for calculation of Cost of Control / Capital Reserve The share of the H. Co. in Post-acquisition Profit & Reserve ( Capital Profit) will be taken in New Balance Sheet ie added to H.Co.Profits/ Reserve. The share of the Minority in Pre and post acquisition Profit & Reserve will be added while calculating Minority Interests.

Cost of control/ Capital Reserve Rs. Rs. xxx Cost of investment in S Ltd. Less : 1) Share in share capital = yyy 2) Share in pre-acquisition profit &Reserve= yyy 3. ) Share in other Capital profit &Reserve =yyy 4). Share in revaluation Profit = yyy 5) Share in Bonus Shares out of profits = yyy 6) Share in Dividends out of Pre acquisition profit = yyy ( If Taken by H.Company to its P&L A/c) Cost of Control ( If xxx is more than yyy) OR Vice versa is Capital Reserve ie. yyy more than xxx

Illustration Balance sheet of S Ltd. as on 31st March 2019 (Liabilities only) Rs. Share capital 40,000 Equity shares of Rs. 10/- each 4,00,000 Reserves and surpluses 2,50,000 Secured loan 2,50,000 Other Liabilities 1,00,000 On the above date H Ltd. acquired 30,000 Equity shares in S Ltd. on the above date for Rs. 7,50,000 fixed assets of S Ltd. were appreciated by Rs. 1,50,000 find out Cost of control / Capital Reserve.

SOLUTION Rs. Rs. Cost of investment in S Ltd. Less : 1) Share in share capital 4,00,000 x = 3,00,000 7,50,000 2) Share in Reserves and surpluses Capital profit 2,50,000x3/4 = 1,87,500 3). Share in revaluation Profit 1,50,000x3/ 4 = 1,12,500 6,00,000 Goodwill (B.F) = 1,50,000 Suppose in above case, cost of investment amounted to Rs. 5,00,000 then instead of goodwill, there would be capital Reserve, Rs. 1,00,000.

Minority Interests Minority interest is the share of outsiders ( non Holding Company shareholders) 1) Proportionate Share in share capital in Subsidiary Co. = aaa 2) Share in pre acquisition Reserve & Profits of subsidiary Co.. = aaa 3) Share in Post acquisition Reserve & Profits of Subsidiary Co (Share in accumulated losses should be deducted.) 4) Share of profit or loss on revaluation of assets. = aaa 5) Share in Bonus Shares 5) Preference share capital of subsidiary company held by outsiders and dividend due on such share capital, if there are profits. MINORITY INTERESTS = aaa = aaa = aaa = TOTAL OF aaa

MINORITY INTEREST Proportionate Share in share capital in Subsidiary Co. (1/4 X 4,00,000) = 1,00,000 2) Share in pre acquisition Reserve & Profits of subsidiary Co.. (1/4 X 2,50,000) = 62,500 3) Share of profit or loss on revaluation of assets. (1/4X 1,50,000 ) = 37500 MINORITY INTEREST = 2,00,000

Elimination of Common Transactions 1. Loan advanced by the holding company to the subsidiary company or vice versa. 2. Bill of Exchange drawn by holding company on subsidiary company or vice versa. 3. Sale or purchase of goods on credit by holding company form subsidiary company or vice versa. 4. Debentures issued by one company may be held by the other. TREATMENT : They will be eliminated from the Consolidated Balance Sheet.