Pure Economic Loss: Definition, Recoverability, and Legal Cases

Pure economic loss, a pecuniary or financial loss not directly resulting from physical damage, can be recoverable in negligence cases depending on jurisdiction. This article explores the concept, examples, and legal precedents surrounding pure economic loss, highlighting cases such as Spartan Steel & Alloys Ltd v Martin & Co (Contractors) Ltd and Majlis Perbandaran Ampang Jaya v Steven Phoa Cheng Loon, discussing when it is recoverable and not, with insights from legal experts like Dr. Sonny Zulhuda.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

PURE ECONOMIC LOSS Dr. Sonny Zulhuda

PURE ECONOMIC LOSS When recoverable? When Not recoverable? Definition

Definition of Economic Loss Economic loss = pecuniary or financial loss, both consequential and pure . Consequential economic loss Loss(es) incurred as a result of physical injuries or damage to property. Pure economic loss other losses that follow which do not flow from the damage (independent from it).

Spartan Steel & Alloys Ltd v Martin & Co (Contractors) Ltd [1973] C had a stainless steel factory which obtained its electricity by a direct cable from the power station. D were doing work on the ground with an excavator and negligently damaged that cable. As a consequence, the factory was deprived of electricity for 15 hours which caused: physical damage to the factory s furnaces and metal, lost profit on the damaged metal and lost profit on the metal that was not melted during the time the electricity was off. Spartan Steel claimed all the three heads of damage.

Spartan Steel & Alloys Ltd v Martin & Co (Contractors) Ltd The first two were allowed because they were consequent upon a threat of physical damage to the plaintiff s property. The third claim was not allowed being a pure economic loss. C suffered these losses because he was prevented from using the furnace and was not consequent upon physical damage to the property

Majlis Perbandaran Ampang Jaya v Steven Phoa Cheng Loon & Ors [2006] 2 MLJ 389 Steve Shim CJ: The third question postulated the consideration of whether pure economic loss is recoverable under the Malaysian jurisprudence in negligence and nuisance. In the law of negligence, there is no immutable rule that pure economic loss is not recoverable. All major Commonwealth jurisdictions recognize that pure economic loss is recoverable in negligence. Under English law, the general duty of care test enunciated in Caparo Industries Plc v Dickman [1990] 2 AC 605 is applicable to all negligence claims, including claims for pure economic loss.

When not recoverable? Loss resulting from damage to property belonging to a 3rdparty Cattle v Stockton Waterworks Co. C contracted to build tunnel under an embankment for a mr. X D negligently caused flood to the embankment and the surrounding land belonging to mr. X this disrupted C s work and C suffered a loss of profit in the performance of his work for mr. X C sued D. Court disallowed the claim for being a pure economic loss. Loss due to a defective product Murphy v Brentwood District Council C (house owner) suffered losses after selling his defective house far below market price C sued D for such losses and for expenses incurred in moving into a new house. Court only allowed C to recover the cost of repairing a defective building due to the negligence, but not the loss for abandoning the premise or expenses for remedying the defect.

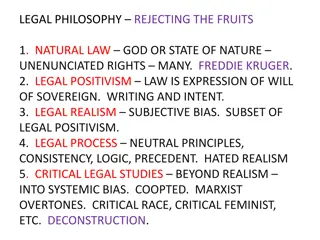

When recoverable? When there is a special relationship Hedley Byrne & Co. Ltd v Heller Loss caused by negligent misstatement Yong & Co v Wee Hood Teck Development Corp. Loss caused by negligent provision of services

Hedley Byrne & Co Ltd v Heller & Partners Ltd [1964] D, a bank gave a reference to C (advertising agent) regarding the financial responsibility of a customer, expecting C to act on it. D replied in a letter that was headed: "without responsibility on the part of this bank, it said that the customer was "considered good for its ordinary business engagements". C relied on the advise and engaged with the said customer. However, that customer then went into liquidation and C lost 17,000 on contracts. C sued Heller & Partners for negligence, claiming that the information was given negligently and was misleading. D argued there was no duty of care owed regarding the statements, and in any case liability was excluded.

Hedley Byrne & Co Ltd v Heller & Partners Ltd [1964] Held: The law will imply a duty of care when a party seeking information from a party possessed of a special skill trusts him to exercise due care, and that party knew or ought to have known that reliance was being placed on his skill and judgment (i.e. when there is a special relationship with reliance) However, since here there was an express disclaimer of responsibility, no such duty was, in any event, implied. Therefore, C lost the case.

On the special relationship Hedley Byrne was followed and further qualified in Mutual Life & Citizens Assurance Co. Ltd. v Evatt: that such special relationship exists only where D is in the business of giving info/advise. However, the principle was liberally widened in Smith v Eric S. Bush, where D can be liable even if they are not in such a business, as long as they knew that their information is relied upon by the plaintiff. This was followed in a local case of The Co-operative Central Bank Ltd v KGV & Associates Sdn Bhd however D was not liable: there was no proximity because the person who relied upon the D s valuation report was not a known person to Defendant

Yong & Co v Wee Hood Teck Development Corp. [1984] 2 MLJ 39 Developer-purchaser-financier arrangement: Financier (Resp) gives loan to purchaser, and the letter agreed to charge the land to the financier. App (legal firm) prepared an agreement between the developer, the purchaser and the financier They undertook to have the land charged in the financier s favor but then acted for developers in charging the land to another bank. When the developer defaulted, the lands were sold to a 3rdparty, and financier was left as an unsecured creditor who cannot execute their claim from the memorandum of charge resulting in a pure economic loss to the financier. Can the Financier recover for the loss from the App?

Yong & Co v Wee Hood Teck Development Corp. [1984] Argued by App: They should not be liable as there is no retainer (retainer contract) between App and Respondent. Court: clear records and evidence from the past showed the existence of the solicitor-client relationship between App and respondent by way of implication Special relationship. Court: App had not only failed to perform their obligation under the contract with the required skill and care but were also liable in tort for their wrongful act of depriving the financier from having security for the loan (i.e. when the Financier failed to execute the memorandum of charge from the Purchaser). A claim for purely financial loss without injury to the person or property is no bar to liability for negligence.

Recap! What is an economic loss ? What are the two types of economic loss? Explain situations where a pure economic loss is not recoverable In what situation would a pure economic loss be recoverable? Special Relationship? Trust and reliance?