Proposed Charter Amendment for Homestead Credit Percentage Deadline Change

The proposed bill CB-48-2020 seeks to amend Section 812 of the Prince George's County Charter by changing the deadline to set the homestead credit percentage, ensuring it is no less than 100% and does not exceed 110% for any taxable year. The County Council provides ballot language for voter approval, with proposed changes and Council member Dernoga's objection regarding informing voters about eliminating the CPI/5% cap.

Uploaded on Oct 02, 2024 | 3 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

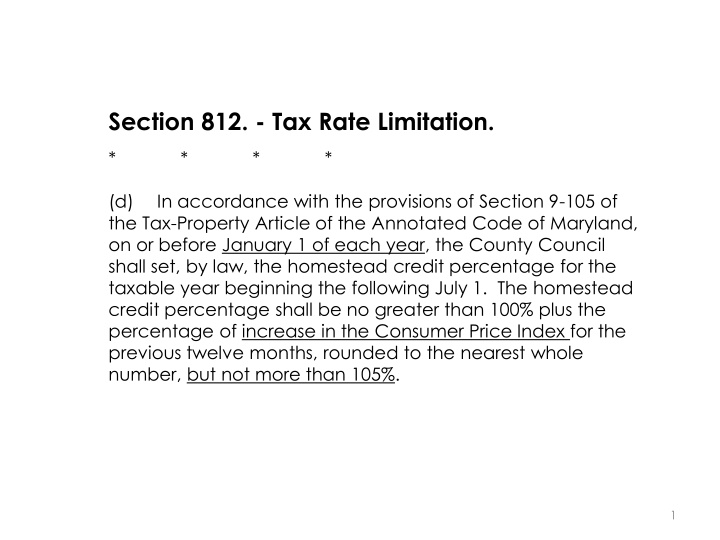

Section 812. - Tax Rate Limitation. * * * * (d) the Tax-Property Article of the Annotated Code of Maryland, on or before January 1 of each year, the County Council shall set, by law, the homestead credit percentage for the taxable year beginning the following July 1. The homestead credit percentage shall be no greater than 100% plus the percentage of increase in the Consumer Price Index for the previous twelve months, rounded to the nearest whole number, but not more than 105%. In accordance with the provisions of Section 9-105 of 1

CB-48-2020 Section 1105 of the Charter provides that 8 members of the County Council may propose a Charter Amendment that must be submitted to the voters: Amendments to this Charter may be proposed by an act of the Council approved by not less than two-thirds of the members of the full Council, and such action shall be exempt from executive veto. 2

CB-48-2020 CB-48-2020 is a proposed bill to amend Section 812 of the Prince George's County Charter as follows: (d) In accordance with the provisions of Section 9-105 of the Tax-Property Article of the Annotated Code of Maryland, on or before [January 1] March 15 of each year, the County Council shall set, by law, the homestead credit percentage for the taxable year beginning the following July 1. The homestead credit percentage shall be no [greater] less than 100% [plus the percentage of increase in the Consumer Price Index for the previous twelve months, rounded to the nearest whole number, but not more than 105%] or exceed 110% for any taxable year; and shall be expressed in increments of 1 percentage point. 3

As part of bill adoption, the County Council provides summary language that the voters will see on the Ballot (and on the Official Sample Ballot). Following is the proposed Ballot language: PROPOSED CHARTER AMENDMENT To change the deadline to set, by law, the homestead credit percentage for the taxable year beginning the following July 1, to on or before March 15, and to provide that the homestead credit percentage shall be no less than 100% or exceed 110% for any taxable year. 4

Council member Dernoga objected that the proposed Ballot language does not tell the voters that voting Yes will eliminate CPI/5% cap. After consultation with the County Office of Law, he proposed the following alternative to inform voters of what was being changed: The deadline for establishing the homestead credit percentage, for the taxable year beginning the following July 1, will be changed from January 1 to March 15 and the homestead credit percent will be no less than 100%, with the maximum amount for any taxable year increased from 105% to a maximum of 110%. This proposed amendment failed 4 to 7: Anderson-Walker, Dernoga, Ivey, Streeter 5

College Park & PGC Property Taxes Rate in Cents per $100 Assessed Value State of Maryland: $0.112 Prince George s County: $0.966 City of College Park: $0.325 WSSC: $0.026 Stormwater/Bay: $0.054 MNCPPC: $0.294 PGC Supplemental Education: $0.04 State of Maryland: $0.112 Total Property Tax: $1.817 411.2 32.5 29.4 5.4 2.6 96.6 College Park Prince George's County WSSC Stormwater/Bay MNCPPC PGC Education State of MD

Assessed Value and Taxes http://taxinquiry.princegeorgescounty md.gov/taxdetail.aspx https://sdat.dat.maryland.gov/RealPro perty/Pages/default.aspx

Purchased: July 2003 Purchase Price: 285k Assessed value: $177,520 Annual Taxes: $3,070.90 Monthly Taxes: $255.84 Overall Taxing Rate: $1.73 per $100 Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Assessed Value $177,520 $204,026 $230,532 $257,040 $316,696 $376,352 $436,010 $372,700 $372,700 $372,700 $298,500 $298,500 $298,500 $310,033 $321,567 $333,100 $375,733 $418,367 $461,000 1% 2% 3% 3% 4% 3% 5% 0% 1% 4% 2% 2% 2% 2% 0% 1% 2% 3% 2% PGC Homestead Rate $32 $3 $0 $0 $270 $540 $22 $1,234 $103 $1,960 $163 $2,614 $218 $1,708 $142 $1,608 $134 $1,476 $123 $461 $38 $375 $31 $299 $25 $411 $34 $515 $43 $610 $51 $0 $0 $0 $0 $0 $0 Savings $45 Monthly Savings $32 $0 $270 $810 $2,044 $4,004 $6,618 $8,326 $9,934 $11,410 $11,871$12,246$12,545$12,956$13,471$14,081$14,081$14,081$14,081 Cumulative Savings Average Homestead Change for County = 2.2% - due to CPI Average Savings = $880/yr or $73/mo Current: 2020 (17 years) Assessed value: $375,733 (211%) Annual Taxes: $6,752.68 (220%) Monthly Taxes: $562.72 (220%) Overall Taxing Rate: $1.817 per $100 *Homestead Calculations include both Prince George s County and City of College Park