Private Insurance Advocacy: Addressing Key Issues

Delve into the critical issues in private insurance advocacy, from enrollment challenges to network adequacy, drug coverage, and out-of-pocket costs. Explore the need for affordable premiums, health insurance literacy, and support for consumers navigating the complex landscape of private healthcare coverage.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

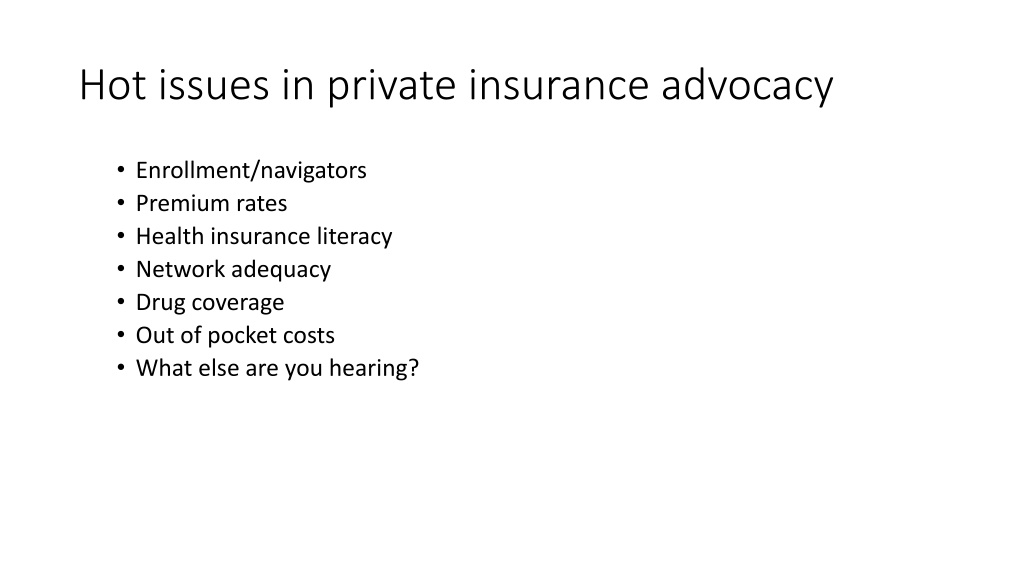

Hot issues in private insurance advocacy Enrollment/navigators Premium rates Health insurance literacy Network adequacy Drug coverage Out of pocket costs What else are you hearing?

Please feel free modify the following slides, and print with your own logo, to orient your new state legislators

Orientation for new state legislators Orientation for new state legislators The Affordable Care Act made many improvements nationally people can now buy coverage even if they have pre-existing conditions, many can get help paying premiums, and consumers have increased protections. For information about what happened in your state, see http://www.whitehouse.gov/healthreform/map. Much remains to be done at the state level. See how many people are still uninsured here: http://kff.org/state-category/health-coverage-uninsured/ How many have enrolled in marketplace coverage, the price of average premiums, and many other statistics will help you understand the current landscape in your state: http://kff.org/state-category/health-reform/

Here are some private insurance issues states Here are some private insurance issues states can take action on: can take action on: Must health plans have adequate networks of providers to serve enrollees? And will the networks be adequate for people of color? If a person uses an out-of-network provider in an emergency, is he or she protected from high costs? Do consumers know what they are getting when they buy coverage? (Do they know what drugs and providers their plan covers, for example?) Do insurance plans make care affordable and provide enough protection from out-of-pocket costs? Are premiums affordable? How is the state providing assistance to consumers both with enrollment, and when they have a problem with their coverage?

Must health plans have adequate networks of Must health plans have adequate networks of providers to serve enrollees? providers to serve enrollees? When health plans design their provider networks, they need to ensure that these networks are adequate and provide meaningful access to care. The Affordable Care Act established the first-ever federal rights guaranteeing private insurance consumers access to adequate networks. Many states also have laws and/or regulations to help ensure that networks can meet consumers needs: http://familiesusa.org/product/standards-health-insurance-provider- networks-examples-states#sthash.Y68ZeYMH.dpuf

Will the networks be adequate for people of color? Will the networks be adequate for people of color? Enacting and enforcing network adequacy laws can also help communities of color. Many communities have long lacked meaningful access to health care because few providers are located in their neighborhoods, or they lack transportation, face language barriers, or cannot afford to lose work hours to see a provider. This brief discusses state policies to address those problems: http://familiesusa.org/product/improving-private-health-insurance- networks-communities-color

If a person uses an out If a person uses an out- -of of- -network provider in an emergency, is he or she protected from high costs? emergency, is he or she protected from high costs? network provider in an When people go out of their plan s network for care in an emergency, federal law requires plans to pay at least as much as they would pay in-network for care http://familiesusa.org/sites/default/files/product_documents/Patient s-Bill-of-Rights.pdf But this does not stop the providers from balance billing and charging the patient a higher amount than their plan s copayments. New York is among states that are enacting legislation to prevent these surprise medical bills http://familiesusa.org/blog/2014/04/new-york%E2%80%99s-new- surprise-bill-law-rolls-out-new-health-insurance-protections- consumers

Do consumers know what providers are in network Do consumers know what providers are in network when they buy coverage? when they buy coverage? Consumers need access to accurate, up-to-date information about which providers are in a plan s network so that they can understand their options for care and avoid unintentionally visiting more costly out-of-network providers. To best serve diverse consumers, provider directories should also indicate what languages other than English (if any) providers speak, and directory information should be available in multiple languages. See examples of state laws and rules here: http://familiesusa.org/sites/default/files/product_documents/ACT_N etwork%20Adequacy%20Brief_final_web.pdf

Do consumers know what drugs their plan Do consumers know what drugs their plan does and doesn t cover? does and doesn t cover? Nevada is working on a rule to make plan formularies more transparent and prevent mid-year changes in the formulary: http://doi.nv.gov/uploadedFiles/doinvgov/_public-documents/News- Notices/Regulations/R074-14-Amendment-v2.pdf American Cancer Society recommends transparency and coverage of cancer drugs: http://www.acscan.org/content/wp- content/uploads/2014/03/Marketplace_formularies_whitepaper.pdf

Do health plans make care affordable and provide Do health plans make care affordable and provide enough protection from out enough protection from out- -of of- -pocket costs? pocket costs? States and insurers can design plans that make some types of care available before consumers reach a high deductible, and they can standardize plans that limit copayments for important services: http://familiesusa.org/product/standardized-health-plans-promoting- plans-affordable-upfront-out-pocket-costs

Are premiums affordable? Are premiums affordable? 1) Extra help 1) Extra help Some states provide help with premiums and cost-sharing for low- and modest -income consumers that goes beyond federal assistance. They do this by establishing a Basic Health Program, increasing Medicaid eligibility, or by offering state assistance in addition to the federal premium and cost sharing assistance: http://familiesusa.org/blog/2014/09/trending-tackling-affordability- barriers-affordable-care-act

Are premiums affordable? Are premiums affordable? 2) Smokers 2) Smokers Smokers can be charged premiums that are so much higher than premiums for non-smokers that coverage is unaffordable. When they quit smoking, it may be many months before they can enroll in affordable coverage. Some state initiatives make coverage and cessation services more readily available: http://familiesusa.org/sites/default/files/product_documents/Tobacc o-Rating-State-Solutions_0.pdf http://www.commonwealthfund.org/publications/blog/2015/jan/ins urance-premium-surcharges-for-tobacco-use

Are premiums affordable? Are premiums affordable? 3) Rate review 3) Rate review States have an important role in reviewing health plans proposed premium increases and rejecting increases that are unjustified and unreasonable. But not all states have adequate laws in place to review rates, nor adequate resources and processes for doing so. These reports provide information about good state practices: http://familiesusa.org/product/states-making-progress-rate-review http://consumersunion.org/rate-review-for-non-actuaries/ http://familiesusa.org/blog/2014/04/making-case-against-health- insurance-premium-rate-increases-part-1-preparing-rate

Who assists consumers with enrollment or in Who assists consumers with enrollment or in solving problems with coverage? solving problems with coverage? Navigators and in-person assisters provide outreach and unbiased, community-based help to people enrolling in coverage. After enrollment, if a consumer encounters a problem with their plan, some states have established consumer assistance programs that educate them about how to use coverage and assist with appeals. All of these programs need funding. http://familiesusa.org/blog/2014/07/new-surveys-confirm- navigators-and-assisters-are-essential-health-insurance-enrollment http://familiesusa.org/product/designing-consumer-health- assistance-program

Questions? Cheryl Fish-Parcham Private Insurance Program Director Families USA cparcham@familiesusa.org