Premium Reduction Program Overview for Employers

Learn about the Premium Reduction Program introduced in November 2018, which offers reduced Employment Insurance premium rates to employers with qualified short-term disability plans. Find out about program requirements, benefits, and steps for employers to participate.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Premium Reduction Program November 2018

Presentation content What is the Premium Reduction Program? What are the requirements that a plan must meet? How can employers get an EI premium rate reduction? What s next for the Premium Reduction Program? 2

What is the Premium Reduction Program? The Program grants reduced Employment Insurance (EI) premium rates to employers if their employees are covered by a qualified short-term disability plan that provides income protection coverage that is equivalent to or better than EI sickness benefits 3

Why the reduction? Employees who are covered by a qualified short-term disability plan may not have to claim EI sickness benefits, or, if they do, may claim them for a shorter period of time; thus, reducing the number of EI claims 4

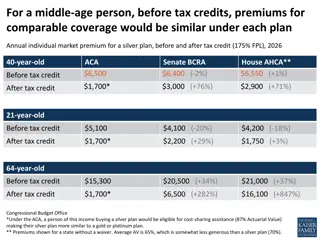

EI premium rate and maximum Workers outside Quebec Year Max. Annual Insurable Earnings Rate Max. Annual Employee Premium Standard Employer Rate Max. Annual Employer Premium (per employee) $53,100 $51,700 1.62% $860.22 1.66% $858.22 x 1.4 x 1.4 $1,204.31 $1,201.51 2019 2018 Workers in Quebec $53,100 $51,700 1.25% $663.75 1.30% $672.10 x 1.4 x 1.4 $929.25 $940.94 2019 2018 5

What types of short-term disability plans can be considered as qualifying plans? Weekly indemnity plans weekly disability benefits ill or injured either the employer or both employer and employees can pay for the cost of the plan self-insured or by a third party Cumulative paid sick leave plans employees accumulate sick leave credits to use when ill or injured 6

Returning part of the savings to your employees EI premiums are paid by employers and employees at a ratio of 7/12 and 5/12 respectively The reduction applies to both employers and employees It s the employer s responsibility to ensure that all employees covered by the qualified plan receive their portion of the savings (at least 5/12 of the savings) 7

How do you apply for a premium reduction? If you believe the short-term disability plan provided to your employees meets the basic requirements, complete and submit an application form available on the Government of Canada website at: Canada.ca/EI-premium-reduction 8

What documents are required? Evidence of your commitment to your employees to provide a short-term disability plan Your undertaking that you will return the employees portion of the savings 9

Is your entitlement to a reduced rate continual? Entitlement to EI reduced rate is automatically continued for employers participating in the EI Premium Reduction Program In the last quarter of each year, Service Canada will send a notice of reduced rate for the coming year to all participating employers You must notify us within 30 days of cancellation or other changes 10

Whats next for the Premium Reduction Program? Continuing efforts to improve service delivery by: Improving communications to employers Reviewing processes and procedures Clarifying policies Exploring automation options in the longer- term 11

Do you need additional information? Visit the Government of Canada website at: Canada.ca/EI-premium-reduction Contact us at: 1-800-561-7923 12