Maritime Emissions Reduction Strategies and Policy Instruments Overview

Assessment of the Expert Groups' reports on maritime emissions reduction strategies, emphasizing the need for multiple policy instruments targeting new ships, existing ships, and operational aspects. Discusses the negative side effects of flexible policies and the importance of imposing requirements on new tonnage. Also compares maritime emissions reduction efforts with road transport and presents three main options for effective reduction.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Assessing the MBM EGs report Dr Per K geson MEPC 61 29 September 2010

The Expert Groups feasibility study and impact assessment of the MBAs A valuable summary and assessment of the proposals Relevant information on abatement measures Interesting but unconventional calculations Good work!

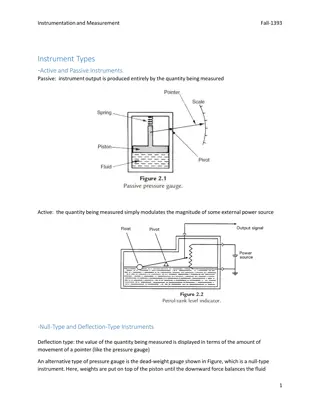

Need for two different instruments? To cut maritime emissions substantially over the next few decades policy instruments must affect: - Specific emissions from new buildings - Retrofitting of existing ships - Operation of all ships This may be difficult to achieve by just one instrument

Negative side-effects of flexible and cost- effective policy instruments Flexibility would allow maritime transport to contribute to inexpensive emission reductions in other sectors Focusing only on low-hanging fruit may make the shipping sector ill-prepared for challenges to come Science may have underestimated climate change and the need to reduce emissions rapidly

Requirements on new tonnage Important to improve the resiliance of the shipping sector and prepare for future mitigation efforts Turnover of the fleet is 30-40 years Accepting sub-standard new builds means taking a risk of having to undertake unnecessarily expensive future CO2 abatement measures The EEDI should be a mandatory supplement to any market-based instrument

Comparing with road transport The life of ships is longer than for cars USA, EU, Japan and China enforce mandatory fuel efficiency standards on new cars, supplementary to using MBMs (i.e. fuel taxes) Significant non-financial barriers in both cases

Three main options 1. Taxing/charging - GHG Fund, LIS, PSL, IUCN 2. Cap on total emissions - Norway/France/UK (auctioning + trade) and GHG Fund 3. Reducing specific emissions - SECT, LIS and VSL

Unconventional methods for calculating Unclear whether EEDI is mandatory in all cases Confuses abatement cost with proceeds Does neither distinguish between private and social cost nor between true abatement costs and transfer of revenues

Making calculations transparent Show average and marginal abatement cost, including administration and other transaction costs Show the burden on industry (abatement cost + any charges or any costs of allowances that are not refunded) Calculate net-revenue + discuss how to use it

A few remarks on the likely results The ETS is most cost-effective Less burden on industry with the GHG Fund Large in-sector reductions with US SECT and LES, smallest with GHG Fund Possibility for large transfers to LDCs and adaptation/mitigation with ETS and PSL

Problems with offsetting by credits Sufficient short- and long-term supply of credits from projects in developing countries? Will other sectors accept market dominance by the GHG Fund ? Long-term dependence on credits smaller when supplemented by a mandatory EEDI

A biased conclusion? The Expert Group says ETS administrative costs would be 3 times those of the GHG Fund Most elements are common ETS trading likely to have transaction costs somewhat above similar costs for GHG Fund levy + the fund s purchase of credits Fuel suppliers may buy allowances on behalf of customers

How to arrive at a market price? LIS and PSL, and IUCN (partly) want to rely on the market price of carbon But there can only be a price if some sectors and countries use emissions trading or uniform taxes Currently only the EU ETS Do the IMO Parties want to leave it to Europe to decide the future price of carbon?

Why make it so complicated? The UK wants to distribute all allowances below a global cap to individual countries This implies that shipping companies should buy allowances on 190 different national auctions? Provides no revenue that can be transferred to developing countries

Emissions from domestic shipping Domestic shipping emissions are currently part of national inventories Same ships are used both domestically and for international voyages To avoid red tape and reduce the risk of fraud, states should be allowed to include emissions from domestic shipping in the global scheme

The size of the burden Non of the proposed schemes would increase fuel cost by more than 6% in 2020 and 9% in 2030 High bunker prices will depress demand for fuel oil and cut emissions and simultaneously reduce the price on CO2.

Conflicting principles The UNFCCC is based on the principle of common but differentiated responsibility An important principle of the UN Convention on the Law of the Sea (UNCLOS) is no more favourable treatment of ships. The expert group could not agree on this matter

Equal treatment necessary The principle of no more favourable treatment of ships must apply to the EEDI (for ships in international traffic) and to all MBMs. Two thirds of all ships above 400 GT are registered in non-Annex 1 Flag States, but about three quarters of this tonnage belongs to firms in Annex 1 countries.

All countries must contribute Common but differentiated responsibility means industrialized nations are expected to do more than could be expected from developing countries. But it does not mean developing countries should not contribute. As countries develop they need to raise their contribution.

Temporary relief or compensation LDCs may be temporarily exempt (possible with ETS, more difficult with PSL and GHG Fund) Certain goods may be exempt (e.g. grain) Funds created by ETS or PSL can be used for compensating developing countries Any decision on a MBM must be long-term

Need for a formula on contributions from non-annex 1 countries (example of a key) States with a per capita income 50% below the poorest quartile of the 1997 Annex 1 countries (in constant 1997 US$) could receive 100% of their share of the revenues, based on the IUCN formula. States with a per capita income 25% below the poorest 1997 quartile could receive 50% back. States with a per capita income equal to or higher than the poorest 1997 quartile would get nothing.

Spending the remaining net-revenue ETS (Norway/France) X% of US$ 17-35 bn Should be compared with the $100 bn promised by rich countries for 2020 An equal amount from aviation might be possible This is money with no obvious owner Risk of free-riders if all contributions must be made from national budgets many large deficits

Political issues to be addressed Mandatory EEDI International tax/charge/levy or cap and trade? Ship size (400 GT or larger)? A practical definition of the principle of Common but differentiated responsibility How to spend the net-revenue and how to finance a US$ 100 billion fund by 2020