Overview of Mortgage Lending Rules in Ireland - Summer 2018

Explore the key lending rules impacting mortgage applications in Ireland during the summer of 2018. Learn about CBI rules, loan-to-value ratios for first-time buyers and non-first-time buyers, requirements for buy-to-let mortgages, and loan-to-income limitations set by the Central Bank of Ireland.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

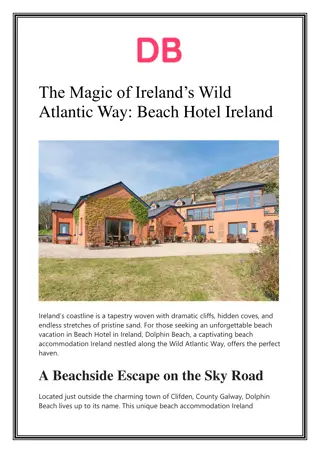

Brokers Ireland Mortgages Summer 2018

Lending Update & Lender Underwriting Requirements Kimberley Hyland - Mortgage Manager

Topics Covered Topics Covered CBI Rules ICB & The Central Credit Register Help to Buy Addendum to the Consumer Protection Code 2012 Affordability Repayment Capacity Balance Of Funds Client Income and Banking Profile

CBI Rules On the 27th of January 2015 - Central Bank of Ireland announced new restrictions on mortgage lenders in relation to the loan to values and loan to income ratios The new rules for Loan to Value (LTV) for principal dwelling houses (PDH) differentiate between First Time Buyers (FTBs), Non- First Time Buyers (NFTBs) and Buy To Lets (BTLs).

NFTB CBI rules PDH mortgages for NFTBs are subject to a limit of 80% LTV Example Property price 350,000 20% deposit = 70,000 *unless the lender approves this application as part of its 20% of lending allowed to exceed the new limits. It s important to note that borrowers in negative equity who wish to obtain a mortgage for a new property are not within the scope of these new LTV limits.

FTB CBI rules The ceiling on the loan to value (LTV) ratio for all first time buyers is set at 90 per cent. This is a shift from the previous requirement, which put the ceiling at 90 per cent for loans up to 220,000 but at 80 per cent for the balance of loans above 220,000. This means that first time buyers will be able to borrow up to 90 per cent of a value of a home, with a requirement for a 10 per cent minimum deposit. The structure of the proportionate LTV allowances is amended. Five per cent of the value of new lending to first time buyers will be allowed above the 90 per cent LTV limit

Buy to Lets BTLs mortgages are now subject to a limit of 70% LTV. This limit can only be exceeded by a maximum of 10% of the euro value of all housing loans for non PDH purposes annually. Example - BTL: Property price 350,000 30% deposit of 105,000 is required, *unless the lender approves this application as part of the 10% exception allowed to exceed the new limits.

Loan to Income (LTI) In relation to the Loan to Income (LTI) measures for PDH mortgages, these are subject to: A limit set at a multiple of 3.5 times loan to gross income. This limit must not exceed more than 20% of the euro value of all housing loans for PDH purposes annually split at 20% FTB and 10% NFTB Example Gross Income of joint borrowers of 40,000 and 30,000 Maximum loan now allowable is 245,000, unless the lender approves this application as part of its 20% allowed exceeding the new limits

Exemptions Applicants can apply for an exemption for LTV or LTI. (not both) Generally a property should be identified Must have repayment capacity Must not be at max on the other exemption. i.e. if looking for LTI exemption the can not be at maximum loan to value on the application. Must have clean ICB Must be well within nets

Exemptions PTSB

Exemptions KBC

Exemptions Haven Spare NDI requirements for exemptions. SINGLE JOINT Loan to Income 2200 3600 Loan to Value 2000 2950 Subject to change

ICB & The Central Credit Register What is an ICB The Irish Credit Bureau (ICB) is the biggest credit-referencing agency in Ireland. The bureau is an electronic library or database that contains information on the performance of credit agreements between financial institutions (for example, banks and building societies) and borrowers (the citizen). A credit agreement can include a mortgage, car and personal loans and leasing and hire purchase agreements. Credit card details are included in the ICB library. Credit cards and credit history In the past, information was mainly supplied by the lenders only where credit cards were revoked or cancelled. Now lenders have the option of supplying full information about opening and closing balances to the ICB. Your card repayment performance will be measured by the ICB on a monthly basis but due to the nature of credit cards, you also get an additional 30 days before negative information about your record is recorded.

ICB & The Central Credit Register Length of time records are kept for Members of the Irish Credit Bureau send information about to the loans they have given to their customers to the Bureau. Therefore, information about a loan will be kept on the ICB database for the full term of the loan whether this is a 3-year personal loan or a 30-year mortgage. The ICB Member records the customer's performance on the repayments and this information is then sent to ICB where it is also recorded. When the loan is completed or when it reaches a frozen state (that is when it is Written Off) the 5-year retention term clock starts ticking. In other words, regardless of what the customer s performance on the loan was like, once the loan is terminated in its current state - it will then stay on the ICB Database for 5 years from that date

ICB & The Central Credit Register What is The Central Bank Register The Government gave a commitment to the IMF to develop a legal framework that would facilitate the collection and centralisation of information on credit, which has resulted in the creation of the Central Credit Register (the Register). The Register is a secure database established and controlled by the Central Bank of Ireland, under the Credit Reporting Act 2013. It is used to collect and store personal and credit information on loans of 500 or more from lenders.

From 30 June 2017 and every month after that, the lenders will submit information to the Register to enable the updating of the comprehensive credit report. The credit report will help lenders when it comes to making decisions about their loans and loan applications. The Register will promote greater financial stability by supporting a full and accurate assessment of loans and loan applications.

What is Included on the Central Credit Register Credit Cards Mortgages Overdrafts Personal Loans What is NOT Included on the Central Credit Register Hire Purchase/PCP* Utility Bills Income and salary information Deposit accounts Tax Liabilities The court services The Insolvency Service of Ireland *these are intended to be included in the future.

Cont Loans will be included if the loan is for 500 or more, and the borrower lives in the State at the time of applying for the loan, or where the loan agreement or loan application is governed by Irish law. Over 500 Lenders are included on the Register including, Asset finance house Banks Credit Unions Firms that have acquired loan books from Irish Financial Institutions Licenced moneylenders Local authorities NAMA

When will the Register start? From 30 June 2017, and every month after that lenders will submit the personal and credit information to the Register. This will apply to any existing loans they have of 500 or more at 30 June 2017, and any new loans of 500 or more that you take out after that. From 30 March 2018, information on loans from licensed moneylenders and local authorities will be included in the Register. How far back does the information go? Personal and credit information for loans existing at 30 June 2017 will be added to the Register from 30 June 2017. No details about transactions on your loans before 30 June 2017 will be submitted to the Register.

What information will be included in the credit report? Personal information includes Name, current and previous addresses, DOB. PPSN number, gender, Eircode and telephone number. Credit information given includes Loan type, Lender name, Loan amount, Loan balance, outstanding balance, no. of overdue payments, date of next payment and the amount of next payment. The Central Bank will publish on the website www.centralcreditregister.ie the exact date of when this service will become available.

Help to Buy Scheme Rules First Time Buyers must not have individually or jointly with any other person previously built or owned a property All tax affairs must be up to date and any outstanding will be deducted from the eligible amount Property purchased must be occupied by the applicants for 5 years post completion To qualify they must have closed between 19/7/2016 31/12/2016 Or Building new property or purchasing from a registered contractor from 01/01/2017

Rules cont Maximum amount claimable per property is 20000 and purchase price is equal or less than 500,000.00 If a joint application they can each claim but subject to the above The qualifying amount is based on tax paid over the last 4 years and any outstanding tax liability. Grants will be paid directly to the property contractor once all final contracts have been signed FTBs apply through ROS or PAYE The applicants can print off confirmation of amount they are eligible for and the reference to provide the lender with balance of funds proof.

Addendum to the Consumer Protection Code 2012 Addendum for Enhanced Mortgage Switching Measures: Transparency and Switching The Central Bank is now introducing new and amending certain existing provisions of the Consumer Protection Code 2012 (the 2012 Code). This Addendum is effective 1 January 2019. The following parts of the 2012 Code are now amended: Chapter 4 Provision of Information Chapter 5 Knowing the Consumer and Suitability Chapter 6 Post-Sale Information Requirements

Addendum to the Consumer Protection Code 2012 Chapter 4 Provision of Information Including, Application process, application forms, timelines, requirements for insurance both life and buildings, comparable product information and redemption figures within 5 Business days Chapter 5 Knowing the Consumer and Suitability Timelines , 3 working day acknowledgement with documents declared, list further items required, 10 working day decision once all documentation has been received, clear drawdown requirements Chapter 6 Post-Sale Information Requirements All in relation to rates, LTVs and consumer rights

Affordability All applications must show affordability. We must evidence the affordability up front through income documents and bank statements. To do a full initial assessment we require Income figure Repayment capacity Balance of Funds It is important to look closely at each, and ensure that payslips match bank accounts and they can afford the savings. We will be looking at each area above in more detail next. Pepper work on affordability with a HEF form and Net income

Before we look at calculators it important to understand where a lender looks for affordability. The areas are: MSR mortgage service ratio NDI net disposable income Repayment capacity It is not sufficient for an applicant to meet some of these areas. They must meet all the above.

MSR MSR is the monthly stressed mortgage repayment expressed as a percentage of the sole or joint applicants net monthly income. Lenders may vary slightly but we would look at approximate MSR being 0 - 34999 up to 35% of income can be used for mortgage payment 35k - 59999 up to 40% of income can be used for mortgage payment 60k - 74999 up to 42.5% of income can be used for mortgage payment 75k - 124999 up to 47.5% of income can be used for mortgage payment 125+ 50% of income can be used for mortgage payment

Net Disposable Income NDI is the sustainable residual net monthly income after making the stressed repayment and any other regular monthly outgoings. Again this figure can vary per lender but we have provided you with the average figures below: Single 1400 Couple 1900 Child 375

Net Disposable Income Example Mr and Mrs Smyth applying for a mortgage have 2 children. Couple Child x2 1900 700 They would need 2600 left out of there net income after making all monthly payments including the new mortgage payment. (discuss living expenses sheet) Net Income can be worked out on PwC Tax calculator

Repayment Capacity Repayment capacity must be evidenced in all cases. Repayment capacity shows the lender that the client can repay the stressed monthly mortgage payments. Proven repayment capacity can be Current rent/mortgage payments Current savings * Current loan repayments (only if cleared prior to drawdown) Increase in current account balance (over last 6 months) Pension contributions (non-mandatory that will no longer be made) Rent and savings must be evidenced in the bank statements and where rent is paid to a direct family member this may be discounted by the lenders *Savings made from a current account that is continuously operating an overdraft will be excluded

Balance of Funds Lenders ideally like to see borrowers have an established regular savings pattern. Where applicants do not have savings and are reliant on a gift, the lender may reduce the amount they can borrow. Savings do not have to be in the form of a general savings account , and may come from various sources; Regular mandated savings (shown over 6 months) An increase in the balance of the a current account (must be shown over 6 months)* Investments in stocks provided they are regular and are increasing Savings bonds The monthly savings figure can be used for repayment capacity PTSB 5% unless 80% or less ltv

Balance of Funds Sale of Shares or Property & Inheritance Sale of Shares or Property & Inheritance Sale of shares will require evidence, generally this can be in the form of a statement from the company. Where the balance comes from the sale of a house, they will look for the confirmation by way of a solicitors letter. Balance of funds obtained by way of inheritance must be shown as lodgement in account and a solicitors letter confirming the source and that the inheritance tax has be cleared. Gifts Gifts For cases where the applicant is being gifted the balance of funds you must supply the following Gift letter* Statements (from both parties)**

Balance of Funds Gifts Gifts A gift may also be given by way of discounted purchase price. the gift letter must state the gift amount, that the gift is non-returnable and that the person waives all interest in the property. It should clearly confirm the relationship to the borrower/s. statements from the gifter are required to confirm that they are gifting monies from an un-borrowed source. Some lenders will require deed of confirmations and a solicitor to confirm the 3rd party has received independent legal advice in relation to the gift amount. This is generally for the larger gifts.

Income & Employment 1 year continuous employment minimum required. Will look at teachers/medical staff/IT contracters on contracts provided they have been renewed and letter confirming renewal is highly likely. Will take between 25% - 50% of Over Time and Bonus provided evidenced in last 3 years P60s and satisfactory employer confirmation.

SELF EMPLOYED Chapter 4 Form 11 Accounts Tax Clearance Certifiate 2 or 3 years depending on lender annual accounts 2 or 3 years depending on lender chapter 4 form 11 12 months business bank accounts

Assessing Income docs, Paye Always look at the taxable year to date figure, and divide by the insurable weeka nd multiply by 52. This figure should closely match the salary cert. Ensure you check for employee pension deductions as this can have a negative impact on the success of the application if not factored in. Check previous years insurable weeks on p60 to ensure that they have been employed as per salary cert. Self-employed Look at the Form 11 figure for total taxable income. This should match closely with the net profit plus depreciation on the accounts. The lenders will average the last 2-3 years for income figure. Take note if profits increased or decreased more that 20% then they will take the average of 3 years. Always look at the accounts year on year to ensure no huge differences particularly in the directors remuneration or wages and the cash held in bank. PTSB Chapter 4 figure.

Bank Statements Investigate the bank statements Referral fees / Unpaid DD s etc. Is the salary mandated? Are there further loan payments? Is there children s allowance? Are clients in their overdraft? Are rent payments evident? No mini statements or screen shots of internet transactions Credit card, loan, savings and current accounts all needed Dated no longer that 4-6 weeks ago DO NOT SEND ORIGINALS If PRA is coming form the bank statements then we need full 6 months

From the income, bank statements and balance of funds you can then assess the mortgage by inputting information on the calculators. Calculators will they show what the client has the capacity to borrow subject to a full credit review and ICB check. You should now be in a place collate the full file ready to submit an application and start preparing your cover sheet.

Importance of the cover sheet. Cover Sheet The cover sheet is the first thing credit see. It outlines Borrowers main request Income details (make comments on pension deductions and ensure factored in) Repayment capacity Balance of funds Full client profile Information on any special offer product the clients wish to avail of This is the presentation of the case and you should ensure that the above details are correct.

Packaging and Documentation Checklist Cover Sheet Calculator AML Docs Application Form & Declarations Income docs Bank Statements Separation agreement (if applicable) Do not submit an incomplete application as lenders will not look at same. Lender specific check sheets

Thank You Q&A