New Anglia LEP Risk Footprint Summary

The New Anglia LEP risk register provides an overview of key risks, changes in risk scores since June 2020, and updates on managing relationships and funding. Key areas include national policy, Brexit impact, stakeholder management, transparency efforts, and funding status for various projects.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

New Anglia LEP Risk Footprint Date: February 2021 Melanie Richardson Finance and Governance Manager

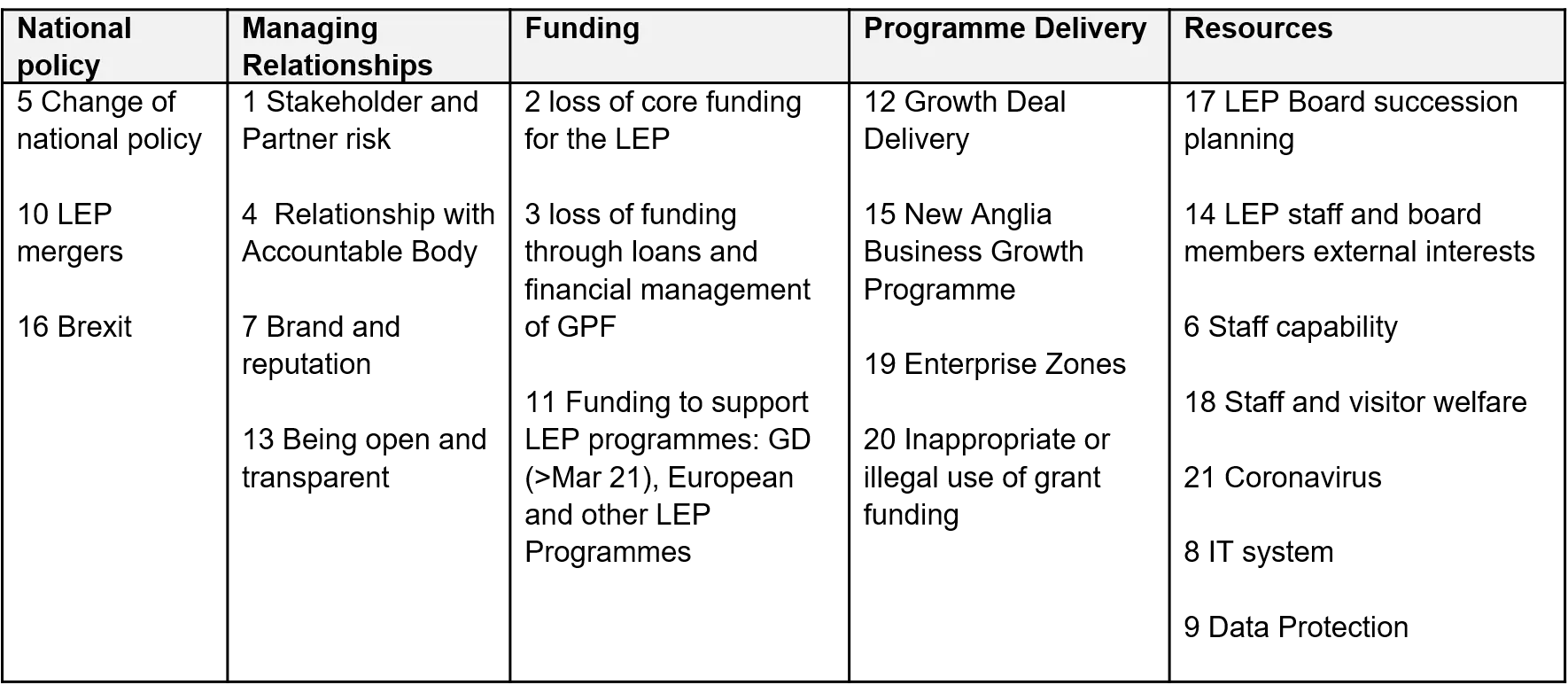

Risk Register Introduction The risk register was fully reviewed and refreshed in June 2020 to ensure that our corporate risks reflect our current operating environment. The risks were renumbered and grouped as shown in the summary below: National policy 5 Change of national policy Managing Relationships 1 Stakeholder and Partner risk Funding Programme Delivery Resources 2 loss of core funding for the LEP 12 Growth Deal Delivery 17 LEP Board succession planning 10 LEP mergers 4 Relationship with Accountable Body 3 loss of funding through loans and financial management of GPF 15 New Anglia Business Growth Programme 14 LEP staff and board members external interests 16 Brexit 7 Brand and reputation 6 Staff capability 19 Enterprise Zones 11 Funding to support LEP programmes: GD (>Mar 21), European and other LEP Programmes 18 Staff and visitor welfare 13 Being open and transparent 20 Inappropriate or illegal use of grant funding 21 Coronavirus 8 IT system 9 Data Protection 2

Risk Register Summary of key changes to register since June 2020 Overall, there were three changes to the current risk score in this period, Enterprise Zones reduced in risk, whilst the risks in respect of funding to support LEP programmes and inappropriate use of grant funding both increased. The key updates to the risk register were: National Policy Risk No.5 Change of National Policy (Owner: Chris Starkie) New reference to the Levelling Up Fund and that the LEP team is looking at other policy areas and funding opportunities to support delivery of the LEP s strategic objectives. Risk No.16 Brexit (Owner: Lisa Roberts) The UK and EU secured a deal before the end of the transition period. Risk updated regarding the potential impact on inward investment, the number of skilled workers in the region and the work required to adjust to challenges and take advantage of opportunities. The LEP is in the process of securing additional consultancy support to assist with outreach support to businesses to ensure that they are as prepared as they can be and provide detailed support where relevant. The longer-term recovery work of the LEP will take account of the UK s future relationship with the EU. The LEP and Growth Hub continue to work closely with the business community to support them through the new relationship and to ensure that any new opportunities or challenges that were not known before are raised and taken care of. 3

Risk Register Summary of key changes to register since June 2020 Managing Relationships Risk No.1 Stakeholder and Partner Risk (Owner: Chris Starkie) Progress continues to focus on bringing together public, private and education sector partners to combat the pandemic and support businesses. Risk No.13 Being Open and Transparent (Owner: Hayley Mace) Accessibility work planned for early 2021 to meet new regulations and to ensure digital communications are accessible to all. Funding Risk No.3 Loss of funding through loans and financial management of GPF (Owner: Chris Dashper) A progress update on the current loans position for Atex Developments, Maltings Ipswich and the Winerack. Currently both Atex and the Winerack are repaying their loans, with the Maltings not due to commence repayments yet. Due to the Covid-19 crisis, the ability of both to repay has been impacted by a lack of sales. However, the impact on both loans is expected to be a slightly lengthened repayment period. Atex have requested a slightly deferred repayment period but expect to make a full repayment in the current financial year. 4

Risk Register Summary of key changes to register since June 2020 Risk No.11 Funding to support LEP programmes (Owner: Rosanne Wijnberg) Current risk score has increased from 15 (amber) to 20 (red) as the longer-term view of infrastructure funding remains unclear. Our current Growth Deal allocation runs to March 2021. We have been awarded 32.1m to support the Getting Building Fund, through to March 2022. Our European funding which supports our business support programmes through the Growth Hub runs to November 2021. We have been allocated additional funds to enhance our business support capabilities over the C-19 and the Transition period. We have enhanced our bidding capability with 2 bids currently in progress. Programme Delivery Risk No.12 Growth Deal Delivery (Owner: Chris Dashper) In spite of mitigating actions, delivery and spend on many projects is later than anticipated. The LEP Board has been updated on the forecast rollover. Risk No.15 New Anglia Business Growth Programme (Owner: Chris Dashper) The programme has seen some slippage during Q3 of 2020, however, it remains on target to meet the required private sector match funding. 5

Risk Register Summary of key changes to register since June 2020 Risk No.19 Enterprise Zones (Owner: Julian Munson) Current risk score has reduced from 6 (amber) to 4 (green). Outstanding Pot C invoices have all been followed up with respective LAs and all payments now concluded. Enhanced invoicing processes now in place. Awaiting decision from Government on EZ rate relief extension. Risk No.20 Inappropriate or illegal use of grant funding (Owner: Chris Dashper) The current risk score has increased from 4 (green) to 8 (amber). The R&R scheme raises the potential for inappropriate use of funding due to the volume of applicants, mitigating measures in place and no issues have occurred to date. Resources Risk No.14 LEP staff and Board Members external interests (Owner: Chris Starkie) A register of interests for LEP staff is in place. Leadership Team and those on funding decision panels must complete a form. Other staff may voluntarily complete a register of interests form if they feel they have a particular interest to declare. 6

Risk Register Summary of key changes to register since June 2020 Risk No.6 Staff Capability (Owner: Rosanne Wijnberg) Internal training and knowledge share sessions have been introduced. Risk No.18 Staff and Visitor Welfare (Owner: Rosanne Wijnberg) Team members hold current first aid at work qualifications as well as mental health first aid. Risk No.8 IT system (Owner: Rosanne Wijnberg) Work is underway to transfer files from the server to the cloud to remove reliance on VPN connections with everyone working remotely. Action almost complete. 7

Risk Assessment 1 2 3 Stakeholder and Partner Risk Loss of core funding for the LEP Loss of funding through loans & financial management of GPF Relationship with Accountable Body Change of National Policy Staff Capability Brand and Reputation IT System Data Protection LEP Mergers Funding to support LEP programmes: GD infrastructure (post March 2022), European and other LEP programmes Growth Deal Delivery Being Open and Transparent LEP Staff and Board Members External Interests New Anglia Business Growth Programme Brexit LEP Board Succession Planning Staff and Visitor Welfare Enterprise Zones Inappropriate or illegal use of grant funding Coronavirus 16 21 5 4 5 6 7 8 9 10 11 12 4 LIKELIHOOD 3 13 3 11 7 8 2 19 5 12 13 14 2 6 18 14 9 10 4 15 15 1 1 17 20 16 17 18 19 20 1 2 3 4 5 Minor Moderate Major Extreme Insignificant IMPACT 21 8

Risk Summary 1. Stakeholder & Partner Risk Partnership breakdown lessens engagement & support from stakeholders. Loss of Core Funding for the LEP Withdrawal of funding from bodies providing the finance for LEP core operations and projects. Loss of funding through loans and financial mgt of GPF Without appropriate financial management measures in place for its loans and grant funding programmes, the LEP could incur significant financial losses. Relationship with the Accountable Body LEP and AB relationship becomes difficult resulting in less effective management of the LEP s finances. Change of National Policy Change of national policy impacts on the LEP s ability to deliver its strategic objectives. Staff Capability Inadequate or a lack of suitable skills within the LEP leads to a failure to deliver some or all of the activities set out in the operational plan. Brand and Reputation Poor communications and brand management can lead to reputational and business risks. IT system Complete failure or reduction of IT systems makes LEP operations extremely difficult. Data Protection The LEP breaks Data Protection Laws. 10. LEP Mergers Merger with other LEPs decreases economic benefits for Norfolk and Suffolk. 11. Funding to support LEP programmes: GD infrastructure (> March 22) European and other LEP programmes Govt has made no announcement of any future rounds of GD, European Funding or Shared Prosperity Funding which causes future uncertainty on the viability of LEP programmes. 12. Growth Deal Delivery Delays in project delivery impacts on delivery of our ambitions. 13. Being Open and Transparent Reputational risk if any of the documents published contain contentious material or confidential information is accidentally published. 14. LEP Staff and Board Members External Interests Reputational risks where grant or loan funding is provided to companies when staff or LEP Board members have an interest in the company. 15. New Anglia Business Growth Programme Financial and reputational risks relating to the delivery of the programme. 16. Brexit Economic implications to the UK and to regions which could impact on the LEP s ability to deliver its Economic Strategy. 17. LEP Board Succession Planning Failure to have a robust succession plan in place for replacement of the LEP Chair and other Board members leads to a lack of consistency, strategic direction and decision making. 18. Staff and Visitor Welfare Risks to staff and visitors to both offices in terms of health and safety 19. Enterprise Zones Failure to achieve signing of EZ site legal agreements impacts on delivery of EZs 20. Inappropriate or illegal use of grant funding Grant awards made are used against ineligible spend or misappropriated. 21. Coronavirus There is a risk that significant number of employees will be infected which will impact on LEP operations. 2. 3. 4. 5. 6. 7. 8. 9.

Risk Measurement Model Event is expect to occur Almost Certain >80% 5 Event will probably occur in most circumstances 50 80% LIKELIHOOD Probable 4 Event will occur at sometime 25 50% Possible 3 Event could occur at sometime 10- 25% Unlikely 2 Event may occur in exceptional circumstances <10% Rare 1 1 2 3 4 5 Minor Moderate Major Extreme Insignificant Loss of critical services for more than 48 hours but less than 7 days Loss of critical services for more than 7 days Minimal disruption to services Significant disruption to services Service Delivery Little disruption to services Loss less than 10,000 Loss of 10,000 to 50,000 Loss of 50,000 to 100K Loss of 100K to 300K Loss greater than 300K Financial Loss Significant impact on achieving LEP objective Little or no effect on LEP objective Minimal effect on achieving LEP objective Partial failure to achieve LEP objective Non-delivery of LEP objective Performance Extensive negative coverage in Local, national and international multimedia Complete loss of stakeholder and investor confidence Moderate negative coverage in local multimedia Moderate loss of stakeholder and investor confidence Significant negative coverage in local & national multimedia Major loss of stakeholder and investor confidence Minimal negative coverage in local multimedia Minimal effect on stakeholder and investor confidence Insignificant damage to reputation Stakeholder and Investor confidence unaffected Reputation & Stakeholder Management 10

undefined

undefined

undefined

undefined