"Naphtha Market Growth Accelerates with Surge in Petrochemical and Fuel Demand,

Naphtha Market, By Type (Heavy, Light), By Application (Chemical, Energy, Fuel), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

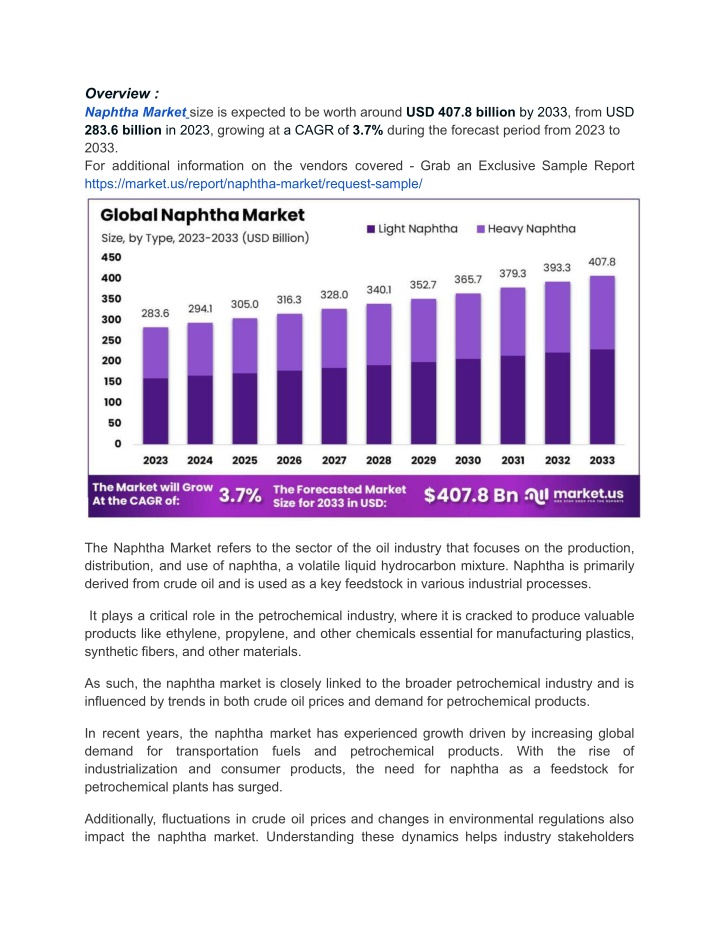

Overview : Naphtha Market size is expected to be worth around USD 407.8 billion by 2033, from USD 283.6 billion in 2023, growing at a CAGR of 3.7% during the forecast period from 2023 to 2033. For additional information on the vendors covered - Grab an Exclusive Sample Report https://market.us/report/naphtha-market/request-sample/ The Naphtha Market refers to the sector of the oil industry that focuses on the production, distribution, and use of naphtha, a volatile liquid hydrocarbon mixture. Naphtha is primarily derived from crude oil and is used as a key feedstock in various industrial processes. It plays a critical role in the petrochemical industry, where it is cracked to produce valuable products like ethylene, propylene, and other chemicals essential for manufacturing plastics, synthetic fibers, and other materials. As such, the naphtha market is closely linked to the broader petrochemical industry and is influenced by trends in both crude oil prices and demand for petrochemical products. In recent years, the naphtha market has experienced growth driven by increasing global demand for transportation fuels and petrochemical industrialization and consumer products, the need for naphtha as a feedstock for petrochemical plants has surged. products. With the rise of Additionally, fluctuations in crude oil prices and changes in environmental regulations also impact the naphtha market. Understanding these dynamics helps industry stakeholders

make informed decisions about investments, production, and strategic planning in this crucial segment of the oil and gas industry. rk t gm nt : By Type: Heavy Light By Process: Chemical Energy Fuel By End-Use: Petrochemicals Agriculture Paints & Coatings Aerospace Others In 2023, Light Naphtha and Heavy Naphtha together dominated the market with over 56.5% share. Light Naphtha led due to its broad application in gasoline production and petrochemicals. The primary application of Naphtha was as a chemical feedstock, accounting for 63.8% of the total volume. It is crucial for producing ethylene, propylene, and gasoline, with catalytic reforming also being a key process. The Petrochemicals sector led the Naphtha market, holding over 51.6% share. It drives demand due to its role in producing essential chemicals like ethylene and propylene for plastics and other products. Other notable end-use sectors include Agriculture, Paints & Coatings, and Aerospace, each utilizing Naphtha in various applications. These segments leverage Naphtha's versatility, though Petrochemicals remain the dominant market driver.

rkt lr LG Chem China Petrochemical Chevron Mangalore Refinery and Petrochemicals Limited Exxon Mobil Corporation Reliance Industries Limited BP Shell SABIC British Petroleum CNPC China Petroleum & Chemical Corporation Formosa Petrochemical Corporation Saudi Aramco Lotte Chemical Corporation Drivers: The naphtha market is significantly driven by its essential role in petrochemical production, where it is used to create key chemicals like ethylene, benzene, and propylene. Additionally, the rising demand for olefin-rich naphtha, used in high-octane diesel production, and its widespread application as a solvent in cleaning agents and dry-cleaning further fuel market growth. Restraints: The market faces challenges from fluctuating crude oil prices, which impact naphtha costs and availability. Increased competition from cheaper alternatives like LPG and natural gas liquids, along with shifts in energy preferences, also pose constraints on market expansion. Opportunities:

Opportunities for the naphtha market include growth in the electrical and transport sectors, which drive higher demand for naphtha. Advances in technology that improve distillation processes and the expansion of the chemical industry present additional growth prospects. Challenges: The naphtha market must navigate fluctuating crude oil prices, which affect cost stability. Competition from alternative fuels and the need for technological upgrades present challenges. Additionally, expanding into new markets and adapting to diverse regulations can be complex for some companies.