Municipal Finance System in the Federal Republic of Germany: Thuringia Example

The presentation outlines the municipal finance system in the Federal Republic of Germany, using Thuringia as an example. It covers tax revenue, key allocations to municipalities, fiscal equalization, and the structure of the federal and state governments. Various taxes, including federal, municipal, and shares in joint taxes, are discussed, highlighting the complex financial arrangements at different administrative levels.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Prof. Dr. Stefan Zahradnik Municipal Finance System in the Federal Republic of Germany: the Example of Thuringia 1

Outline of the Presentation Structure of the Federal Republic of Germany Tax revenue in the Federal Republic of Germany Tax revenue of selected municipalities in Thuringia Municipal taxes Municipal share of income taxes Key allocations to municipalities in Thuringia It is not identical in all L nder, but it is similar. I'll explain using Thuringia as an example. Fiscal equalisation levy in Thuringia Special burden compensation in Thuringia County levy in Thuringia Municipal Finance System in the Federal Republic of Germany 2

Structure of the Federal Republic of Germany Federation (82.2 million inhabitants) 16 L nder thereof: 13 Fl chenl nder 3 City States (Berlin, Bremen, Hamburg) Land Thuringia Land (2.1 million inhabitants) 12 Counties in Thuringia 294 Counties in the Federation Erfurt County County County Gera 619 Municipalities within counties in Thuringia 10.664 Municipalities within counties in the Federation Jena Municipality Municipality Municipality 5 County-free cities in Thuringia 109 County-free cities in the Federation Suhl Weimar (01/2023) Municipal Finance System in the Federal Republic of Germany 3

Tax Revenue in the Federal Republic of Germany According to Article 106 of the Basic Law, the following are entitled to the Federation the L nder the Municipalities* Taxes of the L nder: Property tax Inheritance tax Real property transfer tax Beer tax Race betting and lottery tax Fire protection tax Federal taxes: Motor vehicle tax and air transport tax Insurance tax Solidarity surcharge Various excise taxes (currently energy tax, tobacco tax, electricity tax, alcohol tax, coffee tax, sparkling wine tax, intermediate products tax, alcopop tax) Municipal taxes: Real property tax Local business tax Local excise and expense taxes (e.g. beverage tax, dog tax, hunting and fishing tax, liquor license tax, amusement tax [e.g. gaming machine tax], second home tax) 109.5 25.9 71.6 Shares in joint taxes: Income tax (15%) Value-added tax (currently approx. 3.4%) Shares in joint taxes: Income tax (42,5%) Corporation tax (50%) Value-added tax (currently approx. 47.7%) 266.5 Shares in joint taxes: Income tax (42,5%) Corporation tax (50%) Value-added tax (currently approx. 48,9%) 43.1 269.4 8.3 Tax allocations according to the law of the Land (Municipal fiscal equalisation) Share in local business tax levy 49.3 6.2 Share in local business tax levy 2.1 * resp. associations of municipalities (counties) Taxes 2019 in billion (BMF, 09/2021) L nder fiscal equalisation 5.1 Tariffs XX,X Municipal Finance System in the Federal Republic of Germany 4

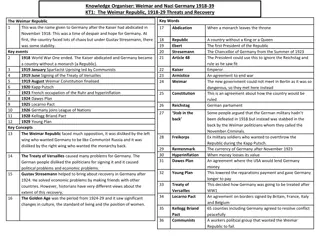

Tax Revenue of selected Municipalities in Thuringia County-free cities Erfurt 214969 340 T 30800 T 107270 T 83769 T 25530 T 5255 T 93517 T 107406 T -7812 T Municipalities within county Nordhausen 41339 100 T 5700 T 23000 T 12903 T 4893 T 589 T 12073 T local rate of assessment Weimar Weida Ohrdruf Inhabitants at 31.12.2022 Real property tax A Real property tax B Local business tax Municipal share in income tax Municipal share in value-added tax Local excise and expense taxes Key allocation for municipal tasks Key allocation for county tasks Local business tax levy Fiscal equalisation levy County levy Total Total per inhabitant 65620 64 T 7800 T 22000 T 24500 T 4600 T 650 T 32126 T 36657 T -1750 T 8205 22 T 1020 T 2050 T 2550 T 400 T 90 T 3230 T 9613 25 T 1215 T 8400 T 3161 T 1297 T 68 T 296 330 330 300 350 480 460 450 400 550 470 430 440 395 400 local rate of assessment 35 -1830 T -182 T -735 T -18 T -5240 T 8172 T 850 -19922 T 37506 T 907 -2364 T 6816 T 831 446075 T 2075 126556 T 1929 (Inhabitants, key allocations and fiscal equalisation levy from Thuringian State Office for Statistics, otherwise Budget data for 2023) The municipalities additionally receive special burden compensation from the Land! Municipal Finance System in the Federal Republic of Germany 5

Municipal Taxes Real property tax A (agricultural operations): Taxable amount local rate of assessment for agricultural operations (percentage) = on the basis of the real property value (fraction of the real property value) Tax debt Real property tax B (other real properties): Taxable amount local rate of assessment for other real properties (percentage) = on the basis of the real property value (fraction of the real property value) Tax debt Local business tax: Taxable amount local rate of assessment for businesses (percentage) = on the basis of the commercial yield (fraction of the commercial yield) Tax debt determined by the tax office of the Land determinded by the local government Local excise and expense taxes: Only consumptions and expenses are taxable. The tax must have a local sphere of action. It must not be similar to a tax already regulated by federal law. (Article 5 para. 2a of the Basic Law) Municipal Finance System in the Federal Republic of Germany 6

Municipal Share of Income Tax Step 1: Determination of the ratio for each municipality: Tm Sum of tax on limited income in municipality m Tax(LIt,m) t=1 for all municipalities m Rm= Ml Tm Sum of tax on limited income in the entire Land Tax LIt,m m=1 t=1 Ratio of the municipality m Tax from the limited income of the taxpayer t residing in municipality m (tax on income up to 35000 for singles or 70000 for jointly taxed spouses) Number of taxpayers residing in municipality m Number of municipalities of Land l Rm Tax(LIt,m) Tm Ml Step 2: Determination of the individual share of the municipality: Share of income tax of municipality m = Rm (RITl 0.15 + RCGTl 0.12) Revenue of the Land l from capital gains tax according to 43 para. 1 sentence 1 nos. 6, 7 and 8 to 12 and sentence 2 Einkommensteuergesetz Revenue of the Land l from income tax ( 1, 3 Gemeindefinanzreformgesetz) Municipal Finance System in the Federal Republic of Germany 7

Key Allocations to Municipalities in Thuringia Tax capacity index Financial need index Inhabitants 1 to 3000 3000 to 5000 5000 to 10000 10000 to 20000 20000 to 50000 50000 to 100000 100000 to 200000 200000 to Percentage 100 100 to 115 115 to 120 120 to 135 135 to 140 140 to 145 145 to 155 155 to 165 Total tax revenue on the basis of standardised rates of assessment: Real property tax A + Real property tax B + Local business tax Local business tax levy + Municipal share in income tax + Municipal share in value-added tax (100) 271 389 395 (100) (100) = Tax capacity Index Standardisation has the effect that the tax capacity index is independent of the local rate of assessment. Linear interpolation within classes. Additional 6.7 per child under 6 years of age. Financial need index = inhabitants percentage + children 6.7 unform basic amount 100 If financial need index > tax capacity index, the following formula applies: Key allocation = 0.80 financial need index tax capacity index 714 The uniform basic amount is set in such a way that the total key mass earmarked for key allocations is used up. The key allocations for the county tasks are determined using a similar, but with regard to the financial need index more complex procedure. (million in 2023) 912 (million in 2023) ( 6-15 Th ringer Finanzausgleichsgesetz) Municipal Finance System in the Federal Republic of Germany 8

Fiscal Equalisation Levy in Thuringia If tax capacity index > financial need index, the following chart applies: 40% additional Euro tax capacity index Share to be paid from each as fiscal equalisation levy The fiscal equalisation levy is paid to the county to which the municipality belongs. It therefore serves to equalise between municipalities with different tax capacities in this county. 20% 19 0% (million in 2023) 115% 15% Exceedance of the tax capacity index over the financial need index ( 29 Th ringer Finanzausgleichsgesetz) Municipal Finance System in the Federal Republic of Germany 9

Special Burden Compensation in Thuringia Schools School transport Education and training tasks Provision of geographic base data Operation and introduction of digital radio Child day care tasks School buildings Elimination of special environmental burdens Burdens on health resorts Municipalities with below-average population density Cultural burdens Municipal investment lump sum Climate protection and adaptation measures Additional burden Fund for budget consolidation, overcoming exceptional burdens, compensating for hardships in the implementation of fiscal equalization and promoting new cooperative ventures between municipalities 965 (million in 2023) ( 16-24 Th ringer Finanzausgleichsgesetz) Municipal Finance System in the Federal Republic of Germany 10

County Levy in Thuringia Key allocation averaged over the previous year and the two preceding years + Tax capacity index Fiscal equalisation levy averaged over the previous year and the two preceding years = County levy base County levy base rate of assessment set by the county = county levy If some municipalities also function as school boards, but others do not, a school levy is applied separately, so that the county levy is then lower. ( 25-28 Th ringer Finanzausgleichsgesetz) Municipal Finance System in the Federal Republic of Germany 11

Tax Revenue of selected Municipalities in Thuringia County-free cities Erfurt 214969 340 T 30800 T 107270 T 83769 T 25530 T 5255 T 93517 T 107406 T -7812 T Municipalities within county Nordhausen 41339 100 T 5700 T 23000 T 12903 T 4893 T 589 T 12073 T local rate of assessment Weimar Weida Ohrdruf Inhabitants at 31.12.2022 Real property tax A Real property tax B Local business tax Municipal share in income tax Municipal share in value-added tax Local excise and expense taxes Key allocation for municipal tasks Key allocation for county tasks Local business tax levy Fiscal equalisation levy County levy Total Total per inhabitant 65620 64 T 7800 T 22000 T 24500 T 4600 T 650 T 32126 T 36657 T -1750 T 8205 22 T 1020 T 2050 T 2550 T 400 T 90 T 3230 T 9613 25 T 1215 T 8400 T 3161 T 1297 T 68 T 296 330 330 300 350 480 460 450 400 550 470 430 440 395 400 local rate of assessment 35 -1830 T -182 T -735 T -18 T -5240 T 8172 T 850 -19922 T 37506 T 907 -2364 T 6816 T 831 446075 T 2075 126556 T 1929 (Inhabitants, key allocations and fiscal equalisation levy from Thuringian State Office for Statistics, otherwise Budget data for 2023) The municipalities additionally receive special burden compensation from the Land! Municipal Finance System in the Federal Republic of Germany 12