Mastering Iron Condors

Dive into the world of iron condors with "The Option Pit Method Mastering Iron Condors" by Option Pit. This comprehensive guide teaches you how to effectively utilize iron condors in options trading. Learn strategies, tips, and techniques to maximize your gains and minimize risks. Whether you're a novice or an experienced trader, this book provides valuable insights to enhance your trading skills and achieve success in the markets. Discover how to navigate the complexities of iron condors and make informed decisions to boost your profitability.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

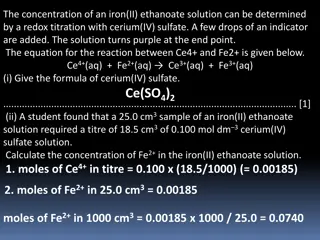

The Option Pit Method Mastering Iron Condors Option Pit

What I will cover What is an Iron Condor Greek Focus Not all Iron Condors are equal- product selection Conditions that make them run and crash Managing the trade

What is an Iron Condor An iron condor is in many ways simply a strangle that is hedged It involves selling an OTM call spread and selling an OTM put spread at the same time. The net creates a landing pad of safety that for the spread to profit from

Characteristics A short iron condor is generally going to have the short calls closer to ATM than the puts This is caused by SKEW Will be short delta Because the shorts are closer to the money than the longs it is Long Theta

Characteristics The spread wants the underlying to stay in a tight range and not to move Thus the spread is SHORT gamma The spread is selling premium, Thus the spread is SHORT VEGA

Keys to Success Notice the basic Iron Condor characteristics in common with other short volatility trades: Short Delta Short Gamma Short Vega Long Theta

Keys to Success Now focus on a change in the basic Greeks Good Iron Condors will have a heavy emphasis on the Vega at the expense of the other Greeks (Delta, Gamma and Theta) If Delta is a problem more on that later Why? Selling Vega is the Greek we want to focus on

Keys to Success RISK is defined as money that can disappear (capital at risk) Iron Condors or butterflies are just devices to sell options!

Keys to Success The Big Question- How to sell options that best fit what is going on? Iron Condors are poor event driven trades Theta is the stuff you get for the gamma you give up Betting on 1 time events give little room for the gamma to work out Iron Condors are risk controlled short Vega trades that give up edge to the skew

The Key to Iron Condor Trading Are the next 30 days (pick your time frame) GOING TO BE AS VOLATILE AS THE LAST 30 DAYS? If the answer is no, then consider the trade.

Product Specifics Equities Biotechs (poor) Dow Stocks (S&P 500) (better) Growth Stocks (maybe- for very short duration) Low Dollar Stocks (no) Volatility ETN s (no too explosive) ETF S (yes) Commodity Futures (maybe) Cash/Future Indexes (yes)

Product Specifics Now look at each product type and differentiate the characteristics among them: Higher IV dropping Realized volatility declining Lower chance of >5% moves Lower negative gamma Flatter skew (if possible)

Keys to Success for both An iron butterfly or an iron condor will perform well when IV is falling Not a good sale in climbing IV generally Be fine with selling into falling IV

Keys to Success Note the dominant Greek in these positions Theta moves slow Vega can move fast

Understanding the Trade- IWM Walk through the steps: Higher IV dropping Realized volatility declining Lower chance of >5% moves Lower negative gamma Flatter skew (if possible) 15 delta strikes or lower EVENT - BREXIT

Understanding the Trade- VRX Walk through the steps: Higher IV dropping Realized volatility declining Lower chance of >5% moves-NOT Lower negative gamma Flatter skew (if possible) 15 delta strikes or lower

Keys to Success Note the dollars we are bringing in on the Iron Condor How can we use that credit to manage the position? Now lets compare IWM and VRX -We will set up the dollars in both trades

Keys to Success A trader wants HV to be falling as well as IV One result of high IV is really high HV Part of the reason that we don t sell high IV is because HV is so high We are looking for the stock to STOP moving or slow down That brings us to Friday, Jun 10th

What Greeks Affect an IB/IC It is VERY bad for delta to become a risk factor in an iron condor As IV increases, it can stop time in an Iron Condor The sale price and vol levels are very important When IV explodes, Vega can become a problem as the IC will not collect theta and the trader must still deal with gamma

What Greeks Affect an IC? The big decision is when will the IV subside! Note the IV in VRX and IWM. Which one has the greater risk to Vega? I like Iron Condor trades for longer duration OR very short duration, and farther away from the money when there is more of a chance the RV might kick up Let s see the difference in trade management

Basic Trade Management The idea here is to reduce Risk by using margin Think of this as adding long contract types into short contract types Buys time and piece of mind Different volatilities and time frames require different adjustments

Basic Trade Management Ways to fix the delta buildup: Calls or puts Call or put spreads (all types) Butterflies inside the risk tent (most types) Ratio call or put spreads (indexes) Margin Trades (usually diagonal time spreads with long gamma) Rolling up (THIS ADDS RISK! But more credit too)

The Dangers of rolling up Make sure you understand the difference between buying time and buying success

Management Trades Lets walk thorough each type and work net change in credit on the trade The better we set up an adjustment the better we have two chances to win

Insurance Buy (index) Long cheap puts are a losing proposition the goal is not to buy to many Use as little of the trading credit to buy cheap puts as possible At MOST 1 put for every 10 IC Meant to mitigate loss in the face of a market blow up Trade of % of credit, at MOST use 10% of total credit Try to use more like 1-3% in normal conditions

Buy Insurance (Index) If the VIX is falling, but is above 25 buy limited insurance or don t buy insurance If the VIX is stable and below 17 buy small insurance If VIX is stable below 15 If one wants to sell above a VIX of 45 do not insure

MGMT Shoot for the credit (keeping adjusting cash) Do not lose more than the credit Max loss Never lose more than the credit Absolute max loss Use the 1/3 1/3 1/3 Rule Use smart adjusting Never roll (a losing side)

Upside Adjustments The Kite Buy 1 call below the call spread Sell enough call spreads to pay for of the call Great on almost any occasion, good when IV is mid-tier or even high If IV is high, sell up to 2/3 of call price Back Ratio Sell 1 near, buy 2 outside the spread Great when IV is LOW (30 days out, indexes only)

Kite Buy 1 call underneath Sell enough call spreads at the IC strikes to pay for half of the purchased call

Back Ratio On a rally if IV implodes the back ratio the best adjustment (30 days to go at least) Trade to pay less than 1/10 the total credit of the Iron Condor

Margin Adjustment The time diagonal Buy 1 in the front month underneath the spread Sell 1 in next month out outside of the spread Pay nothing Great to hedge delta as well at onset Some lower volatility expectation

Time Diagonal Great way to get long gamma and sell vega for little or no cost Try to pay nothing, or even take in a credit Not a great trade when the IV has imploded

Downside Adjustment The Put Spread Set long side inside spread Great for quick deltas When IV is high Ratio Spread Great when IV is sinking with the mkt Skew is collapsing

Put Spread When one is unsure of how IV might move and needs quick deltas When IV has already rallied and one needs deltas When skew is steep

Summary The IC takes a lot of work if you are too early Understand what the IV is going to do Learn to control the Gamma and the Vega Learn to sell into declining realized volatility Not all Iron Condors are created equal Look for manageable Iron Condors as opposed to not

Thank you for attending! For question you can contact: mark@optionpit.com andrew@optionpit.com 1(888) Trade-01

![READ⚡[PDF]✔ European Mail Armour: Ringed Battle Shirts from the Iron Age, Roman](/thumb/20552/read-pdf-european-mail-armour-ringed-battle-shirts-from-the-iron-age-roman.jpg)