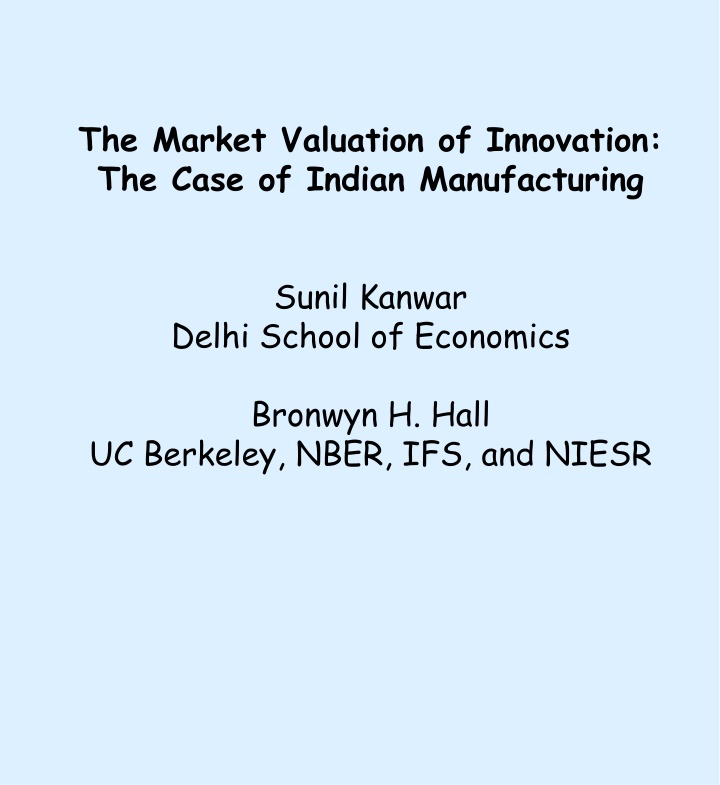

Market Valuation of Innovation in Indian Manufacturing

Explore how financial markets value innovation in Indian manufacturing industries compared to developed countries. The study delves into the market valuation of innovation, responsiveness to quality of spending and market risk, and variations across industries in India. Prior literature mostly focused on developed countries, making this research on India unique and informative.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The Market Valuation of Innovation: The Case of Indian Manufacturing Sunil Kanwar Delhi School of Economics Bronwyn H. Hall UC Berkeley, NBER, IFS, and NIESR

1. Motivation Innovation prime motive force behind economic growth Firms spend large amounts of scare resources on innovative activities Desirable to know whether financial markets value innovation-intensive firms differentially Persuasive evidence that developed country stock markets value innovative activity by firms Can we expect the same in less developed economies? Major reason for incredulity is the fact that predominant share of intellectual capital is generated in a handful of developed economies

A few developing countries do some innovation (Bogliacino et al. 2012) process patents, utility models, smaller innovations. Often for imitation and diffusion, but generate profits and hence market value Hence, stock market s valuation of innovation also relevant in developing country context: Are more innovative firms valued more highly than less innovative ones? Is market valuation responsive to the quality of innovation spending? Is market value responsive to market risk? Does the market value-innovation relation vary across industries; and if so, how? We explore such issues in the context of manufacturing industries in India.

2. Prior literature Very informative, but mostly pertains to developed countries: Griliches (1981); Bloom and Van Reenen (2002); Hall, Jaffe and Trajtenberg (2005); Greenhalgh and Rogers (2006); Griffiths and Webster (2006); Hall and Oriani (2006); exception Chadha and Oriani (2010) Our study broad-bases the available evidence by providing further evidence on a developing country, namely India. Number of distinguishing features, including the context - mostly no product patents; few process patents, limited to certain industries; utility models never an option Far from obvious that stock market would value such innovation as does occur

3. The Model ? = ?(??+ ???+ ????+ ??)?(1) ? ?? ?? ?? ln = ? ln(??)??+?ln 1 + ? ?? ?? ??? ?? ? + ? + ? + ??+ ??+ ??? ?? ?? ?? (2) ? ?? ?? ??+ ? ??+ ??+ ???(3) ??? ?? ? ?? ?? ? ln ??+ ? ?? ??+

4. Sample and Variables Firm-level data for Indian manufacturing sector ( Prowess ; CMIE) Sample: 380 firms, 3494 observations, over 2001-2010, covering 22 industries (mostly 2-digit, some 3-digit levels): Auto ancillaries, automobiles, cement, chemicals, (other) construction material, (other) consumer goods, domestic appliances, drugs and pharmaceuticals, electrical machinery, electronics, food and agro-products, gems and jewellery, glass and glassware, leather and leather products, metals, non-electrical machinery, paper and paper products, personal care, petroleum, plastics and plastic products, rubber and rubber products, and textiles and textile products.

Variables: Market Value (V): equity + debt Physical capital (Kp): net fixed assets Knowledge capital (KK): capitalized value of R&D expenditure; perpetual inventory method (15% depreciation rate) ???= ? ? ?? ? ?+ ??? Other intangible capital (KOI): capitalized value of advertising expenditure; perpetual inventory method (30% depreciation rate) DUM (adv = 0); invariably insignificant Quality of capital (S): real profit after- tax, purged of knowledge capital and other intangible capital (and time dummies)

Table 1 Sample statistics (3,494 observations on 380 firms, 2001-2010) Mean Median Standard Deviation Variable Minimum Maximum Share Variance Within ? ?? ???? ?? ????? ? ?? ?? (M rupees) D (??? = 0) ?? (? ??) ???? ?? ?? ????? ? ?? ???? Definitions: ? = Market value = Equity + Book Debt ?? = Net fixed assets ?? = Knowledge capital at 15% depreciation ?? ??? = Advertising capital at 30% depreciation ? = Quality of capital = Profit surprise Geometric mean Within-firm variance as a proportion of total variance (controlling for overall year means) 4.36 0.12 0.17 0.13 0.00 3.23 0.05 0.06 0.00 0.03 1110.8 3.43 0.20 0.32 0.42 0.31 1.71 0.16 0.00 0.00 0.00 1.94 2.30 19.82 2.72 5.39 7.38 2.02 0.265 0.159 0.181 0.078 0.427 0.050 0.052 ?? 1140.7 42.4% 1,500,007 Correlation Matrix ?? ?? 1 0.077 0.140 0.045 ???? ?? (? ??) ???? ????? ? ?? 1 0.330 0.338 0.302 0.391 0.024 1 0.906 0.112 0.004 0.131 1 0.001 0.039 1 0.004 1 = Knowledge capital at 30% depreciation

Table 2 Nonlinear Regressions Dependent Variable: ln (? ?? (2) (3) NLLS NLLS ) Regressor (1) NLLS (4) NLLS (5) NLLS, lag RHS 1.661*** (0.324) [0.126] *** (0.018) 0.815*** (0.185) [0.051] *** (0.008) 0.031 (0.055) 0.527*** (0.095) 0.013 (0.014) No Yes 0.286 0.571 (6) NLIV ???? ????? D (???= ?) ? ?? ln ?? Industry d.v. Year FEs ?? Standard Error Panel D-W Observations Firms Note: Robust standard errors clustered on firm in parentheses below each coefficient Elasticity at the means in square brackets, with its standard error below it In column (5), all right hand side (RHS) variables are lagged one year In column (6), the instruments are the right hand side variables lagged one year ***,** and * denote significance at the 1%, 5% and 10% levels, for a two-tail test 2.275*** (0.389) [0.164] *** (0.018) 0.020 (0.015) No Yes 0.199 0.608 2.009*** (0.375) [0.140] *** (0.018) 0.988*** (0.224) [0.058] *** (0.009) 0.028 (0.057) 0.020 (0.015) No Yes 0.267 0.582 1.790*** (0.330) [0.134] *** (0.018) 0.817*** (0.183) [0.052] *** (0.008) 0.037 (0.053) 0.508*** (0.103) 0.012 (0.014) No Yes 0.318 0.561 1.473*** (0.336) [0.114] *** (0.019) 0.974*** (0.191) [0.059] *** (0.008) 0.004 (0.056) 0.464*** (0.101) 0.015 (0.015) Yes Yes 0.383 0.536 1.764*** (0.329) [0.137] *** (0.018) 0.640*** (0.145) [0.044] *** (0.008) 0.083 (0.053) 0.709*** (0.031) 0.012 (0.016) No Yes 0.270 0.579 0.266 3494 380 0.285 3494 380 0.316 3494 380 0.345 3494 380 0.360 3114 380 0.346 3114 380

Table 3 Linear Regressions Dependent Variable: ln (? ?? (2) (3) OLS OLS ) Regressor (1) OLS (4) OLS (5) OLS, lag RHS 0.912*** (0.118) [0.114] *** (0.015) 0.392*** (0.055) [0.053] *** (0.007) 0.076 (0.049) 0.686*** (0.074) 0.009 (0.014) No Yes 0.301 0.565 (6) IV ???? ????? D (???= ?) ? ?? ln ?? Industry d.v. Year Fes ?? Standard Error Panel D-W Observations Firms Note: Robust standard errors clustered on firm in parentheses Elasticity at the means in square brackets, with its standard error below it In column (5), all right hand side variables are lagged one year In column (6), the instruments are the right hand side variables lagged one year ***,** and * denote significance at the 1%, 5% and 10% levels, for a two-tail test 1.025*** (0.136) [0.128] *** (0.017) 0.006 (0.015) No Yes 0.177 0.616 0.939*** (0.129) [0.117] *** (0.016) 0.368*** (0.062) [0.049] *** (0.008) 0.079 (0.051) 0.007 (0.015) No Yes 0.238 0.593 0.943*** (0.116) [0.117] *** (0.014) 0.368*** (0.051) [0.049] *** (0.007) 0.079 (0.047) 0.704*** (0.076) 0.007 (0.013) No Yes 0.339 0.552 0.790*** (0.118) [0.098] *** (0.015) 0.393*** (0.055) [0.053] *** (0.007) 0.054 (0.047) 0.633*** (0.071) 0.010 (0.015) Yes Yes 0.396 0.530 0.964*** (0.120) [0.118] *** (0.015) 0.385*** (0.053) [0.051] *** (0.007) 0.039 (0.050) 0.500*** (0.100) 0.011 (0.014) No Yes 0.318 0.559 0.265 3494 380 0.282 3494 380 0.364 3494 380 0.385 3494 380 0.413 3114 380 0.335 3114 380

Table 4 Regressions with Firm Effects Dependent Variable: ln (? ?? (2) OLS with industry fixed effects firm effects 0.785*** 0.688*** (0.117) (0.117) 0.413*** 0.353*** (0.054) (0.048) 0.631*** 0.428*** (0.071) (0.053) 0.011 0.047*** (0.015) (0.018) Yes Yes 3494 3494 380 380 0.395 0.372 0.530 0.347 0.566 0.602 ) Regressor (1) (3) OLS with firm fixed effects 0.428*** (0.140) 0.250*** (0.064) 0.352*** (0.051) 0.158*** (0.042) Yes 3494 380 0.381 0.321 0.737 (4) OLS with firm fixed effects 0.484*** (0.023) 0.315*** (0.087) 0.192*** (0.054) 0.239*** (0.045) 0.182*** (0.032) 0.609*** (0.172) 0.372*** (0.107) Yes 3114 380 0.522 0.271 0.662 (5) GMM-SYS With lag 2+ instruments 0.706*** (0.036) 0.302*** (0.071) 0.146*** (0.028) 0.251*** (0.056) 0.005 (0.014) 1.026*** (0.221) 0.495*** (0.091) Yes 3096 379 OLS with random Lagged dep. Var. ?? ?? ??? ?? ? ?? ln ?? LR coef: ?? ?? LR coef: ??? ?? Year Fes Observations Firms ?? Std. Err. Within Share of variance across firms AR(1) t-test Hansen test (df) AR(1) test (p-value) AR(2) test (p-value) Note: Robust standard errors clustered on firm in parentheses. Hausman test for correlated effects: ?? Instruments in col. (5) are lags 2 and earlier (level and differenced) of the dependent and independent variables. ***,** and * denote significance at the 1%, 5% and 10% levels, for a two-tail test. 69.9*** 29.0*** 30.1*** 1.8*** 255.1** (206) 10.7*** (0.000) 2.0** (0.050) ? = 137.0 (?-value = 0.000).

Table B1 GMM-SYS regressions Dependent Variable: ln (? ?? (2) (3) ) Regressor (1) (4) (5) (6) Estimation Method GMM-SYS with lag 3/4 instruments 0.668*** (0.144) 0.287*** (0.079) 0.821*** (0.153) 0.018 (0.035) 3494 380 165.1*** (96) 6.8*** (0.000) 0.9 (0.365) GMM-SYS with lag 2+ instruments 0.991*** (0.174) 0.336*** (0.055) 0.793*** (0.115) 0.002 (0.035) 3494 380 279.3*** (216) 6.7*** (0.000) 1.0 (0.328) GMM-SYS with lag 3+ instruments 0.711*** (0.130) 0.287*** (0.073) 0.802*** (0.149) 0.024 (0.035) 3494 380 224.1*** (184) 6.9*** (0.000) 0.9 (0.357) GMM-SYS with lag 2+ instruments 0.706*** (0.036) 0.302*** (0.071) 0.146*** (0.028) 0.251*** (0.056) 0.005 (0.014) 1.026*** (0.221) 0.495*** (0.091) 3096 379 255.1*** (206) 10.7*** (0.000) 2.0** (0.050) GMM-SYS with lag 3+ instruments 0.694*** (0.039) 0.326*** (0.094) 0.169*** (0.039) 0.181*** (0.073) 0.011 (0.016) 1.067*** (0.286) 0.553*** (0.133) 3096 379 220.2*** (170) 10.4*** (0.000) 1.9* (0.065) GMM-SYS with lag 3/4 instruments 0.677*** (0.045) 0.238*** (0.110) 0.165*** (0.039) 0.203*** (0.085) 0.001 (0.019) 0.735*** (0.312) 0.510*** (0.125) 3096 379 155.1*** (95) 9.9*** (0.000) 1.9* (0.065) Lagged dep. var. ???? ????? ? ?? ln ?? LR coef: ???? LR coef: ????? Observations Firms Hansen test (df) AR(1) test (p-value) AR(2) test (p-value) Note: Robust standard errors in parentheses Instruments are lags (level and differenced) of dependent and independent variables In columns (1) and (4) they include lag 2 and earlier values, In columns (2) and (5) lag 3 and earlier values, and In columns (3) and (6) lags 3 and 4 only. ***,** and * denote significance at the 1%, 5% and 10% levels, for a two-tail test

Economic Significance: Elasticity w.r.t Knowledge Capital: 0.14 (Hall-Oriani 2006) France: 24% Germany: 22% Italy: 18% US: 42% UK: 24% Semi-elasticity w.r.t Knowledge Capital: 1.75 France: 0.66 Germany: 0.56 Italy: 0.94 US: 0.80 UK: 1.92 Evidence of under-investment

Sectoral Heterogeneity (Pavitt 1984) 1: supplier dominated - leather, textiles & textile products, rubber, gems & jewellery 2: production intensive (scale intensive) automobiles, cement, (other) construction material, (other) consumer goods, domestic appliances, food & agro-products, glass & glassware, metals & metal products, personal care, paper & paper products 3: production intensive (specialised suppliers) - automobile ancillaries, non-electrical machinery 4: science-based - chemicals, drugs & pharmaceuticals, electrical machinery, electronics, petroleum products, & plastic products

Table 5 Nonlinear Regressions by Pavitt Sector Dependent Variable: ln (? ?? (1) (2) ) Regressor (3) (4) Pavitt Sector Specialized- supplier 1.28*** (0.38) [0.093] *** (0.025) 0.73*** (0.18) [0.077] *** (0.013) 0.50*** (0.18) 0.03 (0.02) Yes 0.352 0.549 0.329 1,235 134 Supplier- dominated 4.24 (3.45) [0.102] (0.063) 2.74*** (0.89) [0.097] *** (0.022) 0.41 (0.46) 0.08 (0.06) Yes 0.450 0.464 0.350 316 32 Scale- intensive 1.80*** (0.65) Science- based 1.73*** (0.50) [0.155] *** (0.034) 1.51** (0.64) [0.055] ** (0.016) 0.48*** (0.18) 0.03 (0.02) Yes 0.289 0.581 0.294 1,253 136 ?? ?? ??? ?? ? ?? ln ?? Year Fes ?? Std. Error Panel D-W Observations Firms Notes: Robust standard errors clustered on firm in parentheses Elasticity at means in square brackets, with standard error below it ***,** and * denote significance at 1%, 5% and 10% levels, for two- tail test [0.152] *** (0.034) 0.83 (0.56) [0.030] (0.019) 0.48*** (0.13) 0.10*** (0.04) Yes 0.357 0.541 0.343 690 78

Table A1 Observations by Industry and Pavitt sector Industry Pavitt sector Obs Firms Mean R&D growth 0.23% 3.21% 0.91% 1.42% 1.29% 1.59% 1.33% 0.89% 1.97% 0.51% 2.80% 0.62% 1.79% 2.92% 1.58% 2.59% 0.79% 2.36% 1.39% 0.36% 2.72% 1.21% 1.32% Mean ADV growth 4.81% 0.60% 0.88% 1.08% 4.11% 0.96% 0.78% 0.51% 7.93% 1.03% 0.17% 2.71% 0.08% 1.46% 1.18% 1.94% 0.08% 2.32% 0.83% 2.58% 1.76% 0.09% 1.00% . (i) supplier-dominated (i) supplier-dominated (i) supplier-dominated (i) supplier-dominated (ii) scale-intensive (ii) scale-intensive (ii) scale-intensive (ii) scale-intensive (ii) scale-intensive (ii) scale-intensive (ii) scale-intensive (ii) scale-intensive (ii) scale-intensive (ii) scale-intensive (iii) specialized supplier (iii) specialized supplier (iv) science-based (iv) science-based (iv) science-based (iv) science-based (iv) science-based (iv) science-based Total Gems and jewellery Leather products Rubber products Textiles & textile products Domestic appliances Automobiles Cement Food & agri. products Glass and glassware Metals & metal products Other consumer goods Other construction products Paper & paper products Personal care Automobile ancillaries Nonelectrical machinery Chemicals Electrical machinery Electronics Petroleum products Drugs & pharmaceuticals Plastic products 7 1 3 2 30 20 259 60 101 140 352 25 217 30 171 129 10 419 271 600 129 68 64 268 124 3494 26 7 12 14 39 3 22 3 18 13 3 43 35 62 15 8 7 31 13 380

Table B2 GARCH Model for log(Sales) (2) Parameters of Equation 8(a) 1.000*** 1.002*** (0.002) (0.001) Parameters of Equation 8(c) 3.070*** 2.980*** (0.190) (0.150) 0.064*** 0.078*** (0.026) (0.021) 0.904*** 0.636*** (0.348) (0.075) 0.040 (0.049) In eq (8a) In eq (8a) No No 2752 2752 466.9 466.5 Equations (8a)-(8c) in the text are reproduced below for convenience: ???= ??+ ????,? ?+ ??? ??? ~ ?(?,???) ???= ??? ??+ ?????+ (??+ ?????)(? ?,? ?)?+ (??+ ?????)??,? ? where ? is log(sales), ? is log(??), ? is the industry to which the ??? firm belongs, ?? are the year dummies, and ?? are the industry dummies. Parameter ?? ?? ?? ?? ?? ?? ?? Year FEs Industry FEs Observations Log-likelihood (1) (3) (4) (5) 0.999*** (0.002) 1.002*** (0.001) 1.001*** (0.001) 4.600*** (0.580) 0.384*** (0.086) 0.049*** (0.003) 1.029*** (0.034) 0.005 (0.004) In eq (8a) No 2752 1173.2 0.235*** (0.076) 0.056*** (0.003) 1.075*** (0.008) In eq (8a) In eq (8c) 2752 1216.5 5.030*** (0.480) 0.321*** (0.072) 0.050*** (0.003) 1.063*** (0.008) In eq (8a) No 2752 1172.7

Table 6 Market Value Regressions Allowing for Uncertainty Dependent Variable: ln (? ?? Regressor (1) (2) ?? ?? 0.959*** 0.945*** (0.110) (0.110) ??? ?? 0.380*** 0.374*** (0.050) (0.050) ? 5.790** (2.640) ? ? ? x (?? ?? ) ? ?? 0.727*** 0.716*** (0.080) (0.078) ln ?? 0.009 0.013 (0.014) (0.014) Year Fes Yes Yes ?? 0.329 0.335 Std. Error 0.553 0.551 Panel D-W 0.351 0.329 Observations 3114 3114 Firms 380 380 Notes: OLS regressions. Robust standard errors clustered on firm in parentheses Industry sales variance estimated as shown in Appendix B, Table B3. ***,** and * denote significance at 1%, 5% and 10% levels, for two-tail test ) (3) 0.925*** (0.120) 0.378*** (0.050) 5.540 (8.310) 203.6 (144.0) 0.713*** (0.078) 0.012 (0.014) Yes 0.337 0.550 0.345 3114 380 (4) 1.227*** (0.220) 0.376*** (0.050) 8.300*** (3.180) 13.240 (8.390) 0.716*** (0.078) 0.014 (0.014) Yes 0.337 0.550 0.294 3114 380

Conclusions Where most firms do not patent, or have utility models, we find that: Stock market places greater value on more innovative firms, ceteris paribus Rate of return appears to be larger than that in developed countries, excepting UK Depreciation rate too high? Probably not Firms underinvest in R&D. Probably R&D-intensive firms valued more for option value of R&D programmes Market value-innovation relation appears to vary between supplier-dominated & other industry groups, but few firms in former group, & differences insignificant.