Managing Your Money Portfolio for Financial Wellness

In the journey of financial wellness, understanding what you have in your money portfolio is crucial. Explore your income, debt, living expenses, savings, investments, insurance, and retirement plans to make informed financial decisions and secure your future. Take control of your finances with insights on managing your money effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

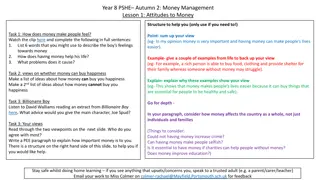

Why not start July with New Month New Me More Money More Me WEEK 3 JULY 2023

BEFOREYOU CAN KNOW WHAT TO DO WITH YOUR MONEY, YOU NEED TO KNOW WHAT YOU HAVEIN YOUR PORTFOLIO Liberty Group Limited is a licensed life insurer and an Authorised Financial Services Provider (no. 2409). Terms and conditions, risks and limitations apply.

WHAT DO YOU HAVE IN YOUR MONEY PORTFOLIO INCOME DEBT LIVING EXPENSES SAVINGS & INVESTMENTS INSURANCE & RETIREMENT Liberty Group Limited is a licensed life insurer and an Authorised Financial Services Provider (no. 2409). Terms and conditions, risks and limitations apply.

Did you know? INCOME ON AVERAGE, SOUTH AFRICAN HOUSEHOLDS HAVE A 63% DEBT DEBT LEAVING VERY LITTLE INCOME FOR OTHER PLANS LIVING EXPENSES SAVINGS & INVESTMENTS LIVING EXPENSES DEBT TO INCOME RATIO? SAVINGS & INVESTMENTS INSURANCE & RETIREMENT INSURANCE & RETIREMENT Liberty Group Limited is a licensed life insurer and an Authorised Financial Services Provider (no. 2409). Terms and conditions, risks and limitations apply.

Income is money you receive in exchange for something you give, make or do. Sometimes it s a gift or grant. Liberty Group Limited is a licensed life insurer and an Authorised Financial Services Provider (no. 2409). Terms and conditions, risks and limitations apply.

Once you know where all your money is coming from, you can also see where else it can come from. Liberty Group Limited is a licensed life insurer and an Authorised Financial Services Provider (no. 2409). Terms and conditions, risks and limitations apply.

Living expenses are the amount of money required to maintain a normal standard of living, including the cost of food, housing, transport, clothing, medical costs. Liberty Group Limited is a licensed life insurer and an Authorised Financial Services Provider (no. 2409). Terms and conditions, risks and limitations apply.

LIVING EXPENSES Your living expenses should be tracked so that you don t overspend, or they ll affect your quality of life. Liberty Group Limited is a licensed life insurer and an Authorised Financial Services Provider (no. 2409). Terms and conditions, risks and limitations apply.

BEFOREYOU CAN KNOW WHAT TO DO WITH YOUR MONEY, YOU NEED TO KNOW WHAT YOU HAVEIN YOUR PORTFOLIO #1 TAKE STOCK OF YOUR MONEY PORTFOLIO KNOW YOUR MONEY! Liberty Group Limited is a licensed life insurer and an Authorised Financial Services Provider (no. 2409). Terms and conditions, risks and limitations apply.