Islamic Financial Management: Understanding Perusahaan and Syirkah in Shariah Finance

Explore the fundamentals of Perusahaan as a contractual arrangement and the various forms of organizational structures in Islamic finance. Delve into the concept of Syirkah, its types, and the principles behind Syirkah al-Mufawadah in managing financial partnerships. Understand the key aspects of Syirkah in Shariah-compliant financial management.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

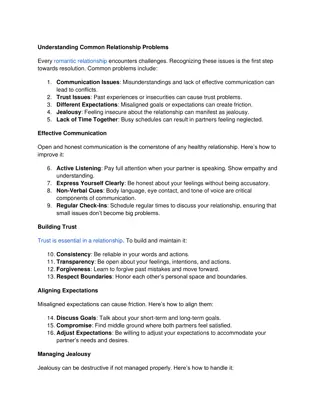

PERUSAHAAN & LANDASAN AKAD/KONTRAK Manajemen Keuangan Syariah

INTRODUCTION Perusahaan Sebagai satu rangkaian kontrak antara pihak-pihak yang berkaitan. Ilmu Fiqh Rangkaian kontrak bisnis atau dagang dikenal dengan istilah syirkah. 2

BENTUK ORGANISASI 1. Perusahaan Perorangan (sole proprietorship) Sistem ekonomi Islam mengizinkan perusahaan swasta yang dikelola oleh setiap individu dan tidak mengikat mereka secara khusus, selama usaha atau bisnis yang dijalankannya terikat dengan ketentuan syari ah. 2. Persekutuan/Syirkah (partnership) Shirkah or sharikah refers to partnership between two or more parties. 3. Mudharabah Means that one party provides capital and the other utilities it for business purposes under the agreement that profit from the business will be shared according to a specified proportion. 3

SYIRKAH 4

SKEMA SYIRKAH Customer Islamic Bank Credit 4 1 Proposal Project Equity & Skill 2 Equity 2 Profit 3 3 NISBAH On proportion to the share of financing) 5

PEMBAGIAN SYIRKAH SYIRKAH Syirkah al-Milk (non-contractual) Syirkah al- Uqud (contractual) Ikhtiyarariyyah (voluntary) Jabbariyyah (involuntary) Al-Mufawadah Al-inan Al-abdan Al-wujuh 6

PEMBAGIAN SYIRKAH Syirkah al-milk (non-contractual partnership) Co-ownership and comes into existence when two or more persons happen to get joint- ownership of some asset without having entered into a formal partnership agreement. Example, shirkah a piece of land ownership or property. Syirkah uqud (contractual partnership) The parties concerned have willingly entered into a contractual agreement for joint investment and sharing of profit and risks. 7

JENIS-JENIS SYIRKAH UQUD Syirkah al-Mufawadah: The partners are adult Equal in their capital contribution Their ability to undertake responsibility and their share of profit and losses Have full authority to act on behalf of the others They are jointly responsible for the liabilities of their partnership business Each partner can act as an agent (wakil) for the partnership business and stand as surety or guarantor (kafil) for the other partners Syirkah Mufawadhah (jumlah dana sama) Pihak I Pihak II akad musyarakah Dana Rp. X dan kerja Dana Rp. X dan kerja Usaha Laba/Rugi Bagi Hasil 8

JENIS-JENIS SYIRKAH UQUD Syirkah al-Inan: All partners need not be adult or have an equal share in the capital They are not equally responsible for the management of the business Their share in profits may be unequal but must be clearly specified in the partnership contract Their share in losses would be in accordance with their capital contributions Syirkah al-Inan (porsi dana tidak sama) Pihak I Pihak II akad musyarakah Dana Rp. X dan kerja Dana Rp. Y dan kerja Usaha Laba/Rugi Bagi Hasil 9

JENIS-JENIS SYIRKAH UQUD Syirkah Abdan: the partners contribute their skill and effort to the management of the business without contributing to the capital Syirkah Abdan (profesionalisme dan profesionalisme) Pihak I Pihak II akad musyarakah Profesionalisme Profesionalisme Usaha Laba/Rugi Bagi Hasil 10

JENIS-JENIS SYIRKAH UQUD Syirkah wujuh: the partners use their goodwill, their credit-worthiness and their contacts for promoting their business without contributing to the capital. Syirkah Wujuh (dana/usaha dan reputasi/kredibilitas) Pihak I Pihak II akad musyarakah Dana atau Usaha Reputasi/ Kredibilitas Usaha Laba/Rugi Bagi Hasil 11

BERAKHIRNYA KONTRAK Adanya kesepakatan jika salah satu dari mereka (yang membuat persetujuan) melakukan tindakan-tindakan yang dapat menyebabkan kerugian atas kepentingan-kepentingan pihak lain. Salah satu dari mitra meninggal dunia, menjadi gila/sangat bodoh & jatuh sakit sehingga tidak mampu untuk melaksanakan tugas-tugasnya. Periode masa kontrak telah berakhir. Pekerjaan atau tujuan dari adanya hubungan kerjasama ini telah terealisasi. 12

MUDHARABAH 13

SKEMA MUDHARABAH Islamic Bank (Shohibul Maal) Customer (Mudharib) 4 Cash / Credit 1 Proposal / Business Plan Equity 100% Skill / Capability 2 2 PROFIT 3 3 Nisbah X % Nisbah Y% Profit Sharing (nisbah) Return of Equity Equity on proportion to the share of financing 14

PENGALOKASIAN KEUNTUNGAN The net profit is to divided between the sahib al-mal and the mudharib. The proportion is in accordance with a just proportion agreed in advance and explicitly specified in the agreement. There cannot be a distribution of profits until the losses have been written off and the equity of the sahib al-mal has been fully restored. In the case of a continuing mudharabah, it may be permissible to specify a mutually agreed accounting period for the distribution of profits, treating each period independently. 15

PENGALOKASIAN KERUGIAN All losses incurred in the ordinary course of business must be charged against profits before they can be charged against the equity of the sahib al-mal. The net loss must be borne by the shahib al-mal. The sahib al-mal risks only his capital, while the mudharib risks only his time and effort. Mudharabah also called as partnership in profit. If agreed that all profit will be taken by the mudharib, then the sahib al-mal would be considered a lender, and the mudarib would be required to bear all losses and be responsible for returning the principal (qard hasan) to the lender in accordance with the agreement. If the profit will be taken by the sahib al-mal, the mudarib will be entitled to the customary remuneration (ajr al-mithl) for his services. 16

BERAKHIRNYA KONTRAK The completion of the venture for which it was undertaken. the expire of the specified time period. the death of either the sahib al-mal or the mudharib. The serving of notice by either of the two partners of his intention to dissolve the mudharabah. 17

REFERENSI Muhamad. 2016. Manajemen Keuangan Syariah Analisis Fiqh dan Keuangan. Yogyakarta: UPP STIM YKPN. Akbar, Nashr. 2014. Bogor: Materi mata kuliah Fundamental Ekonomi Islam STEI Tazkia. 18