Is Bitcoin Mining Profitable in 2024 Key Insights and Trends

The profitability of Bitcoin mining has become a topic of much debate as we head into 2024. With rising energy costs and advancements in mining technology, itu2019s critical for both new and seasoned miners to understand the key factors influencing their returns.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Is Bitcoin Mining Profitable in 2024? Key Insights and Trends Verifying and appending transaction data to the blockchain, a public ledger, is the process of bitcoin mining. Miners tackle challenging mathematical problems using sophisticated technology and software. Key components include: Hardware: ASIC (Application-Specific Integrated Circuit) devices designed for mining.

Software: Mining software like CGMiner or BFGMiner. Pools: Groups of miners combine resources to share computational power and rewards. Energy Consumption: Significant electricity usage. Transaction fees and freshly minted bitcoins are given to Bitcoin miners as rewards. Efficient mining requires balancing costs against potential earnings. Bitcoin Mining Bitcoin mining began with Satoshi Nakamoto s release of the Bitcoin white paper in 2008. The Genesis Block, the first Bitcoin block, was mined by Nakamoto in January 2009. Initially, individuals could mine Bitcoin on personal computers using CPUs. Soon after, miners adopted more powerful GPUs for better efficiency. By 2013, specialized hardware known as Application-Specific Integrated Circuits (ASICs) had emerged, drastically increasing mining capabilities. Around the same time, Bitcoin mining pools gained popularity, allowing miners to combine resources for a higher chance of discovering blocks and sharing profits. What is Bitcoin? Bitcoin is a decentralized digital currency introduced in 2009 by an unknown individual or group under the pseudonym Satoshi Nakamoto. In contrast to conventional currencies, Bitcoin functions as a decentralized peer-to-peer network. Key attributes of Bitcoin include: Blockchain Technology: A public ledger where all transactions are recorded. Finite Supply: There will only be 21 million Bitcoins in all. Mining: the process of adding transactions to the blockchain and validating them; this process is encouraged by transaction fees and the generation of additional Bitcoin. Decentralization: Governed by network consensus rather than centralized control. Bitcoin pioneered the concept of digital currency without the need for intermediaries. How Bitcoin Mining Works

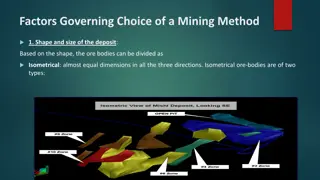

Verifying and appending transactions to the blockchain is the process of mining bitcoins on the network. This process uses computational power to solve complex mathematical problems, known as cryptographic hash functions. The first miner to solve each of these puzzles wins the privilege of appending a new block to the blockchain. Key Points Hardware: High-performance mining hardware like ASICs (Application-Specific Integrated Circuits) is crucial. Hash Rate: Represents the computational power per second to solve the cryptographic puzzles. Electricity: Significant electrical power is required, leading to high operational costs. Rewards: Miners receive Bitcoin as a reward, which halves approximately every four years. Miners Function in the Bitcoin Network Miners serve as the backbone of the Bitcoin network by validating transactions and securing the blockchain. Their primary responsibilities include: Transaction Verification: Miners check fresh transactions for correctness and stop anyone from making duplicate purchases. Block Creation: They compile validated transactions into blocks, adding them to the blockchain. Security Maintenance: By solving complex cryptographic puzzles, miners maintain network security, making it resistant to attacks. Decentralization Support: To avoid a single point of failure, miners contribute to Bitcoin s decentralized structure. Economic Incentive: Through block rewards and transaction fees, miners are financially incentivized to maintain operations and network integrity. Understanding the Blockchain A decentralized digital ledger called the blockchain keeps track of transactions on several computers. Every block in the chain has three things: a timestamp, a cryptographic hash of the block before it, and transaction data.

Decentralization: Unlike centralized systems, blockchain operates on a peer-to-peer network. Immutability: Once a block is added, altering it or preceding blocks becomes highly challenging. Security: Cryptographic hashing and consensus algorithms secure transaction data. Blockchain maintains transparency and trust without intermediaries. Cryptocurrencies like Bitcoin are based on this technology, which guarantees integrity and security during mining and transactions. Mining Hardware: ASICs vs GPUs Mining hardware primarily includes ASICs (Application-Specific Integrated Circuits) and GPUs (Graphics Processing Units). ASICs: Purpose-built for Bitcoin mining. Superior hash rate and power efficiency. Higher initial investment but quicker ROI. Limited versatility; cannot be used differently. GPUs: Versatile and can mine various cryptocurrencies. More accessible and generally costs less than ASICs. Lower hash rate and higher power consumption compared to ASICs. Useful for gaming, rendering, and other applications. ASICs generally outperform GPUs in Bitcoin mining due to their efficiency and specialization, making them a preferred choice for large-scale operations. Mining Software: Best Options for Beginners When considering Bitcoin mining software for beginners, a few key options stand out due to their user-friendly interfaces and functionality. 1. CGMiner Highly customizable

Suitable for a wide range of hardware Active community support 2. BFGMiner Modular design for flexibility Supports FPGA and ASIC mining Extensive configuration options 3. EasyMiner Graphical interface for ease of use Integrates with both CGMiner and BFGMiner Ideal for solo and pooled mining 4. Mining Pools: Why Miners Work Together Bitcoin mining pools are collectives where individual miners combine their computational power. Miners boost the chance of solving challenging cryptographic riddles by cooperating. This collaboration allows them to earn more frequent rewards, which are then distributed among the pool participants based on their contributed power. Key Reasons for Joining Mining Pools 1. Increased Probability of Rewards Cooperative effort boosts the success rate of solving blocks. 2. Steady Income Shared rewards reduce the income volatility experienced by solo miners. 3. Lower Costs Collective resources lead to cost-effective mining solutions and mitigate operational expenses. 4. Technical Support Pools often provide better infrastructure and technical assistance, ensuring smoother operations for individual miners. The Economics of Bitcoin Mining Bitcoin mining in 2024 involves complex economic factors. Key components include: Electricity Costs: Various regions offer different rates, impacting profit margins significantly.

Hardware Investments: Mining rigs with high performance demand a large upfront investment. Bitcoin Price Volatility: Fluctuating prices can affect profitability. Mining Difficulty: Increasing computational difficulty requires enhanced hardware. Transaction Fees: Additional revenue from transaction fees can offset some costs. Regulations and Taxes: Vary across jurisdictions, influencing operational expenses and net earnings. Mining economics requires balancing these variables to maintain profitability. Monitoring market conditions and technological advancements is essential for miners. Legal Aspects of Bitcoin Mining Bitcoin mining s legal framework varies significantly across jurisdictions, necessitating careful consideration. Some regions ban mining entirely, viewing it as an energy drain or economic threat. Some enforce regulations to guarantee adherence to regional statutes. Licensing: Many countries require miners to obtain specific licenses to operate. Taxation: Mining income is often subject to taxes. Reporting requirements can differ. Environmental Regulations: Stricter in areas emphasizing sustainability, impacting mining viability. Miners must navigate these legal landscapes to avoid penalties. Failure to comply can result in fines, shutdowns, or even imprisonment, stressing the importance of legal due diligence. Environmental Concerns and Solutions Bitcoin mining consumes significant energy, raising concerns about environmental sustainability. The high electricity usage stems from the need for massive computational power to solve complex algorithms. The primary environmental concern is the carbon footprint generated by non-renewable energy sources. Key Concerns: Energy Consumption: The energy demand for Bitcoin mining is immense, often compared to that of entire countries. Carbon Emissions: Traditional energy sources for mining operations contribute to greenhouse gas emissions.

Proposed Solutions: 1. Renewable Energy: Encouraging the use of solar, wind, and hydropower to reduce carbon emissions. 2. Energy-Efficient Hardware: Development and adoption of more efficient mining equipment. 3. Carbon Credits: Implementing carbon credit systems to offset emissions from mining operations. Future Trends in Bitcoin Mining Emerging trends in Bitcoin mining hold significant potential to shape the industry landscape. Key developments include: 1. Green Energy Adoption: Increasing use of renewable energy sources like solar and wind. Measures to increase sustainability and reduce carbon footprints. 2. Advanced Mining Hardware: Creation of Application-Specific Integrated Circuits (ASICs) with increased efficiency. Enhanced hardware to minimize energy consumption. 3. Regulatory Changes: Potential implementation of stricter regulations. Impact of governmental regulations on the profitability and operations of mining. 4. Decentralization Initiatives: Push towards smaller, decentralized mining operations. Reduction of reliance on large mining pools. The industry will likely continue evolving with these advancements. How to Get Started with Bitcoin Mining

1. Research and Education: Familiarize oneself with the fundamentals of Bitcoin and blockchain technology. It is crucial to comprehend mining procedures and network architecture. 2. Evaluate Hardware Options: Select appropriate mining hardware. ASIC miners are commonly used due to their efficiency and high hash rates compared to GPUs or CPUs. 3. Choose a Mining Pool: Joining a mining pool can increase the chances of earning rewards by combining computational power. Compare pools based on fees, payout schemes, and reputation. 4. Install Mining Software: Install and set up mining software that works with the hardware and mining pool of your choice. Popular options include CGMiner and BFGMiner. 5. Secure a Wallet: Set up a Bitcoin wallet to store mining rewards. Options include hardware wallets, software wallets, or cold storage. By following these steps, one can begin their journey into Bitcoin mining effectively and securely. Common Challenges and Troubleshooting Tips Bitcoin mining in 2024 presents several challenges: High Energy Costs: Mining farms incur substantial electricity expenses. Operators should seek regions with low energy rates. Hardware Failures: Constant operation can lead to hardware malfunctions. Regular maintenance and high-quality equipment can mitigate this issue. Mining Difficulty: Increasing difficulty levels require more computational power. Miners should stay updated with the latest hardware advancements. Regulatory Policies: Governments may impose new regulations. Staying informed about legal requirements is essential. Pool Downtime: Mining pools can experience outages. Diversifying across multiple pools can reduce downtime risks. Regular monitoring and proactive strategies are crucial for addressing these challenges.

The Future of Digital Gold Mining In 2024, the development of Bitcoin mining is expected to see major changes. Technological Advancements: Enhanced mining hardware, such as ASICs, could revolutionize efficiency and output. Regulatory Landscape: Global regulations will increasingly shape operational frameworks and profitability. Sustainability Efforts: Green energy adoption is likely to become more prevalent, addressing environmental concerns. Market Volatility: Bitcoin price fluctuations will continue to impact profitability. Operational Strategies: Innovations in mining pool strategies and decentralized mining may emerge. Strategic adaptation to these trends will be crucial for sustained profitability in the dynamic digital gold mining industry.