Investing in Real Assets: A Comprehensive Guide

Explore the world of real assets, including real estate, precious metals, and collectibles. Discover the advantages and disadvantages of investing in tangible assets, the correlations with other asset classes, and various forms of financing. Learn about real estate as an investment, different types of properties, and the role of REITs in the market.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

C CHAPTER HAPTER 20 20 EAL A ASSETS I INVESTMENTS NVESTMENTS I IN N R REAL SSETS Fundamentals of Investments FIN-330

Investments in Real Assets Learning Objectives 1. Understand the advantages and disadvantages of real assets. 2. Explain the portfolio significance of the correlations between real estate and other assets. 3. Explain the characteristics of investing in real estate. 4. Discuss the various forms of financing for real estate investments. 5. Explain the traditional appeal of precious metals as a form of investments. 6. Understand the factors that influence the value of collectibles.

Real Assets Real assets are tangible assets that may be: 1. Seen 2. Felt 3. Held 4. Collected Real assets during inflationary environments have at times outperformed financial assets. Examples: Real Estate, Gold & Silver, Diamonds, coins, stamps, antiques, art 20-3

Wealth Indices of Investments in Equity REITs and Basic Series Index (Year- End 1971= $1) Returns by Asset Class Returns by Asset Class 1. Small Company Stocks 2. Equity REITs 3. Large Company Stocks 4. Long Term Governments 5. Treasury Bills 20-4

Advantages and Disadvantages of Real Assets A. Advantages 1. Outperform real assets during inflationary periods 2. Many believe real assets are good hedges against inflation* 3. Helps to diversify your investment portfolio 4. Relatively uncorrelated with financial assets B. Disadvantages 1. Markets tend to be illiquid, charge larger commissions 2. Do not produce current income (except real estate) 3. Require insurance and in some cases specialized storage

Real Estate as an Investment A. More that 60% of U.S. households own real estate as a home or investment B. Brokerage and investment firms are very active 1. Creating and selling Mortgage-Backed Securities (MBS) 2. Real Estate Investment Trusts (REITs) dominate C. Real Estate takes many forms 1. Single & Multi-family housing 2. Condominiums and time shares 3. Commercial real estate: malls, industrial parks, buildings, hotels and motels

Real Estate as an Investment Investments may include: A.Homes B.Duplexes C.Apartments D.Offices E.Industrial buildings F.Shopping centers G.Hotels and motels H.Undeveloped land 20-7

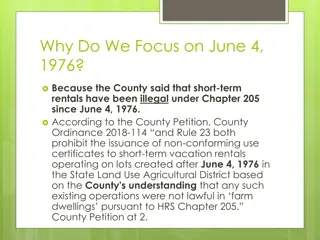

Real Estate as an Investment A. The Tax Reform Act of 1986 1. Substantially increased wait time to take full advantage of real estate tax deductions 2. Severely restricted writing-off of paper real estate losses by passive investors against other forms of income 3. Result: R.E. less attractive to investors and speculators B. Other Issues 1. Various tax reforms blamed for declining economic conditions in late 1980 s and throughout the 1990 s. 2. Lower than normal rates and loose lending standards led to over-supply and speculation

Real Estate as an Investment C. Other Considerations 1. Historically, only small cap stocks have out performed real estate on a risk-adjusted basis 2. Real estate also provides steady cash flow 3. Population growth rates drive demand, which in turn drives increase in supply to meet demand. a. The downside is that supply growth frequently exceed rate of population growth b. The result is the all too familiar housing bubble and its related financial problems.

Valuation & Forms of Real Estate Ownership A. Three Major Methods 1. The Cost Approach: to replace similar v-v duplicate 2. Comparative Sales Value: what similar properties sold for 3. The Income Approach: a. How much NOI is generated and at b. At what rate is it capitalized? c. How does NOI change over time? B. Occasionally all three methods are combined

Valuation of Real Estate: The Income Approach The stream of net earnings generated by an income-producing property capitalized as a measure of that property s worth Annual net operating income = Valuation Capitalization rate (Cap rate) 20-11

Valuation of Real Estate: The Income Approach Future realistic values of annual rentals minus expenses such as property taxes, insurance, Annual net operating income = Valuation Capitalization rate (Cap rate) The rate of return required by investors in similar-type investments 20-12

Financing of Real Estate A. Types if Mortgages 1. 30-Years fixed rate (conventional mortgage, 20% down) 2. Adjustable Rate (ARM) 3. Graduated Payment (GPM) 4. Shared Appreciation (GPM) 5. Equity Participation (EPM)

Forms of Real Estate Ownership Ownership of real estate can take many forms: A. Individual or Regular Partnership B. Syndicate or Limited Partnership C. Real estate investment trust (REIT) 20-14

Forms of Real Estate Ownership Syndicate or Limited Partnership Syndicate or Limited Partnership A. General partner forms partnership 1. Unlimited liability 2. Responsible for managing property B. Limited partners purchase participation units 1. Liability limited to initial investment 2. No responsibilities merely investors C. Front-end fees to General Partner 1. 5-25% D. Blind pool or are specific projects identified? E. Public offering 1. Involves larger total amounts 2. SEC registration F. Private offering 1. Local in scope 2. Maximum 35 investors G. Secondary (resale) markets exist but dealer spreads and commissions high 20-15

Forms of Real Estate Ownership Real Estate Investment Trust Real Estate Investment Trust A. Similar to mutual funds or investment companies B. Trade on organized exchanges or over-the-counter C. Pool investor funds D. No minimum investment other than cost of share E. Most liquid type of real estate investment F. Large secondary market 20-16

Forms of Real Estate Ownership Real Estate Investment Trust (continued) Real Estate Investment Trust (continued) A. To qualify, trust must receive 75% of income from real estate 1. Rents 2. Interest on mortgage loans B. Must distribute at least 95% of income as cash dividend C. Equity Trusts 1. Buy, operate, and sell real estate as investment D. Mortgage Trusts 1. Make long-term loans to real estate investors E. Hybrid Trusts 1. Engage in activities of both equity and mortgage trusts F. There are more than 400 REITS in existence 20-17

Gold and Silver A. Precious metals 1. Most volatile of real asset investments B. Historically, gold and silver: 1. Move up in value during troubled times 2. Decline in value during stable & predictable periods 3. Major price-driving factors: Rumors of wars, political instability, inflation. 4. Best advertised as hedges against uncertainty C. Silver: important industrial uses

Other Collectibles A. Art B. Antiques C. Stamps D. Chinese ceramics E. Rare books F. Baseball cards G. Precious Gems

Homework Assignment A. Questions: 1, 2, 3, 6, 11, 12