Inflation and Price Index Calculation

Learn about inflation, its causes, effects, and measurement through price indices like the Consumer Price Index. Discover how to calculate simple and composite price indices with practical examples.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

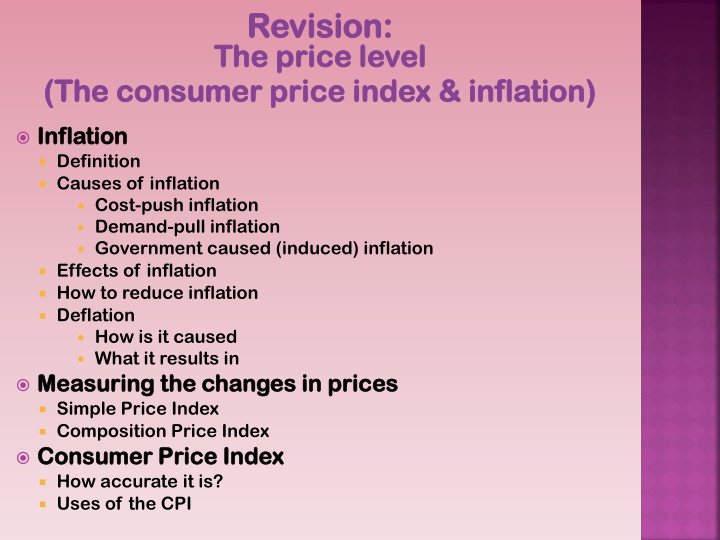

Revision: Revision: The price level The price level (The consumer price index & inflation) (The consumer price index & inflation) Inflation Inflation Definition Causes of inflation Cost-push inflation Demand-pull inflation Government caused (induced) inflation Effects of inflation How to reduce inflation Deflation How is it caused What it results in Measuring the changes in prices Measuring the changes in prices Simple Price Index Composition Price Index Consumer Price Index Consumer Price Index How accurate it is? Uses of the CPI

Inflation Inflation Is defined as the steady and persistent increase in the general level of prices This results in the value of money of money falling and the cost of living increasing Therefore one cannot buy the same quantity of goods and services they could have in the previous year

Simple price index Simple price index Shows the percentage change in the price of the good over a specific time period It is an unweighted price index as it does not take into account the fraction of income spent on the good. 3 steps involved 3 steps involved New Price New Price X 100 X 100 Base Year Price Base Year Price

Composite Price Index Composite Price Index Each good is assigned a weight which reflects the percentage of income which is spent on it. It is a weighted price index and shows the effect to the overall cost of living due to changes in the price of goods. 6 steps involved 6 steps involved

Workbook, page 107, question 10 Workbook, page 107, question 10 For a composite (weighted) price index covering For a composite (weighted) price index covering the three types of expenditure given in the the three types of expenditure given in the following table, calculate the index for the current following table, calculate the index for the current year. The base year value is 100. Show your year. The base year value is 100. Show your workings. workings. Category Category % of income % of income spent on spent on the item item 35 Price of item in Price of item in base year base year (Euro) (Euro) 8.50 Price of item in Price of item in current year current year (Euro) (Euro) 12.75 the Food Food Clothing and Clothing and footwear footwear Other items Other items 15 37.50 45.00 50 20.00 35.00 100

Solution Solution Category Category Prices of Prices of item(s) item(s) Base Base Year Year Euro Calculation of Simple Price Calculation of Simple Price Index X Weight Index X Weight Food Food 8.50 8.50 12.75 X 100 12.75 X 100 = 150 X 35% = = 150 X 35% = 52.50 8.50 8.50 52.50 Clothing Clothing & & footwear footwear 37.50 37.50 45 X 100 45 X 100 37.50 37.50 = = 120 X 15% = 18 120 X 15% = 18 Other Other items items 20.00 20.00 35 X 35 X 100 20 20 100 = 175 X 50% = 87.50 = 175 X 50% = 87.50 Price Index for the Current Year 158 Price Index for the Current Year 158

Today. Today . The Consumer Price Index How accurate is it How it is constructed The economic uses of the CPI

The CPI The CPI The Consumer Price Index The Consumer Price Index It measures the change in the average level of prices paid by all private household on consumer goods/services. It began in January 1997, it is compiled on a monthly basis covering over a thousand items. The Household budget survey is carried out every five to seven years to find out the fraction of income spent on each items. This survey is carried out to get accurate details of consumers spending patterns.

How accurate is the CPI??? How accurate is the CPI??? What are its limitations??? What are its limitations??? 1. It is based on average spending patterns 2. Weights used apply in the base year only 3. Changes in quality of goods is not measured 4. New products on the Market are not included 5. Switching to cheaper brands is not measured

2007, Higher, Section B, Question 7 2007, Higher, Section B, Question 7 A (ii) A (ii) Explain how a Consumer Price Index is conducted? 1. It is based on the National Average Family Shopping Basket Those items which the average Irish family buys frequently and in large quantities are included. 2. Expenditure patterns are divided into various categories The CPI contains various categories of expenditure; food, alcohol, clothing & footwear, housing, transport etc.

3. Calculation of Weight The weight is the fraction of income which is spent on each category of expenditure, obtained through the Household Budget Survey, only takes place every 5 to 7 years. 4. Prices in Base Year Chosen The average cost of the items is equal to 100 e.g. milk 40%, bread 35% and apples 25%. This makes it easier to compare in future years. 5. Prices in Current Year Determined The current prices of each item are collected from a panel of retail and service outlets in various locations throughout the country.

Economic uses of a CPI 1. Measure the rate of inflation 2. Measure International Competition 3. Indexation of savings/investments 4. Maintaining the real value of social welfare payments 5. Wage negotiations

Inflation Inflation . Causes of inflation Cost-push inflation Demand-pull inflation Government caused (induced) inflation Effects of inflation How to reduce inflation Deflation How is it caused What it results in .

Causes of inflation. Cost-push Demand-pull Government induced

Cost push inflation. Cost push inflation . Any increase in the general level of prices due to an increase in the costs of production/costs of inputs faced by the employer. This can be due to This can be due to Increased wage demands due to the minimum wage or social partnership agreements Increased prices for raw materials, e.g. oil Increased costs of production e.g. utility charges, rent costs, insurance costs.

Demand pull inflation. Is when the economy cannot produce enough goods and services to meet the demand of citizens. Too much money is said to be chasing too few good. Therefore demand is greater than supply and producers see an opportunity to increase prices. This can be due to . Goods cannot be manufactured/imported quick enough to meet new demand Unexpected increase in consumer confidence Firms with monopoly power take advantage of their position by raising prices

Government induced inflation. A rise in prices as a result of some action by the government. This can be due to An increase in indirect taxes, e.g. VAT A decrease in direct taxes, e.g. PAYE can cause demand pull inflation as [people will have more money to spend An increase in lending by the banks

Effects of inflation. 1. Lower Standard of living 2. Purchasing power of money falls 3. Increased wage demands 4. Loss of competitiveness 5. Loss of employment 6. Borrowing encouraged 7. Increased disparity between different sectors 8. A rise in government spending 9. Production encouraged 10. Uncertainty

Reducing inflation Use measures that take money out of the economy and reduce demand. Fiscal policy Indirect taxes - VAT Direct taxes PAYE Saving scheme - SSIA Lower government spending National wage agreements Increased competition

Today. Deflation How it is caused What it results in

Deflation Is negative inflation Prices are going down rather than up.

Deflation can be caused by. Over supply relative to demand, e.g. more hotel rooms than there are people to stay in them A sudden drop in demand or investment or government spending or all three, e.g. in a recession Persistent unfavorable balance of payments more money leaving the country on imports than coming in on exports

Results of deflation. An increase in the purchasing power of money - Employers use this to justify wage cuts and the government uses it to justify cuts in social welfare. The government can save money on capital projects cost of construction and raw materials falls. Increased national competitiveness provided that Irish prices fall by more than competing countries prices do.