Inflation, Unemployment, and Economic Policies

Explanation of key economic concepts such as inflation, unemployment, money supply, and their implications on the economy. Discusses the relationship between money supply, price levels, and how government actions like printing money affect inflation. Also touches on hyperinflation, moderate inflation, output gap, and the short-run Phillips Curve.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Inflation and Unemployment

Money and Inflation Rise in money supply does not equal a rise in Real GDP in the long run, since price level rises as well by the same percentage Classical Model of Price Level Since money supply and price level rise together, the Real Quantity of Money (M/P) stays at the original level Wages and prices are more responsive to money supply changes in periods of high inflation

The Inflation Tax Printing money to cover debt drives up inflation Inflation tax is the reduction in value of money held by public when the government prints money to cover deficits The U.S. can and does raise revenue by printing money This is what happens when the Fed buys bonds to increase money supply

Hyperinflation During times of inflation, people hold as little money as possible Printing money (seignorage) creates revenue: ( M/M) (M/P) OR Rate of growth of MS Real MS When govt needs to collect a certain amount but people are holding less money, must increase rate of growth which can spiral out of control

Moderate Inflation and Disinflation Two shifts can lead to an increase in aggregate price level, emphasizing the importance of: Cost-push inflation Demand-pull inflation which can result from expansionary policies Economic policies have political ramifications, which explains why inflation can get out of control

Output Gap & Unemployment Output gap is the difference between current level of output and potential output Because the unemployment rate is the natural rate + cyclical unemployment, there is a relationship between output gap and unemployment rate When aggregate output = YP, unemployment = natural rate When output gap is positive, unemployment < natural rate When output gap is negative, unemployment > natural rate

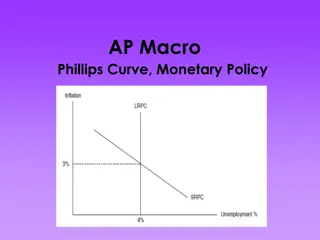

The Short Run Phillips Curve The SRPC depicts the negative short run relationship between the unemployment rate and inflation rate

Inflation Expectations and SRPC Expected inflation rate is the 2ndmost important factor affecting inflation Actual rate of inflation at any given unemployment rate is higher when expected inflation rate is higher

Long Run Phillips Curve Persistent attempts to keep unemployment low result in accelerating inflation To avoid this, unemployment must be high enough that actual rate of inflation = expected rate, resulting in nonaccelerating inflation rate of unemployment NAIRU means there is no longterm tradeoff between unemployment and inflation

Long Run Phillips Curve LRPC is vertical because it is at NAIRU (natural rate) Economists estimate NAIRU by looking at relationship between inflation rate and unemployment over the course of the business cycle

Costs of Disinflation To bring down inflation, contractionarypolicies raise unemployment above the natural rate for an extended period As a result, the economy loses potential output

Deflation Value of money rising over time Debt deflation results from borrowers cutting back their spending because of the additional burden of repaying money that is worth more, reducing aggregate demand which leads to more deflation, which can spiral out of control

Effects of Expected Inflation Fisher Effect shows that interest rates are impacted by expected inflation one-to-one In case of deflation, interest rates will fall but they are zero bound which creates a limit for monetary policy Interest rate too low leaves no incentive to save and a credit freeze Liquidity trap results from sharp reduction in demand for loanable funds, causing interest rates to fall so low that monetary policy is ineffective