Implementation Plan of Eskom Social Compact - Energy Security Workstream

The implementation plan outlines the prioritization of tasks, decision-making items, active engagement requirements, monitoring activities, and key themes related to energy security workstream focusing on Eskom Social Compact. The plan includes proposed meeting themes for Q1 & Q2 of 2023, highlighting areas such as load-shedding, demand side responses, market structure, infrastructure, just transition, electricity prices, and various policy implementations to ensure energy stability and grid resilience.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Energy security workstream: Implementation plan of the Eskom Social Compact v2 30 January 2023 National Economic Development and Labour Council

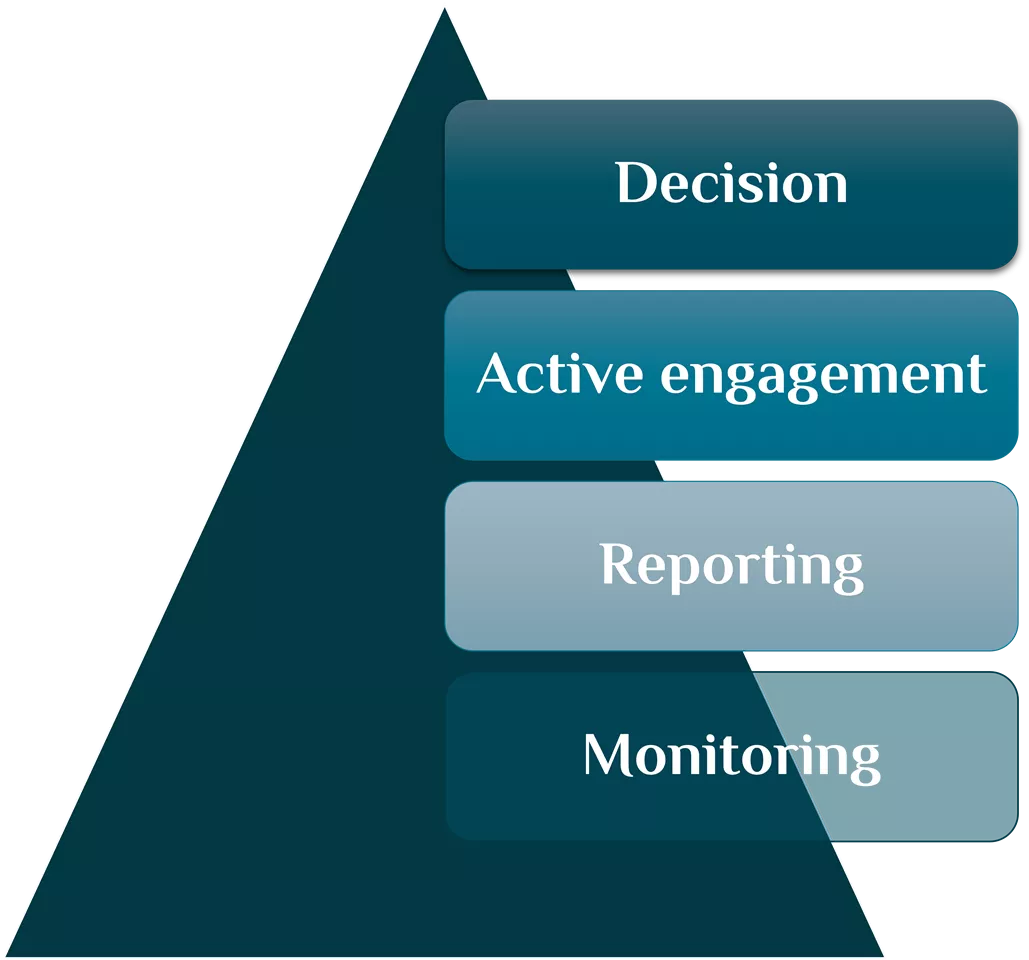

Prioritisation of items Items that the social partners will need to engage on and reach a decision or consensus. Decision Items that the social partners will need to actively engage on however a decision or consensus may not be required. Active engagement Social partners or other stakeholders will be required to report back to the committee/s periodically. Reporting Items that need to be monitored by the secretariate/ social partners for any developments which need to be reported for review by the committee. Monitoring Prioritisation

Legend: Newly added components to be included or removed / moved elsewhere Key themes Load-sheddingand Demand side responses Market structure Electricity Infrastructure Just Transition Electricity prices/tariffs Implementation of SA Just Transition policy JETP funding Eskom JET implementation Redevelopment power station sites RE Investment Establishment of local OEM industry Social compact financing initiative Liaison PCCC, DMRE Electricity Regulation Act Amendment Bill Electricity Pricing Policy Eskom unbundling (DPE Roadmap) and TSMO establishment Electricity wheeling national framework SALGA/AMEU Approval wheeling tariffs NERSA NERSA TPA rules revision NECOM interventions, incl Omnibus Bill, State of disaster and liaison social partners Managing load-shedding (NRS048.9) SAPP imports Net billing/metering guidelines (NERSA/ GCAC) Reducing cost of rooftop solar Revision Eskom grid queuing rules (Virtual) wheeling, Third Party Access (trading) DSM and Energy Efficiency initiatives Communication initiatives Incentives RE businesses/ households NERSA s proposed revised MYPD methodology Eskom ERTSA implementation Eskom tariff applications (2023/24/25 approved), and RCAs OCGT funding Presidential request to halt implementation Generation capacity (S34 and private sector investment) Transmission capacity grid extension and reinforcement (adding RE) IRP2019 acceleration and review Removal of IPP red tape: report back OV RE one-stop-shop Maintenance and EAF performance Eskom financial and operational performance, debt solution, corruption Eskom debt solution (NT) Masakhane Campaign to combat illegal connections and non-payment Municipal debt, Concourt case re Eskom reducing supply to defaulting munics (Dec22) Eskom Review SCM policies Government and social partners initiatives to combat corruption workstream reports

Proposed meeting plan and themes Q1&2 2023 February 2023 March 2023 April 2023 May 2023 June 2023 Load-shedding and grid stability DSM update (Eskom) net metering update (OV, NERSA) revision NRS048.9 (loadshedding schedules) (GCAC/business) Incentives solar rooftops (NT/OV/ business) Eskom focus EAF and maintenance Eskom Update EAF previous 6 months Transmission issues Queuing rules (Eskom) Grid investment Connection new MWs (Eskom and Business) Eskom debt solution Progress Eskom Debt (DPE/NT) Residential and Municipal debt to Eskom Progress recovery from municipalities (Eskom/COGTA) Electricity prices Draft Electricity Price Determination methodology (NERSA) Roundtable wheeling Electricity prices Municipal tariff applications process incl wheeling tariffs ESKOM ERTS (retail tariff) Application Eskom virtual wheeling and power pool initiative Just Energy Transition oIRP 2019 review oDMRE: progress RMI4P, GTP procurement, IRP implementation, Bid Window status oBusiness: feedback progress self-generation oOutcome JET funding plan (OV/NT/PCCC) oCOP27 resolutions progress (OV/DMRE) oEskom progress Komati, status decommissioning coal stations (max. emissions regs) oProgress wheeling framework (SALGA/AMEU, NERSA) Market structure Progress ERA Amendment Bill and EPP (DMRE) Design Day Ahead market (DMRE) Eskom Conversion Act Amendment Bill progress (DPE) and Eskom unbundling progress (DPE) Load-shedding and grid stability Load-shedding and grid stability TBC Communication partnerships ToR Energy Efficiency Communication partnership Task Team (Nedlac, inputs social partners, Masakhane campaign) ESWS workplan EPP Task Team start Eskom Conversion Act Amendment bill? EPP Task Team to conclude

March / April / May meeting focus March: Roundtable wheeling and updates

Proposed roundtable discussions / workshops 2. Day Ahead market and bilateral trading 1. Accelerating national and municipal wheeling Third Party Access to the Transmission (Eskom) and Distribution (municipalities ) grids is required in terms of legislation and NERSA s licence conditions. The ERA Amendment Bill contains a conceptual design of a Day Ahead market that is to be established by the TSMO, to operate in parallel to bilateral (OTC) trades and the regulatedmarket in which the Central Purchasing Agency will participate. No market rules have been set out, nor market participation criteria. However, Eskom is reluctant to allow licensed traders access (preferring IPPs) and the Transmission Grid is unable to connect additional MWs fast enough to keep up with demand for connections. NERSA s draft revised price determination methodology envisages a system in which all generation stations compete and returns are no longer guaranteed. Legacy contracts are to be compensated through a levy. Municipalities are hesitant to allow TPA or trading for fear of loss of revenues (surpluses) and NERSA did not approve wheeling tariffs for the 2022/23 FY. It is not clear when a Day Ahead market will be established, what the transition mechanisms are and whether existing long- term supply contracts (between Eskom Generation and the Single Buyer) will continue to exist outside of the proposed power pool. The impact of a sudden move to a power pool on average electricity prices at various times during a 24 hour period could be calamitous. A roundtable on wheeling could remove some of the misconceptions and shed light on the actual impediments to wheeling to arrive at solutions.