Human Resource Accounting and Development Insights

Uncover the critical role of human capital in organizations through human resource accounting. Learn how to measure and invest in human resources effectively to enhance organizational value and investor confidence. Explore the importance of HR valuation and the long-term benefits of treating employees as assets.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

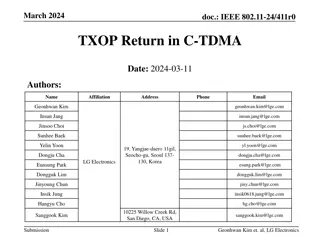

Human Resource Accounting for Training & Development Shital Jhunjhunwala Institute of Public Enterprise

The Importance of Human Capital Average Rank Intangible Asset Top 5 Goodwill 2.48 61.90% Brands 2.05 57.14% Intellectual Property Rights (particularly Patents & Trademarks) 1.76 47.62% Human Capital / Human Resource 1.67 71.43% Technical Know-how/ Knowledge 1.00 23.81% Marketing Rights & Distribution Networks 1.00 28.57% R & D 0.86 28.57% Processes & Recipe 0.86 28.57% Software & IT Capabilities 0.62 23.81% Customer List & Relationships 0.43 23.81% Experience 0.38 9.52% Social Responsibility 0.24 9.52% Business Relationships 0.14 4.76% Others 0.38 9.52% Dr. Shital Jhunjhunwala 2

most important assets of my company walk out of the door every night . Bill Gates, Microsoft 3

The unquestionable Importance of HR . Dr. Shital Jhunjhunwala 5

Myth ROI from human capital cannot be measured! I am just going to treat it as a short term cost, not a long term investment True there is an objective need to build a credible case for the objective measurement of human capital But there is a stronger case to build human capital as an asset and expenditures relating to improved human capital as a long term investment

Why HRA HRA communicates the worth of human resources to the organization and to the public Depicting the true value of the organization ESTABLISHING INVESTOR CONFIDENCE how efficient their personnel is to deliver returns on investments

The case for HR Valuation Monitor effective utilization Deciding about transfers, promotion, training and retrenchment Evaluating the expenditure incurred for imparting further education and training in employees in terms of the benefits derived by the firm.

It is important to be aware of the fact that HRA is not only about putting figures on human capital; It is also about supporting human resource development / management. It is about treating employees as assets and knowing whether the asset is appreciated, depleted or conserved; It is about acquiring and retaining (good) employees

Value of Training Companies that scored in the top 20% of a McKinsey Talent Management Index on average had a 22% higher return to stake holders than peers in their industry Echols, Michael E., ROI on Human Capital Investment (Arlington, Texas: Tapestry Press, 2005). pp. 29-30.

Value of Training In a study by Accenture that measured the overall business impact of investment in learning found those companies who did had a higher performance and produced higher results: Sales per employee = 27% greater Revenue growth = 40% greater Income growth = 50% greater Echols, Michael E., ROI on Human Capital Investment (Arlington, Texas: Tapestry Press, 2005). pp. 29-30.

Value of Training American Society of Training & Development (ASTD) found that the average 5 year returns in stock market value related to the level of a company training investment: Top 50 firms produced 86% returns Bottom 50 firms produced 19% returns Echols, Michael E., ROI on Human Capital Investment (Arlington, Texas: Tapestry Press, 2005). pp. 29-30.

Human Capital Matrix Revenue per Employee Cost per Employee Profit per Employee - Can easily be calculated as based on financial reports

Training Indicators Financial Financial & Non Financial Training Expense per Employee Training Expenses per Employee (Category) Increase in Revenue per Employee Non Financial Training Expenses Training hours per Employee Increase in Output per employee Average satisfaction with competence developed by trainee Training Exp / Adm Exp (%) Training Exp / Total Exp (%) Training Exp / Employee Exp (%) Change in Stock Prices per Employee Average satisfaction with competence developed by immediate head of trainee

Indicators Goal Setting & Performance Evaluation Intra Firm Comparison Between departments/branches Across Time periods Benchmarking

Can I Determine the Benefit derived from Training ?

Training Evaluation Performance / Efficiency after training Performance before training Salesman : Sales after Training Sales before training Worker: Output , Defects IT Personnel : Time / Error

Training Evaluation Managerial Level Increase in Revenue / Reduction in Cost CFO reduce cost of capital - Better reviews from Financial Analysts Feedback from those who report to him Satisfaction of subordinates Promotion to next level

Investment not Cost As human resource is considered as an asset, any expenditure incurred in the acquisition and accumulation of human resource is treated as an investment. Cost of training and development represents sacrifice that will have to be incurred today to acquire and develop people in future

ROI Training ROI = Returns (Net) x 100 Investment Investments (Costs) Returns (Benefits)

Training Investments Design & Development - Internal resources , External experts , travelling, etc Promotional Cost brochure, etc Administrative Cost hours Faculty Cost - including accommodation & travelling cost Material Cost Facility Cost Room, Equipment, Lunch, etc Trainee Cost - Productive time for which he/she is paid Evaluation Cost

Returns from Training Productivity & Efficiency Sales & Profitability Customers & Markets Other Saving Health & Safety, Organizational Culture Other Income

Productivity or Efficiency Reduction in production costs per unit Increase in Productivity - hours saved x Rs. Per hour (per worked hour, per shift, per machine, per annum ) Reduction in Production/completion time per unit (e.g. forms, loans, clients Project) Increase in Output Reduction in overtime (quantity, cost) Less Induction time for new employees Better Equipment/facility/asset utilisation (e.g. down time due to machine stoppages, shift changeover time) Lower Equipment maintenance or replacement costs Capacity of staff to solve routine and non-routine problems (saving of supervision time required) Less errors (less time spent on correcting errors) Faster access to information

Sales & Profitability Reduction in overhead costs Reduction in operating costs Fall in operating costs as a percentage of total costs/revenue Increase in revenue/income/sales (monthly, annually, per employee, per team, per branch or store) Rise in market share (number of customers, unit volume sold) Sales to new customers Enhance Group operating profit Profit per employee Stock market performance (i.e. shareholder return)

Customer Satisfaction & Services More Sales ( customer satisfaction levels with timeliness, availability, quality and price of goods and services) Repeat business (customer retention or loyalty) New business resulting from client referrals New or more customers or markets (e.g. contracts won, loans processed, funding awarded) Less lost business (number of complaints , customers discontinued) Reduction in bad debts

Other Saving Safety: Reduction in accidents or injuries (number, time lost, compensation costs, premium cost/rating) Health : Less Absenteeism Organizational culture : Less Turnover (less recruitment and training cost)

Other Income Sales from referral of non-sales employee New Product ideas leading to new product launches

Returns Increased Sales Productivity increases Other cost savings Other income generation Total Benefits Rs. 2,40,000 675,000 160,000 0 10,75,000 Investments Design and development Promotion Administration Faculty Materials Facilities Trainee Evaluation Total cost Net Return (Return Inv) ROI ( Net Return/Inv x 100) 40,000 5,000 12,000 87,000 15,000 40,000 550,000 1000 750,000 325,000 43% ROI Example 1

ROI Example 2 Each data entry operators cost Rs. 100 per hour. 5 hours are spent on correcting errors per week. After training 20 percent less time is incurred correcting errors. 40 operators were trained at cost of Rs. 50000.

Example 2 Returns : Saving of time : 20% of 5 hours i.e. 1 hour per week Rs.100 ROI = 100 x 40 - 50000 x 100 50000 = - 46000/50000 x 100 = - 92%

Example 2 Is the benefit for only 1 week For a year ROI = 100 x 40 x 52 - 50000 x 100 50000 = (208000 50000)/50000 X 100 = 316%

Example 2 What was the benefit in 3 months ROI = 100 x 40 x 13 - 50000 x 100 50000 = (52000 50000)/50000 X 100 = 4%

Pay Back Period on Training How long did it take to recover the investment Example 1 Benefit of 12 months Benefit in a month 89, 583 Cost Pay Pack (cost/ Benefit per month) 8.3 months 10,75,000 7, 50,000

Value of Training PV Factor (12%) 0.833 0.744 0.664 0.593 0.530 Present Value 173333 123810 88435 63168 45120 493866 50000 443866 Year Savings 1 208000 2 166400 3 133120 4 106496 5 85197 Present value of Savings Less: Investment Value of the Program

Merck Model Gain = Sd x R x P x N Sd = Shift in performance by average trainee from pre training expressed in standard deviation R = The Rupee value of the standard deviation of performance shift P = Percentage of employees impacted N = Number of employees who underwent training

Valuation of Human Assets Cost based approaches: i) Historical Cost ii) Replacement Cost iii) Opportunity Cost iv) Standard Cost Economic value based approaches: i) The Lev and Schwartz Model ii) The Eric Flamholtz Model iii) Morse Model

Historical Costs Acquisition cost (i) Recruitment Cost (ii) Selection Cost (iii) Placement Cost (iv) Campus Interview Cost Learning Cost (i) Formal Training Cost (ii) On the Job Training Cost (iii) Special Training (iv) Development Programmes Welfare Cost (i) Medical Expenditure (ii) Canteen Expenditure (iii) Specific and General Allowances (iv) Children Welfare Expenses (v) Other Welfare Expenditure Other Costs (i) Safety Expenditure (ii) Ex-gratia (iii) Multi-trade incentives (iv) Rewarding Suggestions

Total cost approach Example: A firm has started its business with a capital of Rs.10,00,000. It has purchased fixed assets worth Rs.5,00,000 in cash. It has kept Rs.2,60,000 as working capital and incurred Rs.2,40,000 on recruiting, training and developing the engineers and few workers. The pay and benefits of engineers and workers is assessed at Rs.8,00,000.

Replacement Cost Estimated that the replacement cost of an executive in middle management level is about 1.5 to 2 times the current salary paid in that position a) Communication of job ability b) Pre-employment administrative functions c) Interviews d) Testing e) Staff Meetings f) Travel Cost g) Medical Examination h) Induction i) Pay & Benefits

Opportunity Cost Method This model envisages computation of monetary value and allocation of people to the most promising activity and thereby to assess the opportunity cost of key employees through competitive bidding among investment centres.

Present Value Of Future Earnings Method It recognizes an individual s expected economic value to the enterprise during his remaining service period. An estimate about the future earning is made, for his entire service period till the date of retirement of the employees. Such earnings are discounted by an appropriate range to get the present value.

The Lev and Schwartz Model (Present value of Future Earnings method) All employees are classified in specific groups according to their age and skill Average annual earnings are determined for various ranges of ages The total earnings which each group will get upto retirement age are calculated The total earnings calculated as above are discounted at the rate of cost of capital The value thus arrived at will be the value of human resources/assets

The Lev and Schwartz Formula Vy= t= yPy(t +1) T I (T) /(I + R) t-y Where, Vy= expected value of a y year old person s human capital T = the person s retirement age Py (t) = probability of the person leaving the organisation I(t) = expected earnings of the person in period I r = discount rate

Example: Low Skill Worker Age (Years ) Annual Earnings per Employee 40000 50000 60000 70000 23-32 33-42 43-52 53-62

Example: Low Skill Worker Age (Years ) 23-32 33-42 43-52 53-62 Human Value = Annual Earnings per Employee 40000 50000 60000 70000 PV Factor (10%) Present Value 245800 118450 54780 24640 443670 6.145 (1-10 years) 2.369 (11-20 years) 0.913 (21-30 years) 0.352 ( 31-40 Years) Rs. If they are 100 such workers at the age of 23 then the total value is Rs. 4,43,67,000 . If the attrition rate is 10% the net value is 90% of 4,43,67,000 i.e. Rs. 3,99,30,300

Flamholtz Model (Reward Valuation method) Measure of an individual s value to an organization is his expected realizable value. An individual s value to the organization can be defined as the present worth of set of future services that the expected to provide during the period he remains in the organization. Flamholtz (1971)model

Flamholtz Model Employee mapping in service states (Roles & Positions) Tenure in each Service State Estimation of the value derived by the organization when a person occupies a particular position The Values thus arrived is discounted at a predetermined rate to get the present value of human resources