Georgia Managed Care Update Forum Overview

The Georgia Managed Care Update Forum is a crucial event discussing market trends, value-based care, and top players in the managed care industry. Key players like Anthem BCBSGA and UHC are highlighted, including insights on their goals and market footprints. Topics such as product portfolios, market shares, and strategic initiatives in Medicare Advantage and Medicaid managed care are covered in-depth. Stay informed about the latest developments in the managed care landscape through this comprehensive update.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

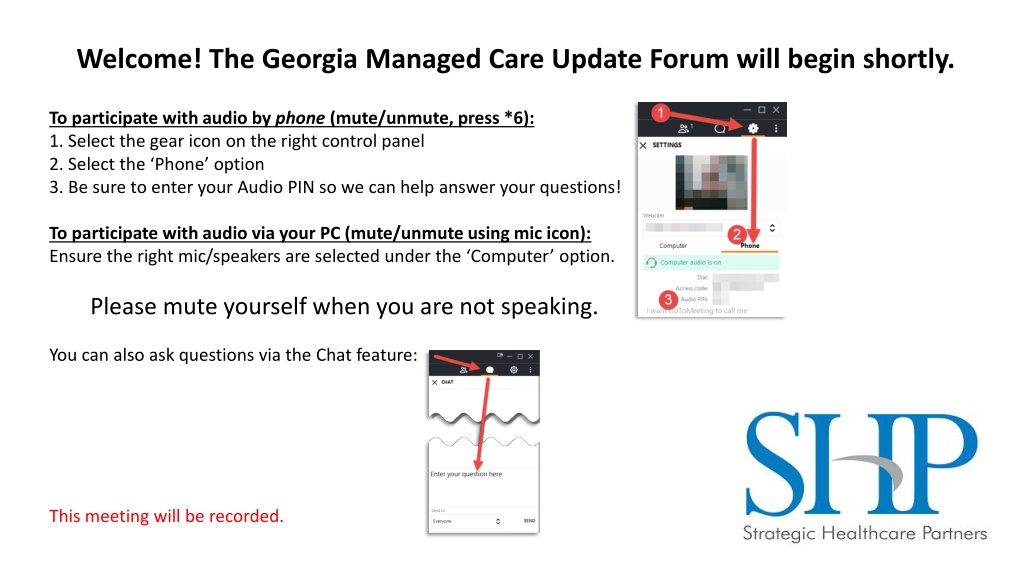

Welcome! The Georgia Managed Care Update Forum will begin shortly. To participate with audio by phone (mute/unmute, press *6): 1. Select the gear icon on the right control panel 2. Select the Phone option 3. Be sure to enter your Audio PIN so we can help answer your questions! To participate with audio via your PC (mute/unmute using mic icon): Ensure the right mic/speakers are selected under the Computer option. Please mute yourself when you are not speaking. You can also ask questions via the Chat feature: This meeting will be recorded.

Georgia Managed Care Update Top Players Market Trends Value Based Care Wrap-Up & Questions shpllc.com | 912-691-5711

Top Players shpllc.com | 912-691-5711

Anthem BCBSGA Footprint Product Portfolio: Commercial/State Health Plans-60% statewide market shareholder (65-70% outside Atlanta) PPO: 30% of Anthem Business HMO: 70% of Anthem Business State Health: 98% market share holder outside of Atlanta Roughly 25-30% of Anthem s commercial membership statewide Medicare Advantage: Immaterial product line Medicaid Managed Care: Amerigroup shpllc.com | 912-691-5711

Anthem BCBSGA Perceived Carrier Goals: Physicians: Shift physician fee for service pricing toward E&Ms/away from surgical/ancillary revenue. Implement mid-level enrollment/billing for savings. Hospitals: Desire to move hospitals to a standardized agreement (Comprehensive Outpatient Prospective Payment System COPPS). Continue to implement/enforce site of service policies designed to shift volume to free standing providers. Reduce cost via payment policy/administrative adjustments. Product Lines: Retrench Pathways product to lower pricing/move to more profitable deployment. Establish Medicare Advantage market as statewide payer. shpllc.com | 912-691-5711 5

UHC Market Footprint Product Portfolio: Commercial/State Health Plans-14% statewide market shareholder; 10% outside Atlanta State Health: Actives-2% market share holder outside of Atlanta Retirees- 98% of market share in Medicare Advantage 30-40% of UHCMA Statewide membership Medicare Advantage: Outside of Atlanta: 60% market share holder for MA products; 85-90% in rural areas. Lost non-SHBP market share in non-Atlanta markets over past 3 years. Alternative Networks- Worker s Comp/Auto, etc. Attempting to build out currently. Medicaid Managed Care: Attempt to be added as 4thCMO pending WellCare/PSHP merger Per DCH, no additions to CMO roster will be made until next RFP in 2023. Overall, generated record profits in the midst of an international pandemic. shpllc.com | 912-691-5711

UHC Perceived Carrier Goals: Physicians: Roll out point of care platform to ease administrative burden/improve quality. Currently no financial incentive to utilize. Hospitals: Continue to implement/enforce site of service policies designed to shift volume to free standing providers (Lab/Rad). Reduce cost differential vs. BCBS via unit cost reductions. Product Lines: Return to dominance in non-Atlanta Medicare Advantage via creating pricing advantages. Establish additional lines of business for worker s comp, auto, and other types of coverage. Gain access to Georgia Medicaid program. shpllc.com | 912-691-5711 7

Aetna Market Footprint Commercial/State Health Plans-11% statewide market shareholder; 11% outside of Atlanta PPO: 30% of Aetna business HMO: 70% of Aetna business Meritain: largest non-carrier claims administrator in market; owned by Aetna State Health: Planning to bid during next RFP in 2021 for 2022-2026 contract cycle Medicare Advantage: Statewide participation/Quickly growing product line for Aetna. CVS Acquires Aetna in 2018 Pilot Programs-building care delivery model around CVS stores. Launched CVS/Aetna Health Hub Pilots in 2019: plan to grow to 1500 locations in the next 24 months Announced in 2020: Social Determinants of Health Outcomes on Knee Replacement Surgery shpllc.com | 912-691-5711

Aetna Perceived Carrier Goals: Physicians: Roll out value based plans to improve physician satisfaction/improve care. Hospitals: Continue to implement/enforce site of service policies designed to shift volume to free standing providers (Lab/Rad). Softer approach currently. Product Lines: Become an option for State Health Benefit Plan for 2022. Build network for health exchange deployment in 2022. Continue to grow Medicare Advantage product line. Compete in claims administration business via Meritain. shpllc.com | 912-691-5711 9

Cigna Market Footprint Product Portfolio: Commercial: 11% statewide market shareholder; 8% outside Atlanta Virtually all business is national/regional that has Georgia covered lives. PPO/HMO: adjudicated on a similar platform; therefore, not administratively different. Flat market share for several years running. Medicare Advantage: Healthspring is immaterial; product line not sold outside of Atlanta market. Carrier Goals (Outside of Atlanta): Reduce commercial pricing to compete with BCBS. Continue to support national/regional business with complete network/price competition. shpllc.com | 912-691-5711

Humana Market Footprint Product Portfolio: Commercial/State Health Plans-7% statewide market shareholder PPO: 40% of Humana business HMO/POS: 60% of Humana business Gained some market share over past 2 years via small group, self funded line of business Planned commercial expansion across Southwest Georgia Medicare Advantage: Somewhat growing product line Carrier Goals (Outside of Atlanta): Grow Medicare Advantage product line. Grow niche lines like level-funded/small self funded products. shpllc.com | 912-691-5711

Centene Market Footprint (Peach St/Ambetter/Wellcare) Product Portfolio: Medicaid Managed Care: Largest CMO in state post Wellcare purchase Health Exchange Largest health exchange membership in state. Likely only carrier in majority of GA counties for 2021 Medicare Advantage: Deployed statewide under Wellcare product name for foreseeable future Somewhat growing outside of Atlanta Carrier Goals (Outside of Atlanta): Implement remaining territory vacated by BCBS for 2021 Execute Wellcare CMO network merge in 2021 Grow all 3 product lines shpllc.com | 912-691-5711

CareSource Market Footprint Product Portfolio: Medicaid Managed Care: 3rd largest CMO in state post Peach State/Wellcare combination Health Exchange Rolling out participation in certain markets for 2021. Statewide by 2022 Medicare Advantage: Launching Medicare product for 2021 in certain markets. Adding territory in 2022 Carrier Goals (Outside of Atlanta): Grow CMO product line Launch health exchange/MA product lines in 2021/brand for growth Position as more friendly provider partner shpllc.com | 912-691-5711

Global Concerns With Payers Nationalization of Provider Support National Call numbers/generalized inboxes for provider inquiries Standardized contract formats/ancillary pricing Payer Policy Changes- Tantamount to fee schedule adjustments in some cases Lab/Radiology/Therapy redirection towards free standing centers Unilateral Physician Fee Schedule Adjustments Anthem New fee schedule 11/15/20 UHC MA- Sub-Medicare reimbursement Cigna Lack of Fee Schedule Transparency Anthem Unilateral Rate Amendments without full fee schedules Cigna: releases only 20 codes at a time via a portal request Underpayments Affects almost all payers and unless plans are fully funded; only have 3-12 months to appeal All Products Contracts Anthem Pathways: Removing ability to term by product line UHC: Leveraging state health contract to ensure all products participation shpllc.com | 912-691-5711

Fragmented Oversight Department of Insurance (DOI) In theory, fully insured commercial carrier issues only but they avoid health exchange issues like the plague. New commissioner testing waters to engage beyond fully insured. Department of Community Health (DCH) Traditional Medicaid and CMO issues. Much improved support during Blake Fulenwider/Frank Berry time. Department of Labor (DOL) In theory, oversees commercial self funded claim issues/disputes but support is non-existent. Centers for Medicare and Medicaid (CMS) Oversees traditional Medicare and Medicare Advantage issues. In theory, applies standards for network adequacy for MA plans. Minimal oversight; overall belief that providers have a methodology for resolving MA issues by suing the health plans. Federal Department of Health and Human Services (HHS) Oversees Medicare/Medicaid plus more directly responsible for Health Exchange carriers/network adequacy. Terrible support. Department of Defense (DOD) Oversees Tri-Care issues .sort of .. All issues appear delegated to intermediary (Humana); seemingly disengaged support. State/Federal Legislators- When all else fails shpllc.com | 912-691-5711

Value Based Care- Primary Care Models Blue Cross Blue Shield Enhanced Primary Care Program Humana Model Practice Engagement- MA and Commercial Aetna PCMH (Patient Centered Medical Home) WellCare Shared Savings Peach State Health Plan: launching new shared savings model for 2021 shpllc.com | 912-691-5711

Value Based Care- Specialist Models Aetna Cardiology Obstetrics/Gynecology Oncology Orthopedics BCBSGA Patient Centered Specialty Care EPHC Model for Specialists with Care Coordination Fees: Cardiology; Endocrinology & Obstetrics/Gynecology BCBSGA Enhanced Payment Bundles Non-capitated bundled payment initiatives for specialists: Gastroenterology Orthopaedics Obstetrics/Gynecology Urological Humana Oncology Model of Care shpllc.com | 912-691-5711

Value Based Care-CMS Centers for the Medicare and Medicaid Innovation Medicare Shared Savings Program ACOs Bundled Care Payment Initiative CPC+ Direct Contracting Model MSSP ACOs are the most prevalent CMMI innovations In performance year 2017; CMS announced that ACOs had saved $1.1. billion CMS pushing value based care in State Medicaid contracts shpllc.com | 912-691-5711

Clover DCE New traditional Medicare opportunity launching April 2021 Direct contract between Clover & CMS to manage a population of red, white & blue Medicare lives Key Features: $4 PMPM $20 Clover Assistant Bonus on E&Ms Opportunity for Shared Savings Full CMS claims feed data Easier transition into value-based care shpllc.com | 912-691-5711

Whats Next/What Do We Do? Commercial Market Market Diversification is key. Too close to being South Carolina or Alabama. Support other carrier commercial product lines. Support non-BUCA product offerings (Benecon, Alliant, etc.). Develop/participate in community network offerings. Upgrade outreach to DOI More complaints. Quarterly meetings. Multiple sources (MAG/GHA/HTH). Support any legislative effort to: Implement/enforce network adequacy standards. Improve all product enforcement. shpllc.com | 912-691-5711

Whats Next/What Do We Do? State Health SHBP and BOR (University System) currently are contracted through Anthem of GA (BCBS) and UHC and Kaiser (Atlanta only) Anthem HMO- 98% share of active enrollees UHC MA- 98% share of retirees Upcoming RFPs BOR RFP released previously for 2022 implementation SHBP RFP pushed for 2022 implementation Aetna plans to bid Next Steps: Support additional bidders to diversify membership. Lobby DCH for more diversify with retirees. Encourage equivalent member premium between carriers to spread active membership. shpllc.com | 912-691-5711

Whats Next/What Do We Do? Medicare Advantage 38% of Georgia Medicare enrollees in a Medicare Advantage plan as of January 2020 Market Disrupters Clover CareSource Medicare EON Pruitt Healthcare (Special Needs Plan) Georgia Assurance(Special Needs Plan) Next Steps: Support non-UHC players in market (Clover/CareSource, etc.) Be leery of BCBS MA growth. Lobby DCH for more SHBP diversify with retirees. Engage value based initiatives as brought forward. shpllc.com | 912-691-5711

Whats Next/What Do We Do? CMOs Current Players: Amerigroup CareSource Peach State Health Plan WellCare Coming Developments PSHP Assumption of WellCare Medicaid in May 2021 Next Steps: Lobby for no UHC/Full reattribution by DCH (vs. dumping into Peach State). Ensure Peach State/Wellcare merger not harmful to organization. Engage value based initiatives when brought forward. shpllc.com | 912-691-5711

Whats Next/What Do We Do? Health Exchange Anticipated 2021 Adjustments: Anthem Pathways Anticipated to leave multiple additional counties. Ambetter Closest to Statewide carrier: In 2021; Ambetter will be in over 90% of Georgia counties. CareSource Continues to grow county offerings. Alliant Making a new market push in South/North Georgia. Aetna Planning new product development for 2020. Next Steps: Be leery of Pathways terminations. Might just be a county they are leaving. Support diversification, even if to hold Ambetter accountable as well. shpllc.com | 912-691-5711

Whats Next/What Do We Do? COVID-19 State of Georgia: employer based coverage down 9% from February to June 2020. National Expectations are rise in: Medicaid/CMO Health Exchanges Higher Self-Pay Some facilities already seeing a 30-50% increase in self-pay from pre-COVID levels Next Steps: Project volume based on shift in payer mix for internal and HHS reporting purposes. Verify coverage like your life depends on it. shpllc.com | 912-691-5711

Wrap Up & Questions shpllc.com | 912-691-5711