Georgia Legislative Session Recap and COVID Stimulus Update

The Georgia Legislative Session Recap and COVID Stimulus Update provides information on recent developments, including the American Rescue Plan impact in Georgia, COBRA subsidies for laid-off workers, and enrollment reopening for health coverage. Learn about eligibility criteria and how the subsidies work under the new legislation. Stay informed on important updates affecting Georgians during the ongoing pandemic.

Uploaded on Nov 21, 2024 | 2 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

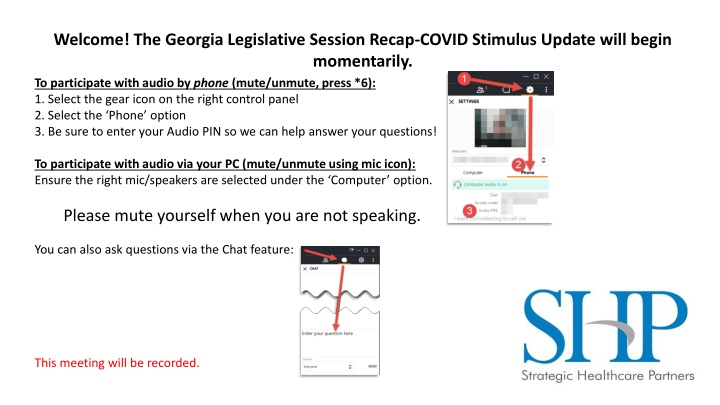

Welcome! The Georgia Legislative Session Recap-COVID Stimulus Update will begin momentarily. To participate with audio by phone (mute/unmute, press *6): 1. Select the gear icon on the right control panel 2. Select the Phone option 3. Be sure to enter your Audio PIN so we can help answer your questions! To participate with audio via your PC (mute/unmute using mic icon): Ensure the right mic/speakers are selected under the Computer option. Please mute yourself when you are not speaking. You can also ask questions via the Chat feature: This meeting will be recorded.

COVID Update shpllc.com | 912-691-5711

American Rescue Plan Affordable Care Act (Health Exchange) Stabilization & Expansion Health Exchange enrollment opened back up for 2/15/21 to 5/15/21 Impact in Georgia More than 40,000 Georgians have signed up for health coverage on the state exchange since the special enrollment period began in February. Typically bulk of enrollments come at the end of the process. Of the 36 states using the federally run healthcare exchange, Georgia ranks third in new enrollments, following Florida and Texas. shpllc.com | 912-691-5711

COBRA Subsidies 100% of costs of COBRA premiums for laid off-workers will be covered. Premium coverage will allow individuals who were involuntarily terminated or had their hours reduced to retain their employer-provided coverage through September 30, 2021. How it Will Work for Employers: COBRA continuation coverage (or continuation coverage under state mini-COBRA laws) must offer a 100% subsidy of COBRA premiums for assistance eligible individuals (AEIs) and their qualified beneficiaries. The subsidy requirement applies to major medical, dental and vision plans offered by employers, but not health flexible spending accounts. shpllc.com | 912-691-5711

COBRA Subsidies Who is an AEI under the legislation? An individual is an AEI if they qualify for COBRA coverage due to an involuntary termination of employment or reduction of hours. Individuals who qualify for COBRA coverage due to other qualifying events, such as a voluntary termination of employment, are not considered to be AEIs eligible for the premium subsidy. Individuals who do not have a COBRA election in effect on April 1, 2021, but who would be AEIs if they did, are also eligible for the subsidy. This means that individuals who experienced an involuntary termination of employment or a reduction of hours so that COBRA would have started sometime within the 18 months prior to April 1, 2021, but who did not timely elect COBRA, may still elect subsidized COBRA coverage prospectively. In addition, individuals who had elected COBRA coverage but discontinued such coverage before April 1, 2021 are eligible to re-elect COBRA coverage if they would otherwise be AEIs and are still within their COBRA 18-month maximum coverage period. Subsidies are only available until an AEI qualifies for Medicare or obtains other full-time employment. shpllc.com | 912-691-5711

COBRA Subsidies What Employers Need to Know: The premium amount is advanced by the employer or plan and will be reimbursed by the federal government through a refundable credit against payroll taxes. For self-insured plans and insured plans subject to federal COBRA, the employer will receive the tax credit via payroll tax remittance process. For insured plans not subject to COBRA, the insurer will receive the credit. Credit amounts exceeding Medicare taxes will be treated as a refund of a Medicare tax overpayment. The Department of Labor (DOL) just released their updated guidance regarding these provisions on April 7, 2021. For additional information and updated notification forms, please see below: Updated FAQs regarding ARP COBRA Provisions: https://www.dol.gov/sites/dolgov/files/EBSA/about- ebsa/our-activities/resource-center/faqs/cobra-premium-assistance-under-arp.pdf Summary of ARP COBRA Provisions & Employee Election Form: https://www.dol.gov/sites/dolgov/files/ebsa/laws-and-regulations/laws/cobra/premium-subsidy/summary- of-provisions.pdf shpllc.com | 912-691-5711

HHS Provider Relief Fund HHS has still not released any new guidance on reporting on the use of PRF Funds. Only recent update has been posted on the HRSA Portal established for eventual reporting HRSA/HHS intend to push updates to registrants; therefore, it is critical that everyone register for the reporting portal for all applicable entities. Registration Link: https://prfreporting.hrsa.gov/s/ The registration process will take at least 20 minutes to complete and must be completed in one session. It will not allow you to save a partially complete registration. shpllc.com | 912-691-5711

HHS Provider Relief Fund Estimated Fund Availability: $32B with $8.5B specifically earmarked for rural providers. Rural Provider Distribution will require an application process. HHS Secretary has broad powers to define rural providers. No news yet from HHS on the application process or distribution methodology that will be used for these funds. shpllc.com | 912-691-5711

PPP Provisions Payroll Protection Program Application Cycle Extended Until May 31, 2021 for first and second draw loans! Additional $7.25 billion in funding has been allocated to the PPP. Additional Eligibility: More non-profits will soon be eligible for PPP funds, including: Larger non-profits with up to 500 employees per physical location, compared to a max of 300 employees for second-draw PPP loans. Health Systems with > 500 employees will now qualify part of their staff for those staffing physical locations outside of the main hospital; regardless of under single TIN or under affiliate TINs. And, since these organizations did nder First Draw rules vs. Second Draw (i.e. $10M limit vs. $2M limit) shpllc.com | 912-691-5711

PPP Forgiveness for Original Draw Loans If a borrower does not apply for loan forgiveness within 10 months after the last day of the borrower s loan forgiveness covered period, loan payments are no longer deferred and the borrower must begin making payments on the loan. For example, a borrower whose covered period ends on October 30, 2020 has until August 30, 2021 to apply for forgiveness before loan repayment begins. Very little bank activity in pushing for forgiveness applications, even post 10 month cutoff. Appears enforcement of timeline may not be terribly stringent. Borrowers may submit a loan forgiveness application any time before the maturity date of the loan, which is either two or five years from loan origination. shpllc.com | 912-691-5711

Medicare Sequestration Updates Medicare sequestration was back on as of 4/1/2021. Congress returned from recess on April 12 and is expected to pass the legislation to continue the hold on sequestration; projected through 12/31/21. Therefore, on 3/30/2021, CMS announced that based on Congress s intent to pass legislation that extends the temporary pause on Medicare sequestration, they placed a temporary hold on Medicare claims. The CMS claims hold will prevent the need to reprocess claims. That said, there should be minimal claims impact since CMS already holds all claims for 14 days after receipt, MACs would not even begin to process claims submitted on April 1 (for services rendered on April 1) until April 15. Updates should be forthcoming shortly . shpllc.com | 912-691-5711

Wrap Up & Questions Unmute using *6 or the mic icon in the app or use the chat to ask. shpllc.com | 912-691-5711