Functions and Services of Parish Government in Louisiana

The Police Jury Association of Louisiana (PJA) was established in 1924 to enhance parish government in Louisiana. PJA offers member services, legislative advocacy, and training to the 64 parishes in the state. Parish governing authorities have the power to regulate operations, construct drainage districts, and manage various public services such as agriculture, airports, fire protection, and more.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

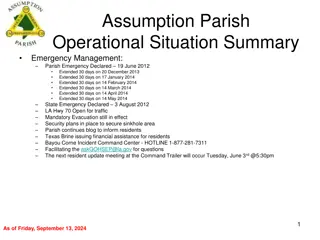

Police Jury Association of Louisiana Roland Dartez, PJA Executive Director George Marretta, PJA Tax Specialist

What is the PJA? Created in 1924 to improve parish government in the State of Louisiana, membership is open to each of the 64 parishes whether organized as a police jury, parish council or parish commission.

Member Services Legislative Advocacy Training

Functions & Services in Parish Government

Authority Provision The primary provision setting forth the authority of a police jury is found in LRS 33:1236. The authority granted in this statute ranges from the authority to regulate its own operations to construction and maintenance of drainage districts to regulate litter. Numerous other statutes also grants powers to parish governing authorities, particularly those pertaining to the creation of special districts to perform certain public functions.

Functions & Services of Parish Government Agricultural Arena Authority, Agricultural Industrial Boards Airport Authorities, Airport Districts Ambulance Services Bridges & Ferries, Causeways & Tunnels, Toll Bridges Cemeteries Coliseum Authority Drainage Districts Economic Development Corporations Enterprise Zones Fire Protection Districts Fish & Game Preserves Garbage Districts Historic Preservation Districts Homeland Security & Emergency Preparedness Hospital Districts Public Housing Industrial Districts

Functions & Services of Parish Government Continued . Bond Issuances Public Utilities Irrigation Districts Telecommunications Jails & Prisoners (Multi-Parish Prisons) Recreation Districts Redevelopment Agencies Animal Control Officers Roads Districts Sewage Districts Libraries Tourist Commission Mosquito Abatement Districts War Memorial Civic Center Waterworks Districts Planning Commissions

How are the daily operations of local government funded?

Sales Tax Major Revenue Sources for Parish Government Ad Valorem Tax Severance Tax Occupational license Tax/ Insurance Premium Tax

Royalties Allocation Alcohol Permit/Fees Beer Tax Riverboat Admission Tax Cable Franchise Fees Miscellaneous Revenues

Additional Revenues.. Video Poker(HB 1, Schedule 20) 2% Fire Insurance Premium Tax(HB 1, Schedule 20) LGAP: Local Government Assistance Program (HB 1, Schedule 20) Revenue Sharing (La. Const. Article VII, Section 26) Parish Transportation Fund (HB 1, Schedule 20/ La. Const. Art. VII Section 27) State Sales Tax Dedication (HB 1, Schedule 20)

Mandated Expenses at the Local Level

Judicial Expenses on Parish Government Clerks of District Courts Salaries & Expenses Allowance(If fee shortfall occurs) Offices, furniture & equipment Attendance in Court Building & Furniture for District & Circuit Courts District Judges Salaries Office, furniture & equipment Court Reporters Stenographic, secretarial and other personnel Juvenile Courts

Judicial Expenses on Parish Government Judges, Marshals, Clerks and Deputy Clerks annual salaries payable monthly in equal proportions by the respective municipalities and parishes where the courts are located City Courts Constables & Justices of the Peace Salaries Annual Training (permissive) Parish portion of salary Necessary expenses District Attorneys Expenses are paid out of criminal court fund (One-half (50%) of any surplus in fund on Dec. 31, goes into the Parish General Fund) Criminal Courts Keeping & feeding prisoners; Office, furniture & equipment; Court Appearances Medical Expenses; Transfer of Parish Inmates Sheriffs

Mandated Expenses on Parish Government Board of Election Supervisors Elections costs for parish boards of election supervisors; payment of compensation; Reimbursement expenses under certain conditions Parishes pay their portion with certain exceptions Election Expenses Salaries Election Commissioners

Mandated Expenses on Local Government Office, furniture, & equipment Supplies and maps Assessors Office, equipment, & supplies Salaries Registrars/Deputy Registrar of Voters Salaries/fees; Necessary expenses Deputy Coroner, Etc.- If fee based-model coroner pays. Burial of Paupers- Parish in which the death occurred. Coroners

Prohibited Taxes The police jury/parish governing authority may not levy or collect a tax on motor fuel or license fee on motor vehicles, severance tax, income tax, inheritance tax (Const., Art. VII, Sec. 4 (C) and 5)

Loss of Potential Revenue for Parish Operations Sales Tax Exemptions State Impact $2.9 billion (Source: Dept. of Rev. FYE 2015) Homestead Exemption $771.8 Million (Source: LA Tax Commission,2015 data) Industrial Tax Exemption LA ranked 2nd in corporate subsidies at an estimated $16 billion (Source: Together Louisiana, 2011-2015 data) Remote Sales Tax

Questions? Roland Dartez PJA Executive Director 225.343.2835 attyrol@aol.com