Establishing Regional Value Chains in the Post-Epidemic Era: Opportunities for the Greater Tumen Region

Recent events, including escalating tensions between the US and China and the impact of COVID-19, have led multinational enterprises to seek new production centers. The Greater Tumen Region, encompassing Jilin, is positioned to become a key global production center with established regional value chains. Global value chains play a crucial role in the international fragmentation of production, offering insights into countries' integration and positioning within these chains.

- Regional Value Chains

- Post-Epidemic Era

- Greater Tumen Region

- Global Value Chains

- Multinational Enterprises

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

A Golden Opportunity for the Greater Tumen Region to Establish Regional Value Chains in The Post-epidemic Era Halin Han Korea Institute for International Economic Policy September 23, 2020

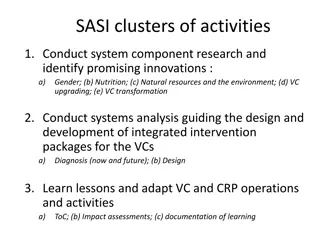

Table of Contents Background Global/Regional Value Chains Trade of the Northeast China (GTI Member States & World) Grubel-Lloyd (GL) Index Conclusion

Background Recent Events surrounding the Northeast Asia Countermeasures Escalating tension between the US and China Enhancing the political economic uncertainties of the region that would potentially lead to the decrease of the FDI to the corresponding region Demand for shift of the production centre Higher wages, sluggish economic growth after the global financial crisis are driving multinational enterprises to move out of the central and coastal China The outbreak of COVID-19 across the globe Uncertainties over the employment, significant reduction of disposable income, travel restrictions are calling the central governments to pursue stimulate the economy Disruption of Supply Chains across the globe On top of the on-going 4thIndustrial Revolution, the global pandemic crisis is urging the industries to establish global production networks with its shift of focus on safety, risk management and resilience Re-shoring of essential industries, diversification of production centres and other measures are being introduced. The wave of shifting the production centre out of - China to regions in proximity has been witnessed since 2012. The Southeast Asia, represented by a number of the ASEAN countries, including Malaysia and Thailand, emerged as the best alternative for the multinational enterprises to move out of the original production centre - - - This move has been accelerated by the spread of the COVID-19 It forced the multi-national enterprises to look for new, sustainable places close to where they used to base in. - - GTR as the alternative global production centre Ensure the Northeast Asia, specifically the Greater Tumen Region that encompasses Jilin, to be the next best alternative of the production centre with firm regional value chains across the region. - - 1

Global/Regional Value Chains Global Value Chains (GVCs) are synonymous with international fragmentation of production. - The ability to identify trade in intermediate products, as distinct from trade in final goods, can provide important insights into how countries integrate into GVCs, and indeed where they position themselves in these chains. - The most commonly and widely used definition of intermediate goods in merchandise trade is based upon United Nations Broad Economic Categories (BEC) Classification, which provides a simple tool to link trade data to the three basic System of National Accounts (SNA) classes: Intermediate Goods, Capital Goods, and Consumption Goods Categories Commodities Capital goods (except transport equipment), Industrial transport equipment and its parts and accessories Capital goods Primary food and beverages mainly for industry, processed food and beverages mainly for industry, primary and pr ocessed industrial supplies, primary industrial supplies, processed fuels and lubricants for other than motor spirit, p arts and accessories of the capital goods, parts and accessories of transport equipment Intermediate goods Food and beverages mainly for household consumption, non-industrial transport equipment and parts and accesso ries, durable semi-durable non-durable consumer goods Consumption goods 1

Total Trade over the recent years by Province 2013 597.4 6,366.8 9.4 6,566.4 63,682.3 10.3 1,133.7 3,454.4 32.8 5,734.8 14,642.1 39.2 403.7 19,082.8 2.1 5,327.3 49,816.6 10.7 4,672.2 7,893.1 59.2 15,568.4 22,639.7 68.8 193.8 - 12,716 1,239.2 13,866 - 3,538.6 - 4,439 - 9,833.6 - 7,998 2014 619.2 5,494.3 11.3 6,610.8 58,723.6 11.3 1,374.3 5,707.3 24.1 7,609.6 15,556.4 48.9 402.7 20,594.9 2.0 5,431.6 55,145.8 9.8 5,691.7 8,158.5 69.8 14,484.2 21,558.3 67.2 216.5 - 15,101 1,179.2 3,578 - 4,317.4 - 2,451 - 6,874.6 - 6,002 2015 554.7 4,482.9 12.4 5,489.8 50,794.5 10.8 1,177.4 5,158.9 22.8 2,329.5 7,656.3 30.4 464.0 14,131.8 3.3 6,291.9 45,235.3 13.9 4,667.7 7,107.1 65.7 8,508.9 12,902.6 65.9 90.7 - 9,649 - 802.1 5,559 - 3,490.3 - 1,948 - 6,179.4 - 5,246 2016 572.0 4,172.5 13.7 4,866.8 43,149.8 11.3 1,073.4 4,427.1 24.2 1,366.5 4,711.7 29.0 569.7 14,096.4 4.0 6,417.6 43,059.4 14.9 4,753.0 7,209.1 65.9 7,451.8 11,381.4 65.5 2.3 - 9,924 1,550.8 90 3,679.6 2,782 6,085.2 - 6,670 2017 668.4 4,392.1 15.2 6,038.7 44,825.0 13.5 1,251.6 4782.2 26.2 1,578.0 5,043.9 31.3 714.8 14,009.4 5.1 8,216.5 54,601.2 15.0 6,048.5 8,956.0 67.5 9,387.2 13,635.7 68.8 - 46.3 - 9,617 - 2,177.9 - 9,776 - 4,796.8 - 4,174 - 7,809.2 - 8,592 2018 634.2 4,921.1 12.9 5,914.8 48,739.9 12.1 1,334.2 5744.4 23.2 1,327.2 4,446.1 29.9 1,001.1 15,635.1 6.4 7,947.6 65,614.8 12.1 7,129.7 9,890.4 72.1 17,416.7 21,872.9 79.6 - 367.0 - 10,714 2,032.8 - 16,875 - 5,795.5 - - 16,089.5 - 17,427 2019 690.6 4,607.3 15.0 6,168.3 45,349.8 13.6 1,155.6 5424.1 21.3 1,361.8 4,716.3 28.9 1,059.8 14,090.5 7.5 5,862.9 59,435.4 9.9 7,032.3 10,353.9 67.9 16,969.0 21,833.0 77.7 - 369.2 - 9,483 305.4 - 14,086 - 5,876.7 - 4,930 - 15,607.2 - 17,117 Member States the World Share Member States the World Share Member States the World Share Member States the World Share Member States the World Share Member States the World Share Member States the World Share Member States the World Share Member States the World Member States the World Member States the World Member States the World Jilin Liaoning Export Inner Mongolia Heilongjiang Jilin Liaoning Import Inner Mongolia Heilongjiang Jilin - - Liaoning Trade Balance - - - Inner Mongolia 4,146 Heilongjiang 5

Classification of Goods by Broad Economic Categories (BEC) Classification of Goods by BEC Unique Categories Basic Classes in SNA 1 Food and beverages 11 Primary 111 112 Mainly for Industry Mainly for Household Consumptio n 1 2 Intermediate Consumption 12 Processed 121 Mainly for Industry 3 Intermediate 2 Industrial supplies not elsewhere specified 21 22 3 Fuels and Lubricants 31 32 Primary Processed 5 6 Intermediate Intermediate Primary Processed 321 322 7 Intermediate Motor spirit Other 8 9 Not Classified Intermediate 4 Capital Goods (Except transport equipment), and parts and accessories thereof) 41 10 Capital Capital Goods (except transport eq uipment) 42 Parts and accessories 11 Intermediate 5 Transport Equipment and parts and accessories thereof 51 Passenger motor vehicles 12 Not Classified 52 Other 521 522 Industrial Non-Industrial 13 14 Capital Consumption 53 Parts and Accessories 15 Intermediate 6 Consumer Goods not elsewhere specified 61 62 63 7 Goods not elsewhere specified Durable Semi-Durable Non-Durable 16 17 18 19 Consumption Consumption Consumption Not Classified 6

Jilin GTI Member States World 7

Liaoning GTI Member States World 8

Inner Mongolia GTI Member States World 9

Heilongjiang World GTI Member States 10

Grubel-Llyod (GL) Index Intra-industry trade indices in intermediates serve as a proxy of a country s insertion in GVCs, as well as to identify bilateral production linkages between countries and regions. A high level of intra-industry trade in intermediates (i.e. two-way exchange of intermediate goods within the same industry) is interpreted as indicating greater production links between participating countries, which would reflect international fragmentation. The World Input-Output Database (WIOD) is a publicly available multiregional input-output databse developed by a consortium of European institutions to analyse the effects of globalisation on trade patterns, environmental pressures and socio-economic development (Timmer, 2012). The latest version was released in 2016 and covers 43 countries which account for more than 85% of world GDP with a time frame spanning 15 years (2000-2014). The most widely used alternative intra-industry trade measure is the Grubel-Lloyd (GL) index. This index relates the net exports of a group of products q (usually defined within a standard industrial classification) with total trade (i.e. the sum of exports and imports) of the same products. At the bilateral level, the GL index in intermediates can be computed as follows: 11

Grubel-Llyod (GL) Index (continued) q intEXGRc,pq IMGRc,pq : The Grubel-Lloyd (GL) index in intermediates at the bilateral level GLc,p= 1 q intEXGRc,pq + IMGRc,pq GLc q int EXGRc,pq + IMGR q int|EXGRc,pq IMGRc,pq | c,p(q = 1 q int EXGRcq + IMGRc(q q intEXGRc,pq + IMGRc,pq p : The GL index for a single nation s world-wide trade, where EXGRcq = pEXGRc,p(q are country c s total exports of intermediate products q; and IMGRcq = pIMGRc,p(q are country c s total imports of intermediate products q. The index takes values between 0 and 1: values close to zero indicate a low level of intra-industry trade, whereas values approaching one indicate a high level of intra-industry trade. In the absence of intra-industry trade the index would be equal to zero (indicating pure inter-industry trade), while in the absence of inter-industry trade it would be equal to one (indicating pure intra- industry trade). 12

GL indices of the Northeast China at a bilateral level Year Jilin s GL index 2013 2014 2015 2016 2017 2018 2019 Country Mongolia ROK Russia 0.18 0.0000 0.1008 0.0016 0.0000 0.1252 0.0008 0.0000 0.1477 0.0010 0.0000 0.1606 0.0023 0.0000 0.0975 0.0003 0.0000 0.0097 0.0000 0.0000 0.1563 0.0014 Jilin 0.16 Year 0.14 2013 2014 2015 2016 2017 2018 2019 Country Mongolia 0.0041 0.0049 0.0000 0.0000 0.0000 0.0000 0.0000 0.12 ROK 0.1585 0.1654 0.1570 0.1618 0.1179 0.0114 0.1537 Liaoning 0.1 Russia 0.0226 0.0135 0.0086 0.0064 0.0034 0.0003 0.0145 0.08 Year 2013 2014 2015 2016 2017 2018 2019 Country Mongolia ROK Russia 0.06 0.0000 0.0439 0.0006 0.0016 0.0843 0.0009 0.0000 0.0278 0.0005 0.0000 0.0521 0.0003 0.0000 0.0088 0.0003 0.0000 0.0004 0.0000 0.0015 0.0813 0.0003 Heilongjiang 0.04 0.02 Year 2013 2014 2015 2016 2017 2018 2019 0 Country Mongolia 0.0002 0.0001 0.0005 0.0004 0.0000 0.0000 0.0001 2012 2013 2014 2015 2016 2017 2018 2019 2020 Inner Mongolia ROK Russia 0.0055 0.0004 0.0067 0.0005 0.0040 0.0005 0.0062 0.0004 0.0003 0.0001 0.0047 0.0000 0.0082 0.0030 Mongolia Russia ROK 13

Interim Conclusion Challenges Opportunities 2020 can be the golden time for the GTR to step up to the next level of economic integ ration despite challenging ti mes Industrial Parks can be one of the production centres for the GTI Member States It should be readily available to Make the best possible use of complementarity of the re spective area of the GTR In the end, enhancement of the connectivity in productio n would lead to closer coop eration and incurring driving forces for sustainable growt h in the region. External Market Shocks - - - Geopolitical risks Global Pandemic Crisis Stagnation of the global eco nomy Hardly any production linkag e in the Northeast Asia Mobilisation of both tangible and intangible resources to establish firm and stable pro duction connections across t he GTR - - - 14

Thank You 15