Enhancing Public Procurement Efficiency in South Asia Through PPP and E-GP

Ministry of Road Transport & Highways (MORTH) in India plays a crucial role in developing and maintaining the vast road network, emphasizing the significance of National Highways. Implementing various modes for NH projects and programs like NHDP, the country aims to improve road transportation infrastructure for economic growth and connectivity. Public-Private Partnerships (PPP) and Electronic Government Procurement (e-GP) are highlighted as effective tools in bridging the fiscal gap and enhancing efficiency in the region's public procurement processes.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

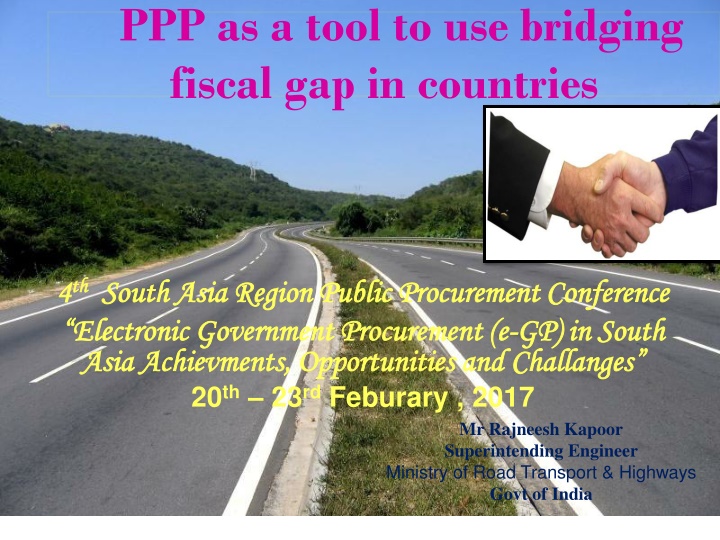

PPP as a tool to use bridging fiscal gap in countries 4 4th thSouth Asia Region Public Procurement Conference South Asia Region Public Procurement Conference Electronic Government Procurement (e Electronic Government Procurement (e- -GP) in South Asia Asia Achievments Achievments, Opportunities and , Opportunities and Challanges 20th 23rdFeburary , 2017 GP) in South Challanges Mr Rajneesh Kapoor Superintending Engineer Ministry of Road Transport & Highways Govt of India

INTRODUCTION Ministry of Road Transport & Highways (MORTH) is an apex organization under the Central Government is primarily responsible for development and maintenance of National Highways. India has about 5.472 million Kilometer of road network out of which NHs are only 1,03,933 Km. National Highway comprises only 2% of total road network in India but carries about 40% of the road traffic. Road Transport is considered to be one of the most cost effective and preferred mode of transport in India, both for freight(60%) and passengers(87%).

Road Network in India The road network in India is second largest in World after USA. Details of road in India is as under: Road Network of India Length (Km) National Highway (NH) 1,03933 State Highway (SH) 1,61,487 Other Roads (MDR, ODR & VR) Total Length 52,07,044 54,72,464

Implementation modes for NH Projects in India Implementation agencies for NH projects National Highways Authority of India (NHAI) State Works Dept (PWD)/ State Road Development Corporations Border Roads Organization (BRO) National Highways Infra Dev Corp Ltd. (NHIDCL) Implementation modes for NH projects Build Operate Transfer (BOT) Toll (PPP) BOT Annuity (PPP) Hybrid Annuity (PPP) EPC (Public funded)

Programme for road development in India NHDP (National Highways Development Project)- 48298 km SARDP NE(Special program for North East) - 7611 km LWE (Left Wing & Extremist affected areas) -1770 km National Highway Interconnectivity Improvement Programme (NHIIP) under proposed World Bank Loan Assistance Total Development of remaining NHs of length 45134 Km are taken up under NH(O) scheme through Budgetary support of Govt of India - 1120 km 58799 Km

NH DEVELOPMENT PROJECT (NHDP) The Government launched National Highways Development Project (NHDP) to upgrade and strengthen National Highways through various phases of NHDP. National Highway Development Project (NHDP) is among the largest highway development programs in the world NHDP is being implemented by MoRTH through National Highways Authority of India (NHAI) State PWDs/ Road Implementation Agencies

Phases of NHDP NHDP Phase-I: approved in Dec 2000 at the cost of Rs 30300 cr. NHDP Phase-II: approved in 2003 at the cost of Rs 34339 cr. NHDP Phase-III: approved in Dec 2006 at the cost Rs 80626 cr NHDP Phase-IV: approved in Dec 2006 at the cost of Rs 41210 cr. NHDP Phase-V: approved in October 2006 at the cost of Rs 41210 cr. NHDP Phase-VI: approved in Nov 2006 at the cost Rs 16,680 cr NHDP Phase-VII: approved in Dec 2007 at the cost Rs 16,680 cr

Status of NHDP NHDP Phase Mode Length (Km) Awarded/ under implementation (Km) To be awarded (Km) 1 Approved cost (Rs in Cr) 30,300 Phase I EPC 7522 7521 Phase II EPC/ BOT EPC/ BOT EPC/ BOT BOT 6647 6399 248 34339 Phase III 12109 10430 1679 80626 Phase IV 20000 15829 4171 27800 Phase V 6500 3457 3043 41210 Phase VI BOT 1000 166 834 16680 Phase VII BOT 700 120 580 16680 Total 54478 43922 10556 247,635

Special Accelerated Road Development Programme (SARDP) SARDP-NE aims at improving road connectivity of district headquarters and remote places of North Eastern region of India with state capitals. It envisages two/ four laning of about 4798 km of National Highways and two laning/ improvement of about 5643 km of state roads. This will ensure the connectivity to 88 districts headquarters in the North-Eastern states to nearest NH by at least 2 lane road. This programme is being implemented on EPC basis

Development of roads in Left Wing Extremism (LWE) affected areas Approved in Feb 2009 at a cost of Rs 7300 cr Envisages development of 1177 km NHs and 4276 km State Roads ( Total 5453 km) to 2-lane Development of roads in 34 districts affected by LWE in the 8 States of India Further, development of 594 km of State Roads at a cost of Rs 1,200 cr was approved in Nov 2010. This programme is being implemented on EPC basis

National Highway Interconnectivity Improvement Programme (NHIIP) About 1,120 km length of NHs are proposed to be improved to 2-lane NH standards following corridor development approach under the World Bank Loan Assistance of USM$ 500. All Contracts have been already awarded and 439 km of length has been completed. Total estimated cost is Rs 6461 cr. This programme is being implemented on EPC basis

FINANCING OF VARIOUS PROGRAMMES To meet with the massive requirement of funds, innovative means of financing have been adopted by Govt of India. Special financing strategies are needed, as raising adequate resources from budgetary resources alone is very difficult. The details of fund raised from various sources is as under: Cess on diesel and petrol: A cess of Rs 6 per liter is levied for road development. NHAI (Toll Remittance) Market borrowings on the strength of future inflow in cess/Toll: Funds are raised from Bonds issued by NHAI Avail long tern external loans from the World Bank, ADB & JICA. Budgetary resources of Govt of India under NH(O) public private partnership (PPP)

Public Private Partnership in India Implementation modes for NH projects Build Operate Transfer (BOT) Toll (PPP) BOT Annuity (PPP) Hybrid Annuity (PPP) EPC (Public funded) Preference of Mode BOT(Toll) is the Default Mode Earlier, the projects not viable on BOT(Toll) were taken up on BOT Annuity (PPP). Now, projects not viable on BOT(Toll) are taken up on Hybrid Annuity Model(HAM) When no response is received on BOT(toll) and HAM then projects are taken up on EPC Mode.

Public Private Partnership in India- BOT (Toll) Concessionaire construct the road and recovers the cost through collection of toll revenue during concession period maximum upto 30 year. Viability Gap Funding (VGF) maximum up to 40% of Total Project cost (TPC) paid to concessionaire by Authority during construction period in 5 installments linked to project milestones. Remaining project cost is recovered by concessionaire through collection of toll revenue during operation period during which concessionaire also maintains the road. Construction and tolling risk is with concessionaire and Govt has to pay only viability gap funding. 15

BOT(Toll)Model 1. Toll revenue to be retained by concessionaire 2. Interest payments (on reducing balance @ Bank Rate + 2%) VGF support upto 40% of TPC by Govt. COD BOT(Toll) Project Toll collection by Concessionair e O&M by Concessionaire Balance Project Cost to be arranged by Concessionaire for Financial Close Operations Period Bid Parameter VGF quoted Construction Period Concession Period

Public Private Partnership in India- BOT(Annuity) Concessionaire construct the road and recovers the cost through Annuities paid semi annually after completion of construction and during operation period (maximum upto 17.5 year). Construction risk with concessionaire. Authority collects toll and Concessionaire remains insulated from Toll Revenue Collection Risk. O&M responsibility is with concessionaire. Authority has to pay annuities during operation period hence payment liability deferred during construction and paid in installment during operation period. 17

BOT(Annuity) Model 1. Annuity payments (biannually) for 15 years 2. Interest payments (on reducing balance @ Bank Rate + 2.5%) No Construction Support by Govt. COD BOT(Annuity) Project Toll collection by Govt. O&M by Concessionaire 100% of Project Cost arranged by Concessionaire for Financial Close Operations Period Bid Parameter Semi Annuity quoted Construction Period Concession Period

Hybrid Annuity Model The Model 40% of Project Cost paid to Concessionaire by Authority during construction period in five equal instalments linked to project milestones. Balance 60% of Project Cost to be brought in by Concessionaire who also designs, builds and operates the highway for a period of 15 years after construction. Investment recovered by Concessionaire through Annuity payments over 15 years along with interest thereon @ Bank Rate + 3 %. O&M responsibility is with Concessionaire, who receives O&M payments bi-annually along with Annuity payments. Authority collects toll and Concessionaire remains insulated from Toll Revenue Collection Risk. Project payments are inflation indexed.

Hybrid Annuity Model salient features This is a new innovative Model in which Annuities paid to concessionaire are not equal but increases with time. This helps to reduce the pressure on budgetary resources initially since annuity amount increased with time to match the budgetary resources (2.1% to 4.75% of balance cost). Separate provisions exist for O&M payments to the concessionaire from the Authority. Toll collection shall be the responsibility of the Authority. As of now 30 projects are awarded on HAM mode out of which 9 has achieved financial close, which will be started shortly .

Annuity payment schedule Pre determined Annuity following the COD Completion Cost 1st Annuity 2.10% 2nd Annuity 2.17% 3rd Annuity 2.24% 4th Annuity 2.31% 5th Annuity 2.38% 6th Annuity 2.45% 7th Annuity 2.52% 8th Annuity 2.60% 9th Annuity 2.68% 10th Annuity 2.76% 11th Annuity 2.84% 12th Annuity 2.93% 13th Annuity 3.02% 14th Annuity 3.11% 15th Annuity 3.20% Percentage of Balance Annuity following the COD 16th Annuity 17th Annuity 18th Annuity 19th Annuity 20th Annuity 21st Annuity 22nd Annuity 23rd Annuity 24th Annuity 25th Annuity 26th Annuity 27th Annuity 28th Annuity 29th Annuity 30th Annuity Percentage of Balance Completion Cost 3.30% 3.40% 3.50% 3.61% 3.72% 3.83% 3.94% 4.06% 4.18% 4.25% 4.25% 4.44% 4.71% 4.75% 4.75% 100%

Hybrid Annuity Model 1. Annuity payments (biannually) for 15 years 2. O&M payments 3. Interest payments (on reducing balance @ Bank Rate + 3%) 40% of Project Cost (Construction Support) by Govt. COD Hybrid Annuity Project Toll collection by Govt. O&M by Concessionaire 60% of Project Cost arranged by Concessionaire for Financial Close Operations Period Bid Parameter NPV of the quoted Bid Project Cost + NPV of the O&M Cost for the entire Operations period Construction Period

Salient features of BOT(Toll),BOT(Annuity) & HAM in India Particulars Construction Period Concession Period Upto 30 Years VGF/Annuity BOT(Toll) 18 Month to 36 Month BOT(Annuity) 18 Month to 36 Month Upto 20 Years Semi Annual Annuity HAM 30Month 17.5 Years 40% construction support+60%Semi Annual Annuity+ O&M cost 15% 10000 PCU Maximum grant upto 40% (VGF) EIRR Capacity of 2lane + PS Capacity of 4 lane Capacity of 6 lane 15% 10000 PCU 15% 10000 PCU 60000 PCU 1,20,000 PCU 60000 PCU 1,20,000 PCU 60000 PCU 1,20,000 PCU 23

PPP as a tool to use bridging fiscal gaps in countries All the 3 modes of PPP is very useful in bridging the fiscal gap in budget of country. In BOT(Toll) Mode, government has to pay only 40% of project cost and project will be constructed and maintained by concessionaire for maximum period of 30 year. In HAM mode, government has to pay only 40% of project cost during construction period and remaining as semi annual annuities during 15 year operation period and project will be constructed and maintained by concessionaire for period of 17.5 year. In BOT(Annuity) mode, government has to pay semi annual annuities during 15 year operation period and project will be constructed concessionaire for period of 17.5 year. and maintained by

Road Development on PPP in India Put investment through PPP is enabling reduced dependence on public expenditure for infrastructure projects. In India, 30% (approx) funds for NHs are being raised through PPP and 30% through (approx) Internal borrowing. Highway sector in India has effectively used the PPP route and presently, 39000 Km length of National Highways are being developed on PPP basis in India. 259 projects with a length of 22225 Km is already awarded on PPP basis. The details are as under: Total projects awarded Total Length awarded Length Completed Length under Implementation Total Project cost of awarded project 259 No. 22225 Km 7566 Km 14659 Km US$ 28.84 Billion

Allocation/Expenditure for NHs Financing Scheme Funds Raised (2014-15) Funds Raised (2015-16) Expenditure upto Jan 17 (2016-17) Cess on diesel and petrol NHAI (Toll Remittance) Avail long tern external loans from the World Bank, ADB & JICA. Budgetary resources of Govt of India under NH(O) Market borrowings on the strength of future inflow in cess/Toll public private partnership (PPP) Total investment for NH in India Rs 15923 cr Rs 5448 cr Rs 138 cr Rs 34257cr Rs 6500 cr Rs 547 cr Rs 25001 cr Rs 7500 cr Rs 171cr Rs 5292 cr Rs 4216cr Rs 4010 cr Rs 3343cr (7%) Rs 23281cr (23%) Rs 27831cr (36%) Rs 19232 cr (38%) Rs 49376 cr Rs 29770 cr (30%) Rs 98571 cr Rs 11277 cr (15%) Rs 75790 cr

Advantages of PPP Timely Completion Value for Money Whole life asset performance o Private entity takes responsibility & assumes risk for the performance of the asset and delivery of service over a long term Payment for Performance o Revenue/ Payment to private entity is subject to performance in relation to specific & quantified criteria enshrined in the contract 27

Delhi Gurgaon- PPP Project BOT (Toll)

Jammu-Udhampur PPP Project- BOT(Annuity)

Thank you 30

![Comprehensive Overview of Corruption Watch Submission on Public Procurement Bill [B18B-2023]](/thumb/138344/comprehensive-overview-of-corruption-watch-submission-on-public-procurement-bill-b18b-2023.jpg)