PPP Training Program: Marketing, Promotion, Bidding & Investment Opportunities

Explore the role of marketing and promotion in successful PPP procurements, along with strategies for promoting and marketing PPP bidding opportunities. Understand the importance of PPP investment promotion to attract private investors and developers. Dive into real-world examples like the Navotas BOT Power Project in the Philippines to grasp the impact of PPP initiatives on economic development.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

PPP Training Program 4.3 Marketing & Promoting 4.3 Marketing & Promoting PPP Bidding & Investment PPP Bidding & Investment Opportunities Opportunities

Session Overview Session Overview 1. The Role marketing and promotion to achieving successful PPP procurements 2. Menu of options to promote & market PPP bidding opportunities 3. PPP Investment Information Memoranda (InfoMemos) 4. Request for Expressions of Interest (RfEoI) for a PPP project 2

1. Role of PPP Investment Promotion 1. Role of PPP Investment Promotion Unless private investors, developers, lenders, and operators know about Tanzania s PPP program, and its specific PPP projects, they may not bid on them PPP investment promotion is especially needed for the first group of PPP transactions. After that, the performance & profitability of these pilot PPPs (or lack thereof) will speak for itself In practice, private investors often look at what other private investors are doing and where they are making money (which sectors & countries) and where they are not. The MOST effective form of PPP investment marketing is the returns and profits that a current PPP project in the country & sector is already making. 3

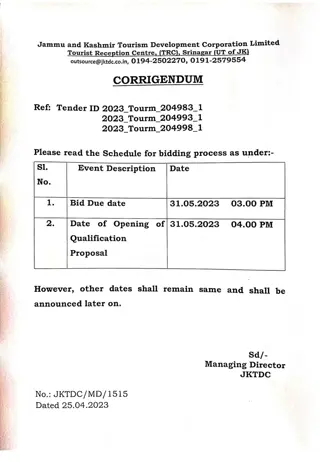

Example: Philippines Example: Philippines Navotas Navotas BOT Power Project BOT Power Project Late 1980 s (Post-Marcos) Philippines faced chronic electric power shortages that were crippling the economy 1988: Proposal from a private real estate developer to Build-Operate-Transfer a $41 million, 200 MW, 12-year combined cycle emergency power project, (using old, existing generating equipment from a peaking power plant in the USA, built back in 1975, that was under-used and no longer needed ). In 1989 There was no policy, legal, or institutional framework for PPPs in the Philippines Navotas was one of the very first IPPs in the developing world Although intended as a peaking plant for just 3-hours per-day (paid higher spot market prices, ala emergency power ), Navotas IPP was run as a base-load generator (13 hours per day) by the National Power Corp. due to the severe power shortage in the country. It earned much higher than expected profits for its investors. Most observers (private investors, international donors, private power developers, commercial lenders, etc.) all expected that the Govt of Philippines would force the renegotiation of this the PPA contract and reduce the prices paid and the private profits earned 4

Navotas Navotas IPP Philippines Example IPP Philippines Example Instead the GoP let the terms and prices of this first PPP stand 1990 Philippines BOT Law Passed & BOT Center Created inside the powerful Office of the President (High-Level Political Leadership) NAPOCOR allowed to accept unsolicited proposals and issue direct awards for IPPs. Private power investors, operators, and lenders from all the world came to the Philippines to invest in the attractive and growing new market. Over $37 billion of new private investments in power generation 1990-2017 Biggest factor cited by int l private power investors in their decisions to pursue IPP investments in the Philippines is the proof of clear profits being earned by other developers (ie Hopewell Holdings, Inc s Navotas IPP) The best marketing the Govt could have hoped for! Private PPP investors & commercial lenders will likely place more importance on the proven track record of PPPs that are already making money in Tanzania, rather than on published public relations and paid investment media marketing. 5

Philippines: $56 Billion in Private Investments in Philippines: $56 Billion in Private Investments in Infrastructure (1990 Infrastructure (1990- -2017) 2017) 6

2. What Do Investors Look For When 2. What Do Investor s Look For When Preparing PPP Investments? (WB Survey) Preparing PPP Investments? (WB Survey) 7

Why PPP Investments Have Succeeded or Failed Why PPP Investments Have Succeeded or Failed 8

PPP Investment Promotion PPP Investment Promotion Conferences & Road Shows Conferences & Road Shows PPP Investor Conferences are meetings conducted by public authorities to promote private investor interest in an individual or a group of related PPP investment projects and contracting opportunities. PPP investment conferences, which seek to distribute key information about new projects, may be conducted within Tanzania, or may even feature investment road shows beyond the region, which will target potential foreign investors and operators. 9

Promoting PPPs to Local and Regional Private Promoting PPPs to Local and Regional Private Developers, Investors & Financiers Developers, Investors & Financiers Determine the target audience for PPP investment and operation promotion. For all PPP projects, local service providers including private investors, construction and design firms, equipment suppliers, as well as commercial banks and lenders should be given the opportunity to bid on their own or in partnership with regional and/or international partners. Investment Promotion Agencies can be an important source of assistance in preparing and implementing local and regional investors conferences and promotional activities. 10

Promoting PPPs to International Promoting PPPs to International Investors, Contractors & Financiers Investors, Contractors & Financiers For international investment road shows, foreign trade and development agencies, and commercial attaches (especially from OECD countries) may be willing to support the costs of travel and transportation for high level delegations to visit their countries as well as the costs of preparing relevant marketing and promotion materials about a specific project and its contracting opportunities. Only publicly known information needs to be discussed during road shows. Good practices also recommend maintaining a formal record of matters discussed and information provided during the road shows. 11

3. Drafting the Invitation for 3. Drafting the Invitation for Expressions of Interest ( Expressions of Interest (EoI EoI) ) Because EoIs are used at an early stage of planning, it is important that the communications are clear about its nature and purpose so as not create an expectation that would disappoint the market or the citizens if the project were not pursued. An Invitation for EoI document should generally contain the following information so as to obtain valid results: 12

PPP Request for Expressions of PPP Request for Expressions of Interest Interest - - Contents Contents Name and brief description of the public authority s functions Background with respect to the present state of the relevant service Objectives and overview of the project, drawing upon the Project Initiation, Screening & Selection and PPP Feasibility Analyses & Proposed Risk-Allocation Structure Nature of the partnership being considered (i.e., Lease, PFI, concession, etc.) Services that the private sector is expected to deliver Proposed PPP risk-allocation Expertise being sought from the private sector 13

4. The PPP Investment Information 4. The PPP Investment Information Memorandum Memorandum The Information Memorandum (or Info Memo ) is a summary of the most relevant information that private investors would need to understand the overall purpose, objectives, key components, and major financial requirements and return opportunities from the new project. Unlike full PPP feasibility studies, which can go into great technical detail describing and analyzing a PPP project, an Info Memo provides a summarized version (usually just 30-75 pages) of these different analyses and describes the PPP project s risk-allocation structure to allow investors and financiers to decide whether and how to invest in the project. 14

PPP Project Info Memos PPP Project Info Memos Based upon all of the available sources of information about the project prepare an Information Memorandum of roughly 30 75 pages that addresses (can be read in one sitting .): 1. Introduction Brief description of the PPP project 2. Economy Background information on Tanzania s economy, its recent performance data, the investment environment, the environment and performance of foreign investment, foreign exchange issues, commercial lending opportunities, and other key economic issues important to the PPP Project 3. Tanzania s PPP Program Descriptions of the key elements of Tanzania s PPP program including objectives, accomplishments, key elements, legal & regulatory framework for PPPs, etc. 15

PPP Investment "Info Memo" PPP Investment "Info Memo" 4. The organization and description of the relevant infrastructure sector sector size, scope and performance; sector policies; sector investment plans & forecast demand levels; institutional roles in the sector; 5. The Specific PPP Project Description of scope, size/capacity & output standards; descriptions of key elements of the PPP contract including risk-allocation and available public sector contributions; procurement timetable 6. Annexes Further information on output service delivery standards, other project requirements, etc. 16

PPP Project Information Memorandum 17

Egyptian PPP Pipeline Projects Egyptian PPP Pipeline Projects 5 years plan 5 years plan 2008 2008 2012 2012 - - 18

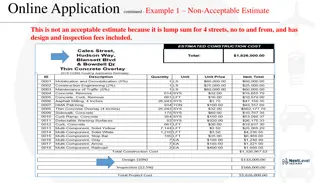

Egypt: New Public Schools Pilot PPP Project Egypt: New Public Schools Pilot PPP Project 2,100 New Public Schools in Egypt (7 batches) Project Description 1st batch of 345 schools to be tendered out by GAEB jointly with MOF. IFC Transaction advisor Private Service Provider shall design, finance, construct, furnish maintain, operate and provide non- educational services Location over 27 Governorates & Project Duration 15 Years Remaining 6 batches of schools to be tendered over coming 5 years PLANNED Project Timeframe November 2007 January 2008 April 2008 June 2008 November 2008 January 2009 April 2009 Issuance of RFQ Bid Submission Deadline Announcement of Qualified Bidders Issuance of Pre-Final Tender Documents Issuance of Final Tender Documents Contract Signature Commencement of Construction 19

Egypt Schools PPP: Info Memo Contents Egypt Schools PPP: Info Memo Contents A. Introduction B. Economy Economic Performance Investment Environment Foreign Investment Exchange Rates Bank Credit & Interest Rates C. The PPP Program Objectives Key Elements of the Program Legal & Regulatory Framework 21

Egypt Schools PPP: Info Memo Contents Egypt Schools PPP: Info Memo Contents D. Education Sector Education System Education Policy Education Spending General Authority for Education Buildings (GAEB) E. Project Project Description PPP Contract Project Financing Project Financial Model Tender Process & Timetable Annexes A. Summary of Service Obligations 22

PPP Project Scope PPP Project Scope Private sector to design, build, furnish, finance and provide non-educational services (maintenance, cleaning, security, etc.) for 300 new schools (as first tranche of a projected 2,210 new school PPPs) GAEB has identified the land, conducted soil analyses, and completed all data gathering on the physical characteristics (location, etc.) All relevant data will be distributed to interested bidders on CD- ROM 23

Discussion Questions: Discussion Questions: Which PPP bid promotion techniques would be most appropriate for your country s/organization s PPP Projects? Would PPP Info Memos be a useful tool for generating private investor interest in your country s PPP Projects? What would be the most important contents to include in PPP Info Memos for your country s PPP Projects? 24