Employee Benefits Study 2011 and Beyond: Group Life and AD&D Insurance Overview

This comprehensive study delves into the intricacies of employee benefits, focusing on group life and AD&D insurance for entities in the communications, business, and wireless sectors. It discusses the application of prior claim experience, credibility, cost structures, retirement funding accounts, investment gains, and real challenges faced in developing competitive rates. Additionally, it highlights the advantages of choosing Prudential for innovative products and services in the employee benefits realm, along with record-keeping, beneficiary services, and termination processes.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

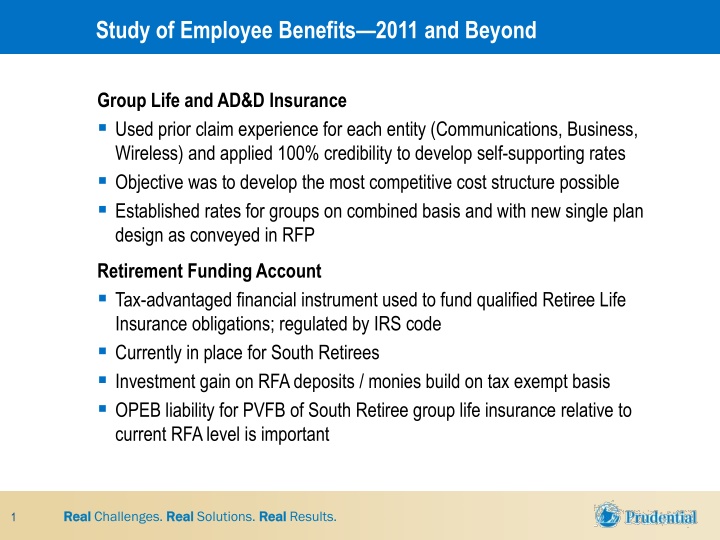

Study of Employee Benefits2011 and Beyond Group Life and AD&D Insurance Used prior claim experience for each entity (Communications, Business, Wireless) and applied 100% credibility to develop self-supporting rates Objective was to develop the most competitive cost structure possible Established rates for groups on combined basis and with new single plan design as conveyed in RFP Retirement Funding Account Tax-advantaged financial instrument used to fund qualified Retiree Life Insurance obligations; regulated by IRS code Currently in place for South Retirees Investment gain on RFA deposits / monies build on tax exempt basis OPEB liability for PVFB of South Retiree group life insurance relative to current RFA level is important Real Real Challenges. Real Real Solutions. Real Real Results. 1

Study of Employee Benefits2011 and Beyond Group Life and AD&D Insurance 100% credibility for self-supporting rates Develop competitive cost structure Group rates combined with single plan Retirement Funding Account Fund Retiree Life Insurance Investment gain on RFA deposits OPEB liability Real Real Challenges. Real Real Solutions. Real Real Results. 2

Advantages of Choosing Prudential Innovative Products and Services Enhanced offerings help keep your employee benefits competitive Proven project management staff provides flawless account installation Experienced, responsive account team focuses on value-added service Expert Implementation and Account Management Best-in-Class Technology Easy access and functionality streamlines program administration Exceptional Enrollment Capabilities Professional enrollment portfolio gives valuable campaign options Industry Leader Brand recognition helps ensure employee satisfaction with your carrier selection Real Real Challenges. Real Real Solutions. Real Real Results. 3

Record-Keeping ServicesThe Details by Group Basic / Optional GUL / GVUL 273 Clients 2.8M Covered Employees 95% Persistency Direct Bill Groups Active Retiree Active Accept paper or Web All records on Web available 24 x 7 Provide confirmations Process changes and permit self-service Re-solicit for updated records Beneficiary and Assignment Services Accept termination files Mail materials to terminated employees with two notices Process portability forms Provide ongoing direct-billing for ported policies Termination Services (Portability and Conversion) Prepare claims with eligibility data Collect supporting documents and certified death certificate Perform follow-up mailings Pay claim via SHC s dedicated claim team Life Claim Facilitation Services Accept Hewitt and SHC self-billed files Direct bill specified GUL population Billing Eligibility Prudential will transfer and house records Real Real Challenges. Real Real Solutions. Real Real Results. 4