Economic Snapshot: UK Inflation Down, Nigerian Reserves Slip, Domestic Commodities Movement

UK inflation hits a 3-year low at 1.5%, while Nigeria experiences delays in releasing inflation data. Brent crude increases to $62.85pb, impacting external reserves as the Naira slightly depreciates. Power output decreases, leading to concerns. Domestic commodity prices show varied movements, signaling a shift in the economy. Consumer goods prices fluctuate, affecting purchasing power.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

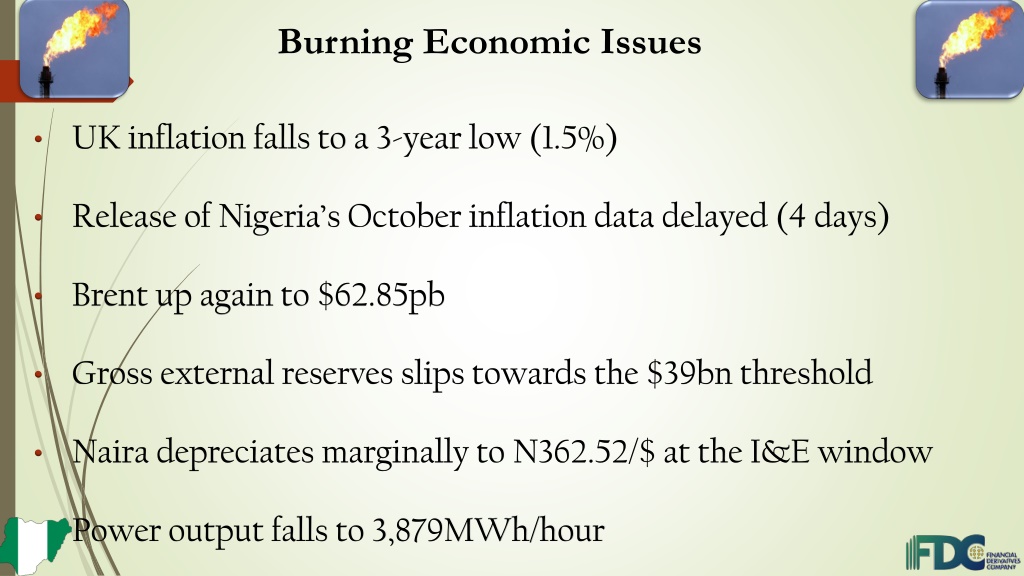

Burning Economic Issues UK inflation falls to a 3-year low (1.5%) Release of Nigeria s October inflation data delayed (4 days) Brent up again to $62.85pb Gross external reserves slips towards the $39bn threshold Naira depreciates marginally to N362.52/$ at the I&E window Power output falls to 3,879MWh/hour

Impact The Goodies The Downers US yield curve no longer Petrol price spikes along inverted Nigerian borders Easing fears of a likely Price of rice sticky at global recession N27,500

State Temperature(noon- time) 310C 330C 310C Power Sector Abuja Kano Lagos November 12th Average power output: 3,879MW/h (up 22.28MW/h) Gas constraints stood at 1,382.5MWh/hr, Grid constraint was 1,951.5MWh/hr. There was no water constraint Naira equivalent of power loss: N1.6billion (annualized at N584billion)

Domestic Commodities Price Movement Relatively Elastic Products Commodities Current Prices Previous Month Prices N9,000 Directional Change 1-Year Low 1-Year High Palm Oil (25l) N9, 000 N9,000 N10,000 Semovita (10kg) N2,900 N2,800 N2,800 N3,000 New Yam (medium size) N500 N600 N400 N1,900 Sugar (50kg) N13,500 N13,500 N13,000 N15,000

Domestic Commodities Price Movement Relatively Inelastic Products Commodities Current Prices Previous Month Prices N6,850 Directional Change 1-Year Low 1-Year High Garri (50kg) Yellow N6,900 N6,150 N6,900 Rice (50kg) N27,500 N24,000 N14,000 N27,500 Flour (50kg) N11,500 N11,500 N10,000 N11,500 Beans (Oloyin)(50kg) N15,000 N15,000 N14,000 N25,500 Cement (50kg) N2,600 N2,550 N1,600 N2,700 Tomatoes (50kg) N10,000 N10,000 N6,000 N20,000 Pepper (bag) N9,000 N9,000 N5,000 N15,000

Domestic Commodities Price Movement Domestic prices increasing in line with inflation Rice Border closure Garri Seasonality effect Minimum wage impact on prices yet to be felt

Consumer Goods Current price Supermarket price Street price % difference Goods 0% Pepsi (50cl) N100 N100 N300 N330 -10.00% Heineken beer (60cl) N350 N400 Bread Loaf -12.5% N2,000 Indomie (1 carton) N2,300 -15.0% 0% N100 N100 Gala (big size)

Commodity in Focus - Limestone Total global output: 420 million tonnes Crushed stone used as a construction material, road base and railroad material Other uses: water treatment, paper & pulp, POP Key driver for limestone market is the increased demand from the construction sector Building & construction form over 30% of the Source: Statista, FDC ThinkTank market share World s top producers: China, USA, India

Limestone Production in Nigeria Deposits of over 31million tonnes across the Federation Mainly found in the Southwest and Middle Belt regions Domestic demand between 18-20 million tonnes per year Owing to increased demand for infrastructure projects

Listed Users of Limestone Revenue: (9M 19): N163.06bn, down Revenue: (9M 19): N679.8bn, 30.41% y/y down 0.8% y/y PAT: Moved to positive territory at PAT: N154.35bn, down by 2.5% N20.57bn EPS down 1.6% to N9.10 EPS: Moved to positive territory at Share Price: N145 N128 Down 23.56% YTD Share Price: N14

Stock Market NSE ASI 0.37% to 26,357.61pts on November 13th Consumer goods sub index: 0.40% at 475.58pts Share Prices (N) 1,150 1.00 15.2 Daily % Change (November 12th- November 13th ) - 1.96 - YTD (% Change) Nestle Honeywell Flour Mills 22.56 21.88 34.20 Cadbury Dangote Sugar Unilever Ikeja Hotels 9.00 9.95 - - 10.00 34.75 18.50 0.96 5.61 9.09 50.00 37.25

Oil Markets Today CURRENT PRICE DAILY CHANGE November 13th 14th YTD COMMODITY BRENT 16.82% $62.85pb 0.77% WTI 26.78% 0.79% $57.57pb NATURAL GAS 3.35% 8.50% $2.69MBtu

Oil Prices Brent up 0.77% to $62.85pb Market updates: Rising US stockpiles Dampening hopes of a trade deal between the US and China

Agricultural Commodities Wheat Cocoa Sugar Corn Graphic Design Wheat prices Cocoa prices up by 4.22% to $2,620/mt Sugar prices rose down by 0.44% to $514.76/bushel Due to forecasts of higher global production by 0.16% to $12.59/pound Driven by prospects of a global supply deficit Corn prices fell by 0.26% to $376.75/bushel Driven by a boost in US exports Despite expectations of higher production in Ghana

OUTLOOK Oil Prices Brent likely to trade above $60pb in the coming days Supported by: Trade war uncertainties

OUTLOOK Agricultural Prices Prospects of higher global supplies to depress prices GRAINS further Sugar SOFTS Forecasts of global supply deficit to further support prices Cocoa Expectations of higher outputs in Ghana and Ivory Coast to depress prices in the near term