Carbon Pricing Overview and EU Green Deal Agenda

The overview of carbon pricing inside the EU highlights key aspects such as the EU Green Deal, revision of the EU ETS, and the Carbon Border Adjustment Mechanism. The EU aims for carbon neutrality by 2050 with a 55% reduction target. The Fit for 55 initiative emphasizes relevance for the Energy Community. Ambitious updates to the cap and linear reduction factor are necessary to align with emission goals. The Industrial Carbon Border Adjustment Mechanism (CBAM) seeks to address carbon leakage risks in sectors like iron & steel, cement, and more.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

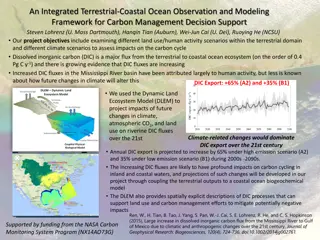

Overview of Carbon pricing Overview of Carbon pricing inside the EU inside the EU Sof a Mart nez, Principal Specialist, Climate and Energy Bosnia Herzegovina Energy Summit, April 2023

Agenda Agenda EU Green Deal Revision of the EU ETS Carbon Border Adjustment Mechanism

EU Green Deal (EGD) EU economic strategy to make Europe a climate-neutral continent by 2050, while ensuring a fair and just transition. -55% CARBON NEUTRALITY BY 2050

Fit for 55% EU green Deal, Fit for 55 and relevance for the Energy Community

Agenda Agenda EU Green Deal Revision of the EU ETS Carbon Border Adjustment Mechanism

AMB AMBITION ITION Need to update the cap in line with at least -55% (from -43%) Increase the linear reduction factor (from 2.2%) Two major reductions of the cap in the year of entry into force and in 2026 to align the cap with emissions, while allowing for some breathing space in the short term Cap and linear reduction factor need to take into account ETS extension to maritime EC proposal Agreement Target EU27 (EC scope) -61% -62% Rebase 2024 117 M allowances 90 M allowances Rebase 2026 27 M allowances LRF from 2024 -4,3%: 2024-27 -4,2% -4,4%: 2028-30 Cumulative cap EU27+EEA 12.309 Mt 12.295 Mt

Link with CBAM (1/2) Link with CBAM (1/2) Industrial Carbon Border Adjustment Mechanism (CBAM) sectors are iron & steel, cement, fertilisers, aluminium and hydrogen; they represent around 54% of the total free allocation in the period 2021 2025 Free allocation under the ETS and the proposed CBAM are interlinked: To ensure compatibility with the EU s international obligations, and maintain incentives to decarbonise, free allocation will be phased out as CBAM is phased in Free allocation will be phased out Review of the carbon leakage risk for CBAM sectors by 2025 Free allocation no longer provided to these sectors will be auctioned and the revenues accrue to the Innovation Fund Significant share of Innovation Fund for CBAM sectors Retained free allocation from conditionality may partly be used by MS to address residual risks of carbon leakage

New ETS2 New ETS2 30% of building heating emissions, electric vehicles and large part of industry fuel emissions already covered by existing ETS For the buildings and road transport sectors, the new ETS could contribute 45% of the additional emission reductions needed in 2030 compared to what current policies would achieve in 2030 Separate upstream emissions trading system for buildings, road transport, combustion fuels used by non-ETS industry Emission cap set in line with cost-effective contribution: -42% GHG reductions 2030 to 2005, LRF of 5.1% (cf 2024) No free allocation, auctioning revenues to be used to finance Social Climate Fund or by MS for climate and social purposes. Operational from 2027, with possible postponement by one year in case of exceptionally high gas or oil prices Front-loading in 2027 of additional 30% of 2027 auction volumes to ensure a smooth start with sufficient liquidity Market Stability Reserve (MSR) for the new sectors will be a fully rule-based mechanism adapting the supply of allowances: initial volume of 600 million allowances and volume-based thresholds of 210 and 440 million allowances Price (increase)-based mechanisms for MSR releases to counter risks of excessive prices and fluctuations; Additional trigger until 2029 if carbon prices reach 2020 45

Agenda Agenda EU Green Deal Revision of the EU ETS Carbon Border Adjustment Mechanism

Carbon Border Adjustment Mechanism (CBAM) Carbon Border Adjustment Mechanism (CBAM) CBAM Objectives Source: EU COM

Carbon Border Adjustment Mechanism (CBAM) Carbon Border Adjustment Mechanism (CBAM) Equal carbon pricing EU businesses pay a carbon price on their production in the EU Imports will need to pay a carbon adjustment, corresponding to the price they would have paid if the goods had been produced under the EU s carbon pricing rules (ETS). The CBAM charge will be adjusted to reflect the level of EU ETS free allowances allocated to EU production of sectors in scope. No double pricing If a non-EU producer can show that they have already paid a carbon price for the production of the imported goods in a third country, that amount can be deducted for the EU importer. Gradual phase in, with simplified procedures, to allow businesses to adapt. Sectors first phase selected on basis of 3 criteria: High risk of carbon leakage (High carbon emissions; High level of trade) Covering more than >45% of CO2 emissions of ETS sectors Practical feasibility CEMENT IRON & STEEL ALUMINIUM FERTILISER ELECTRICITY In a second stage, extended to other sectors

An internationally open mechanism An internationally open mechanism CBAM is open to and incentivises decarbonisation efforts in third countries and favours international coordination thanks to a five-tier system: Actual Emissions methodology Countries applying EU ETS or linked to it will be excluded Deduction of the carbon price paid in third countries from the adjustment on imported products International agreements on how to take into account carbon price Special rules on electricity for countries whose electricity market is coupled with the Union internal market for electricity

An internationally open mechanism An internationally open mechanism Based on purchased of certificates (EUR/tCO2 emitted) Post transitional phase 2026 onwards Importers must declare amount of embedded emissions in the total goods they imported. Rules for calculating embedded emissions are clearly spelled out. Transitional phase 2023-25 Monitoring and reporting Certificates price based on average trading price of EU ETS allowances (week prior to import)

Legislative process Legislative process Practical implementation importers: Source: EU COM

And international discussions And international discussions On 13 December 2022, the Council and the European Parliament reached a political agreement on the implementation of the CBAM. Bilateral Discussions G7 Export Free allocation Timing Product scope Centralisation G20 Climate Club Indirect emissions Use of revenue De minimis Review clause Own resources OECD IFPC Practical implementation Circumvention Trade partners