Consultation on 2023/24 Fee Scale by PSAA: Key Points and Deadlines

PSAA is conducting a crucial consultation to set the fee scale for 2023/24, involving elements like audit fees, legal framework, and consultation details with stakeholders. The process includes setting scale fees, handling fee variations, adhering to statutory roles, and addressing the audit backlog. Feedback is welcomed before the consultation closes on October 10th, leading up to the final fee scale publication by November 30th.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

PSAA WEBINAR 2023/24 Fee Scale Consultation 26 September 2023 PSAA Team

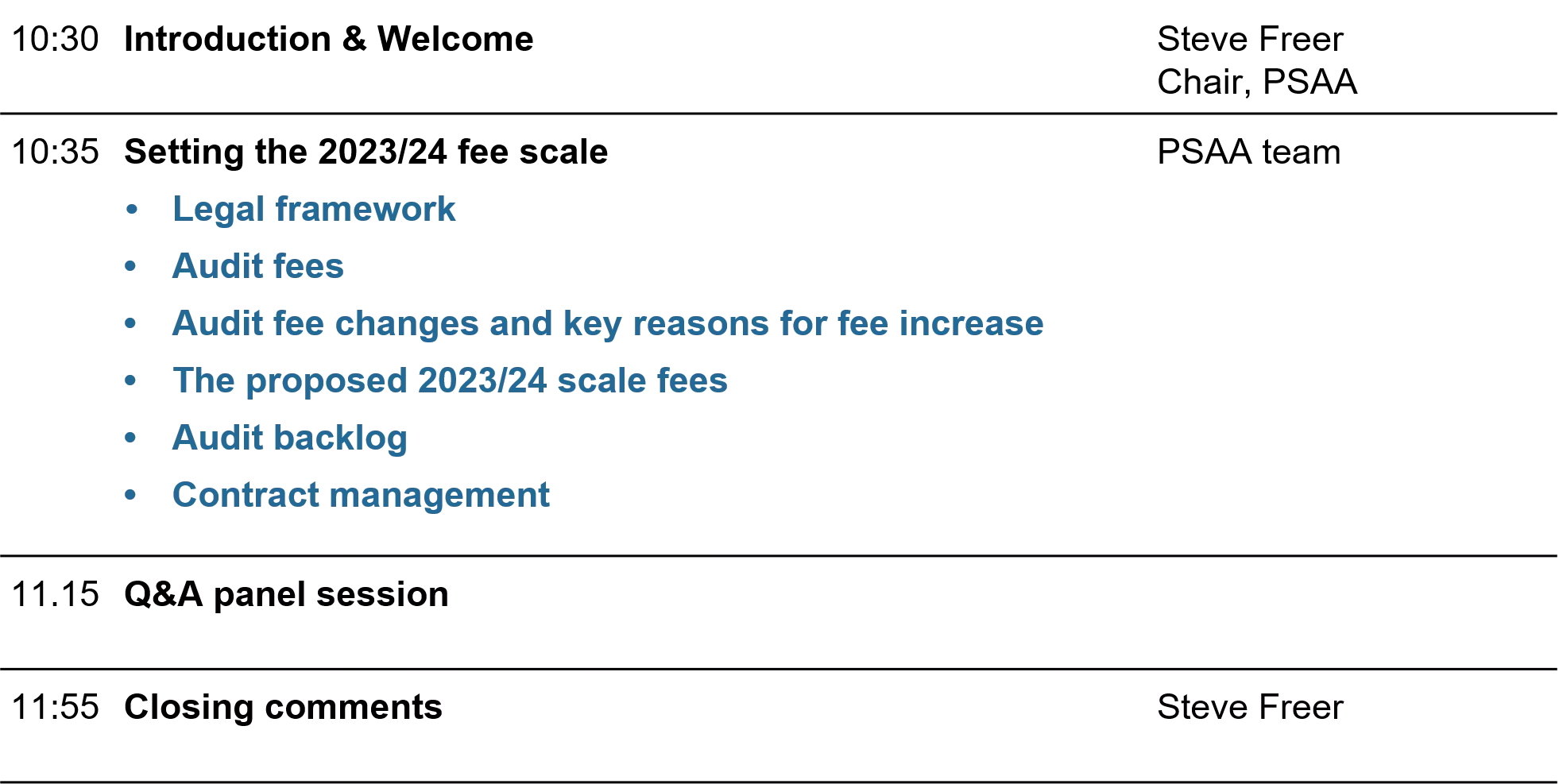

Agenda 10:30 Introduction & Welcome Steve Freer Chair, PSAA 10:35 Setting the 2023/24 fee scale Legal framework Audit fees Audit fee changes and key reasons for fee increase The proposed 2023/24 scale fees Audit backlog Contract management PSAA team 11.15 Q&A panel session 11:55 Closing comments Steve Freer

Legal framework PSAA PSAA s statutory role is to appoint auditors, set fee scales, and oversee issues of auditor independence and contract management PSAA works to specific regs Local Audit (Appointing Person) Regulations 2015 once appointed, auditors are independent by design of the framework The specification is determined by the requirements of the: National Audit Office sets the scope (Code of Audit Practice approved by Parliament) Financial Reporting Council the regulator that sets the audit quality expectations CIPFA/LASAAC sets the requirements of financial statements

Consultation on the 2023/24 fee scale PSAA is required under the regulations to consult on and set a fee scale we must consult opted-in bodies and other stakeholders before setting scale fees in the absence of confirmed changes to the scope of audit for 2023/24 we are consulting on the basis of existing requirements in the event of any subsequent changes to address the audit backlog, we will determine corresponding fee adjustments we have also written to all bodies setting out their specific scale fee calculation based on the proposed fee scale elements we welcome feedback on the proposed fee scale the consultation will close on 10 October, and we must publish the final fee scale by 30 November

Audit fees Your audit fee has two elements: the scale fee which must be set by 30 November fee variations that may be needed subsequently PSAA s statutory role includes setting both fee elements Scale fee Scale fees for each opted-in body: are based on the expectation that complete and materially accurate financial statements, with supporting working papers, will be available within agreed timeframes reflect as far as possible the auditor s previous assessment of audit risk and complexity Fee variations Regulation 17(2) enables the auditor to propose that fees should be varied where work was substantially more or less than envisaged by the scale fee, and PSAA is required to determine the outcome

Audit fees scale fees the fee scale must be set before 1 December of the relevant financial year the regulations do not allow a fee scale to be changed after 1 December scale fees are set to cover the full cost of supplier contracts and our own costs following consultation, our response and the scale of fees are published on our website

Audit fees - fee variations (1) PSAA sets the fee scale each year based on the most accurate information available about audit requirements and the work needed to deliver them additional requirements are assessed using the fee variations process the auditor must discuss fee variation proposals with the audited body at the earliest opportunity, although it may not be possible to quantify the proposed fee until the work is done PSAA must be satisfied that additional work was necessary and the fee is appropriate we assess every fee variation proposal on a case-by-case basis, irrespective of its value and whether it has been agreed our fee variation assessment process is available on our website PSAA does not have a vested interest in fee assessment - as a not for profit company any surplus is distributed to opted-in bodies

Audit fees - fee variations (2) Reasons for fee variations examples significantly increased regulatory challenge on audit quality, for example: - property, plant and equipment valuations - pension figures - use of experts Code of Audit Practice changes or changes in accounting/audit standards technical accounting issues group accounts issues with working papers dealing with elector queries/formal objections

Key reasons for fee increases for 2023/24 Outcome of the procurement in 2022 PSAA completed a major procurement of audit services for the audits of 2023/24 to 2027/28 Changes in local audit requirements Audit requirements have increased in recent years as a result of: changes to audit work required under the Code of Audit Practice updated auditing and financial reporting standards increased regulatory challenge

Outcome of the 2022 procurement Background Introduction The legislative framework and whole system design was based on an assumption of a plentiful supply of auditors and surplus capacity for the delivery of local audit work across the sector. 2017 local audit is in a steady state PSAA s procurement attracts competitive bids. Successful bids are the main driver of the level of audit fees the successful bids were lower than the previous contracts, resulting in a 23% scale fee reduction

Outcome of the procurement (2) 2018 a very significant turning point for the audit industry, which is still ongoing high-profile corporate failures multiple government reviews of audit with over 170 recommendations more demanding regulatory requirements, increasing the time and effort needed for audits audit suppliers become risk averse in response to the challenges

Outcome of the procurement (3) 2022 local audit is not attracting enough audit suppliers It was challenging to procure in a turbulent market, and it was extremely difficult to secure sufficient capacity for all the bodies that opted into our scheme Procurement environment: a troubled audit profession a local audit system facing unprecedented difficulties large volumes of delayed audit opinions a less competitive market

Outcome of the procurement (4) As a result of the procurement PSAA was just able to obtain sufficient resource significant increase in bid rates compared to rates secured in the previous procurement in 2017 the successful bids reflect the overall state of the audit market with an increase of 151% in firms overall bid rates a substantial fee increase is required for 2023/24 calculation of the procurement uplift of 151% also applies to the hourly rates used to calculate fees for additional work Impact on the 2023/24 fee scale PSAA must set the fee scale each year based on the income it needs from audit fees to meet the costs of the audit contracts and our own costs (1.4% of the total) we return any surplus to opted-in bodies by means of a distribution, once it is clear the surplus is no longer needed to discharge our responsibilities.

Changes in local audit requirements (1) Setting the fee scale each year Our aim is to set a scale fee for each opted-in body that reflects the cost of the expected audit work to: provide greater certainty for opted-in bodies minimise the need for fee variations enable discussions to focus on the audit not the fees But: firms are paid to deliver a Code of Audit Practice audit, so if that changes the fee must change to reflect additional work in the fee scale we must be able to assess the amount of work needed before the deadline for publishing the fee scale if requirements change after the fee scale has been set, a fee variation will be needed

Changes in local audit requirements (2) Independent technical research PSAA commissions independent technical research to consider the likely audit work and fee impact of changes in local audit requirements the purpose is to consider whether it is possible to determine at a national level the additional audit work and fees needed for new audit requirements the research started in 2021 and has been updated in 2022 and 2023 as part of the research, we meet with each firm to understand how: they plan to discharge their responsibilities through their standard work programme their approach has changed from the previous year, for example for new auditing standards this also helps us to identify in advance the sources of potential fee variations

Changes in local audit requirements (3) Independent technical research the original starting point for the research was to review the potential impact of changes relevant to local audit requirements, including: the Code of Audit Practice 2020 (the Code); proposed International Standards on Quality Management 1 and 2; revised International Standards on Auditing (UK) 220, 230, 240, 250, 260, 315, 500, 540, 570, 580, 600, 620, 700, 701 and 720; amendments to IFRS 9, IAS 19, and IAS 28; and IFRS 16 some but not all the changes in audit requirements and accounting requirements do require substantial additional audit work some requirements also require a higher grade skill mix than previously

Changes in local audit requirements (4) Independent technical research For the 2023 research, the researchers considered specifically the impact on audit fees of: the VFM arrangements commentary updated standards: ISA 220 Quality Control (PIES) ISA 540 Estimates ISA 600 Groups ISA 240 Fraud ISA 315 Planning the potential impact of other initiatives: infrastructure asset reporting, non- investment property and materiality

Changes in local audit requirements (5) Independent technical research The research conclusions highlight that: the requirements of the Code of Audit Practice, ISA 540 and ISA 315 have a significant impact, requiring a substantial increase in audit time, seniority and expertise for most new requirements, the impact in the first year is more significant than for subsequent years the local arrangements and circumstances of individual opted-in bodies have a substantial impact on the amount of additional audit work needed

Setting the 2023/24 fee scale Summary 2023/24 fee scale: proposed elements A. The scale fees for 2022/23 Plus: B. Fee variations for recurrent additional audit work in prior years not yet included in scale fees C. Changes in local audit requirements D. Adjustments at specific bodies for local circumstances E. Adjustment for the procurement outcome

Setting the 2023/24 fee scale Scale fees set for 2022/23 we use the scale fees for the previous year as the starting point for the next fee scale then we take into account any necessary adjustments, for example for recurring approved fee variations this should provide the most up-to-date information possible about the work required to deliver an audit compliant with the Code of Audit Practice and regulatory requirements However: the impact of delayed audit completions meant that when we consulted on the last fee scale in autumn 2022 we did not have complete data on total fees we therefore could not update the scale fees for ongoing additional work at all opted-in bodies

Setting the 2023/24 fee scale Fee variations for recurrent requirements not yet included in the fee scale where the additional audit work is recurrent we consolidate the additional fee into the fee scale fee non-recurrent additional work continues to be dealt with through one-off fee variations each year for the 2023/24 fee scale we are proposing to update the scale fees for all individual opted-in bodies where additional recurrent audit work is needed the categories of additional work for consolidation cover: group accounts, pension valuation, PPE valuation, enhanced audit requirements in relation to public interest entities and major local audits, increased FRC challenge, PFI, and investment valuation (pension funds) while most PFI schemes will be long-standing schemes, an incoming audit firm will not be familiar with the details of each scheme and will need to undertake additional work to understand the scheme and model. This additional work will require a fee variation

Setting the 2023/24 fee scale Changes in local audit requirements Based on the research this year we have determined the level at which it is reasonable to consolidate additional work into the 2023/24 fee scale for: the VFM arrangements commentary additional requirements in ISA 540 Other new requirements (for example ISA 315): the research has concluded that consolidation into the fee scale is premature at this stage we therefore propose using the fee variations process to establish a realistic fee level for consolidation into a future fee scale

Setting the 2023/24 fee scale Adjustments for specific opted-in bodies as part of our work to update the fee scale we have considered whether there are opted-in bodies which have experienced significant changes in size or complexity or other factors we propose making a temporary scale fee adjustment in less than 20 cases, subject to detailed review after the first audit year in order to compare to the actual outcome. We will then determine if the adjustment is correct or requires further refinement for subsequent years our aim in amending the 2023/24 scale fee in this way is to provide a scale fee that is aligned with the likely final audit fee required

Setting the 2023/24 fee scale Example 1) 2022/23 scale fee 52,140 2) Add: approved fee variations or estimates for recurring work not already included 10,500 3) Add: changes in audit requirements (VFM arrangements, ISA 540) 10,000 4) Add: adjustment for special circumstances (where applicable) 0 5) 2022/23 scale fees plus recurring fees 72,640 6) Audit fee adjustment to reflect the procurement outcome (uplift by 151%) 109,686 Total scale fee for 2023/24 182,326

Setting the 2023/24 fee scale Audit backlog the consultation is taking place at a time of change in the local audit system in July 2023 the Department for Levelling Up, Housing and Communities (DLUHC) announced proposals to address the backlog, and is working with all stakeholders to tackle the complex issues involved the proposals include the possibility of a time-limited revision to the Code of Audit Practice, which may reduce the amount of audit work needed while the backlogs are resolved any changes affecting fees are still to be confirmed, so we cannot reflect them in the proposed fee scale yet we will need to assess the impact on audit fees once changes are confirmed, and write to opted-in bodies to set out how we will update fees where an auditor has collected audit fees in part or in full and a change in requirements means that the total work done represents less than the fee already collected, then the auditor must return the balance and refund the body the appropriate amount this ensures that bodies pay only for work that has been done

Contract management (1) strengthened contract management provisions in the 2022 audit services contracts milestone-based payment mechanism method statement KPIs rectification plan reflects change in the local audit market addresses feedback from opted-in bodies about audit delivery will revisit the actual milestones and KPIs if the expected backlog solution changes the framework recognises that the ultimate sanction of being able to remove auditors from appointments is essentially mute because the local audit market has no surplus capacity

Contract management (2) Milestone-based payment production of the previous year s Auditor s Annual Report unless 1st year as new auditor production of the draft Audit Plan to audited body, will set out the auditor s plan & timetable planned hours (50% complete) planned hours (75% complete)

Consultation The 2023/24 fee scale consultation closes on Tuesday 10 October 2023 the details are available on the front page of our website and have been sent to all opted-in bodies and other stakeholders the PSAA Board will consider consultation responses carefully in determining the final fee scale we will publish the final fee scale on our website by 30 November 2023

Closing comments We value your feedback on this session, so ask you to complete a short feedback form

undefined

undefined

undefined

undefined

undefined

undefined