Compilation of a Government Budget and Budget Cycle Overview

Understanding the key concepts of revenue and expenditure, capital vs. operational spending, policy directives, and the budget year in public finance. Exploring the budget cycle stages: preparation, approval, execution, and control for the central government's annual budget.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

BONAMELO CAMPUS PUBLIC FINANCE N6 HLANGABEZA MT

MODULE 3: COMPILATION OF A GOVERNMENT BUDGET Budget concepts Revenue: The source of funds income tax, corporate tax, etc Expenditure: The spending of public funds this is detailed so that it should be clear to see exactly who gets what funds Capital expenditure: This is spending on infrastructure or services which last longer than a current year Operational expenditure: The funds needed to run a department Policy directives: At all times any budget should reflect the overall policy of the government of the day Budget year: The fiscal year of the public service runs from 1 April until 31 March; local government runs from 01 July until 30 June each year

Budget for the central government the annual budget Budget cycle: (i) Preparation (ii) Approval (iii)Execution (iv)Control

(i) Preparation Giving instructions: Government departments are given guidelines by the Treasury National Treasury concern is concerned with the overall financial and economic situation Guidelines might include, for example, a maximum limit on expenditure Departments might be told to limit spending to not more than certain percentage increase over the previous financial year The overall policy direction and priorities are communicated to these various departments

(i) Preparation Preparation of the draft budget: A finance division department provides a written motivation report The motivational accompanied by estimates of what it will cost to continue with existing activities and to develop and initiate new activities This means that the Treasury can clearly see what is planned and how much it will cost of each government report must be

(i) Preparation Review of the draft budget: The operational departments submit the draft budget to a budget department The draft budget estimates of expenditure The budget department will then check if the budget complies with departmental policy consolidates the

(i) Preparation Consideration of draft budget: The executive authority needs to view and approve the draft budget The budget department document to the Minister of Finance The executive authority determine whether the draft budget meets the policy directives submits one may now

(ii) Approval Once the executive authority approves the budget, it is then printed and submitted to the legislature In a democratic government only the legislative authority (parliament) approves the raising of taxes, expenditure of this revenue The operating programmes authorities may not be implemented before this happens The budget documents parliament by Minister of Finance The budget speech is made in parliament by the Minister of Finance of administrative are submitted to

(ii) Approval Aims of budget speech: To announce publicly the plans of the various departments To give the broad outline of the social needs To give indication of the financial state of the government To announce new policies, goals and explain increases in expenditure To announce tax proposals, changes in income and consumer tariffs

(iii) Execution The budget is then used to check spending the following is important: Funds are made available for specific purposes itemized in the budget documents Ministers may approve of excess spending, but only up to an amount of 2% Funds allocated must be spent within that financial year Funds are not simply spent without the approval of the accounting officer Approval of the legislature is needed if departments consider spending funds on anything other than what they voted for

(iv) Control A vital component of the budget cycle is the control of expenditure The legislature is responsible to the individual taxpayer The main tool of control is the audit this is the examination of financial records by various authorities Control may take different forms a priori control and ex post facto control

(iv) Control As control measure, expenditure must take place according to the wishes of parliament and therefore the people. Various powers and authority are vested in the auditor general, accounting officer and the public account committee. The examination of financial records by various authorities to make sure all revenue and expenditure have been properly and dutifully recorded and accounted for. A priori control is a control measure which is framed before any expenditure takes place. Both control measures exist in order to make sure that expenditure has taken place in accordance with the wishes and directives of the legislature.

Types of budgets Revenue budget: All income or revenue paid into one account the State Revenue Fund Expenditure budget: Forms part of the budget which is read parliament and tabled in

Adjustments Appropriation Bill Transfers: A function may be transferred from one department to another the funds needed for this also have to be transferred Suspension of funds: In order for these funds to be allocated to other state departments, they would first have to be suspended from the office Roll overs: Commitments were made in a previous financial year, but were not, realised or completed Unforeseen or unavoidable circumstances: Government departments often make unreasonable request - Treasury Committee has to approve each submission

Budget Information Four information Financial responsibility: the institution needing finance should be clearly identified Purpose of expenditure: every project or task will start with an objective Expenditure items: once the specific objective is detailed, specific goods and services should be mentioned in order to realise the objective Source of financing: the source of the funding itself will be the budget vote, a fund or account factors are essential for classifying

Parts of the expenditure budget The organisational unit is the authority responsible for a particular service Each unit will then have a budget vote here the objective of the expenditure is stipulated The objective of the budget vote is broad and general The budget vote will list programmes such as administration, laying of pipes, construction of dams, etc Each programme will consist of an objective (a sub-objective of the description and structure budget vote itself), a

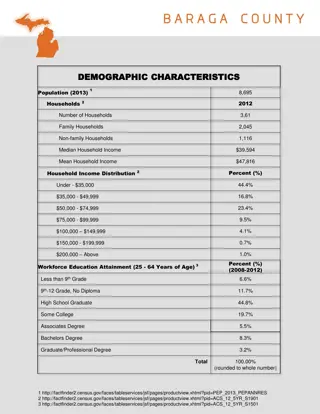

Provincial government finance All the problems and considerations which apply to a national government, also apply to any provincial authority. The following are the main sources of income for provincial government: (i) National government grants: This is the main source of income for provincial governments The constitution states that all revenue collected nationally must be divided equitably (fairly) between the three spheres of government Some provinces, though, feel the formula is not fair as the portion they receive is less than their contribution to the State Revenue Account The formula by which the national government arrives at distribution is often controversial and always difficult Added to this complication is that the socio-economic problems of an urban area might differ dramatically from those of a rural area

Provincial government finance (ii) Taxation: Provinces are allowed to levy taxes on betting bookmakers), motor gambling fees and gambling taxes (iii) Levies and general activities: Levies might include licenses for hunting and fishing; general activities might include fees for hospitalisation, professional services, etc. (totalisator vehicles-licenses, and

Local government finance The accountability, expenditure which apply to the executive and administrative authorities should also apply to local authorities. The main differences between the budgets of the national legislature authorities: principles of good governance, and efficient effective nationally, and that of local

Local government finance The main difference between the budgets of the national legislature and that of local government can be listed as follows: Capital budgets and operational budgets are drafted separately The expenditure and revenue budgets are drafted separately There is only one main budget A budget vote listing programmes and projects is drawn up for each service There is no distinction between collective, particular and quasi-collective services

END END OF PRESENTATION