Chile's Financial Services Liberalization Overview

This content provides an in-depth look at Chile's main reservations under the OECD Codes of Liberalization, including its context of accession to OECD Free Trade Agreements and commitments to liberalization in services, investments, and financial services. It covers aspects such as cross-border trade in financial services, banking and non-banking financial services, insurance, professional services, and more. The framework for cross-border trade in financial services, limitations for non-residents, and regulations for payments and investment services in Chile are also explored.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Chiles Main Reservations under the OECD Codes of Liberalization Rodrigo Monardes

OECD Codes of Liberalization Context of Chile s accession to the OECD Free Trade Agreements, including Services, Investment and/or Financial Services chapters Liberalization commitments and Market Access Negative list and consolidation of the degree of openness at international level.

Current Invisible operations Main reservations Cross-border trade in Financial Services Banking and non-banking financial services Insurance and private pensions Cross-border Trade in Non-Financial Services Transport Services Professional Services Current Transfers and Payments Central Bank authority

Cross-border trade in Financial Services General Framework: Chilean residents are generally free to consume and contract financial services abroad. Some exceptions or restrictions for non-residents to supply or provide financial services in Chile. The aim of the limitations are prudential in nature and for consumer protection purposes.

Cross-border trade in Financial Services General Framework: Open to sophisticated investors Prior authorization for foreign banks to establish representations office's Branching not available for some non-bank financial services and securities, as a form of establishment

Cross-border trade in Financial Services Payments Services Investment Services Settlement, clearing and custodial and depositary Asset management services

Payments Services Payments Services including payment instruments and fund transfer services: The supply of these kind of services are reserved for resident in Chile reservation under items E/1 (Payment Services) of the CLCIO.

Banking and Investment Services Item E/2: only applicable to underwriting and broker dealer services: Only authorized agents which should be locally established and supervised entities. Thus only residents are allowed to provide the service Banking and investment services for foreign exchange for those transactions which in accordance with Central Bank regulations must be conducted through authorised agents.

Settlement, clearing, custodial and depositary Services Only provided by residents. However: For settlement and clearing - the restriction was for the access, so no reservation. Custodial services for foreign assets of pension funds, prudential in nature and non-discriminatory, so no reservation. The reservation on E/3 refers to the supply of custodial and depositary services by non-residents in Chile.

Asset management Services E/4 The reservation applies only to: i. The offer in Chile by non-residents of asset management services (including securities or collective investment schemes to resident investors); i. The provision in Chile by non-residents of trust services reserved for resident financial institutions; ii. Asset management services for collective investment schemes or pension funds, except for those asset management services for investments abroad offered in Chile by non-residents to resident fund managers.

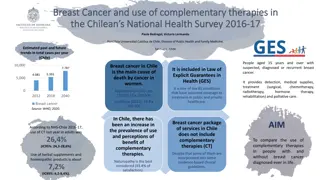

Cross-border trade in Financial Services Insurance services Life and non-life insurance Other insurance services Private pensions

Insurance Services Branching is allowed, with some restrictions: incorporation is requiered for certain activities Separation or specialization requirements for life and non-life insurance: apply to all, thus no reservation needed under CLCIO Reinsurers may operate both, but separate accounts and specific financial requirements

Insurance Services Branches may perform the same operations as companies incorporated in Chile. Facing same requirements regarding technical reserves and capitalisation, as required by liberalisation obligations under the CLCIO. The specific capital requirement for the branch is intended for the protection of policyholders and does not impose more burdensome conditions than those required of other market participants.

Insurance Services D/7 Entities providing other insurance services: The reservation, which includes the activity of promotion, applies only to: i. Intermediation services for insurance contracts other than those relating to goods in international trade and that are not covered by the reservation under item D/2; ii. Consultancy services in connection with the mandatory pension system established by Decree Law 3500; and iii. Claim settlement services for contracts entered into in Chile.

Insurance Services D/2 Insurance relating to goods in international trade. D/3 Life assurance D/4 all other insurance Cross-border is allowed, when the transaction is entered at the initiative of the proposer Offer or promotion of insurance services is not allowed for companies not established in Chile For D/2 The reservation, which includes the activity of promotion, applies only to the insurance of international road and railway transport and of satellites and satellites liability.

Private Pensions Services D/8 The reservation, which includes the activity of promotion, applies only to: i. The cross-border provision of services, except if the contract is taken out at the proposer s initiative and it is not a pension product or a service that is linked to the pension regime established by Decree Law 3500; ii. The establishment of branches of pension funds in Chile; and iii. The deductibility for tax purposes of contributions to pension funds purchased from non-residents

Cross-border trade in Non-financial services Transport Professional Services

Transport Services Chile may restrict harbour access to fishing vessels and such measures are undertaken only to prevent the evasion of Chilean laws and regulation, no reservation needed for items C/1, C/5 or C/6. Under the Chile-Brazil maritime transport agreement, cargo between the two countries is reserved to national flag vessels. This restriction wasreflected in a reservation under item C/1 Cabotage is reserved to Chilean vessels, both for cargo and for passengers. Reservation under item C/2 (Inland Waterway Freights, Including Chartering) of the CLCIO.

Professional Services L/6 Professional services (including services of accountants, artists, consultants, doctors, engineers, experts, lawyers, etc.): The reservation applies only to auditing of financial institutions, operators of multi-modal transport and legal services except advice on international law or foreign laws.

Current Transfers and Payments In the field of exchange controls, the free convertibility of the domestic currency enables residents and non-residents to freely carry out payments and transfers in connection with current international transactions, as well as with capital account operations.