Challenges and Transitions in North Korea's Economy

North Korea's economy faces severe strain due to weak productivity and external sanctions. Transitioning from a planned to a market economy has been incomplete, leading to low investment and corruption. The upcoming Party Congress may offer clues on reform under Kim Jong Un. Marketization, trade partnerships, and the impact of nuclear sanctions on China-North Korea trade further add complexity to the economic landscape.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

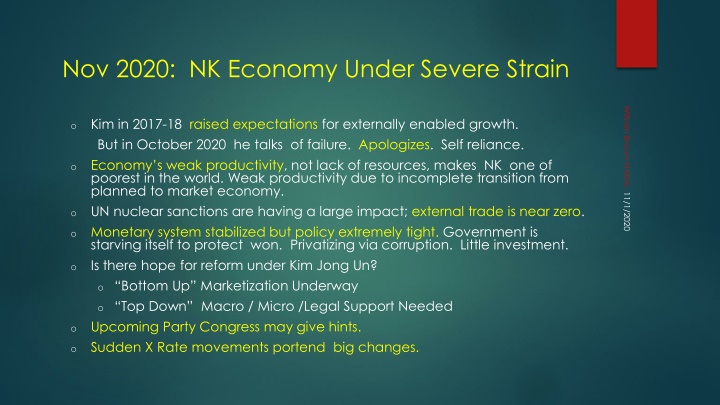

Nov 2020: NK Economy Under Severe Strain William Brown NAEIA, 11/1/2020 Kim in 2017-18 raised expectations for externally enabled growth. But in October 2020 he talks of failure. Apologizes. Self reliance. Economy s weak productivity, not lack of resources, makes NK one of poorest in the world. Weak productivity due to incomplete transition from planned to market economy. UN nuclear sanctions are having a large impact; external trade is near zero. Monetary system stabilized but policy extremely tight. Government is starving itself to protect won. Privatizing via corruption. Little investment. Is there hope for reform under Kim Jong Un? o Bottom Up Marketization Underway o Top Down Macro / Micro /Legal Support Needed Upcoming Party Congress may give hints. Sudden X Rate movements portend big changes. o o o o o o o

Markets Marketization: Much more than marketplaces Goods Markets Services Markets Labor Markets - Real Estate/Land Markets Capital/Finance Markets Foreign Exchange Markets What is a Market? Many buyers, sellers Rules, Structure, defines boundaries Flex price clears the market Usually most efficient outcome Money the medium; Competition the force. Law of One Price

Planned economy failed during famine no rations. But it didn t go away. Now dysfunctional, hybrid. Part command, part unregulated markets. Sustained by external support through 2017. Now that support has been suspended. Transitioned from ration, no money, economy under KIS to hyper-inflated won economy under KCI, to partially dollarized economy under KJU. People now can have financial assets, US dollars, RMB. Emergent capitalism. Rations, fixed wages, still exist but real money circulates. Trouble for the Plan and the state budget. Won, RMB , US$ freely circulate. Two prices, fixed plan price and market, for everything. Too Long Economic Transition to what end?

North Korea: Top Ten Trade Partners, 2006 million dollars North Korea: Top Ten Trade Partners, 2016 million dollars 0 20 40 60 80 100 120 140 160 China China India South Korea Philippin es India Russia Russia Thailand Thailand Venezue la Brazil Sri Lanka Singapore Singapor e Japan Taiwan Germany Ukraine Hong Kong 0 1,000 2,000 3,000 4,000 5,000 6,000 Global Trae Atlas source data

China-North Korea Trade: 2001-2018 million US dollars China 2016-7 Nuclear sanctions create trade, financial crisis. 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 2002 2004 2006 2008 2010 2012 2014 2016 2018 China Customs data China Imports China Exports

North Korea won per US dollar: 2012- 2018 Won stabilized despite export collapse 10,000 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 1-Sep 27-Sep July 2013 15-Sep 27-Oct Dec-16 Dec-17 Dec-18 Daily NK source data

China Customs data

Hypothetical Balance of Payments Post 2017 To 2017, per month - $150 million goods - $50 million goods + $50 million service, transfers, income, FDI, Portfolio, bank credit + $50 million illicit , services, transfers, income, FDI, Portfolio, bank credit NET - $100 million NET 0 Cumulative $3 billion outflow, private and public No Change in FX 2020 NET $0

Tight Monetary, Fiscal Policy to Defend Won Central bank reduces won supply in parallel with loss of dollars. Little printing of new cash. Few new net loans to state enterprises and state agencies State firms allowed to privatize assets to make ends meet. State agencies raise fees to raise funds. (no normal tax system). Allow state workers to engage in private income earning work. Impact stops inflation and devaluation, but devastates state investment, employment. Cost of stable won is shrinking state sector. State owns the country so this can last a long time. Like China. By allowing $US RMB to circulate, real savings vehicles are available for the first time, allowing citizens to save. Reduces current demand.

North Korea Won per US Dollar 2019-2020 10,000 9,500 9,000 8,500 8,000 7,500 7,000 6,500 6,000 5,500 5,000 9/1/2019 11/12019 1/1/2020 3/1/2020 5/1/2020 7/1/2020 9/1/2020 11/1/2020 Asia Press, source data.

North Korea Won per China Yuan 2019-2020 1,400 1,300 1,200 1,100 1,000 900 800 700 9/1/2019 11/12019 1/1/2020 3/1/2020 5/1/2020 7/1/2020 9/1/2020 11/1/2020 Asia Press, source data.

China Yuan per US Dollar North Korean cross rates 8.500 8.000 7.500 7.000 6.500 6.000 9/1/2019 11/12019 1/1/2020 3/1/2020 5/1/2020 7/1/2020 9/1/2020 11/1/2020 Asia Press, source data.

Why Revalue Won ? Speculation Maybe Not real market action Otherwise RMB would not drop versus dollar. Daily NK sources say no one sell dollar at the new rate. Government is trying to eliminate use of FX Orders use of won, not dollars, yuan in state stores Getting ready for new Plan to reset state prices, move to market . First attempting to shore up won. With imports near zero, state doesn t think it needs FX. Forcing a juche isolationist country. Implications: Unclear if stop toward reform or step backwards. But sure sign of trouble in Pyongyang.

FURTHER READINGS NAEIA.org https://naeia.com/links/f/north-korea-hits-bottom--decision-time-for-the- young-chairman https://www.ncnk.org/sites/default/files/NCNK_William_Brown_NK_Shackl ed_Economy_Report.pdf http://www.theasanforum.org/sanctions-and-nuclear-weapons-are- changing-north-korea/ https://img1.wsimg.com/blobby/go/9a8f9774-2f47-4d62-a2f0- 85fdb2cadf25/downloads/GW%20Lecture%20(2).pdf?ver=1586459563795