Central Service Agencies Cost Allocation Training Plan

This training plan by the Department of Finance's Fiscal Systems and Consulting Unit focuses on understanding Central Service Agency costs, cost allocation plan development, workload spreadsheets, data analysis, and due dates. It covers the definition of workloads, expenditures, and centralized services provided to state departments for efficient state operations. The plan includes course objectives, agenda, and detailed descriptions of Central Service Agency costs and functions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Department of Finance Fiscal Systems and Consulting Unit Pro Rata/SWCAP Training for Central Service Agencies 2016-17 Plan 1

Agenda Central Service Agency/Functions Central Service Costs Allocation Definition of Workload Definition of Expenditures Workload and Expenditure Spreadsheets Data Analysis Transmittal Instructions 2

Course Objectives To understand: Cost Allocation Plan Development How to complete workload and expenditure spreadsheets CSA/FSCU analysis Due dates 3

What is a Central Service Agency (CSA) Cost? 4

Central Service Agency Costs State Administrative Manual Section 8753 Central service costs are those amounts expended by central service departments and the Legislature foroverall administration of state government and for providing centralized services to state departments. These functions are necessary for state operations and are centralized to provide efficient and consistent statewide policy and services. 5

Central Services Function Code Finance (DOF) Central Service Workload Unit Source 004 005 011 Audits Audit Hours DOF/OSAE Budgets Budget Hours DOF/Admin Fiscal Systems & Consulting Unit State Ops $ DOF/Sch. 10 California Technology Agency 105 CA Dept of Technology Financial Information Systems for California Financial Information System for California (SWCAP only) State Controller s Office (SCO) 201 Accounting & Reporting 202 Claim Audits 203 Payroll 204 General Disbursements State Ops $ DOF/Sch. 10 110 State Ops $ DOF/Sch. 10 Transactions SCO Warrants SCO Warrants SCO Warrants SCO

Central Services Function Code State Controller s Office (SCO) Central Service Workload Unit Source 205 211 Field Audits Audit Hours SCO Personnel/Payroll Services Division and Information Systems Division Positions SCO State Treasurer s Office (STO) 301 Investment (Pro Rata Only) 302 Item Processing 303 Treasury/Security Mgmt and Public Finance Division Interest Earned SCO Warrants SCO State Ops $ DOF/Sch. 10 400 State Personnel Board (SPB) Positions SCO California Human Resources (CalHR) formerly DPA Office of Admin Law (OAL) SCO 410 Positions 510 520 Review Hours OAL CA State Library (CSL) State Ops $ DOF/Sch.10

Central Services Function Code Central Service Workload Unit Source Health Benefits (HB) for Annuitants (Retired Employees) Dental Benefits (DB) for Annuitants' (Retired Employees) Health Benefits (HB) for CA State Universities (Retired Employees) HB Costs for Active Employees DB Costs for Active Employees HB Costs for Active Employees SCO/PERS/ CalHR SCO/PERS/ CalHR 600 601 SCO/PERS/ CalHR 602 Department of Justice (DOJ) 605 Legal (SWCAP Only) Attorney Hours DOJ 607 Tort Liability (SWCAP Only) Attorney Hours DOJ 700 Secretary for CA Health & Human Services Agency (Weighted avg of State Ops for depts within the Agency) State Ops/Sch.10 799 Audit Hours California State Auditor CA State Auditor 8

Central Services Function Code Central Service Workload Unit Source Sum of Past Actual Costs for Functions 004-799 800 Legislature (Pro Rata Only) DOF/FSCU Legislative Counsel Bureau (Pro Rata Only) Sum of Past Actual Costs for Functions 004-799 805 DOF/FSCU Sum of Past Actual Costs for Functions 004-799 Sum of Past Actual Costs for Functions 004-799 Governor s Office (Pro Rata Only) Office of Planning & Research (Pro Rata Only) 810 DOF/FSCU 815 DOF/FSCU 9

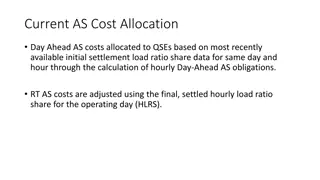

Central Service Costs Allocation 10

The Pro Rata Plan & the SWCAP Plan Central service costs are allocated through Pro Rata for special funds and through SWCAP for federal funds. We refer to this allocation process as the Pro Rata Plan and the SWCAP Plan. 11

The Pro Rata Plan & the SWCAP Plan -- continued The Plan distributes CSA costs to each state department based on workload. The total allocation for each department is calculated using the formula below. PY is prior year and BY is budget year. PY PY Roll - BY Actual Estimate Forward Estimate = = + Total Allocation 12

The Pro Rata Plan & the SWCAP Plan -- continued In Pro Rata, a department s allocation is then further allocated to each fund within the department. In SWCAP, since only Federal funds are billable, the Federal portion is calculated using the department s ratio of Federal funding to their total State Operations amount. 13

The Pro Rata Plan & the SWCAP Plan -- continued Funds are classified as billable or nonbillable For Pro Rata: Billable funds: Funded by special revenue sources such as fees, licenses, penalties, assessments, interests, etc. Nonbillable funds: General Fund Federal Funds Special Deposit Fund For SWCAP, only federal funds are billable. 14

Pro Rata /SWCAP Reports CSA Reported Expenditure Data CSA Reported Workload Data Budget Data (Schedule 10 download) Miscellaneous Agencies Reported Data PY Actual and BY Estimate PY Actual CSA Cost Allocation SWCAP Pro Rata Reports Reports

Workload Each function code represents a specific type of workload. Workload is obtained from a variety of sources and can be from more than one CSA. 17

Workload - continued Hours Transactions Warrants Positions State Operations Interest earned Other 18

Expenditure Data Actual Expenditures (only State Ops): General Fund (GF) Central Service Cost Recovery Fund (CSCRF) Expenditures excluded in plan development: Reimbursements Non-CSA Expenditures/Other Funds Unallowable costs (Title 2 Code of Federal Regulations, Part 200) 20

Expenditure Data continued Reimbursed CSA expenditures are excluded because they represent services the CSA provided and which they received reimbursement. Unallowable CSA expenditures are identified in federal regulation (Title 2 Code of Federal Regulations, Part 200) Some examples: Fines, Penalties Cost of Assets $5,000 and up Lawsuits against the federal government 21

Expenditure Data - continued Actual Expenditures $ XXXX Less: Reimbursements Non-CSA Expenditures/Other Funds XX Unallowable Costs* Adjusted Actual Expenditures** $ XX XX -XXX $ XXXX * SWCAP only ** Distributed in CSA cost allocation plans 22

Workload Requirements What you need: Workload Data Checklist Workload spreadsheet Crossover table 24

Workload 26

Comparison Non-Reimbursed Autofill from prior worksheet Pre-populated by FSCU 27

Comparison Reimbursed Autofill from prior worksheet Pre-populated by FSCU 28

Crossover Table Workload is summarized into approximately 180 primary departments for budgeting purposes. The crossover table is used to consolidate the workload into the primary organization code. 31

Crossover 32

Crossover Example Orig Agcy Pro Rata Original Agency Name Pro Rata Agency 1110 Consumer Affairs - Regulatory Boards, Department of 1110 Consumer Affairs - Regulatory Boards, Department of 1111 Dept. of Consumer Affairs - Bureaus, Prog. Div. 1110 Consumer Affairs - Regulatory Boards, Department of 1120 California Board of Accountancy 1110 Consumer Affairs - Regulatory Boards, Department of 1130 California Board of Architectural Examiners 1110 Consumer Affairs - Regulatory Boards, Department of 1140 State Athletic Commission 1110 Consumer Affairs - Regulatory Boards, Department of 1150 Bureau of Automotive Repair (Moved to 1111) 1110 Consumer Affairs - Regulatory Boards, Department of 1160 Board of Barber Examiners (Moved to 1111) 1110 Consumer Affairs - Regulatory Boards, Department of 1165 Board of Barbering and Cosmetology, State (Moved to 1111) 1110 Consumer Affairs - Regulatory Boards, Department of 1170 Board of Behavioral Sciences 1110 Consumer Affairs - Regulatory Boards, Department of 1180 Cemetery Board (Moved to 1111) 1110 Consumer Affairs - Regulatory Boards, Department of 1190 Bureau of Security & Investigative Serv. (Moved to 1111) 1110 Consumer Affairs - Regulatory Boards, Department of 1200 Bureau of Security & Investigative Serv.( Moved to 1111) 1110 Consumer Affairs - Regulatory Boards, Department of 33

Crossover to 0000 Pro Rata Orig. UCM Title Payment of Interest on PMIA Loans Resources - DOF USE ONLY 3880 0000 General Obligation Bonds Resources - DOF USE ONLY 3882 0000 State Mandated Local Costs Resources - DOF USE ONLY 3884 0000 Miscellaneous Adjustments Resources - DOF USE ONLY 3886 0000 3945 0000 Payment of Interest on PMIA Loans - DO NOT USE 34

Crossover Table If an agency is not listed on the crossover table or workload spreadsheet: Check input Research organization code Call us Place in other entity 35

Description Verification Along with your workload spreadsheets you will receive a Description Verification document. Function descriptions are required in the SWCAP package that is submitted annually to the federal government. 36

Description Verification - continued We ask that you verify the descriptions are correct. If necessary, make any required changes to the document. Complete reviewer s name and date, and save your changes. Email the document back to us along with the Workload file. 38

What You Need Expenditure Data Checklist Expenditure spreadsheets (actual and estimated) Expenditure supporting schedules (only some departments) 40

Expenditure Spreadsheets Expenditure Data Checklist Actual Expenditures* (must agree with the year-end financial statements) Estimated Expenditures* Comparison tab *enter data in white cells only 41

Comparison Tab The comparison tab compares expenditure data from the prior year. Ten percent or less is an acceptable growth rate. Please provide explanation for changes (+/-) beyond 10 percent for both actual and estimated expenditures. 45

Comparison 46

Federal Requirement (Support Schedule) Certain CSAs must complete additional financial statements to support actual expenditures. Expenditure schedules provide a breakdown of cost items reported in the SWCAP plan. 47

Adjustments for Assets Tangible and intangible assets of at least $5,000 are treated as an Unallowable Cost subtracted from CSA expenditures Straight-line depreciation method applied to assets at least $5,000 and added to CSA expenditures. 48

Your Responsibility Check for accuracy/post correctly Explain any variances Workload explanation is needed only if total workload changed by more than plus or minus 10 percent. Expenditure explanation is needed for any change of more than plus or minus 10 percent. Send support documentation if required Call us immediately if workload or expenditure data submitted needs to be changed 49

Transmittal Instructions The workload and expenditure worksheets must be reviewed and approved by the departmental budget officer. Departmental budget officer must email completed workload spreadsheet(s) by and expenditure spreadsheet(s) by the specified deadlines. To: fiproswp@dof.ca.gov Email subject line must include: Function code, Workload or Expenditure , and 4 digit department/agency code e.g., F204 Workload 0840 (SCO) 50