Captured Carbon

A comprehensive exploration of DSU and TSSU mechanisms in energy settlement, focusing on credit issues, exposure alignments, and ex-ante trading risks. Discusses potential solutions to enhance efficiency and net exposure balance between units.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

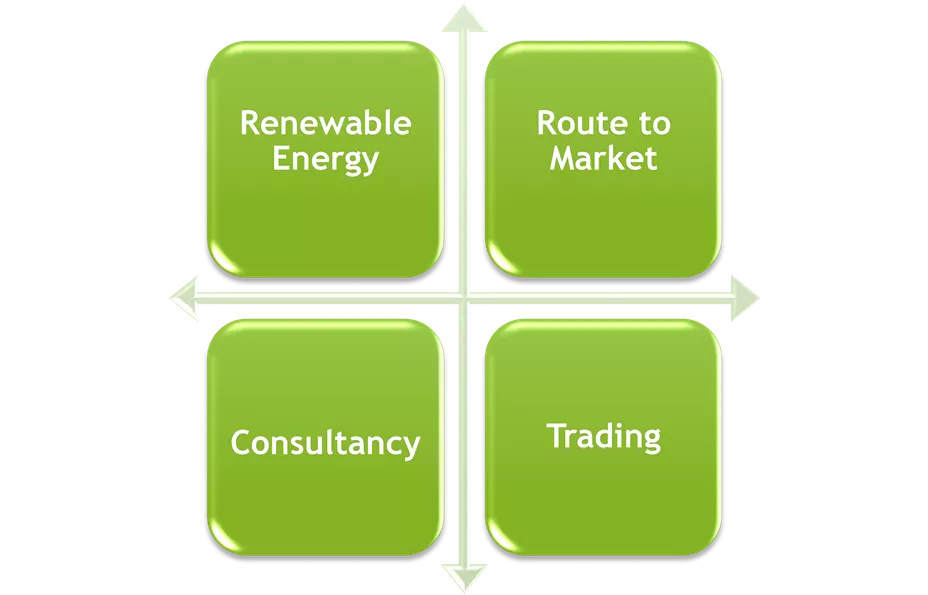

Captured Carbon Renewable Energy Route to Market Trading Consultancy

Mod_03_18 DSU Concerns DSUs also have a trading site supplier unit as with autoproducers Functioning is different to autoproducer but credit issue persists The demand of this site is determined by the DSU Demand is set to DQ * -1 By necessity, the TSSU can only consume energy of the DSU This is design so that the demand site nets to zero in energy settlement Without modification, this demand feeds into credit calculations Can lead to outturn collateral positions being too high This only affects undefined exposures Defined exposures/traded not delivered are unaffected

DSUs and Energy Settlement By design, DSU and TSSU will net with each other This is so that the DSU is not in receipt of energy payments It was decided in I-SEM to continue to do this through the TSSU mechanism Both units are settled under the same PT This leads to a net exposure to the market of zero For the TSSU to have any charge, the DSU will have an opposite payment Single invoicing covers the risk that the DSU will be paid but TSSU will not pay However, undefined exposure on the DSU and TSSU are not aligned TSSU has longer exposure period Leads to credit reflecting more demand exposure than generator benefit Value of unpaid/unbilled invoices likely to net to zero

DSUs and Energy Settlement Ex Ante Trading A risk to the market can exist where the DSU trades ex-ante Here the DSU may take a position on the market spread and create an exposure to SEMO Example: DSU sells 10 MW in DAM but TSSU buys 0 MW TSSU has CIMB of 10 MW * PIMB due to SEMO. This is not covered by SEMOpx revenues In this example there is an exposure to SEMO based on the trading Any solution must take account of ex-ante trading and the effect on risk

For Discussion Solution Requirements We are of the view that potential solutions should reflect: That settlement will ultimately be on a net basis between DSU and TSSU That it is not possible for the TSSU to have demand without corresponding DSU dispatch (i.e. QM is set equal to Dispatch Quantity * -1) We would welcome the view of SEMO on its findings at arriving at the relevant interim solutions for DSU collateral

undefined

undefined