Calculating Terminal Multiple in DCF

To determine the Terminal Multiple in a DCF analysis, consider factors such as comparable public company multiples, implied growth rates, and reasonable Terminal Growth Rate. Utilize the formula Final Year FCF * (1 + FCF Growth Rate) to calculate the Implied Growth Rate Terminal Value. Explore the nuances behind picking the right Terminal Multiple and understand the implications on the valuation process.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

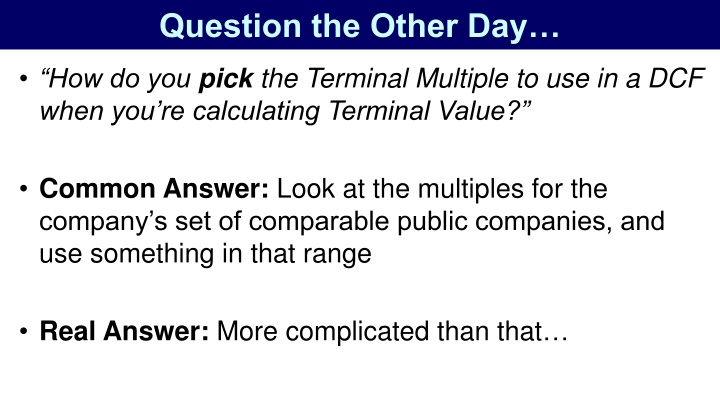

Question the Other Day How do you pick the Terminal Multiple to use in a DCF when you re calculating Terminal Value? Common Answer: Look at the multiples for the company s set of comparable public companies, and use something in that range Real Answer: More complicated than that

3 Main Problems with Comps 1. Multiples often decline as growth slows down investors won t pay 50x revenue for a mature manufacturer, but they might for a tech startup 2. The Terminal Multiple must also imply a reasonable Terminal Growth Rate yes, you can calculate the Growth Rate implied by a Terminal Multiple 3. It s more about the range of values, not a specific multiple from the set

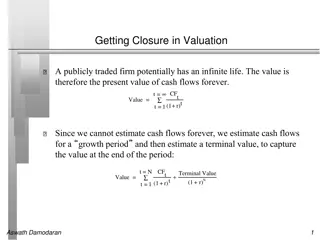

The Implied Growth Rate Terminal Value = Final Year FCF * (1 + FCF Growth Rate) (Discount Rate FCF Growth Rate) Terminal Value * (Discount Rate FCF Growth Rate) = Final Year FCF * (1 + FCF Growth Rate) Terminal Value * Discount Rate Terminal Value * FCF Growth Rate = Final Year FCF + Final Year FCF * FCF Growth Rate

The Implied Growth Rate Terminal Value * Discount Rate Terminal Value * FCF Growth Rate = Final Year FCF + Final Year FCF * FCF Growth Rate Terminal Value * Discount Rate Terminal Value * FCF Growth Rate Final Year FCF Final Year FCF * FCF Growth Rate = 0 Terminal Value * FCF Growth Rate Final Year FCF * FCF Growth Rate = Terminal Value * Discount Rate + Final Year FCF

The Implied Growth Rate Terminal Value * FCF Growth Rate Final Year FCF * FCF Growth Rate = Terminal Value * Discount Rate + Final Year FCF FCF Growth Rate * ( Terminal Value Final Year FCF) = Terminal Value * Discount Rate + Final Year FCF FCF Growth Rate * (Terminal Value + Final Year FCF) = Terminal Value * Discount Rate Final Year FCF

The Implied Growth Rate FCF Growth Rate * (Terminal Value + Final Year FCF) = Terminal Value * Discount Rate Final Year FCF FCF Growth Rate = (Terminal Value * Discount Rate Final Year FCF) (Terminal Value + Final Year FCF)