Assessment Method for Level IL Enhancement in Indonesian Companies

Abdul Halim, QA Coordinator in 2019, introduced a method to elevate the IL position within companies in Indonesia's highest band. The mechanism involves a sharp and systematic QA approach and the formation of DOBLE QA for companies transitioning between EIL, IL, and BM positions. The process emphasizes fact-based evaluation, systematic improvement, and organizational learning, integrating current and future organizational needs. It focuses on sustaining beneficial trends, evaluating performance levels, and reporting results across key areas to ensure organizational success.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Metode Assessment Level IL up Oleh Abdul Halim Koordinator QA 2019

Background Perusahaan dengan posisi IL merupakan band TERTINGGI di Indonesia. Perlu dipastikan bahwa posisi ( band) tersebut memenuhi PERSYARATAN. Diperlukan MEKANISME QA yang lebih tajam dan sistematis. Dibentuk DOBLE QA untuk perusahaan yang berubah posisi dari EIL to IL, atau dari IL to BM.

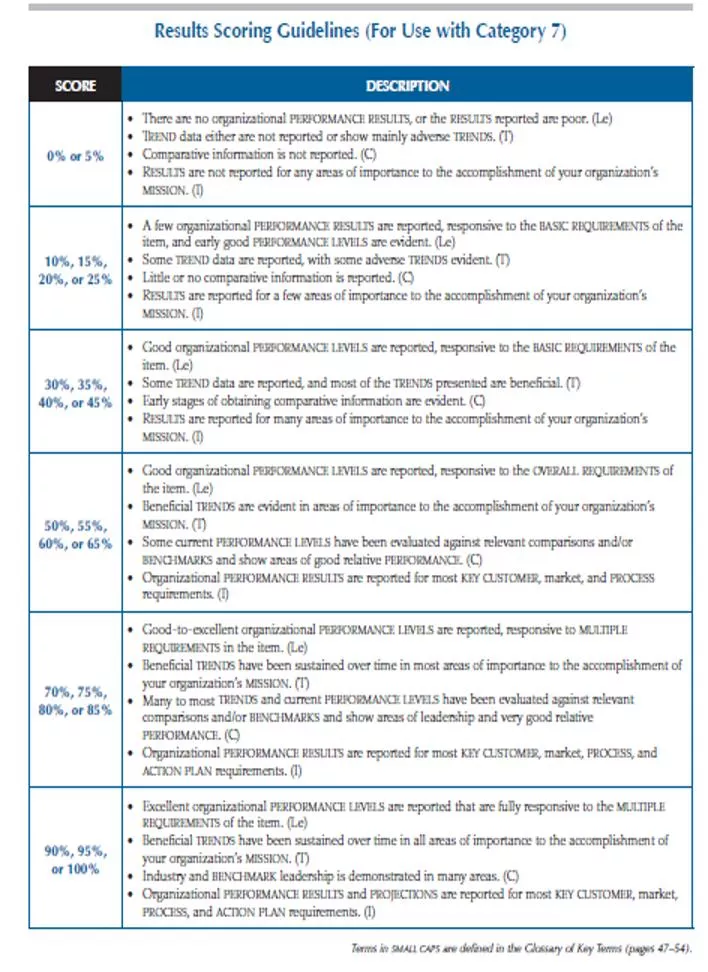

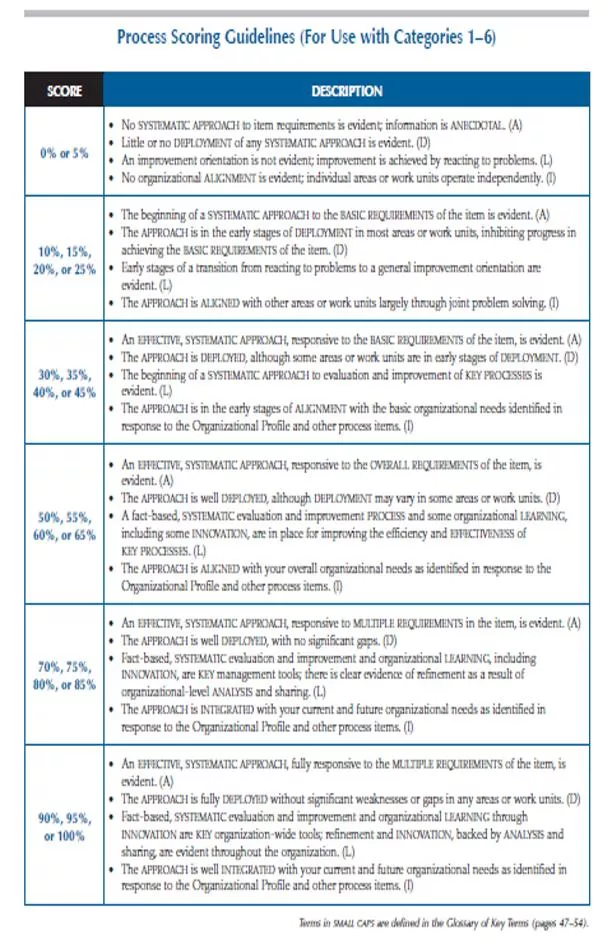

Chareakteristic Band IL up 70%, 75%, 80%, or 85% to multiple requirements in the item, is evident. The approach is well deployed, with no significant gaps. (D)Fact-based, systematic evaluation and improvement and organizational learning, including innovation, are key management tools; there is clear evidence of refinement as a result of organizational-level analysis and sharing. (L) The approach is integrated with your current and future organizational needs as identified in response to the Organizational Profile and other process items. (I) An effective, systematic approach, responsive P 70%, 75%, 80%, or 85% levels are reported, responsive to multiple requirements in the item. (Le)Beneficial trends have been sustained over time in most areas of importance to the accomplishment of your organization s mission. (T)Many to most trends and current performance levels have been evaluated against relevant comparisons and/or benchmarks and show areas of leadership and very good relative performance. (C) Organizational performance results are reported for most key customer, market, process, and action plan requirements. (I) Good-to-excellent organizational performance h

Integrated Approaches (70 100%) Operations are characterized by repeatable processes that are regularly evaluated for change and improvement in collaboration with other affected units. The organization seeks and achieves efficiencies across units through analysis, innovation, and the sharing of information and knowledge. Processes and measures track progress on key strategic and operational goals.

Memahami skor 70% up di Hasil 70%, 75%, 80%, or 85% responsive to multiple requirements in the item. (Le)Beneficial trends have been sustained over time in most areas of importance to the accomplishment of your organization s mission. (T)Many to most trends and current performance levels have been evaluated against relevant comparisons and/or benchmarks and show areas of leadership and very good relative performance. (C)Organizational performance results are reported for most key customer, market, process, and action plan requirements. (I) Good-to-excellent organizational performance levels are reported, Reported Most key Cust, market, process, and Action plan Beneficial Trend have been sustained in Most Area L T C I Good-to-excellent reported, Multiple Req Good-to- excellent reported, Multiple Req Many to Most very good .

FEW (5-15) SOME (>15-30) MANY (>30-50) MOST (>50-80) NEARLY ALL (>80-<100) ALL (100)

7.5 HASIL/KINERJA FINANSIAL DAN PASAR 7.5a(1) Kinerja Keuangan 1 7.5.1.Pendapatan (Rp M) 1 7.5.2.Pendapatan Bisnis Personal (Rp M) 1 7.5.3.Pendapatan Bisnis Home (Rp M) 1 7.5.4.Pendapatan Bisnis Enterprise (Rp M) 1 7.5.5.Pendapatan Bisnis Wholesale (Rp M) 1 7.5.6.Pendapatan Bisnis Digital Service (Rp M) 1 7.5.7.Pendapatan Enterprise Connectivity (Rp M) 1 7.5.8.Pendapatan DC & Cloud (Rp M) 1 7.5.9.Pendapatan IT Services (Rp M) 1 7.5.10.Pendapatan BPO (Rp M) 1 7.5.11.Pendapatan Device (Rp M) 1 7.5.12.Pendapatan Adjacent Services(Rp M) 1 7.5.13.Pertumbuhan Usaha (%) 1 7.5.14.Pertumbuhan Bisnis Digital Service (Rp M) 1 7.5.15.CAPEX to Revenue Ratio (%) 1 7.5.16.EBITDA (Rp M) 1 7.5.17.EBIT (Rp M) 1 7.5.18.Laba Bersih (Rp M) 1 7.5.19.Collection Period (Average in Days) 1 7.5.20.Likuiditas (%) 1 7.5.21.Debt to Equity Ratio (%) 1 7.5.22.Days Cash on Hand (hari) 1 7.5.23.Asset Utilization (%) 1 7.5.24.Cash and Cash Equivalen (Rp M) 7.5a(2) Kinerja Pasar 1 7.5.25.Porsi Penguasaan Pasar Fixed Broadband 2018 (%) 1 7.5.26.LIS Pasar Fixed Broadband (SSL) 1 7.5.27.Porsi Penguasaan Pasar Mobile Broadband 2018 (%) 1 7.5.28.LIS Pasar Mobile Broadband (SSL) 1 7.5.29.Porsi Penguasaan Pasar Seluler 2018 (%) 1 7.5.30.LIS Pasar Seluler (K SSL) 1 7.5.31.LIS Triple Play Services (SSL) 1 7.5.32.Porsi Penguasaan Pasar Triple Play (%) 1 7.5.33.LIS Triple Play Services - Benchmark (K SSL) 1 7.5.34.Winback Pelanggan (SSL) 1 7.5.35.Kapitalisasi Pasar (Rp M) 1 7.5.36.Share Kapitalisasi Pasar (%) 1 7.5.37.Peringkat Market Capitalization (Peringkat) 1 7.5.38.Revenue Share (%) 1 7.5.39.Revenue Share Layanan Voice Seluler (%) 1 7.5.40.Revenue Share Layanan Mobile Broadband (%) 1 7.5.41.Revenue Share Layanan Fixed Broadband (%) 1 7.5.42.Revenue Share Layanan Wholesale (%) 1 7.5.43.Revenue Share Layanan Interkoneksi Internasional (%) 1 7.5.44.Revenue Share Layanan Transit Domestik (%) 1 7.5.45.Revenue Share Layanan Satelit (%) 1 7.5.46.Revenue Share Layanan Digital (%) 1 7.5.47.Pemenangan Tender Pelanggan Enterprise (jumlah) 1 7.5.48.Pemenangan Tender Pelanggan Business (jumlah) 1 7.5.49.Pemenangan Tender Pelanggan Government (jumlah) Note: Warna Merah POOR

The Integration Insight The Integration Insight

Tim Doble QA Tim A ( Integration): Abdul Halim, Arif K, Dudung P Tim B( Kelayakan Skor & Komen): Firmanto P, Teddy J, Imn S

Metode doble QA Focus on Integration Tim A Applicant (BUMN) Focus on Kelayakan SKOR dan KOMEN Tim B

Kertas Kerja QA Integration (form) Kertas Kerja QA Integration (form) Kertas Kerja QA kelayakan SKOR KOMEN (isian) Contoh FBR aplicant Kertas Kerja QA kelayakan SKOR & KOMEN (isian) Contoh FBR aplicant

Aspek Tantangan Keunggulan Strategis Melakukan benchmark produk untuk dapat mengetahui tingkat dan posisi kompetitif dari ragam/varian produk yang dimiliki. Strategi penjualan produk memperhatikan karakteristik produk dan segmentasi saluran distribusi maupun pasar potensial. Melakukan kegiatan promosi terpadu baik above the line dan below the line untuk meningkatkan branding dari sisi Top Brand Index serta peningkatan penjualan. Melakukan pengembangan dan peluncuran produk baru dengan acuan hasil riset pasar dan kebutuhan pelanggan dalam rangka peningkatan layanan, inovasi dan pengembangan produk. Meningkatkan jaringan kerja sama/ sinergi aliansi untuk memperoleh investor/partner dan membuka pasar baru. Meningkatkan jumlah mitra/tenaga pemasar asuransi jiwa untuk memperluas cakupan pasar. Meningkatkan kemampuan teknologi yang dimiliki untuk dapat memberikan pelayanan yang lebih optimal kepada nasabah. Mempercepat proses bisnis pelayanan. Restrukturisasi organisasi; talent, key capabilities. Evaluasi portofolio produk termasuk analisis profitabilitas produk. Pengembangan model dan Branch . Integrasi strategi pemasaran, penjualan, keagenan, dan IT. Analisa mendalam struktur biaya dan identifikasi potensi efisiensi biaya. Analisis gap layanan (service) untuk end-to-end experience nasabah. Set-up fundamental untuk transformasi digital; inisiasi big data dan mobile app. Ketersediaan kelengkapan dokumen pengajuan polis dan klaim. Intensifikasi penjualan produk memanfaatkan database pelanggan. Peningkatan penjualan pembayaran berkala. Melakukan minimalisasi tunggakan premi Old Business (OB) pertanggungan perorangan dan pertanggungan perkumpulan maksimal 10%. Akselerasi sistem pelayanan pelanggan. Disain produk yang mudah dijual dan dipahami tenaga pemasar dan memenuhi kebutuhan pasar, Melakukan sosialisasi dan edukasi asuransi jiwa dengan melakukan publikasi menyediakan fasilitas informasi pelanggan melalui contact center. Melakukan peningkatan performa kondisi gedung kantor untuk meningkatkan citra Perusahaan. Melakukan program Management (CRM) dan customer loyalty dalam rangka meraih pasar pemegang polis baru dan mempertahankan pemegang polis eksisting. Menerapkan rencana sistem pemberian pinjaman berkelompok (sistem cluster) agar mempermudah dalam hal pelaksanaan pembinaan terhadap mitra binaan. Status Jiwasraya sebagai satu-satunya BUMN asuransi jiwa ditambah dengan ragam/ varian produk yang dimiliki memberi peluang untuk memperluas pasar melalui program kerjasama sinergi BUMN serta berbagai bentuk kerja sama aliansi. Bisnis identifikasi kebutuhan secara komprehensif, Best piloting untuk Sistem modern menyelesaikan masalah klaim atas polis yang dimiliki serta mengetahui perkembangan polis ataupun manfaat atas polis yang dimiliki. dukungan mempermudah layanan yang nasabah semakin dalam asuransi dengan produk dengan cara Operasional di media dan Customer Relationship Program kemitraan dalam bentuk pinjaman dengan sasaran penyaluran untuk komunitas (kelompok/cluster usaha) sinergi BUMN sehingga Tanggung Jawab Sosial melalui memiliki program wilayah