Anomalies in Law and Ways to Rectify Them

This presentation sheds light on the anomalies in W.P. Land Revenue Rules, 1968 and HCROs, discussing their formation, effects, and types. It explores how anomalies in law impact justice, highlighting reasons behind their development and probable forms. The content emphasizes the importance of addressing these anomalies to uphold the Rule of Law and ensure credibility in the judicial system.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

We Begin with the Name of Almighty Allah This Presentation is dedicated to the entire District Judiciary Mansehra with a lot of gratitude

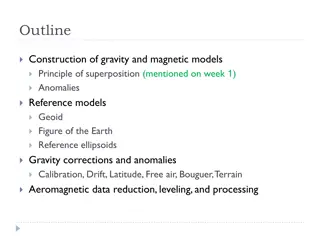

Anomalies in HCROs and W.P Land Revenue Rules,1968 There are numerous anomalies in the W.P Land Revenue Rules, 1968 and HCROs. It would be appropriate to first determine; What anomalies are; How they are formed and How they could be removed as this would provide a better perspective to our discussion on the issue.

What are Anomalies in Law; its Effects Anomalies in law Means, The inconsistencies, contradictions or adversities in law and in the judicial decisions. In Pakistan, many Laws have developed anomalies due to lack of connectivity in the various organs of the State or the lack of dynamism or inherent inflexibility in the interpretation of such Laws. Some of the anomalies in the Law cannot be corrected due to Inherent Limitations contained in the Law as it stands while some of them, though not capable of being corrected, can be explained in perspective to and with reference to legal or moral principles enunciated in the Law. Many of the anomalies are rectifiable but, unfortunately, they are not noticed, or if noticed, not corrected; and even when corrected, give rise to further anomalies. Such anomalies have a bearing on rendering of justice and when left un-rectified, undermine the Rule of Law. They create confusion in the minds of the public, lawyers and Judges and complicate the judicial process. In extreme cases, they lead to an unwarranted and uncharitable description of law. They also lead to despair and dissatisfaction among the litigants, in turn affecting the credibility of the judiciary.

Anomalies occur mainly due to the following three reasons Reasons for development of Anomalies. Omissions and Comissions of the Legislatures and the Judiciary; The existing difference between concepts of morality and concepts of Law which are moulded by political, economic and social necessities; and The inherent limitations of the legal system.

Probable kinds and forms of Anomalies They could be glaring contradictions in any provisions of one or more laws. They could be the missing link in connecting two provisions of law. They could also be the result of wrong or contradictory interpretation(s) of the provisions of any one or more laws. They could also be the result of lack of dynamism in reviewing the laws. There could be multiple reasons which are a combination of any of the above.

1. Anomalies attributable to legislature: Some of the frequently encountered anomalies in the field of law and justice are: Anomalies arising by reason of failure to review and revise statutes periodically taking note of the effect of inflation, needed modifications and pace of time. Anomalies arising by reason of legislature s failure to improve/update laws by taking note of the changing needs of the society. Anomalies arising out of defective drafting of statutes. Anomalies arising out of separate adjudications under civil and criminal laws in respect of a common cause.

2. Anomalies attributable to Judiciary: Some of the frequently encountered anomalies in the field of law and justice are: Anomalies arising out of personal philosophies and idiosyncrasies of Judges. Anomalies arising out of erroneous judicial interpretation of statutes. Anomalies arising from judgments per incuriam. Anomalies arising from the orders made for doing complete justice . Anomalies arising from ipse dixit orders. Anomalies arising from discretionary non-adjudicatory directions.

Some of the frequently encountered anomalies in the field of law and justice are: 3. Anomalies inherent in rule of law, not capable of effective correction: Anomalies arising out of inherent difference between justice according to law and justice according to morality. Anomalies arising out of generality of law. Anomalies arising from application of different scales for rich, powerful and well-connected & poor, weak and lacking in influence.

Legislative anomalies are require to be addressed by the legislature which made the law. How anomalies could be addressed Judicial anomalies require to be addressed by the judiciary as well as the legislature. Remaining anomalies are natural consequences of Rule of Law in regard to which effective correction would be difficult, if not impossible.

Anomalies in HCROs and The WP Land Revenue Rules, 1968: Before starting discussion over the anomalies that exist in the HCROs and the Rules, it is essential that certain meeting points are first determined to see whether they have any nexus at all to justify discussing their anomalies. No laws that are poles apart can be put in juxtaposition to find their points of similarity or dissimilarity. This means that both the HCROs and WP Land Revenue Rules, 1968 are interconnected

Given below are the bridges between the two Rules; Land Revenue Rules, 1968 were promulgated on 14thJuly, 1968 vide notification No. 377/68-219-U, in concurrence with the then High Court. This also finds mention in section 170 of Land Revenue Act, 1967 which is the parent Law on the subject. High Court Rules and Orders (Volume.1, Ch.2, Part B) relates to the jurisdiction of Civil/Revenue Court. Rule 2 of the said Part describes what is already laid down in the parent Law on Revenue. Similarities & Anomalies Section 53 of the Land Revenue Act, 1967 has given power to the Civil Courts to entertain certain nature of suits which do not fall within the exceptions contained in section 172 of the ibid Law. So, Both the Land Revenue Act, 1967 (Rules of 1968) and HCROs supplement each other.

This is not the real picture The real picture is different. The HCROs are in the nature of a subservient law rather than the supervisory and controlling provisions as they are claimed to be. The existence of Revenue Court and its apparent supervision by High Court are knitted to each other but there are numerous anomalies and controversies that overshadow this relationship and make this relationship an obscure and uncertain affair.

High Court does not enjoy any direct supervision over the Revenue Courts, Courts of Appeal/ Revision and any order of Member Board of Revenue is final, as to facts. This overshadows the original scheme of things because if the High Court does not have any such supervision over factual issues arising out of such summary proceedings. Mere a constitutional jurisdiction could be had independent of such connection between two separate Laws/procedures as prescribed in HCROs and WP Land Revenue Act & Rules. 1. Anomalies apparent in the provisions of both the Rules; The other anomaly worth consideration is in Rules 07, 08 and 13 of the WP Land Revenue Rules. Rule 07 relates to appointment of commission while Rule 08 relates to determination of expenses of witnesses. Both these Rules have made the Code of Civil Procedure, 1908 and HCROs applicable to proceedings before the Revenue Courts to the extent of appointment of Commission (CPC) or expenses of witnesses. Rule 13 relates to execution of orders of ejectment to which the CPC has been extended. Now if we read these provisions and compare them with HCROs, Vol.1 Ch.1 Part M & Vol.1 Ch.2 Part.B, you will get a different picture. In all these provisions of HCROs, the factual controversies relating to demarcation, appointment of commission, expenses of witness etc which are sole functions of Revenue officers are discussed in details. But no reason exists that such matters would be challengeable before HC as that power is only restricted to appeals before Revenue hierarchy. The purpose of connecting the HCROs and WP Land Revenue Rules is obviously defeated by this. It would thus be necessary that both these Rules are put in order of their conncetions inter se and other Laws that are dealt with thereunder, for example, CPC, Tenancy Act, Land Revenue Act etc. 2.

Anomalies apparent in the provisions of both the Rules; 3. No second appeal lies as per Land Revenue Act/Rules, if the original order is confirmed on first appeal, meaning thereby that, a concurrent finding of two lower forums in the Revenue hierarchy is not appealable on facts and only a point of law can be discussed before the MBR or HC or SC. This is not so as per judgments of either of these appellate/Constitutional Fora.

4. The other anomaly is in the judgments of the Constitutional Courts. Plethora of judgments have diversified this supervisory/constitutional Jurisdiction of the High Court. The High Court has declared many acts/orders of the Revenue Officers as being patently illegal but at the same time expressed their opinions on facts most of the time rather than issuing any directions to set the procedures right. Appointment of a Lambardar and Demarcation proceedings and matters incidental thereto have been dealt with this diverse approach which indicates the anomaly that the supervisory role, as envisaged in the Rules, is superficial and not real. Nowhere has this approach of such interference been regularized in either of the Rules to give clear powers and limitation, restriction etc. This anomaly can be cured if such supervision be clearly taken away from the constitutional Courts as this serves a mere opinionated character rather than decisive when not equipped with the power of revision etc. This also means that such revision/appeal/ review have been impliedly allowed while expressly the same has been discouraged by both the Rules. Anomalies apparent in the provisions of both the Rules; 5. The execution of orders of ordinary Courts has been entrusted to Revenue officials per HCROs, Rules and CPC and many interwoven paths or procedures are identifiable and yet both the hierarchies have different procedures for trial, appeal etc. (Ref. Vol:1 CH:2, Part-B of HCROs and Land Revenue Act, 1967 & Rules, 1968).

6.Trial before the Revenue Hierarchy are summary in nature despite the fact that CPC is partly applicable to its procedures. If a special law has overlapping character then it must provide a separate procedure for all proceedings which is not the case, consequently no hard and fast line is drawn in the Rules and judgments in respect of such summary proceedings. The Land Revenue Act/Rules have provided a vast field of work for all revenue officers and procedures have been provided distinctly for trials, appeals etc. By applying a general law and that too partly to procedures before a special Court/tribunal is likely to create confusions rather than certainties when discussing them collectively. The Maxim Generalia Specialibus non derogant (General Things/Law should give way and not derogate from special law/things) is clearly misapplied to all such voids while applying the general as well as special law simultaneously to one procedure before the revenue hierarchy. In this scenario, the WP Land Revenue Act and Rules would hold field against all procedures provided in the HCROs. Thus, if the special law is silent on any procedure, not necessarily will the CPC be applied. Precisely for this reason the High Court is restricted to very less while indulging in the matters of revenue hierarchy with the same freedom as it does in case of ordinary Courts through appeals etc. Anomalies apparent in the provisions of both the Rules;

Case Study A person approached the Revenue Officer for partition of his estate. During the process, certain irregularities occurred and appeals were filed finally before MBR. MBR directed that the entire process of partition could not be nullified and kept intact the order of partition along with scheme of partition already devised in the commission report which commission report was drafted prior to any appeal. MBR remanded the case to Lower Forum to have the irregularities removed but they were never removed. The aggrieved party approached the Civil Court to interfere and implement the actual order of MBR in letter and spirit. Civil Court dismissed the suit due to bar contained in sec.172 Land Revenue Act. On appeal against the said dismissal, case was remanded back to Civil Court with direction to the plaintiff to amend his pleadings to bring the case within the jurisdiction of Civil Court. The said matter was never appealed against at any stage before the HC, whether the orders of Revenue Officers or those of the Civil Courts. The question is When the order for removal of irregularities is neither corrected by the Revenue Officers or Court, why the person would be barred to have direct recourse to HC and why he has to face long drawn litigation upto HC without HC even having the power to resolve this factual problem and why the Courts are barred under sec.172?

Thank You All For your patient hearing Haider Ali Khan CJ-IV Mansehra