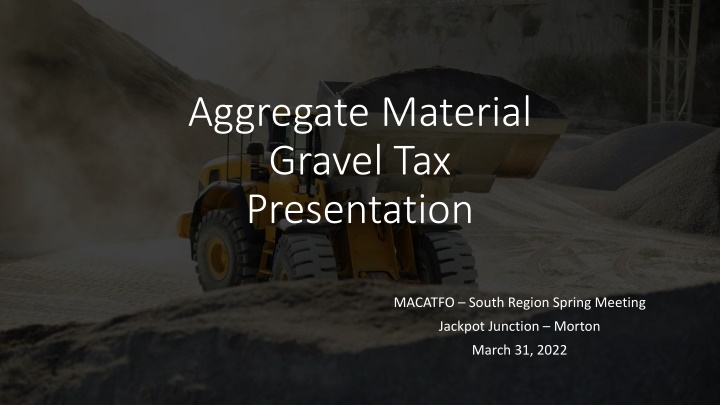

Aggregate Material Tax Presentation at MACATFO Spring Meeting

Explore the comprehensive presentation on Aggregate Material Tax at the MACATFO South Region Spring Meeting held at Jackpot Junction, Morton on March 31, 2022. The agenda covers the definition of aggregate tax, identification of production counties, historical changes in statutes, compliance, and more. Learn about government-owned pits, tax administration, and the counties where aggregate material production tax is applicable.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Aggregate Material Gravel Tax Presentation MACATFO South Region Spring Meeting Jackpot Junction Morton March 31, 2022

Agenda Definition of Aggregate Tax Identify Aggregate Production Counties History of Statute Changes and clarification - 1980 to current Discussion regarding Statute - Subdivisions 3 through 8 Use of restoration/reserve funds Auditing compliance Aggregate tax support group Questions and comments

Aggregate Definition Aggregate Definition What is and what is not aggregate material for purposes of aggregate tax? Aggregate material is nonmetallic natural mineral aggregate including but not limited to sand, silica sand, gravel, stone, boulders, crushed and uncrushed rock, including landscape rock, rip-rap, crushed granite, crushed limestone and borrow, but only if transported on a public street or highway. Aggregate material is NOT dimension stone, dimension granite, agricultural lime and limestone used in taconite production. Crushed concrete and/or crushed asphalt (CONBIT) is not subject to another aggregate tax (Likely was already taxed.)

Government Owned Pit Government Owned Pit Is a government entity required to pay the tax on aggregate removed form a pit they own? Maybe . The tax is imposed on every operator in the business of removing or producing aggregate for sale. No tax is required when a governmental unit removes aggregate for its own use, or hires a contractor to remove and crush for governmental units own use. If government entity sells the aggregate, it is subject to the aggregate tax.

Aggregate Tax Administration Collection of aggregate material tax is the responsibility of the county auditor in each county that imposes the tax on its aggregate operations. The County Auditor is required to develop tax reports, correspond with aggregate operators or importers and collect the tax.

Aggregate Material Production Tax Counties Becker Clay Goodhue Lake of Woods Le Sueur Mille Lacs Pipestone Rice Stearns Wright Benton Cottonwood Hennepin Big Stone Dakota Kanabec Mahnomen Marshall Norman Pope Scott Wabasha (Highlighted yellow: Region 4, 5, 8 or 9) Carver Dodge Kandiyohi Chicago Freeborn Kittson Meeker Pennington Red Lake Sibley Nicollet Polk Rock Steele Olmsted Ramsey Sherburne Washington Wilkin

Outline of Minnesota Statute 298.76 changes from onset through current Statute Changes Identify County Auditor s responsibilities

Statute as it began in 1980 Counties may impose upon operator engaged in removing gravel for sale from gravel pits or deposits, a production tax. Operator shall file quarterly reports with the county auditor in which the gravel is removed. If any operator fails to make report as required, county auditor shall determine the amount of tax due and notify the operator. Failure to file the report shall result in a penalty.

Production Tax Rates in 1982 The county may shall impose equal to ten cents per cubic yard or seven cents per ton. Distribution: 50% to county road and bridge fund 30% to town road and bridge fund as determines by the county board 10% to a special reserve fund which is established for expenditure for restoration of abandoned pits, quarries, or deposits located upon public and tax forfeit lands within the county. If there are no abandoned pits, quarries, or deposits located upon public or tax forfeited lands within the county, this portion of the tax shall be deposited in the county road and bridge fund for expenditure for the maintenance, construction and reconstruction of roads, highways and bridges.

Change to Statute in 1986 Language added pertaining to County Auditor duties: It is a misdemeanor for the operator or importer who is required to file a report to file a false report with intent to evade the tax.

Change to statute in 1992 County auditor has not received the report by the 15thday after the last day of each calendar quarter from the operator or importer as required by subdivision 3 of statute, the county auditor shall determine estimate the amount of tax due and notify the operator. Failure to report and submit payment shall result in penalty of $5 for each of the first 30 days, beginning on the 15thday after the last day of each calendar quarter.

Change to statute in 1994 When aggregate material is stored in a stockpile withing the state of Minnesota and a public highway, road or street is not used for transporting the aggregate material, the tax shall be imposed either when the aggregate material is sold or when it is transported from the stockpile site, or when it is used from the stockpile, whichever occurs first.

Change to statute in 1997 Aggregate material must be measured or weighed after it has been extracted from the pit, quarry or deposit. The county auditor or its duly authorized agent may examine records, including computer records, maintained by the importer or operator. Business records related to an importers or operator s collection, transportation, and disposal of aggregate to the extent necessary to ensure the required production taxes have been paid.

Changes effective January 1, 2009 If there are no abandoned pits, quarries or deposits located within the county, this portion of the tax shall be upon public or tax forfeit lands within the county, this portion of the tax shall be deposited in the county road and bridge fund for expenditure for the maintenance, construction and reconstruction of roads, highways and bridges used for any other unmet reclamation need or for conservation or other environmental needs.

Rate Changes effective January 2009 A county that imposes the aggregate production tax shall impose upon every importer a production tax of 21.5 cents per cubic yard or 15 cents per ton. The county auditor may retain an annual administrative fee of up to five percent of the total collected in any year. Distribution: (Total tax collected less administration fee) 42.5 percent to county road and bridge fund 42.5 percent to city or town in which the mine is located 15 percent to a special reserve fund for restoration

Minnesota Statute 298.76 Subd. 3 8 Outlining Auditor s Responsibilities

Minnesota Statute 298.76 Subd. 3 Report and remittance. (a) By the 14th day following the last day of each calendar quarter, every operator or importer shall make and file with the county auditor of the county in which the aggregate material is removed or imported, a correct report under oath, in such form and containing such information as the auditor shall require relative to the quantity of aggregate material removed or imported during the preceding calendar quarter. The report shall be accompanied by a remittance of the amount of tax due.

Minnesota Statute 298.76 Auditor estimate; statement of objections. Subd. 4 If the county auditor has not received the report by the 15th day after the last day of each calendar quarter from the operator or importer as required by subdivision 3 or has received an erroneous report, the county auditor shall estimate the amount of tax due and notify the operator or importer by registered mail of the amount of tax so estimated within the next 14 days. An operator or importer may, within 30 days from the date of mailing the notice, and upon payment of the amount of tax determined to be due, file in the office of the county auditor a written statement of objections to the amount of taxes determined to be due. The statement of objections shall be deemed to be a petition within the meaning of chapter 278,and shall be governed by sections 278.02 to 278.13.

Minnesota Statue 298.76 Subd. 5 Failure to file and pay; penalty. Failure to file the report and submit payment shall result in a penalty of $5 for each of the first 30 days, beginning on the 15th day after the last day of each calendar quarter, for which the report and payment is due and no statement of objection has been filed as provided in subdivision 4, and a penalty of $10 for each subsequent day shall be assessed against the operator or importer who is required to file the report. The penalties imposed by this subdivision shall be collected as part of the tax and credited to the county revenue fund. If neither the report nor a statement of objection has been filed after more than 60 days have elapsed from the date when the notice was sent, the operator or importer who is required to file the report is guilty of a misdemeanor.

Minnesota Statue 298.76 Subd. 6 Penalties; removal of aggregate if previous tax not paid; false report. It is a misdemeanor for any operator or importer to remove aggregate material from a pit, quarry, or deposit or for any importer to import aggregate material unless all taxes due under this section for all previous reporting periods have been paid or objections thereto have been filed pursuant to subdivision 4. It is a misdemeanor for the operator or importer who is required to file a report to file a false report with intent to evade the tax.

Minnesota Statute 298.76 Subd. 7 Proceeds of taxes (b) The county auditor may retain an annual administrative fee of up to five percent of the total taxes collected in any year. (c) The balance of the taxes, after any deduction under paragraph (b), shall be credited as follows: 1. 42.5 percent to the county road and bridge fund for expenditure of the maintenance, construction and reconstruction for roads, highways and bridges; 2. 42.5 percent to the general fund of the city or town in which the mine is located, or to the county, if the mine is located in an unorganized town, to be expended for maintenance, construction and reconstruction of roads, highways and bridges; and 3. 3. 15 percent to a special reserve fund which is hereby established, for expenditure for the restoration of abandoned pits, quarries, or deposits located within the county. 4. If there are no abandoned pits, quarries or deposits located within the county, this portion of the tax shall be used for any other unmet reclamation need or for conservation or other environmental needs.

Minnesota Statue 298.76 Subd. 8. Examination of records; maintenance of records. The county auditor or its duly authorized agent may examine records, including computer records, maintained by an importer or operator. The term "record" includes, but is not limited to, all accounts of an importer or operator. The county auditor must have access at all reasonable times to inspect and copy all business records related to an importer's or operator's collection, transportation, and disposal of aggregate to the extent necessary to ensure that all aggregate material production taxes required to be paid have been remitted to the county. The records must be maintained by the importer or operator for no less than six years.

Use of Restoration Funds Statute 298.75 Subd 6 If there are no abandoned pits, quarries or deposits located within the county, this portion of the tax shall be used for any other unmet reclamation need or for conservation or other environmental needs. Meeker Experience: We did an informal inventory on abandoned pits in our county. Was very difficult to define abandoned . We received requests for consideration of restoration funds. Working with the County Attorney, we developed a process for review. Worked with our Aggregate Tax County Committee. The County Board of Commissioners adopted the process and application forms.

Application Process Special Reserve Restoration Funds Best practice would be to set up a process for expending any reserve funds prior to making any commitments or payments. Meeker County created a Reimbursement Application Process outline to obtain funding Application for consideration to obtain proceeds Findings of Fact with criteria needed to qualify Aggregate Committee reviews and makes recommendation Finally, County Board of Commissioners make authorization or deny request for funding

Auditing Compliance Where to we begin? Develop a process to inspect every truck Staffing for this task Require/contract for a scale to weigh the materials Each hauler/operator is required to submit quarterly activity reports and payments to the County. Reports require documentation of either tons or cubic yards transported. Use these reports to further explore compliance? How can we go beyond the tithing cards.

Auditing Continued Could we require a copy of royalty statements given to the pit owner? Could we review construction invoices for gravel brought into the project? Some counties have created an aggregate tax committee could we engage this committee to be more engaged to assist in monitoring compliance? Could we work more closely with the township supervisors and clerks? They tend to have knowledge of projects in their areas are a valuable resource.

Publishing Activity Reports Counties are publishing summaries of their quarterly reports on their websites. Counties share the annual activity reports with Commissioners, Township Staff and operators. *** Making these reports public tends to favor scrutiny by local residents/township supervisors/other haulers-operators, and competition to report non-compliance. Some counties use expanded resources within their county when renewing conditional use permits or issuing new permits.

Don Walsh Retired Department of Revenue Staff For the period of time from 2004 through June of 2014, Don was available as an independent aggregate tax auditor and consultant. Worked with County Auditors to audit aggregate producers, aggregate importers, ready mix and bituminous producers and assisted county boards with aggregate tax issues. Prior to that he had 20 years aggregate tax experience with the Minnesota Department of Revenue. He authored the Aggregate Material Tax Information Brochure.

Aggregate Tax Audit General Information Suggestions from Don Walsh Reconcile the information on the Annual Aggregate Tax Information Report (filed by the aggregate producer with their annual payments of the aggregate tax due to the county) to the quarterly reports filed by that producer AND To the royalty report that shows the tons/yards produced and the royalty paid to each person to whom the producer pays royalty. Producers either produce aggregate from their own land OR from land owned by someone else to whom they pay royalty.

General Operations from Standard Hauler Suggestion Trucks are weighed empty, then trucks are weighed full. Type of materials are listed along with weights (including Date/Price) Sales receipts/tickets are tabulated to bill their customers and prepare aggregate/royalty statements Use of an inspection site?

Sample Letter to Haulers/Operators This letter is to inform you of policy and procedure changes ___________ County has made to our Aggregate Removal Tax Reporting form. Starting effective immediately we will impose a penalty for all late forms not received per MN Statue 298.75 Subd.5. This statue, states if payment is not received by the 14thday after the last day of each calendar quarter, there is a $5.00 penalty per day for the first 30 days and any day after, the penalty is $10.00 per day. The Aggregate Removal Tax Reporting form plus payment needs to be submitted by the due date even if there is nothing to report. Failure to submit a form or payment after more than 60 days from the date when the invoice was sent, the operator or importer who is required to file the report is guilty of a misdemeanor. Also, MN Statute 298.75 allows for examination of records; we will be implementing this process and may request that you submit additional documents along with reporting form. It is important to recognize fairness and compliance for all operators within the county.

Support Group Support Group We started an Aggregate Tax Support Group to help share ideas or concerns from the auditor s perspective. If you would like to see information from that group, please email Bob (bob.hiivala@co.wright.mn.us) and he will add you to the list.

Questions, Comments or Answers Questions, Comments or Answers If you are doing something that helps you audit aggregate tax, please share. If you have concerns and/or are willing to assist in developing a Best Practice , please contact us also. Any other questions or comments?

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)