After-Election Tax Strategies: What Changes Could Mean for You in 2024

As the results of the 2024 election come to light, the new administrations proposed tax policies are already making headlines.

Uploaded on | 4 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

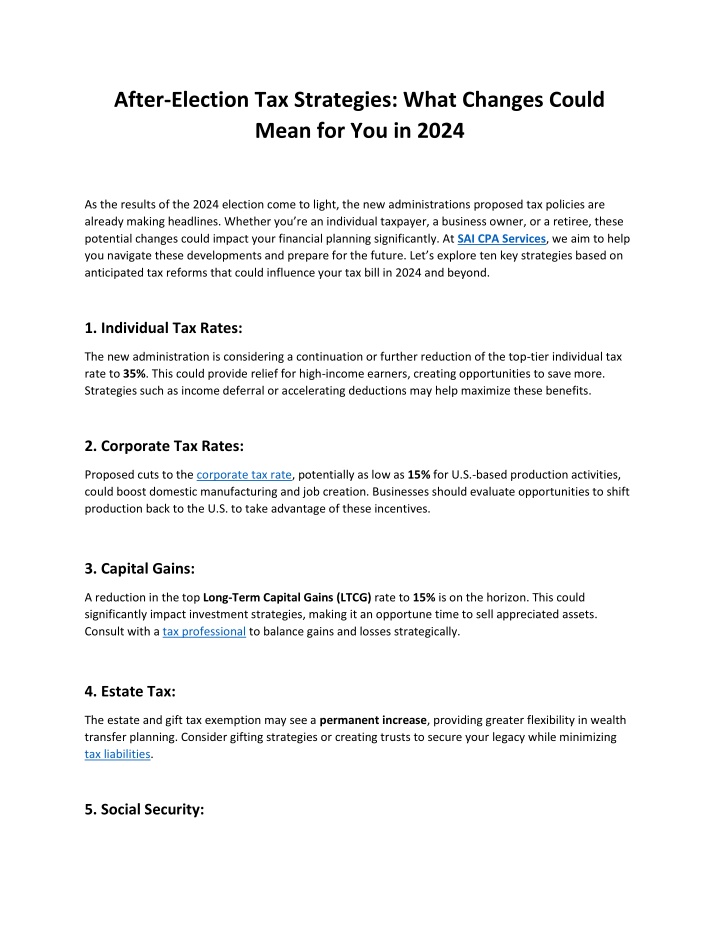

After-Election Tax Strategies: What Changes Could Mean for You in 2024 As the results of the 2024 election come to light, the new administrations proposed tax policies are already making headlines. Whether you re an individual taxpayer, a business owner, or a retiree, these potential changes could impact your financial planning significantly. At SAI CPA Services, we aim to help you navigate these developments and prepare for the future. Let s explore ten key strategies based on anticipated tax reforms that could influence your tax bill in 2024 and beyond. 1. Individual Tax Rates: The new administration is considering a continuation or further reduction of the top-tier individual tax rate to 35%. This could provide relief for high-income earners, creating opportunities to save more. Strategies such as income deferral or accelerating deductions may help maximize these benefits. 2. Corporate Tax Rates: Proposed cuts to the corporate tax rate, potentially as low as 15% for U.S.-based production activities, could boost domestic manufacturing and job creation. Businesses should evaluate opportunities to shift production back to the U.S. to take advantage of these incentives. 3. Capital Gains: A reduction in the top Long-Term Capital Gains (LTCG) rate to 15% is on the horizon. This could significantly impact investment strategies, making it an opportune time to sell appreciated assets. Consult with a tax professional to balance gains and losses strategically. 4. Estate Tax: The estate and gift tax exemption may see a permanent increase, providing greater flexibility in wealth transfer planning. Consider gifting strategies or creating trusts to secure your legacy while minimizing tax liabilities. 5. Social Security:

A bold proposal to eliminate taxes on Social Security benefits could alleviate the financial burden on retirees. If enacted, it s an excellent time to revisit retirement income plans and reallocate savings to tax-advantaged accounts. 6. Tip Taxation: A proposal to end taxes on tips and eliminate payroll taxes for tipped workers could mean more take- home pay for millions in the hospitality industry. Businesses in this sector should prepare for potential payroll changes to ensure compliance while benefiting employees. 7. Child Tax Credit: The administration s promise to increase the Child Tax Credit to $5,000 per child could provide substantial relief for families. If this change becomes law, parents should adjust their withholding and tax planning to optimize refunds or lower tax bills. 8. Auto Loan Deductions: The introduction of a tax deduction for auto-loan interest could benefit car buyers significantly. This is a good time to consider purchasing a new vehicle, especially if this deduction aligns with your broader financial goals. 9. Housing Initiatives: Plans to reduce mortgage rates and build more homes aim to address housing affordability. Homebuyers and real estate investors should stay informed on these policies to seize opportunities for lower borrowing costs and tax benefits. 10. Expatriate Tax Relief: Proposals to end double taxation for expatriates could simplify tax compliance and reduce financial burdens. Expats should work with tax professionals to take advantage of potential savings while remaining compliant with U.S. tax laws. What s Next? While these changes are promising, it s crucial to understand that they are proposals and subject to legislative approval. The specifics of how and when these policies will take effect remain uncertain. At SAI CPA Services, we are here to help you:

Stay informed: We monitor policy developments and provide timely updates. Plan strategically: We tailor strategies to your unique situation, ensuring optimal outcomes under the new tax laws. Optimize your finances:Whether you re managing individual or corporate taxes, we ll help you navigate complexities effectively. Take Action Today Tax planning is not a one-time activity; it requires vigilance and proactive strategies. Contact SAI CPA Servicestoday to schedule a consultation. Together, we ll develop a plan to help you minimize your tax liabilities and make the most of the opportunities presented by these potential changes. Let s make 2024 a year of financial growth and success!

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)