Accounting of Transactions of Foreign Currency

"Understanding the accounting process for transactions involving foreign currency, including imports, exports, purchase of fixed assets, borrowing and repayment in foreign currency. Learn about Foreign Exchange Fluctuating Account, journal entries, and more."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Chapter-Accounting of Transactions of Foreign Currency

Accounting of Transactions of Foreign Currency Meaning- Imports of Goods Exports of Goods Purchase of Fixed Assets outside from India Borrowing and Repayment of loan in Foreign Currency

Accounting of Transactions of Foreign Currency FEF Account is a Nominal Account. At the end FEF account balance is transferred to Profit and Loss Account. Foreign Exchange Fluctuating Account (FEF A/c) Debit Side -All Expenses and Losses Due to Foreign exchange rate difference. Credit Side -All Incomes and Gains Due to Foreign exchange rate difference.

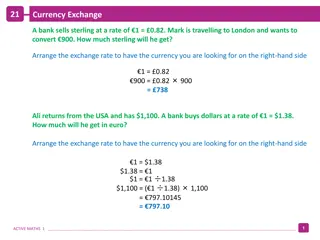

Accounting of Transactions of Foreign Currency Journal Entries- In case of Imports of Goods First Year Imports of Goods Payment made Loss or Gain due to FER Difference( FER as on date of payment FER on date of Purchase) X Foreign Currency Payment Loss/Gains due to Foreign Exchange Fluctuation for valuation of Remaining Creditors Next Year when payment is made to Creditor/Party Payment made Loss or Gain due to FER Difference (FER as on date of payment FER as on date of Balance sheet ) x Foreign Currency Payment

Accounting of Transactions of Foreign Currency Journal Entries- In case of Exports of Goods First Year Export of Goods Payment Received Loss or Gain due to FER Difference( FER as on date of payment received FER on date of Sale) X Foreign Currency Payment Loss/Gains due to Foreign Exchange Fluctuation for valuation of Remaining Debtors Next Year when payment is received form Debtors/Party Payment Received Loss or Gain due to FER Difference (FER as on date of payment received FER as on date of Balance sheet ) x Foreign Currency Payment

THANKYOU!! Assistant Prof. Pradeep H. Tawade DEPARTMENT OF ACCOUNTANCY, NSS College of Commerce & Eco. Tardeo, Mumbai-34 Email ID pradeeptawade26@yahoo.com Mobile No. 9619491859