International Financial Environment and Foreign Exchange Markets

The international financial system encompasses the management and trading of international money and monetary assets. This involves transactions in foreign currency, foreign deposits, investments, and assets. The foreign exchange market facilitates the exchange of currencies, determining exchange rates based on supply and demand. Functions of the foreign exchange market include transfer of purchasing power and provision of credit for foreign trade transactions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

INTERNATIONAL BUSINESS NOTES COMPILED BY: MS. Deepika Commerce department Notes for: B.com(H) 3rdyear Group 2

International financial Environment Important questions from the topic: Functions of foreign exchange market Short note on foreign exchange risk Types of foreign exchange rate Foreign exchange risk and foreign exchange exposure

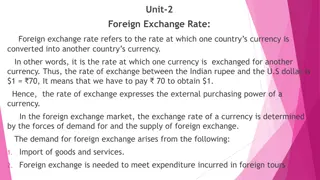

International financial environment International financial system relates to the management of and trading in international money and monetary assets. These monetary assets are claims on foreign currency, foreign deposits and investments and/or foreign assets. The claims may be denominated in various foreign currencies purchased and sold and involve exchange as between various currencies. Thus, these transactions give rise to (i) Borrowing and lending operations in foreign currencies or trading in financial assets denominated in foreign currencies and (ii) A foreign exchange transaction involving an exchange of one currency for another. The first is called the foreign currency market and the second is the foreign exchange market.

Foreign Exchange Market: International relations between countries involve exchange of goods and services and payments for these exchanges. The payments lead to conversion of one currency into another. Each country has its own financial system and its own currency Exchanges between the money and financial assets of one country for money or financial assets of another international financial transactions. economic and commercial and financial assets. country constitutes

THE DEMAND FOR ANY CURRENCY AS AGAINST ITS SUPPLY IN SUCH MARKETS DETERMINES THE EXCHANGE RATE. THESE FINANCIAL ASSETS COULD BE MONEY OR NEAR-MONEY ASSETS, CHEQUES, DRAFTS, MAIL TRANSFERS AND OTHER NEGOTIABLE INSTRUMENTS.

Functions of foreign exchange market 1. Transfer Function: It transfers purchasing power between the countries involved in the transaction. This function is performed through credit instruments like bills of foreign exchange, bank drafts and telephonic transfers. 2. Credit Function: It provides credit for foreign trade. Bills of exchange, with maturity period of three months,

are generally used for international payments. Credit is required for this period in order to enable the importer to take possession of goods, sell them and obtain money to pay off the bill. 3. Hedging Function: When exporters and importers enter into an agreement to sell and buy goods on some future date at the current prices and exchange rate, it is called hedging. The purpose of hedging is to avoid losses that might be caused due to exchange rate variations in the future.

Kinds of Foreign Exchange Markets Foreign exchange markets are classified on the basis of whether the foreign exchange transactions are spot or forward accordingly, there are two kinds of foreign exchange markets: (i) Spot Market, (ii) Forward Market.

Foreign exchange market Spot market Spot market refers to the market in which the receipts and payments are made immediately. Generally, a time of two business days is permitted to settle the transaction. Spot market is of daily nature and deals only in spot transactions of foreign exchange (not in future transactions). The rate of exchange, which prevails in the spot market, is termed as spot exchange rate or current rate of exchange. Forward market Forward market refers to the market in which sale and purchase of foreign currency is settled on a specified future date at a rate agreed upon today. The exchange rate quoted in forward transactions is known as the forward exchange rate. Generally, most of the international transactions are signed on one date and completed on a later date.

Foreign exchange exposure Foreign Exchange Exposure refers to the risk associated with the foreign exchange rates that change frequently and can have an adverse effect on the financial transactions denominated in some foreign currency rather than the domestic currency of the company.

References: https://economistindia.wordpress.com/2012/10/12/components-of-international- financial-environment/ http://www.yourarticlelibrary.com/macro-economics/balance-of-payment/foreign- exchange-market-meaning-functions-and-kinds/30428 https://www.investopedia.com/ask/answers/042315/what-difference-between- forward-rate-and-spot-rate.asp https://www.wallstreetmojo.com/foreign-exchange-risks/ https://www.differencebetween.com/difference-between-foreign-exchange-risk- and-vs-exposure/ https://efinancemanagement.com/international-financial-management/types-of- foreign-exchange-currency-exposure https://www.slideshare.net/nikitabhinde/indian-foreign-exchange-market-rupee- exchange-rate