Strategies to Address Childhood Obesity and Food Insecurity in Oregon

Various paths to reduce childhood obesity and food insecurity in Oregon are discussed, including the impact of SNAP, soda taxes, and key objectives to focus on. The importance of ensuring interventions do not cause harm over other dimensions is highlighted. The evidence on soda taxes, SNAP program,

6 views • 10 slides

Understanding EVE Model for Indirect Taxes Using Household Data

The EVE model developed by PBO analyzes household expenditure to estimate taxes paid on goods and services, facilitating the assessment of policy proposals' cost and impact. Utilizing microsimulation, EVE covers a range of indirect taxes like VAT, excises, and carbon tax, providing valuable insights

0 views • 19 slides

PROPERTY TAXES 101

Property taxes in Ohio are levied in mills, with a mill equaling $1 in taxes for every $1,000 of assessed property value. The base tax of 10 mills is applied to all residents, with additional taxes requiring voter approval. House Bill 920 controls property tax growth, ensuring revenue remains steady

0 views • 10 slides

Understanding Withholding Taxes: A Comprehensive Overview

Explore the intricacies of withholding taxes under tax laws, including definitions, categories, exemptions, and double taxation considerations. Learn about the role of withholding agents, withholdees, and the Ghana Revenue Authority. Delve into specific sections of the Income Tax Act, 2015 and disco

1 views • 24 slides

Understanding the Purpose of Taxation: Financial, Social, Legal, and Ethical Perspectives

Taxation is a crucial method governments use to collect funds for public services. This chapter delves into the principles of a fair tax system, exploring how taxes should be related to income, predictable, cost-effective to collect, and convenient for taxpayers. It also discusses the redistribution

0 views • 19 slides

Taxing the Wealthy in Lower-Income Countries: Research Evidence and Policy Implications

The world is facing various crises, with lower-income countries disproportionately affected. To boost revenue without new wealth taxes, effective taxation of the wealthy is crucial. Existing taxes in LICs are inadequate compared to HICs. Wealth inequality is stark in LICs and Sub-Saharan Africa. Imp

0 views • 20 slides

Understanding Tax Tables, Worksheets, and Schedules for Federal Income Taxes

Explore the concept of tax tables, worksheets, and schedules for calculating federal income taxes. Learn how to express tax schedules algebraically and compute taxes using IRS resources. Examples featuring single and married taxpayers provide practical insights into determining taxable income and ca

0 views • 11 slides

Understanding Taxes and Government Spending: A Comprehensive Overview

This comprehensive overview delves into the fundamental concepts of taxes and government spending. It covers topics such as the definition of taxes, the power of Congress to tax, limits on taxation, tax structures, characteristics of a good tax, and the burden of taxes. Exploring these concepts prov

1 views • 29 slides

Overview of Gross Receipts Taxes in Louisiana and Other States

Gross Receipts Taxes, a resurgence in state revenue-raising mechanisms, are examined in Louisiana and other states, highlighting similarities and differences in approaches. The presentation delves into the structure and implications of gross receipts taxes, providing insights on legislation and fisc

0 views • 27 slides

Guide to Income Withholding Order Preparation in Orange County Superior Court

Create an Income Withholding Order with step-by-step instructions and online form access. Print and file at Lamoreaux Justice Center in Orange County for wage garnishment in support cases.

0 views • 42 slides

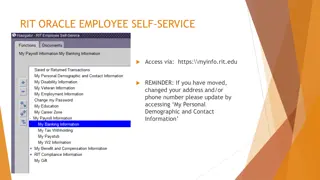

RIT Oracle Employee Self-Service Information

Access RIT Oracle Employee Self-Service via https://myinfo.rit.edu for managing personal demographic details, updating contact information, adding bank accounts, changing tax withholding, accessing pay stubs, and opting out of a printed W2 form. The system provides detailed FAQs on banking, tax with

0 views • 4 slides

Understanding Taxes and Income in India

Explore the concepts of taxes and income in India, including direct and indirect taxes, the Income Tax Act of 1961, government revenue, and the administration of income tax. Learn about the various components of income, tax laws, and the importance of proper tax administration for the country's fina

0 views • 12 slides

Withholding Taxes and Revenue Regulations Overview

The content delves into the concept of withholding taxes, particularly final and creditable withholding taxes, as per Revenue Regulations No. 02-98. It explains the responsibility of withholding agents, the distinction between final and creditable withholding tax systems, and the implications for pa

0 views • 20 slides

Understanding Income Tax: Overview and Application

The Income Tax Act covers three modules - administration, taxes, and general provisions. It distinguishes between direct and indirect taxes, and outlines various types of taxes like income tax, VAT, and customs duty. Tax revenue funds government departments, and the taxation scheme calculates taxabl

0 views • 58 slides

Independent Contractor Classification Policy at Drexel University

This policy outlines the classification process for determining if a service provider is an employee subject to tax withholding or an independent contractor responsible for their own taxes at Drexel University. Understanding this process is crucial to avoid misclassification risks and ensure complia

0 views • 20 slides

Understanding Federal Taxes in the United States

Explore the key aspects of federal taxes in the United States, including individual and corporate income taxes, Social Security, Medicare, and unemployment taxes. Learn about tax brackets, withholding, tax returns, and more. Discover the economic importance of taxes and how they support the function

1 views • 15 slides

Maryland Revenue Estimates & Economic Outlook March 2022

The revenue estimates and economic outlook for Maryland in March 2022 show growth in income taxes, sales and use taxes, and other revenues. Detailed figures for fiscal years 2021-2023 indicate estimates and actual data for various tax types like individual and corporate income taxes. The changes in

0 views • 17 slides

Evolution of Legal Process Taxes in County Clerk Offices

Explore the historical progression of legal process taxes related to marriage licenses, property conveyance, and other transactions as mandated by KRS 142.010. Delve into the changes in tax rates and base over time, along with the reliance on these taxes for revenue generation. The receipts of legal

0 views • 9 slides

The Impact of Cigarette Taxes and Indoor Air Laws on Prenatal Smoking and Infant Death

This study examines the effects of cigarette taxes and indoor air laws on prenatal smoking and infant death. It discusses how cigarette taxes can increase smoking cessation during pregnancy and reduce the probability of smoking, while comprehensive smoking bans can decrease the likelihood of smoking

1 views • 27 slides

Workshop on Sales Tax Laws on Services Part 1: Provincial Withholding Sales Tax on Services

This workshop conducted by Asif S. Kasbati covers topics such as Provincial Withholding Sales Tax in Sindh and Punjab, exemption and reduced rates in SST and PST, federal withholding sales tax, withholding agents, and the mechanism of withholding sales tax under SST and PST for different categories

0 views • 68 slides

Key Dates and Financial Management Guidelines for Year-End 2023 and Beginning 2024

Key dates and guidelines for year-end financial management covering topics such as internal revenue rates, ACA, SSA, W-2 forms, paid leave, state withholding taxes, and more. Ensure proper staffing, emergency payroll procedures, and payments for deceased employees. Coordinate with various agency dep

0 views • 26 slides

Composition of Ohio's State and Local Taxes Revealed

Ohio relies heavily on sales taxes for state and local government tax revenue. In FY 2019, Ohio's combined state and local tax revenue sources included property taxes, individual income tax, and sales taxes. Sales taxes accounted for the highest percentage of revenue, followed by property taxes and

0 views • 4 slides

Understanding State and Local Sales and Income Taxes

Delve into the intricacies of state and local sales and income taxes in Lecture 10 of State and Local Public Finance. Explore topics such as efficiency, equity, administrative issues, design of federal tax, link to state income taxes, and design of local income taxes. Uncover how sales taxes create

0 views • 42 slides

A Farmer's Perspective on Taxes and Income Reporting

Explore the practical workings of major types of taxes for farmers, including property, sales, employment, income, self-employment, gift, and estate taxes. Delve into income tax reporting with IRS Form 1040, itemized deductions, taxable income calculation, and understanding US progressive income tax

0 views • 11 slides

Understanding Income Taxes and Contributions in Quebec

This resource provides comprehensive information on income taxes and contributions in Quebec, covering topics such as taxable income, tax deductions, rights and responsibilities of taxpayers, and ways to reduce tax payments through investment plans like TFSAs and RRSPs. It also emphasizes the import

0 views • 43 slides

Understanding Sin Taxes in State and Local Public Finance

Sin taxes are levied on products with negative externalities, such as alcohol, tobacco, and gambling. While they generate revenue and aim to discourage consumption, their long-term revenue potential is limited. Policy changes may be needed to strengthen sin tax revenue growth and prevent tax evasion

0 views • 54 slides

Importance of Recurrent Property Taxes for Fiscal Sustainability

Recurrent property taxes play a crucial role in enhancing fiscal sustainability by reducing dependency on inter-governmental transfers, increasing local government accountability, and promoting equity in taxation. This article discusses the benefits of recurring property taxes, emphasizes the need f

0 views • 19 slides

Understanding Transportation Funding in Georgia: HB 170 Overview

Explore the intricacies of transportation funding with an overview of HB 170 in Georgia presented by Shaun Adams, Associate Legislative Director of ACCG. The bill converts state motor fuel taxes to excise taxes, establishes alternative fuel vehicle fees, and introduces highway impact fees. Local imp

0 views • 14 slides

Understanding Vehicle Ownership Taxes and Special Assessments in Teller County

Exploring Specific Ownership Taxes (SOT), 1.50 and 2.50 fees, and special assessments in Teller County. Learn about how these taxes and fees are paid, distributed, and the challenges in estimating collections. Discover the allocation of funds to county road and bridge funds, municipalities, and gene

1 views • 10 slides

Remedying DBA Violations with Withholding and Debarment

Understanding the process of withholding contract funds to address DBA/DBRA/CWHSSA violations pending resolution of wage disputes, ensuring payment of back wages to covered workers, and implementing effective enforcement strategies. Explore sample letters for withholding requests and verification. L

0 views • 35 slides

Understanding Income Taxes and Contributions in Canada

This content provides an overview of income taxes and contributions in Canada, covering topics such as tax facts, tax basics, taxpayer rights and responsibilities, types of taxes, government revenues, and key messages for Canadian taxpayers. It emphasizes the importance of filing tax returns accurat

0 views • 43 slides

Understanding Nonresident Alien Tax Compliance

Explore the complexities of nonresident alien tax compliance, including federal income taxes, state income tax withholding, and social security/medicare taxation. Learn about the tax system, residency statuses, payment processing procedures, treaty benefits, and best practices. Gain insights into wi

0 views • 24 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Understanding Property Transfer Taxes and Fees in the EU

Explore the intricacies of property transfer taxes and municipal user fees, advantages and disadvantages, types of property transfer taxes within the EU, taxpayer classifications, and more in this comprehensive presentation.

1 views • 20 slides

Understanding Taxes, Charitable Giving, and Legislative Impacts

Explore the intersection of taxes, charitable giving, and pivotal legislative acts such as the Tax Cuts and Jobs Act of 2017. Learn about key considerations, planning tools, and changes in federal income taxes under the Biden Tax Plan. Discover how estate taxes, donor-advised funds, and retirement a

0 views • 59 slides

Property Taxes and Local Decision-Making in Texas

Texas relies on property taxes and sales taxes as major revenue sources for state and local government funding. The majority of property taxes fund public schools, with the burden increasing due to unfunded mandates from the Texas Legislature. Student funding is impacted by property value growth, be

0 views • 24 slides

Changes in 1099 Withholding Forms for CY2022

Explore the latest updates in 1099 withholding forms for CY2022, including changes in IRS forms, PeopleSoft withholding modifications, and additional considerations for withholding processes. Learn about the new requirements and enhancements impacting 1099-MISC and 1099-NEC forms, such as FATCA comp

0 views • 39 slides

Understanding IRS Guidelines on Tip Reporting

Explore the history of tax rules on tip income and delve into the new IRS guidance regarding tips versus service charges. Learn about the distinctions, employer responsibilities, and the impact on FICA taxes and Federal income tax withholding. Gain insights into key factors that differentiate tips f

0 views • 30 slides

Trends in Iowa Property Taxes: Past and Future

Property taxes in Iowa have decreased as a source of local revenue over the years. The decline is more significant when looking at own-source revenue excluding state and federal grants. Other revenue sources like charges and sales taxes have become more important. Different trends are observed for c

0 views • 18 slides

Small Business Taxation Overview for Iowa Entrepreneurs

Discover key steps for starting your business with a tax focus in Iowa, including business structure determination, EIN acquisition, tax treatment selection, eligibility for S-Corp status, and tracking financial metrics. Learn about different types of small business taxes, such as federal and state

0 views • 10 slides