UMass Boston Student Payment Plan Working Group

The student payment plan working group at UMass Boston aims to enhance the billing and collections process to prevent financial troubles for students. By defining and implementing effective payment strategies, the group seeks to ensure that students either pay their bills in full or have a feasible

0 views • 6 slides

Understanding Withholding Taxes: A Comprehensive Overview

Explore the intricacies of withholding taxes under tax laws, including definitions, categories, exemptions, and double taxation considerations. Learn about the role of withholding agents, withholdees, and the Ghana Revenue Authority. Delve into specific sections of the Income Tax Act, 2015 and disco

1 views • 24 slides

Understanding Liquidated Damages in Construction Contracts

Liquidated damages in construction contracts serve as predetermined compensation for delays in project completion, distinct from penalties for nonperformance. Contractors may have payments withheld if unsatisfactory progress causes time overruns. The SE-330 and OSE Manual outline procedures for asse

5 views • 21 slides

Understanding Dvividha Upakarma: Two Kinds of Therapy in Ayurveda

Ayurveda outlines two main types of therapies - Brihmana (nourishing, enriching) and Langhana (depleting, cleansing) based on the body types of obese and lean. Brihmana therapy focuses on increasing weight and heaviness, while Langhana therapy aims to reduce weight and impart lightness. These therap

3 views • 32 slides

Belgian Payroll Tax System Overview

The Belgian payroll tax system covers various aspects such as the principle income concerned, legal basis, persons liable to pay tax, exemptions for embassy staff, and obligations of those subject to the tax. It outlines the types of income subject to taxation, obligations for withholding tax, and t

0 views • 18 slides

Guide to Income Withholding Order Preparation in Orange County Superior Court

Create an Income Withholding Order with step-by-step instructions and online form access. Print and file at Lamoreaux Justice Center in Orange County for wage garnishment in support cases.

0 views • 42 slides

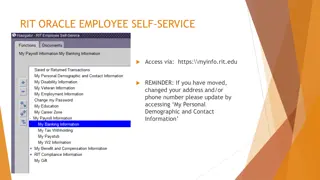

RIT Oracle Employee Self-Service Information

Access RIT Oracle Employee Self-Service via https://myinfo.rit.edu for managing personal demographic details, updating contact information, adding bank accounts, changing tax withholding, accessing pay stubs, and opting out of a printed W2 form. The system provides detailed FAQs on banking, tax with

0 views • 4 slides

Withholding Taxes and Revenue Regulations Overview

The content delves into the concept of withholding taxes, particularly final and creditable withholding taxes, as per Revenue Regulations No. 02-98. It explains the responsibility of withholding agents, the distinction between final and creditable withholding tax systems, and the implications for pa

0 views • 20 slides

Best Practices for Antibiotic Use in Infectious Diseases Management

Antibiotics play a crucial role in preventing and treating diseases, but misuse and overprescription are common issues. Dr. Fahad Almajid emphasizes the importance of accurate diagnosis, host factors consideration, and microbiology testing for effective treatment. Identifying life-threatening infect

0 views • 51 slides

Independent Contractor Classification Policy at Drexel University

This policy outlines the classification process for determining if a service provider is an employee subject to tax withholding or an independent contractor responsible for their own taxes at Drexel University. Understanding this process is crucial to avoid misclassification risks and ensure complia

0 views • 20 slides

Understanding Federal Taxes in the United States

Explore the key aspects of federal taxes in the United States, including individual and corporate income taxes, Social Security, Medicare, and unemployment taxes. Learn about tax brackets, withholding, tax returns, and more. Discover the economic importance of taxes and how they support the function

1 views • 15 slides

Economic and Revenue Review Update Briefing for Money Committees

Adjusting for timing issues and taxpayer rebates, general fund revenues grew 10.3% year-over-year in October. With one-third of the fiscal year completed, revenues are up 8.3% adjusted for policy and timing impacts. The impact of the increased standard deduction is expected to reduce withholding rat

0 views • 15 slides

Workshop on Sales Tax Laws on Services Part 1: Provincial Withholding Sales Tax on Services

This workshop conducted by Asif S. Kasbati covers topics such as Provincial Withholding Sales Tax in Sindh and Punjab, exemption and reduced rates in SST and PST, federal withholding sales tax, withholding agents, and the mechanism of withholding sales tax under SST and PST for different categories

0 views • 68 slides

Key Dates and Financial Management Guidelines for Year-End 2023 and Beginning 2024

Key dates and guidelines for year-end financial management covering topics such as internal revenue rates, ACA, SSA, W-2 forms, paid leave, state withholding taxes, and more. Ensure proper staffing, emergency payroll procedures, and payments for deceased employees. Coordinate with various agency dep

0 views • 26 slides

Update on International Treaty on Plant Genetic Resources for Food and Agriculture

The International Treaty on Plant Genetic Resources for Food and Agriculture aims to establish a system compatible with CBD, conserve and sustainably use genetic resources, and ensure fair benefit-sharing. However, there are challenges with the current Standard Material Transfer Agreement (SMTA) and

0 views • 15 slides

Ethical Debate on Euthanasia: Rachels' Critique of AMA Doctrine

James Rachels challenges the American Medical Association's distinction between active and passive euthanasia, arguing that it lacks ethical justification. The AMA doctrine permits passive euthanasia but forbids active euthanasia, leading to potential prolonged suffering for terminally ill patients.

0 views • 20 slides

Understanding the Right-to-Know Law Basics

The Right-to-Know Law provides a framework for requesters to access public records from state or local agencies. It outlines the process of submitting requests, agency responses, appeals procedures, and what constitutes a record. The law does not differentiate between formats, encompassing various t

0 views • 58 slides

Graduate Student Tax Reporting & Financial Support Overview

This document provides information on tax reporting for graduate student payments at the School of Medicine & Dentistry, including details on fellowships, assistantships, and tax obligations for non-resident aliens. It covers job codes, tax treaties, necessary documentation, and withholding requirem

0 views • 34 slides

Understanding Different Types of Domestic Abuse in Adult Social Care

The role of Adult Social Care (ASC) in countering domestic abuse is crucial, especially in identifying various forms of abuse beyond the typical scenarios portrayed in media. This includes recognizing abuse involving older adults, adult sons or grandsons as perpetrators, and different dynamics such

0 views • 8 slides

Engaging Narrative Writing Scheme for Character Development

Embark on a four-week narrative writing scheme focusing on character development through a slow process. Utilize modeling techniques and diverse sentence structures to enhance prose quality. Explore key elements like withholding information, building climactic scenes, and crafting memorable conclusi

0 views • 39 slides

Crafting Engaging Narratives Through a Slow Writing Process

Delve into a four-week scheme focused on nurturing narrative and creative writing skills using a deliberate, gradual approach. By starting from rudimentary examples and progressing through the I-WE-YOU modeling process, students learn to enhance their prose with diverse sentence types and techniques

0 views • 23 slides

Understanding Government Information Disclosure

Ethical considerations guide the disclosure of information to the government, emphasizing truthfulness in responses to direct questions. Withholding information may be acceptable in certain situations, especially when the likelihood of government discovery is low. Various methods and levels of gover

0 views • 17 slides

Understanding Exemptions in the Right to Information Act

The Right to Information Act in India provides citizens with the right to access information, but there are exemptions outlined in Sections 8(1) and 9. These exemptions include provisions to protect public and private interests, commercial confidence, trade secrets, and intellectual property. The au

0 views • 12 slides

Remedying DBA Violations with Withholding and Debarment

Understanding the process of withholding contract funds to address DBA/DBRA/CWHSSA violations pending resolution of wage disputes, ensuring payment of back wages to covered workers, and implementing effective enforcement strategies. Explore sample letters for withholding requests and verification. L

0 views • 35 slides

Organic Poultry Production Practices Overview

Organic poultry production practices adhere to strict standards to ensure the birds are raised organically from an early age, without the use of hormones or antibiotics. Organic management requires access to the outdoors and prohibits withholding treatment from sick animals. Certification involves s

0 views • 21 slides

Employee Self-Service (ESS) Registration and Account Recovery Guide

Employee Self-Service (ESS) Version 2.21 provides convenient access for employees to manage their withholding, earnings, check history, documents, leave balances, and more. This guide covers the registration process and account recovery options such as password and username retrieval. Ensure a smoot

0 views • 28 slides

Overview of Immigration Law Proceedings in the United States

This content provides detailed information on various aspects of immigration law in the United States, covering topics such as the American Civil Liberties Union, the Immigration and Nationality Act, removal proceedings, grounds for inadmissibility and deportation, detention statutes, and different

0 views • 22 slides

Understanding Investigative Process and Fund Disbursement in Employment Law

Delve into the investigative process, fund withholding, and disbursement under SCA/CWHSSA/FLSA regulations. Explore the steps involved, reasons for investigations, compliance issues, and preliminary steps in conducting thorough inquiries in the realm of employment law.

0 views • 16 slides

Understanding Nonresident Alien Tax Compliance

Explore the complexities of nonresident alien tax compliance, including federal income taxes, state income tax withholding, and social security/medicare taxation. Learn about the tax system, residency statuses, payment processing procedures, treaty benefits, and best practices. Gain insights into wi

0 views • 24 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Understanding U.S. Tax Information for Foreign Students

Foreign students in the United States must navigate complex tax regulations based on their residency status. This includes distinctions between resident and nonresident aliens for tax purposes, income tax withholding requirements, types of taxable income, and considerations for student compensation

0 views • 16 slides

Cultivating a Culture of Faithfulness Through Generosity and Giving

Cultivating a culture of faithfulness involves embracing generosity, inspired by God's prescription to be open-hearted and charitable. Understanding that God is a great giver, exemplified by Jesus' sacrifice, motivates us to give as an expression of love. Recognizing God as a generous giver challeng

0 views • 12 slides

Changes in 1099 Withholding Forms for CY2022

Explore the latest updates in 1099 withholding forms for CY2022, including changes in IRS forms, PeopleSoft withholding modifications, and additional considerations for withholding processes. Learn about the new requirements and enhancements impacting 1099-MISC and 1099-NEC forms, such as FATCA comp

0 views • 39 slides

Understanding IRS Guidelines on Tip Reporting

Explore the history of tax rules on tip income and delve into the new IRS guidance regarding tips versus service charges. Learn about the distinctions, employer responsibilities, and the impact on FICA taxes and Federal income tax withholding. Gain insights into key factors that differentiate tips f

0 views • 30 slides

Understanding FIRPTA - Foreign Investment in Real Property Tax Act of 1980

Explore the key aspects of FIRPTA - from when it applies to withholding requirements, sale of U.S. real property by non-U.S. persons, and common indicators of U.S. status. Gain insights on what constitutes real property, certification of non-foreign status, and more under this tax act presented by L

0 views • 28 slides