Understanding Collective Bargaining: Insights on Wage Setting in Africa

Explore wage-setting systems in Africa through collective bargaining negotiations to address inequality and social justice. This paper analyzes the content of agreements using the WageIndicator database, shedding light on pay-settings and related clauses. Specific issues addressed include additional

0 views • 10 slides

2024 NJC Pay Campaign for Council and School Workers in England, Wales, and Northern Ireland

The 2024 NJC pay campaign focuses on increasing pay by £3,000 or 10%, introducing a £15 per hour minimum wage by 2026, addressing equalities pay gaps, reducing the working week by two hours, and providing an additional day of annual leave. The background highlights the impact of the cost of living

1 views • 14 slides

Understanding Legal Matters: Wills, Lawsuits, and Elder Abuse

Dive into the complexities of will-making, including intentionalities, revocation, and restrictions. Explore the legal landscape of lawsuits against estates, encompassing will contest actions and tortious interference with inheritances. Delve into the nuances of elder abuse, including financial expl

0 views • 21 slides

Understanding Current Wage & Hour Developments with Derrick T. Wright

Delve into the latest wage and hour developments with Derrick T. Wright, covering topics such as minimum wage, child labor laws, equal pay, overtime requirements, worker classification, and the intricacies of independent contractors. Explore the basics, exemptions, and common issues related to wage

0 views • 31 slides

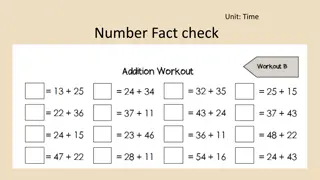

Exploring Time with 3rd Graders: Telling Time to the Half Hour and Quarter Hour

Dive into the world of time-telling with 3rd-grade students as they learn to tell time to the nearest half hour and quarter hour. From understanding analog and digital clocks to distinguishing between A.M. and P.M., this engaging lesson covers essential vocabulary and practical applications of time

0 views • 32 slides

2021 Wage and Hour Update: Federal and State Changes

This update covers significant changes in federal and state wage and hour regulations for 2021. Topics include state minimum wage increases, tip credit rules, and the impact of federal developments on tipped employees. Stay informed and compliant with the latest updates affecting wages and hours in

0 views • 12 slides

Analysis of "Minimum Wage: Maximum Wahala" Poem by Tayo Olafioye

Tayo Olafioye's poem "Minimum Wage: Maximum Wahala" scrutinizes the plight of Nigerian workers affected by a meager minimum wage imposed by the government. The poet vividly portrays the struggles faced by the laborers, likening politicians to pythons preying on the populace for personal gain. Throug

0 views • 13 slides

Understanding Wage and Salary Administration in Organizations

Explore the concept of wage and salary administration in organizations, encompassing definitions of wages, salaries, compensation, and the nature and characteristics of wage administration. Learn about the importance of establishing equitable pay structures, balancing personnel interests, and motiva

1 views • 7 slides

Impact of New Minimum Wage and Semi-Monthly Pay on Charter Schools

Presentation by Kari Wallace at the CCSA Conference on how the progressive increase in California's minimum wage affects exempt/non-exempt classifications and the introduction of semi-monthly payrolls. The presentation discusses key details, including Delta Managed Solutions' experience, labor code

0 views • 33 slides

DAAWS: Disabled Australian Apprentice Wage Scheme Overview

The Disabled Australian Apprentice Wage Scheme (DAAWS) provides funding to employers and training organizations to support apprentices with disabilities. Benefits include tutorial and mentor support, workplace modifications, and financial incentives for employers. Eligibility criteria and contact in

0 views • 10 slides

Understanding the Minimum Wage Increase: By the Numbers

Exploring the impact of the minimum wage increase on employees and employers, this detailed analysis breaks down the employee and employer portions, total wages, benefits, and budget implications. It also outlines the progression towards a $15 per hour minimum wage by 2025 as per the Lifting Up Amer

0 views • 14 slides

Understanding Job Evaluation in Human Resource Management

Job evaluation is a systematic process that helps determine the value and worth of jobs performed within an organization, essential for establishing fair wage and salary structures. This evaluation involves assessing job demands, relative worth, skills required, and other human qualities. The primar

1 views • 10 slides

10 largest personal injury lawsuits in history - Goldberg & Loren

Ever wondered how much a life, a limb, or a lifetime of suffering is worth in the eyes of the law? Dive into the world of record-breaking settlements and jaw-dropping verdicts with our infographic, exploring the 10 largest personal injury lawsuits ev

1 views • 2 slides

Running a Sandwich Shop on the National Minimum Wage

Running a sandwich shop on the National Minimum Wage involves understanding the different wage rates based on age and the hours worked by employees. The current rates for the UK National Minimum Wage are outlined, and scenarios are presented to calculate the cost of employing staff members and manag

2 views • 11 slides

Understanding Section 14(c) of the Fair Labor Standards Act

Section 14(c) of the Fair Labor Standards Act allows for the payment of subminimum wages to workers with disabilities when their productivity is impaired. The Wage and Hour Division of the U.S. Department of Labor oversees compliance with this provision, aiming for a vigorous and effective program.

0 views • 126 slides

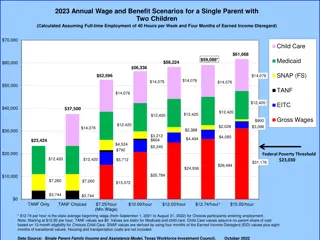

Comparison of Annual Wage and Benefit Scenarios for Single Parent with Two Children

Annual wage and benefit scenarios for a single parent with two children in 2019 and 2023, considering full-time employment with four months of earned income disregard. The analysis includes child care costs, Medicaid, SNAP (FS), TANF, EITC, gross wages, and federal poverty thresholds. Trends in wage

0 views • 6 slides

Addressing Lawsuits Among Believers in Corinth

As we delve into First Corinthians, we encounter Paul's teachings on Christian conduct, church discipline, and spiritual growth. The issue of lawsuits among Christians in Corinth is highlighted, with Paul urging them to resolve conflicts within the community rather than seeking legal recourse outsid

0 views • 34 slides

Local Government Workers and the Living Wage: A Fair Pay Claim

Local government workers in the UK are advocating for a fair pay claim to address the disparity in earnings, with over half a million earning less than the Living Wage. The real value of pay has decreased since 2010, leading to financial struggles for many workers. Support for the Living Wage is gro

0 views • 19 slides

Understanding DBA and DBRA: Wage Determinations and Construction Projects

This content delves into the application of multiple wage determinations under the Davis-Bacon Act (DBA) and the Related Acts (DBRA), specifically focusing on how minimum wages are determined for laborers and mechanics on construction projects. It also explains what constitutes a project of a charac

0 views • 18 slides

Overview of Fair Labor Standards Act (FLSA) and Overtime Management

Explore the Fair Labor Standards Act (FLSA) history, current regulations, minimum wage requirements, and compensation options for overtime-eligible employees. Learn about the basic tenets of wage and hour laws, including minimum wage and overtime pay rules. Delve into the concept of compensatory tim

0 views • 36 slides

Gender Wage Gap Among Those Born in 1958: A Matching Estimator Approach

Examining the gender wage gap among individuals born in 1958 using a matching estimator approach reveals significant patterns over the life course. The study explores drawbacks in parametric estimation, the impact of conditioning on various variables, and contrasts with existing literature findings,

0 views • 18 slides

Understanding Quarterly Census of Employment and Wages (QCEW) Program

The Quarterly Census of Employment and Wages (QCEW) is a collaborative program between federal and state entities that collects and disseminates employment and wage data at local levels. This program covers over 10 million establishments, offering valuable insights into employment trends and industr

0 views • 28 slides

Understanding Prevailing Wage and DGLVR Program Updates

Dive into the world of prevailing wage requirements and the Dirt, Gravel, and Low Volume Road Program through informative webinars and expert insights. Learn about federal Davis Bacon standards, PA PW updates, and engage with specialists in this essential area of labor compliance. Stay informed abou

0 views • 21 slides

Ensuring Timely Wage Payments in Telangana Rural Development Department

Mechanisms in place to monitor and improve timely wage payments in Telangana's Department of Rural Development under the MGNREGS program. Provisions for compensation for delays, status of wage payments, measures to curb delays, process improvements, and key processes involved in the payment system a

0 views • 34 slides

Significant Challenges in Wage and Hour Lawsuits

Continued increase in class action wage and hour litigation poses personal liability risks for employers. Recent amendments to New York minimum wage laws and white collar exemptions, along with issues like worker misclassification, create compensation pitfalls for non-exempt employees. The surge in

0 views • 89 slides

Understanding SCA Section 4(c) and Wage Determinations

The content delves into the intricacies of Service Contract Act (SCA) Section 4(c) and wage determinations. It covers the statutory requirements, application of Collective Bargaining Agreements (CBA), successor contractor obligations, limitations, exceptions, and more. The key focus is on how Sectio

0 views • 35 slides

Understanding the Minimum Wage Debate and Economic Implications

The discussion revolves around the Minimum Wage Law (MWL) in the US, with contrasting perspectives on its impact. Advocates argue for its necessity while opponents highlight potential unemployment risks. The Austrian approach provides a comprehensive view, emphasizing market distortion concerns. Eco

0 views • 27 slides

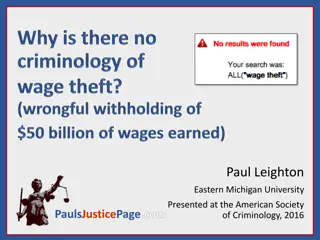

Understanding Wage Theft: A Closer Look at Violations and Consequences

Wage theft, a prevalent issue in the labor market, encompasses various violations such as not paying minimum wage, altering breaks, and misclassifying employees. The Fair Labor Standards Act of 1938 addresses these offenses with penalties, including imprisonment for repeat offenders. Studies indicat

0 views • 15 slides

Analysis of Wage Rankings and Dispersions in Global Health Workforce

This study delves into the wage rankings, dispersions, and standardized wage levels of 16 health workforce occupational groups across 20 countries. The research objectives include exploring variations in occupations and countries concerning wage levels, dispersions, and rank-orders. Data collected f

0 views • 13 slides

Learning to Tell Time Using Quarter to the Hour

This educational material focuses on teaching students how to tell time using quarter to the hour on an analogue clock. It covers key vocabulary, such as time, clock, hour hand, minute hand, quarter past, and quarter to. The content includes engaging activities, stem sentences, and a twist exercise

0 views • 11 slides

Workers' Compensation Wage Statements Explanation

This document provides wage statement details for two employees in Maine, along with calculations for their Average Weekly Wage (AWW) for Workers' Compensation purposes. It includes information on earnings, injuries, and relevant deductions for determining compensation eligibility.

0 views • 25 slides

Understanding the Fair Labor Standards Act (FLSA)

The Fair Labor Standards Act (FLSA) was signed into law in 1938 by President Franklin D. Roosevelt to address child labor, establish minimum wage, and regulate work hours. It sets standards for minimum wage, overtime pay, recordkeeping, and youth employment, impacting both private and government sec

0 views • 56 slides

Understanding Wage Determination and Payment Compliance under SCA

The Service Contract Act (SCA) mandates contractors and subcontractors to pay service employees prevailing wage rates and fringe benefits, with strict guidelines on wage determination, payment deadlines, and recordkeeping. Compliance with SCA principles is crucial to avoid penalties and ensure fair

0 views • 25 slides

Understanding UK Employment Terms and Living Wages

Discover the ins and outs of zero-hour contracts, National Living Wage rates, Real Living Wage, and entitlement to benefits in the UK. Get insights on employment options, wage structures, and benefits available, including tips on finding out what you're entitled to receive. Learn about the pros and

0 views • 29 slides

Understanding SCA Prevailing Wage Determinations

The SCA (Service Contract Act) requires covered contracts above $2,500 to include wage determinations for both wages and fringe benefits. There are two types of prevailing wage determinations, including union dominance wage determinations. These determinations must be based on data and reflect a con

0 views • 46 slides

Proposed Fee Rate Increase and Real Living Wage Implementation in Adult Social Care

In the realm of adult social care, discussions are ongoing regarding the implementation of the Real Living Wage in April 2021 and proposed fee rate increases for 2021/22. The Real Living Wage, set at £9.50 for 2021/22, aims to uplift care and support staff pay rates. The proposed fee adjustments in

0 views • 5 slides

Higher Education Pay Offer 2016/17: UNISON's Analysis and Recommendations

Employers in higher education have made a final pay offer for 2016/17, prompting UNISON's consulting and recommendations to reject. The offer includes different percentage increases for pay points and implications for hourly rates, living wage, and pay-related inequality. UNISON emphasizes the need

0 views • 17 slides

United States Department of Labor Prevailing Wage and Surveys Overview

Explore the concepts and filing tips related to prevailing wages and surveys by the United States Department of Labor. The presentation covers general filing tips, validity periods, wage survey concepts, and more provided by key presenters from the National Prevailing Wage Center. It emphasizes the

0 views • 55 slides

UCONN-AAUP Informational Meeting for Ratification 2024 Wage Reopener Agreement

The UConn-AAUP Executive Committee has accepted the 4th Year Wage Reopener from the Negotiating Team and is recommending approval of the Temporary Agreement to its membership. A 2021-2025 CBA was ratified in March 2022 with contract language improvements and wage increases. The 4th Year Reopener sta

1 views • 9 slides

Lawsuits Against the Government – Rules and Procedures

This comprehensive article discusses various aspects of lawsuits against the government, including the specific rules and procedures involved in such cases. It covers important topics such as suits by or against the government, notice requirements, exceptions for urgent relief, and where notices sho

0 views • 13 slides