Comparative Analysis of Positive Charge's Charging Stations Evolution

This PowerPoint template example created by Romy Bailey for Positive Charge showcases a comparative study of high-speed charging stations versus traditional charging stations, along with a comparison of past year versus current year data, and a year-over-year analysis of Positive Charge's growth. It

1 views • 6 slides

Regain Shoulder Strength with Robotic-Assisted Reverse Shoulder Joint Replacement

Discover best reverse total shoulder arthroplasty experts in Champapet, Hyderabad. Choose the best hospital and orthopedic surgeon for reverse shoulder replacement at Dr. Balaraju Naidu

3 views • 2 slides

Bookkeeping in Bromsgrove

JRMA United Kingdom, based totally in Bromsgrove, specializes in green VAT answers. With a crew of experienced professionals, they navigate the complexities of value-added tax to ensure compliance and optimize financial tactics for agencies. Trust JRMA.Co.Uk for expert steering, reliable advice, and

1 views • 2 slides

Challenges and Solutions in VAT Registration for Dubai-based Businesses

Discover the challenges of VAT registration in Dubai, UAE, and learn effective solutions to navigate the process smoothly. Ensure compliance with UAE tax regulations with these expert tips and strategies.

1 views • 11 slides

Bookkeeping in Bromsgrove

Navigating VAT regulations in Droitwich is made easier with my expertise as a knowledgeable professional. With a comprehensive understanding of VAT laws and compliance requirements, I provide valuable guidance to businesses in effectively managing th

1 views • 2 slides

Understanding P-N Junction Diodes and Zener Diodes

A normal p-n junction diode allows electric current only in forward biased condition, offering small resistance. When reverse biased, it blocks current. If the reverse biased voltage is highly increased, it can lead to zener or avalanche breakdown. Zener diodes are specifically designed for working

0 views • 19 slides

Afghanistan Revenue Department Implements Value Added Tax

The Afghanistan Revenue Department has introduced Value Added Tax (VAT) as a step towards self-reliance and economic stability. The program aims to inform taxpayers about VAT, its purpose, implementation process, and impact on domestic revenues. By adopting VAT, Afghanistan aims to decrease reliance

0 views • 35 slides

Bookkeeper in Worcester

Navigating VAT regulations in Droitwich is made easier with my expertise as a knowledgeable professional. With a comprehensive understanding of VAT laws and compliance requirements, I provide valuable guidance to businesses in effectively managing th

2 views • 1 slides

Enhancing VAT Revenue in Zambia through Electronic Fiscal Devices

Analyzing the impact of Electronic Fiscal Devices (EFDs) on VAT remittances in Zambia and exploring policies to complement their implementation. The study discusses the design, distribution, and effects of EFDs, highlighting a reduction in remittances post-registration. The research also examines se

0 views • 16 slides

Managing Customer Returns and Reverse Logistics in Customer Service Operations

This learning block delves into the processes, responsibilities, and metrics associated with managing customer returns and reverse logistics in customer service operations. It covers key aspects of the return process, employee responsibilities, metrics used, and best practices for effective manageme

0 views • 21 slides

A Guide to Making Tax Digital (MTD) for VAT Regulations

The new Making Tax Digital (MTD) for VAT regulations came into effect from April 1, 2019. Businesses with a taxable turnover over £85,000 must keep digital records and file VAT returns using HMRC-approved software. The Government Gateway for VAT returns will be disabled, and businesses need to regi

0 views • 10 slides

Overview of TRAIN Revenue Regulations No. 13-2018 on Value-Added Tax

These regulations under the Tax Reform for Acceleration and Inclusion (TRAIN) Act (RA 10963) focus on Value-Added Tax provisions, amending Revenue Regulations No. 16-2005. They cover zero-rated sales, VAT-exempt transactions, claims for input tax, refund procedures, and more. Conditions for VAT appl

1 views • 54 slides

Brexit VAT Treatment of Goods and Services Overview

The Brexit VAT treatment of goods and services impacts cross-border supplies to the UK, VAT refunds for goods, separation provisions under the Withdrawal Agreement, and the Ireland/Northern Ireland Protocol. Changes in VAT regulations and protocols are outlined for businesses and traders within the

3 views • 10 slides

Sales Tax Administration Presentation at ZICA AGM by Commissioner Domestic Taxes-ZRA

The presentation discusses the transition from Value Added Tax to Sales Tax in Zambia, outlining the reasons for the change, challenges with VAT, and benefits of Sales Tax. It emphasizes the simplicity and efficiency of Sales Tax administration compared to VAT, aiming to improve tax collection and r

0 views • 27 slides

Comprehensive Overview of Divine IT Limited and PrismVAT

Divine IT Limited is a pioneering IT consultancy firm offering ERP solutions and web applications since its inception in 2005. With a strong focus on innovation and customer retention, the company has garnered several accolades and certifications. One of its flagship products, PrismVAT, is a web-bas

0 views • 20 slides

Uganda's Tax Policy and Revenue Mobilization: Challenges and Measures

The Ministry of Finance, Planning, and Economic Development in Uganda faces challenges in revenue mobilization and implementing tax policy measures. The tax policy aims to generate revenue for budget financing, promote investment and exports, redistribute income, and ensure compliance with regional

0 views • 22 slides

Understanding Value Added Tax (VAT) and Unemployment Insurance in Mathematical Literacy NQF Level 3

Dive into the realm of Value Added Tax (VAT) in South Africa, distinguishing between VAT-inclusive and VAT-exclusive pricing, and exploring the Unemployment Insurance Fund. Learn how to calculate VAT on exclusive prices and decipher payslips to enhance your mathematical literacy skills at NQF Level

0 views • 23 slides

Overview of Dealer Details Filing Procedures Under Different Forms

This content outlines the process for dealers to file various details under different forms such as Index Sheet, VAT-18, VAT-19, CST Form, VAT-23, VAT-24, Worksheet-4, Worksheet-5, and Worksheet-6. With the arrival of GST, changes in the filing requirements have been highlighted, emphasizing the imp

0 views • 10 slides

European Islands VAT and Taxation Policy Overview

European islands have unique VAT and taxation policies. Various islands in Europe have different approaches to VAT, including special rates and exemptions. For example, in Greece, certain islands have lower VAT rates compared to the mainland. Countries like Germany and Spain exclude specific territo

0 views • 8 slides

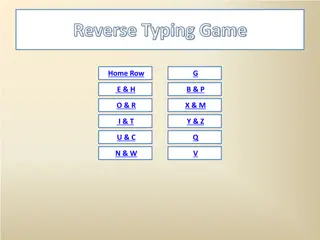

Interactive Typing Game: Challenge Yourself with Reverse Typing!

Discover the excitement of reverse typing with this interactive game that tests your skills in a fun and engaging way. Navigate through various challenges like Row G.E. & H.B., Left Pinky, Right Ring, and more to improve your typing speed and accuracy. Explore different levels and enjoy the thrill o

0 views • 133 slides

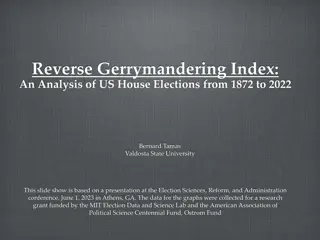

Analysis of Reverse Gerrymandering Index in US House Elections

This presentation discusses the Reverse Gerrymandering Index (RGIx) as a tool to analyze gerrymandering in US House elections from 1872 to 2022. It explains the concept of RGIx, how it functions to reverse packing, its advantages, and how it provides district-level scores unaffected by statewide var

0 views • 26 slides

Towards a Modern VAT System for Intra-Union Trade

The European Commission aims to replace the current fragmented and complex VAT system for intra-Union trade with a definitive system. This new system, based on taxation at the destination, seeks to reduce VAT fraud, enhance compliance, and bring uniformity to EU supplies. The two-step legislative ap

0 views • 19 slides

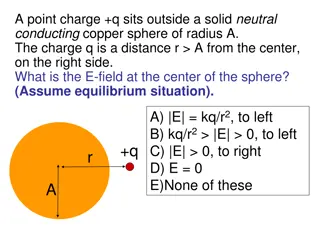

Understanding Electric Fields and Charges in Different Scenarios

Explore various scenarios involving electric fields and charges such as the E-field at the center of a conducting sphere, the effect of total charge on E-field, E-field above a charged conductor, charge distribution on the surface of a copper sphere with a hollow, field inside a charged non-conducti

0 views • 9 slides

Charge Transport Model for Swept Charge Devices (SCD) in Astrophysics Research

Exploring the charge transport model for Swept Charge Devices (SCD) in collaboration with various institutions like ISRO Satellite Centre and e2V technologies Ltd. The research aims to enhance spectral response, reduce uncertainties, and improve global lunar elemental mapping using advanced X-ray sp

0 views • 30 slides

Understanding Vat Dyes: Properties, Dyeing Process, and Limitations

Vat dyes are known for providing excellent color and fastness properties to textile materials, especially natural and manmade fibers. The dyeing process involves steps like aqueous dispersion, vatting, absorption by fibers, re-oxidation, and soaping off to ensure colorfastness. However, there are ce

0 views • 25 slides

Understanding the Reduced Rate of VAT in the Hospitality Industry

Delve into the intricacies of the Reduced Rate of VAT in the hospitality sector through this upcoming live webinar presented by Richard Taylor, VAT Manager at Albert Goodman. The webinar covers various aspects including catering, hotel and holiday accommodation, admission to attractions, and account

0 views • 16 slides

VAT in Worcester

JRMA offers comprehensive VAT services in Kidderminster, ensuring businesses comply with tax regulations while maximizing savings. With meticulous attention to detail, they handle VAT registration, returns, and advisory, easing the burden for clients

2 views • 1 slides

Efficient Reverse Reachable Set Generation for Influence Maximization

This research revisits the influence maximization problem, focusing on efficiently generating reverse reachable sets with tightened bounds. The Independent Cascade (IC) model is explored along with existing solutions based on Random Reverse Reachable Set. The concept of RR sets and their significanc

0 views • 17 slides

Understanding Time and Value of Supply in VAT Webinar Series

This course note covers the essential aspects of time and value of supply in relation to VAT rules. It explains key rules that determine when VAT must be accounted for and paid, focusing on important regulations impacting vendors. Topics include general time of supply rules, rules for connected pers

0 views • 44 slides

Comparative Study of Sales Tax on Services in Various Countries

This content provides information on the scope and implementation of sales tax on services in different countries like Pakistan, India, Australia, Canada, France, Japan, and Malaysia. It highlights the VAT/GST regimes across the globe, the number of countries implementing VAT/GST by region, and coun

0 views • 55 slides

Dispute over VAT Liability in Car Purchase Case

Cartrader A bought cars from B Ltd., paid VAT, but B Ltd. didn't remit VAT. C involved in evasion. A held liable initially, successful appeal against VAT evasion assessment. Dispute over A's knowledge of C's intentions.

0 views • 10 slides

Understanding Electrostatics: Charges, Objects, and Conservation Law

Electrostatics is the study of stationary electrical charges, where objects can be neutral, positively or negatively charged based on the balance of electrons. The charge of electrons and protons, elementary charge, examples of charge calculation, and the law of conservation of charge are key concep

0 views • 25 slides

Understanding Reverse Engineering Process

Reverse engineering is the method of dismantling an object to comprehend its inner workings, structure, and functionality. This process allows for improvements in cost reduction, material enhancement, and environmental impact reduction. Teams engaged in a reverse engineering project must analyze the

0 views • 14 slides

Success with Reverse Auctions in Educational Procurement at Tarrant County College District

Tarrant County College District, a comprehensive two-year institution, successfully implemented reverse auctions for educational procurement, achieving cost savings and price compression. The systematic sourcing strategy involved utilizing various tools like group purchasing agreements and competiti

0 views • 22 slides

Understanding VAT Reverse Charge for Construction Services

Overview of VAT reverse charge for construction services effective from 1st March 2021, covered areas, how it works, services covered & not covered, and specifics on labor-only construction services eligible for reverse charge. Details on invoicing, accounting, and transitional arrangements, with ex

0 views • 25 slides

Understanding Static Electricity and Electrostatics

Static electricity is a result of electric charge buildup on insulating materials due to friction, causing electrons to transfer and create a charge difference. This can lead to phenomena like a balloon sticking to a wall. The origin of static charge lies in the electrons and protons within atoms, w

0 views • 9 slides

Vintech Polymers Pvt Ltd Leading Manufacturer & Supplier of Reverse Printed PVC Shrink Labels and Sleeves in India

Reverse Printed Shrinkable Labels are used all over the world by food, beverages, pharmaceutical and cosmetic manufacturers on their containers to improve aesthetic value as also to boost the brand image of their products. Reverse printed labels offe

0 views • 7 slides

Preparing for Brexit Customs Declarations VAT and Duty Webinar Overview

Detailed webinar presented by Richard Taylor, VAT Manager at Albert Goodman, discussing changes in import procedures for EU movements, duties, VAT, customs declarations, and more post-Brexit transition period.

0 views • 24 slides