Scheme of Arrangement under the Companies Act, 1956

The changes introduced in the existing procedures for stock exchanges and listed companies regarding the scheme of arrangement under the Companies Act, 1956. It covers the submission of draft schemes, display on websites, changes in internal procedures, court process, approval of shareholders, and i

4 views • 16 slides

Status Report: Task Force Automated Vehicles Regulatory Screening (TF-AVRS) of UN Regulations and GTRs under Responsibility of GRSP

This status report provides an overview of the progress made by the Task Force Automated Vehicles Regulatory Screening (TF-AVRS) in evaluating the UN Regulations and GTRs falling under the responsibility of GRSP. It discusses the background, affected regulations, interaction with other GRs, and the

2 views • 13 slides

Conflict of Interest Requirements Under NAHASDA

The conflict of interest requirements under the Native American Housing Assistance and Self-Determination Act (NAHASDA) presented by Christine Dennis of Tribal Consulting Resources. This presentation covers both the general rules for conflict of interest and specific regulations under NAHASDA.

3 views • 17 slides

GST Controversies and Input Tax Credit Issues

Explore controversies under GST related to input tax credit issues. Learn about recent cases involving reversal of credits, buyer responsibilities, and legal implications for buyers and sellers. Understand the complexities of availing input tax credits under GST.

5 views • 93 slides

Prior: Art. 66(b)(1): Appeals by Accused – A Court of Criminal Appeals shall have jurisdiction of a timely appeal from the judgment of a court -martial , entered into the record under section 860c of this title (article 60c), as follows:

The content outlines amendments introduced in the FY23 NDAA regarding appeals by accused individuals in court-martial cases and modifications to court-martial findings and sentences. It details the expansion of jurisdiction for Court of Criminal Appeals, the powers granted to the Judge Advocate Gene

2 views • 12 slides

One Council Programme The Newcastle Under Lyme Borough Council

The Newcastle Under Lyme Borough Council embarks on a transformative journey with the One Council Programme, focusing on collaborative design, driving change, and establishing design principles for their Future Operating Model (FOM). Pre-launch activities include high-level assessments, benchmarking

0 views • 12 slides

Understanding Works Contract Services Under GST Act 2017

Works contract services under the CGST Act, 2017 involve various activities related to immovable property with the transfer of goods, treated as a supply of services. The levy of tax on different types of works contracts is explained, highlighting the applicable rates for different scenarios such as

0 views • 17 slides

READ⚡[PDF]✔ European Mail Armour: Ringed Battle Shirts from the Iron Age, Roman

\"COPY LINK HERE ; https:\/\/getpdf.readbooks.link\/9463721266\n\nDOWNLOAD\/PDF European Mail Armour: Ringed Battle Shirts from the Iron Age, Roman Period and Early Middle Ages (Amsterdam Archaeological Studies) | European Mail Armour: Ringed Battle Shirts from the Iron Age, Roman Period and Early

11 views • 6 slides

Postal Ballot Guidance Plan: Understanding Exceptions and Entitlements

The guidance plan delves into the exceptions to the voting in-person norm, focusing on Postal Ballot as an alternative method. It covers the entitlement categories of voters, such as Service Voters, Special Voters, and those under Preventive Detention. The presentation details the process of prepara

1 views • 63 slides

Informant DBT Module under NTEP - Ni-kshay Workflows Overview

Gain insights into the Informant DBT module under NTEP - Ni-kshay workflows, including the staff and treatment supporter roles, presumptive TB registration process, and how to utilize the Ni-kshay DBT dashboard for effective patient management and notification incentives. Explore the Informant regis

0 views • 29 slides

Banking Sector Services under GST

The banking sector services under GST encompass a range of offerings including wealth management, wholesale banking, retail banking, investment assistance, and asset management services. Banks serve as brokers and portfolio managers, charging fees for their services. Revenue is generated through len

7 views • 22 slides

Buyback of Shares in India under Companies Act & Tax Consideration

Explore the intricacies of share buybacks in India, from regulatory compliance under the Companies Act to tax considerations under the Income-tax Act. Discover how companies navigate legal frameworks to optimize surplus cash, enhance shareholder value, and strengthen promoter holdings through strate

6 views • 4 slides

Steps to Create Indoor Weed Home Grow Under $500

For many cannabis enthusiasts, the idea of growing their own plants at home is appealing, but the perceived cost can be a deterrent. However, with careful planning and budget-conscious choices, setting up an indoor cannabis homegrown can be achieved for under $500. In this comprehensive guide, weu20

8 views • 1 slides

Taxation of F&O Transactions under Indian Income Tax Law

This content discusses the taxation of Futures and Options (F&O) transactions in India under the Income Tax Act of 1961. It covers the types of F&O transactions, relevant heads of income for reporting income or loss, and the provisions of Section 43(5) related to speculative transactions. The articl

0 views • 24 slides

Acquisition Strategy Under Financial Constraints: Shelving or Developing Potential Competitors?

Analysis of the acquisition of potential competitors under financial restraints, emphasizing the prevention of anti-competitive deals through a proposed merger policy. The discussion includes evaluating acquisition prices, determining fair value under uncertainty, and the informative value of purcha

0 views • 7 slides

Understanding Large Scale Retailing and Store Classification

Large scale retailing encompasses department stores, multiple shops, mail-order businesses, and super bazaars. It can be classified into store-based and non-store based retailing, further divided based on ownership and merchandise offered. Store-based retailers include independent retailers, chain r

1 views • 16 slides

Ship Registration Process Under Maltese Law Explained

Explore the registration of ships under Maltese law, including the types of assets that can be registered, the significance of ship nationality, who can register a ship, eligible vessel definitions, and the reasons and process for ship registration. Discover how ship registration impacts ownership,

0 views • 21 slides

Soldier of Christ: The Armour of God - Spiritual Warfare Insights

Explore the powerful imagery of the Armour of God in Ephesians 6:10-18 and its significance in the spiritual battle believers face. Delve into the girdle of truth, breastplate of righteousness, shield of faith, helmet of salvation, sword of the Spirit, and more. Understand the necessity of being spi

0 views • 10 slides

Understanding Tax Invoices and Billing Procedures under GST

An in-depth overview of tax invoices, credit notes, and debit notes, focusing on their significance under the GST taxation system. Explains the difference between a tax invoice and a bill of supply, and provides guidance on issuing proper documentation under different scenarios. Covers the time limi

0 views • 24 slides

Understanding Transmission Operator Obligations in Under-Frequency Load Shedding

ERCOT Compliance ensures that Transmission System Operators (TSOs) and Distribution System Operators (DSOs) have automatic under-frequency load shedding circuits in place to provide load relief during under-frequency events. The TSOs are required to shed a specific percentage of their connected load

0 views • 6 slides

Guidelines for Running Races Under COVID Conditions

Racing under COVID guidelines established from SQA Plan de Relance focuses on conditions for races under COVID, such as racing in Outaouais when it's yellow or green, allowing AOA registered athletes, and residents of Ottawa competing in Outaouais. Race organization emphasizes online payments, safe

2 views • 4 slides

Liquidation Process and Costs under Insolvency and Bankruptcy Code

The process of passing a liquidation order under the Insolvency and Bankruptcy Code is detailed, including scenarios for passing the order and the steps involved in the liquidation process. The costs associated with liquidation, as defined under Section 5 and Regulation 2(ea), cover various expenses

0 views • 28 slides

Understanding Departmental Audits in GST

Departmental audits in GST involve the examination of records, returns, and other documents to verify the correctness of turnover declared, taxes paid, refunds claimed, and input tax credit availed. This audit ensures compliance with the provisions of the CGST Act, 2017. Types of audits under GST in

7 views • 27 slides

Procedure and Jurisdiction Under a Specific Act for Investigation of Offences

The investigation and identification of property of an accused person under a specific Act involves powers vested in the investigating officer, special judge appointments, reporting to the BFIU, investigation by the Investigation Agency, trial procedures, and the necessity of government approval. Of

0 views • 11 slides

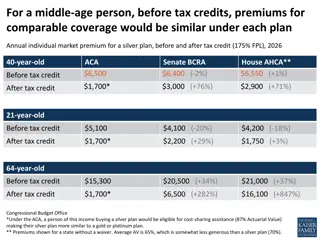

Higher Premium Impact on Older and Low-Income Populations Under BCRA

Premium comparisons reveal that low-income, older adults face substantial increases in premiums under the Senate BCRA compared to the ACA. States with older, lower-income, and rural populations would experience over 100% higher average premiums under the BCRA. The BCRA could result in significant di

2 views • 5 slides

EPA Regulations and Clean Air Act: Legal Interpretation

The case of Util. Air Regulatory Grp. v. E.P.A. (2014) addresses whether the EPA's regulations on motor-vehicle greenhouse gas emissions trigger permitting requirements for stationary sources under the Clean Air Act. It delves into the provisions of the Act concerning both stationary and moving sour

0 views • 79 slides

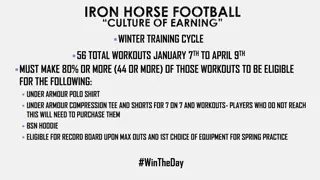

Iron Horse Football Culture of Earning Training Program

The Iron Horse Football program offers a structured training cycle comprising winter, spring, and summer sessions where players must meet specific attendance criteria to qualify for various apparel and team incentives. Clear guidelines are outlined to ensure eligibility for rewards such as Under Arm

0 views • 4 slides

Latest Amendments Under Refund FA 2022 and Inverted Duty Structure in GST Law

Latest amendments under Refund FA 2022 include extension of time limit for filing refunds, addressing inverted duty structure issues, and procedural changes for various refund scenarios under GST law. The amendments aim to streamline refund processes and provide relief to taxpayers. The changes also

0 views • 59 slides

2021 Under Armour Field Hockey Gear Guide

Discover the essential gear for field hockey, including practice equipment, game day necessities, and sideline/travel items. Get expert advice and contact Assistant Athletic Director, KaShauna Cook, for any questions.

0 views • 5 slides

Changes in New Jersey Department of Education Under ESSA

The New Jersey Department of Education has implemented changes under the Every Student Succeeds Act (ESSA) to improve the academic achievement of disadvantaged students and enhance basic programs in schools serving low-income families. These changes provide supplemental funding to support quality ed

0 views • 20 slides

Reporting Obligations Under the Montreal Protocol and Multilateral Fund

This informative content focuses on the reporting obligations under the Montreal Protocol and Multilateral Fund, highlighting data reporting under Article 7, submission requirements, differences between Article 7 and Country Programme reporting, and details on when and how to submit data. It also di

0 views • 19 slides

Understanding Probability and Planning Under Uncertainty

Probability plays a crucial role in decision-making under uncertainty, where factors like laziness, ignorance, and randomness influence outcomes. This lecture covers key concepts in probability, including outcomes, events, random variables, and conditional independence. It also delves into the chall

0 views • 42 slides

Understanding Decisions Under Risk and Uncertainty

Decisions under risk involve outcomes with known probabilities, while uncertainty arises when outcomes and probabilities are unknown. Measuring risk involves probability distributions, expected values, and variance calculations. Expected profit is determined by weighting profits with respective prob

0 views • 45 slides

MAC Performance Evaluation of Multiple BAN Coexistence Under TG6ma Channel Model

This document presents preliminary MAC performance evaluation results for multiple Body Area Networks (BANs) coexisting under the TG6ma channel model. The study focuses on synchronous BAN coordination to avoid packet collisions, showcasing the importance of the proposed structure under various coexi

0 views • 10 slides

State Aid Measures in the Field of Services: Exempt Aid Granted - Casebook Summary

State aid in the EU can be permissible under certain conditions even if generally prohibited. Derogations under Articles 107(2) and 107(3) TFEU allow for exceptions. Article 107(2) lists obligatory exemptions, while Article 107(3) provides discretionary ones. All aid falling under these articles mus

0 views • 21 slides

Guidance on USFWS Species Mitigation Fund for Coastal Trout and Frog Conservation

This guidance document provides information on the covered species under USFWS jurisdiction, including Coastal Cutthroat Trout, Coastal Tailed Frog, Mountain Whitefish, and other species. It explains the objectives of the presentation, highlighting ESA coverage, mitigation funding, and actions under

0 views • 10 slides

Housing Discrimination Based on Disability under NY State Human Rights Law

This presentation by John P. Herrion covers the provisions of the New York State Human Rights Law (NYSHRL) that protect individuals with disabilities from housing discrimination. It discusses the types of housing discrimination prohibited under the NYSHRL, requirements for reasonable accommodations,

0 views • 28 slides

Guidelines for Conducting Surveys under Section 133A by S. Mohd Mustafa, IRS, JCIT, TPO, Chennai

Conducting surveys under Section 133A requires careful planning and adherence to certain protocols to maintain confidentiality and gather necessary information effectively. Before initiating a survey, ensure the confidentiality of the survey's purpose, obtain necessary approvals, and equip the team

0 views • 27 slides

Challenges and Opportunities for Chartered Accountants under Companies Act, 2013

Explore the various penalties and punishments for defaults under the Companies Act, 2013 as discussed in a workshop held on 26th October 2013 in Ahmedabad. The session covered offenses such as misleading statements in prospectuses, fraudulent inducements, and fictitious applications for securities,

0 views • 33 slides

Companies (Winding Up) Rules, 2020: An Overview

The Companies (Winding Up) Rules, 2020 provide guidelines for winding up a company by the Tribunal under the Companies Act, 2013. The rules cover various aspects such as modes of winding up, circumstances under which a company may be wound up by the Tribunal, definitions, forms, and more. It specifi

1 views • 110 slides

![READ⚡[PDF]✔ European Mail Armour: Ringed Battle Shirts from the Iron Age, Roman](/thumb/20552/read-pdf-european-mail-armour-ringed-battle-shirts-from-the-iron-age-roman.jpg)