Approaches to the study of Human Rights

The Marxist perspective on human rights emphasizes social rights over individual rights, viewing the full realization of self within society. Marx connects bourgeois society with human rights, highlighting how exploitation under capitalism alienates individuals. In contrast, the Third World perspect

5 views • 19 slides

Analysis of the Older Persons Amendment Bill 2022 Presentation

The presentation to the Portfolio Committee on the Older Persons Amendment Bill 2022 by Prof. Kitty Malherbe from the University of the Western Cape highlights commendable aspects of the Bill, concerns about clarity on the 'Caregiver' concept, and gaps in the text of the Bill. The analysis covers is

1 views • 11 slides

A Call To Action Legislative Bill Package Overview as of March 15, 2024

The legislative bill package introduced includes SB 1491, AB 2326, AB 1905, SB 1166, AB 810, AB 2407, AB 2047, AB 2048, AB 2608, and AB 1790. These bills aim to address issues such as discriminatory events disclosure, LGBTQ+ rights, sexual harassment complaints, employee recommendations, and employm

0 views • 22 slides

Experience Effortless Postpaid Recharges with PayRup

Experience the convenience of seamless postpaid bill payments with PayRup. Whether you're looking to recharge your mobile or pay your postpaid bill, PayRup offers a hassle-free solution for all your needs. Our platform supports online postpaid bill payments for major service providers, including Air

0 views • 1 slides

Briefing to Select Committee: SAIDS Bill Update

Update on SAIDS Amendment Bill process, A-List Bill adoption, and arbitration matters for Select Committee consideration and further processing. Department presented Draft Bill to amend SAIDS Act to ensure WADA Code compliance.

0 views • 13 slides

Understanding E-Way Bill Applicability and Practical Issues in GST

The seminar discusses key topics related to E-Way Bill in GST, including its applicability, notification changes, case studies, consignment note, and scenarios requiring E-Way Bill generation. Various aspects such as transportation, movement, and document requirements are covered to provide clarity

0 views • 39 slides

Understanding Human Rights: Overview and Evolution

Human rights encompass various aspects such as human needs, generations of rights, individual status, and the indivisibility of rights. Dr. Anna Ledzi ska-Simon discusses the translation of human needs into rights, the historical evolution of rights across generations, individual rights according to

3 views • 17 slides

Understanding Human Rights in Queensland Government Work

The Human Rights Act of 2019 in Queensland outlines protected rights such as equality, freedom of expression, and fair trial. All public service employees must adhere to these rights, ensuring decisions and actions respect human rights. This act applies to everyone in the Queensland Government, with

2 views • 13 slides

Child Justice Bill 2021 Public Consultation Overview

The Child Justice Bill 2021 Public Consultation provides an opportunity for community engagement to ensure consistency and appropriateness in dealing with child offenders. It aims to establish a clear system for child justice, aligning with international obligations such as the United Nations Conven

0 views • 42 slides

Tax Filing, Payment, and Penalties Overview for LRA Practitioners in Monrovia 2021

Comprehensive training module covering income tax, excise tax, goods and services tax filing requirements, due dates for tax returns, and more for taxpayers in Monrovia. Learn about the responsibilities of taxpayers, due dates for filing tax returns, and specific requirements for various types of ta

0 views • 43 slides

Enhancing Taxpayer Education for Voluntary Compliance

Liberian taxes operate on a self-assessment system, where taxpayers must assess, submit returns, and pay taxes. Taxpayer education is crucial in promoting voluntary compliance. The Liberia Revenue Authority's Taxpayer Service Division conducts extensive educational programs covering tax types, respo

0 views • 21 slides

Understanding 1099 Reporting Guidelines and Systems

The article provides insights into the 1099 reporting process, including details about the Miscellaneous Income System (MINC), Form 1099 issuance, criteria for 1099 reporting, the Statement of Earnings System (EARN), and the Special Payroll Processing system (SPPS). It explains the responsibilities

2 views • 15 slides

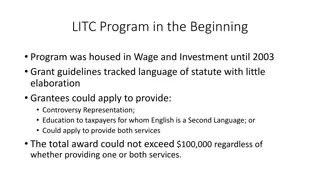

Evolution of Low Income Taxpayer Clinics (LITC) Program

The Low Income Taxpayer Clinics (LITC) Program has evolved over the years to ensure fairness and integrity in the tax system for low-income taxpayers and those who speak English as a second language. Initially housed in Wage and Investment, the program now reports to the National Taxpayer Advocate.

0 views • 10 slides

Streamlining Bill Management with Bill.com: A Partner's Perspective

Partnering with Bill.com empowers our firm to efficiently manage clients' bill payments, ensuring security, control, and transparency. Discover the benefits of outsourcing bill pay and how it contributes to profitable revenue streams while enhancing client satisfaction. Learn about prospecting strat

0 views • 18 slides

Challenges and Progress in 1920s American Civil Rights Movement

The 1920s in America saw significant changes in civil rights, women's movement, and prohibition. Civil rights encompass personal freedoms guaranteed by the U.S. Constitution, including freedom of speech, voting rights, and protection from discrimination. Violations of civil rights have occurred thro

1 views • 42 slides

Understanding National Debt and its Implications

National debt refers to the total money owed by the government to financial institutions and individuals. Managing national debt, measured through the Debt/GDP ratio, is crucial as it impacts future taxpayers and national wealth. Borrowed money comes with the burden of interest repayment, posing cha

0 views • 49 slides

Online Bill Submission System for Advocates - Form for Appearance Bill (FAB)

The Legal Information Management & Briefing System (LIMBS), under the Department of Legal Affairs, Ministry of Law & Justice, offers an efficient online process for advocates to submit appearance bills using the Form for Appearance Bill (FAB) module. Advocates can log in to www.limbs.gov.in, enter t

0 views • 21 slides

Evolution of Human Rights: From Ancient Times to Modern Era

Throughout history, ideas of rights and liberty have evolved, leading to the recognition of universal human rights in the modern sense. The concept of human rights can be traced back to significant historical events such as the English Bill of Rights, the Virginia Declaration of 1776, and the French

0 views • 7 slides

Understanding the Debate around a Bill of Rights in the UK

Explore the discussion on whether the UK needs a Bill of Rights, weighing the advantages and disadvantages. Consider examples globally, evaluate the impact on the judiciary and rights protection, and ponder the implications of introducing a Bill of Rights.

0 views • 10 slides

Trade Union Bill Campaign Overview

The Trade Union Bill of 2015 aimed to reform trade unions and regulate strikes affecting public services. The bill faced various stages in Parliament, including readings, debates, and voting. Key aims included reducing union capacity, making industrial action harder, and imposing restrictions on str

0 views • 21 slides

Human Rights and Citizenship Rights in Leisure, Sport, and Tourism: A Historical Perspective

This text delves into the intersection of human rights, citizenship rights, and leisure activities like sports and tourism. It explores the definitions, history, and declarations related to human rights, emphasizing the importance of allowing individuals the freedom to pursue leisure activities with

0 views • 20 slides

Motor Fuel Single Point Filing System Update

Motor Fuel Single Point Filing System has been in operation for almost a year, allowing taxpayers to electronically file and pay county or municipal motor fuel taxes. This voluntary system, established under Act 2018-469, provides a centralized platform for tax compliance and reporting. Local requir

0 views • 12 slides

Overview of International Human Rights Law and Treaties

This comprehensive overview delves into the foundations of international human rights law, exploring key documents such as the Universal Declaration of Human Rights, the International Bill of Rights, and various human rights treaties addressing discrimination, women's rights, children's rights, migr

0 views • 27 slides

Protection of Rights in the Bill of Rights Explained

In Chapter 4, Section 2 of the Bill of Rights, various guarantees regarding legal procedures and rights of individuals accused of crimes are outlined. It covers topics such as search warrants, indictment, grand jury, double jeopardy, due process, eminent domain, bail, militia, civil cases, and crimi

0 views • 25 slides

Understanding Income Taxes and Contributions in Quebec

This resource provides comprehensive information on income taxes and contributions in Quebec, covering topics such as taxable income, tax deductions, rights and responsibilities of taxpayers, and ways to reduce tax payments through investment plans like TFSAs and RRSPs. It also emphasizes the import

0 views • 43 slides

Madison County Revenue Compliance Procedures

The procedures followed by Amy Beard, a Revenue Compliance Officer II in Madison County, towards delinquent taxpayers include contacting, sending certified letters, filing warrants, and conducting hearings and trials. Repeat attempts are made to contact taxpayers and ensure compliance. Failure to co

0 views • 11 slides

Understanding the Impact of Audits on Post-Audit Tax Compliance

Audits have direct and indirect effects on taxpayers, influencing compliance behaviors. While more audits generally lead to increased compliance, outcomes can be ambiguous, with some studies showing a decline in post-audit compliance. Behavioral responses to tax audits are driven by perceived risks

0 views • 15 slides

The Significance of Human Rights in the Modern World

Human rights are fundamental rights that belong to all individuals, are inalienable, indivisible, interconnected, and should be respected without prejudice. The Universal Declaration of Human Rights, adopted in 1948 after WWII by the United Nations, is a crucial milestone document emphasizing human

0 views • 5 slides

Concerns Raised by Citizens With Disabilities Ontario Regarding Bill 175 and Patients' Rights

Citizens With Disabilities Ontario (CWDO) is advocating for the rights and independence of individuals with disabilities in Ontario. They express concerns over the existing Bill of Rights and emphasize the need for broad consultations to strengthen rather than demote it. CWDO highlights the importan

0 views • 13 slides

Understanding the Bill of Rights: Critical Insights into Constitutional Amendments

Explore the intricacies of the Bill of Rights through an in-depth examination of key amendments, including controversial topics such as gun rights, privacy protections, procedural safeguards, and the concept of unenumerated rights. Delve into the significance of each amendment in safeguarding indivi

0 views • 10 slides

Understanding Capitalization Regulations in Taxation

This document delves into the intricate world of capitalization regulations in taxation, covering topics such as safe harbors, routine maintenance, small taxpayers, partial disposition elections, and more. It discusses the evolution of the 263 regulations, changes in methods of accounting, and the c

0 views • 64 slides

Enhancing Transparency in Human Rights Performance Measurement

This information focuses on initiatives like the Human Rights Measurement Initiative (HRMI) that aim to provide new data for researching and advocating human rights issues globally. The HRMI project, founded in 2015, collaborates with various stakeholders and is funded by philanthropic grants. It em

0 views • 19 slides

The Bill of Rights: Summary of Constitution Amendments

The Bill of Rights comprises the first ten amendments to the United States Constitution. These amendments guarantee various fundamental rights and protections to American citizens. Amendment I protects religious freedoms, free speech, and the right to assemble. Amendment II safeguards the right to b

0 views • 11 slides

The English Bill of Rights: Definition and Impact

The 1689 English Bill of Rights was a pivotal British law passed after the Glorious Revolution of 1688. It outlined the rights and liberties of people, limiting the monarchy's power and establishing a constitutional monarchy in Great Britain. The Bill influenced constitutional developments in North

0 views • 10 slides

Understanding Citizenship Rights in South Africa

South Africa's Constitution guarantees various rights and freedoms to all citizens, ensuring equality, dignity, and protection. The Bill of Rights enshrines over 25 fundamental rights, emphasizing equality before the law and prohibiting unfair discrimination based on various grounds. The Constitutio

0 views • 49 slides

Understanding Income Taxes and Contributions in Canada

This content provides an overview of income taxes and contributions in Canada, covering topics such as tax facts, tax basics, taxpayer rights and responsibilities, types of taxes, government revenues, and key messages for Canadian taxpayers. It emphasizes the importance of filing tax returns accurat

0 views • 43 slides

Legislative and Form Updates for Taxpayers in Virginia

Reporting and paying consumer use tax, conformity to IRC, electronic income tax payments, historic rehabilitation tax credit limitations, land preservation tax credit, and neighborhood assistance tax credit changes are among the legislative and form highlights affecting taxpayers in Virginia. These

1 views • 7 slides

Understanding Human and Civil Rights in DIDD Services

Protecting the rights of individuals receiving Department of Intellectual and Developmental Disabilities (DIDD) services is essential. This training covers Title VI and individual rights under the Civil Rights Act of 1964, emphasizing equality and access to programs regardless of race, color, sex, d

1 views • 31 slides

Understanding Human Rights: Module 1 Overview

This module serves as an introduction to human rights principles, instruments, and monitoring mechanisms. It covers the definition of human rights, the Universal Declaration on Human Rights, key principles, and state obligations. Human rights are universal legal guarantees that protect individuals a

0 views • 21 slides

EU Charter of Fundamental Rights and European Convention on Human Rights Overview

The course module on European Union Law in Doha focuses on the EU Charter of Fundamental Rights and its relationship with the European Convention on Human Rights. It covers topics such as the EU's accession to the Convention, external action on human rights, and the differences between the Charter a

0 views • 26 slides