Facilities Improvement Fund (FIF): Tax Implications

Learn how Facilities Improvement Fund (FIF) grants impact taxable income for home-based child care providers in this informative webinar. Find out how to calculate taxable income and make informed financial decisions. Presenter: Margie Cangelosi, E.A.

0 views • 25 slides

Payroll Tax & Medical Centre Businesses

The intricacies of payroll tax in the context of medical businesses, including obligations, taxable wages, payments to contractors, and exemptions. Gain insights on how to register, provide voluntary disclosure, and navigate the Payroll Tax Act of 2011 effectively.

10 views • 23 slides

Murray City School District FY25 Budget Overview

Murray City School District is preparing for the FY25 budget hearing in June 2024. The budget officer, usually the superintendent, must submit a tentative budget before June 1 each year. Legal requirements include holding a public hearing and publishing budget information for public inspection. The

1 views • 25 slides

Analysis of GST Provisions in the Banking Industry

The Goods and Services Tax (GST) regime replaced the old service tax regime on July 1, 2017. In the context of the banking industry, the provisions governing GST for services provided by Cooperative Banks and Banking Cooperative Societies are similar to those of the service tax regime. While interes

1 views • 13 slides

Deductions in Taxation

Explore the essentials of tax deductions in Module 5, including how to calculate taxable income, lower taxable income plus income taxes, differentiate between Standard and Itemized Deductions, select the appropriate deduction for a client's return, and identify expenses covered by Itemized Deduction

2 views • 20 slides

A Guide to Making Tax Digital (MTD) for VAT Regulations

The new Making Tax Digital (MTD) for VAT regulations came into effect from April 1, 2019. Businesses with a taxable turnover over £85,000 must keep digital records and file VAT returns using HMRC-approved software. The Government Gateway for VAT returns will be disabled, and businesses need to regi

0 views • 10 slides

Taxation Process for Expert Witness Income at U.N.C.H.E.A.L.T.H.C.A.R.E.S.Y.S.T.E.M

Expert witness income at U.N.C.H.E.A.L.T.H.C.A.R.E.S.Y.S.T.E.M is subject to unrelated business income tax (UBIT) if the income is related to a provider testifying as an expert. The process involves calculating taxable income, determining tax rates, and reporting to the University's finance departme

1 views • 5 slides

Assessment of Various Income Types for Residents and Non-Residents

The solution presented details the assessment of different types of income for residents, non-residents, and non-ordinary residents as per Income Tax laws. It covers scenarios like salaries drawn outside India, profits earned abroad, dividends received, and more. The scope of taxable income based on

0 views • 14 slides

Rwanda Income Taxation and Transfer Mispricing Overview

Explore the taxation framework in Rwanda covering taxable presence, computation of business profits, deductable expenses, and base erosion with profit shifting measures. Understand how residents and non-residents are taxed on their incomes and the criteria for taxable presence in the country. Learn

0 views • 16 slides

Public Perceptions of Housing Benefit Tax in Papua New Guinea

The research conducted at the University of Papua New Guinea in 2018 focused on the public perceptions surrounding housing benefit tax in the country. The study highlighted changes in taxable values of employer-provided housing, justifying tax adjustments, tax measures introduced in budget documents

0 views • 16 slides

Overview of Tax Reform for Acceleration and Inclusion (TRAIN) Income Tax Regulations

Detailed briefing on the provisions of RA 10963, also known as the Tax Reform for Acceleration and Inclusion (TRAIN) law, specifically focusing on the revised income tax rates for individual citizens and resident aliens of the Philippines for the years 2018-2022 and beyond. The summary includes upda

0 views • 74 slides

Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

Office of Assessments - Overview of Property Assessment in Davidson County

The Office of Assessments in Davidson County, led by Assessor Vivian M. Wilhoite, is responsible for identifying, listing, appraising, and classifying taxable properties to achieve equity in value. They conduct periodic assessments, including post-disaster valuations, tax rate adjustments, and a reg

2 views • 10 slides

May Trucking Co. v. ODOT - Ninth Circuit Case Analysis

May Trucking Company, an interstate motor carrier, challenged an assessment by the Oregon Department of Transportation (ODOT) for underpaid fuel taxes. The dispute centered on whether fuel consumed during idling should be taxable under the International Fuel Tax Agreement (IFTA). The Administrative

2 views • 9 slides

Killeen ISD Cash In Lieu Program Enrollment Guide 2024

Explore the Cash In Lieu Program offered by Killeen ISD for 2024, allowing eligible employees to opt for a taxable monthly payment in lieu of health insurance benefits. Learn who qualifies, steps to participate, document submission guidelines, and more to make informed decisions.

2 views • 10 slides

Taxable Scholarships at International Tax Informational Workshop

Explore the essentials of taxable scholarships at an informational workshop for international students and employees. Learn about compensatory payments, Forms W-2 and 1042-S, and how to differentiate between qualified and non-qualified education expenses to manage tax liabilities effectively.

0 views • 22 slides

Moving Expense Information and Eligibility Guidelines

Information on moving expense eligibility for non-taxable treatment, including distance requirements and time considerations. Details on taxable vs. non-taxable moving expenses, helpful hints for new employees, and guidelines for adequate accounting. IRS Publication 521 is referenced for additional

1 views • 6 slides

GST Issues in Real Estate Sector

Explore the implications of taxable supply under GST in the real estate sector, various tax rates, input tax credit mechanisms, and anti-profiteering measures. Delve into the fundamental concepts of GST Act and activities treated as supply under different schedules.

0 views • 46 slides

Wisconsin Sales and Use Tax Training for Grocers - Audit Preparation and Record Keeping

This resource provides guidance on preparing for a sales tax audit as a grocer in Wisconsin. It covers important topics such as record-keeping requirements, taxable and exempt products, and necessary documentation. Maintaining detailed records, including sales tax returns, invoices, and exemption ce

0 views • 30 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

1 views • 19 slides

Nevada Department of Taxation Guidelines for Repair and Reconditioning Services

Tax guidelines for repair and reconditioning services in Nevada provided by the Department of Taxation. Covers taxable repair labor, treatment of parts, repairmen as retailers or consumers, fabrication vs. refurbishing labor, painters, polishers, finishers, and replacement parts taxation.

0 views • 11 slides

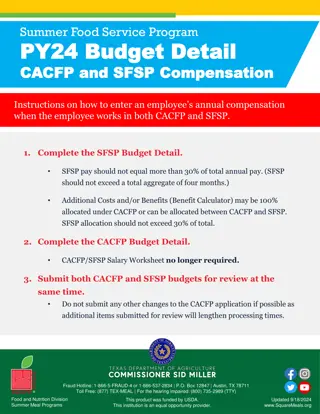

Summer Food Service Program PY24 Budget Details for CACFP and SFSP Compensation

Detailed instructions on how to enter an employee's annual compensation when working in both CACFP and SFSP, including completing the SFSP and CACFP budget details, ensuring SFSP pay does not exceed 30% of total annual pay, and submission guidelines for review. The document provides specific guideli

0 views • 4 slides

South Carolina Public Service Authority Revenue Obligations Investor Presentation

This investor presentation provides details on South Carolina Public Service Authority Revenue Obligations for 2024, including Tax-Exempt Improvement Series A, Tax-Exempt Refunding Series B, and Taxable Improvement Series C. It emphasizes the preliminary nature of the information and the need for ca

0 views • 24 slides

Ohio Small Business Investor Income Deduction Overview

Ohio offers a 50% Small Business Investor Income Deduction for individuals, allowing up to $250,000 of small business investor income to be deducted at 50% for taxable years 2013 and beyond. This deduction is reported on Schedule IT SBD and Form IT1040 Schedule A. The deduction is favorable for busi

0 views • 46 slides

Tax Rates and Standard Deductions for Different Filing Statuses

This content provides information on tax rates and standard deductions for various filing statuses for tax years 2010 and 2011. It includes details on taxable income brackets and corresponding tax rates for single filers, all filers, and married filing jointly, along with standard deductions for dif

0 views • 10 slides

W-2 Discrepancies and Pay Statement Variances

The W-2 form and pay statements may not always match due to differences in taxable wages, deductions, and withholdings. Understanding how to reconcile Box 1 wages, Box 2 federal income tax withheld, and Box 3 Social Security wages can help employees accurately report their income for tax purposes. T

0 views • 14 slides

A Farmer's Perspective on Taxes and Income Reporting

Explore the practical workings of major types of taxes for farmers, including property, sales, employment, income, self-employment, gift, and estate taxes. Delve into income tax reporting with IRS Form 1040, itemized deductions, taxable income calculation, and understanding US progressive income tax

0 views • 11 slides

U.S. Graduate Student Tax Reporting for Fellowships and Assistantships

U.S. Graduate Student Tax Information Session for U.S. students and resident aliens covers tax reporting rules for fellowships and assistantships. It discusses taxable and non-taxable aspects based on expenditure categories. Tips on accessing and utilizing tax-related documents are provided.

0 views • 63 slides

Tax Reporting Guidelines for Graduate Students in the US - March 2020

This document provides tax reporting guidelines for US citizens, permanent residents, and resident aliens who receive fellowship or assistantship payments. It explains the tax implications of these payments, detailing what is considered taxable and non-taxable income. The document also outlines the

0 views • 44 slides

Guidelines for Increasing Non-Voted Levies in FY2022 Budgets

Guidelines outlined in Senate Bill 307 and House Bill 351 require trustees to adopt a resolution estimating revenue increases for non-voted levies in various funds. The resolution spreadsheets must be completed with projected taxable values. Additional information on permissive levy authority, schoo

0 views • 26 slides

Tax Information for US Resident Students and Scholars

Fellowship stipends for students and postdoctoral fellows, tax responsibilities, qualified expenses exclusion, taxable stipends for services like TA and RA assistantships, and guidelines for reporting taxable amounts on tax forms are discussed in detail in the provided information.

0 views • 17 slides

Constructive Receipt in Taxation

The doctrine of constructive receipt in taxation dictates that income, even if not physically received, is taxable when made available to the taxpayer. This principle applies to various scenarios such as interest credited to accounts and compensation for services rendered. Failure to recognize const

0 views • 19 slides

Overview of Changes in IGST and Place of Supply Provisions

The presentation outlines the changes in the final IGST laws, including the amendments in the Customs Act as well as definitions related to intermediaries and taxable territories. It also covers the administration, levy, and collection of IGST, emphasizing the procurement from unregistered suppliers

0 views • 43 slides

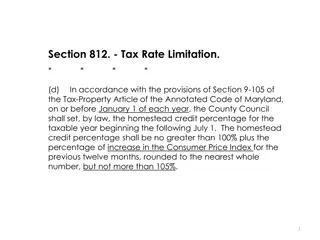

Proposed Charter Amendment for Homestead Credit Percentage Deadline Change

The proposed bill CB-48-2020 seeks to amend Section 812 of the Prince George's County Charter by changing the deadline to set the homestead credit percentage, ensuring it is no less than 100% and does not exceed 110% for any taxable year. The County Council provides ballot language for voter approva

0 views • 8 slides

Corporate & Dividend Tax in Oil & Gas Industry

Explore the computation of Corporate & Dividend Tax in the oil & gas sector, based on Indonesian regulations. Learn about the background, calculation methodology, and taxation process, including income tax, costs deductions, taxable income, and entitlement approach for tax calculation.

0 views • 10 slides

Taxable Scholarships for International Students

Explore the taxation implications of scholarships for international students at UNT System, including what constitutes taxable scholarships, qualified education expenses, and examples illustrating the calculation of taxable scholarship amounts. Gain insights into the importance of understanding thes

0 views • 24 slides

Comprehensive Overview of Colorado Springs Special Districts Work Sessions

Delve into the detailed sessions held by the Colorado Springs Special Districts on various topics including district accountability, transition of governance, dissolution, and more. Learn about the progression from prior sessions to the latest updates on mill levies, taxable status, and property ass

0 views • 19 slides

Legislative and Form Updates for Taxpayers in Virginia

Reporting and paying consumer use tax, conformity to IRC, electronic income tax payments, historic rehabilitation tax credit limitations, land preservation tax credit, and neighborhood assistance tax credit changes are among the legislative and form highlights affecting taxpayers in Virginia. These

1 views • 7 slides

Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

Overview of Ohio School District Taxable Property Values

Residential and agricultural properties make up a significant portion of Ohio's total taxable property values. The composition varies by district type, with suburban and urban districts experiencing the fastest growth since 2017. Public utility tangible personal property values have also seen rapid

0 views • 4 slides